Certain parts of Your Money or Your Life (YMOYL) are based on audio recordings of courses of Joe Dominguez, who became financially independent at the age of 31.

Thanks to a well-paid job on Wall Street and extremely low expenses, he was able to save approximately 70,000 $ in a relatively short amount of time (491,000 $ converted to today's prices) and did not accept any remuneration for his work for the rest of his life.

Later, he began teaching the basics of financial independence with Vicki Robin, and they eventually wrote a book on this subject.

YMOYL is more of a philosophical rather than financial publication. Emphasis is placed on values and creating a healthy relationship with money rather than on specific investment recommendations and strategies for achieving financial independence.

The main idea is that it doesn't make sense to spend major (and the best) part of your life at work just to buy materialistic things for the money you earn. The authors guide the reader to the "right" path in 9 steps.

However, I will not go through all of the steps in detail, I will only mention a few interesting and useful recommendations.

Find out how much you really earn

One of the first tasks is to calculate the actual net hourly rate. In the first step, simply divide your monthly paycheck by the number of hours worked. If your net income is 1,500 euros and you work 8 hours a day, your net salary would be approximately 8,93 euros per hour, when calculating with 21 working days per month (1500 euros / 168 hours).

But that's not the end of it. In the second step, you should deduct from this the expenses related to your work. These can be, for example, the necessary transport costs (car, fuel, repairs, insurance, etc.), (expensive) clothes, (expensive) food at work, costs of dealing with work-related stress (more frequent and more expensive holidays), etc.

After adjusting your income for these expenses, you may find out that your actual net hourly rate is 5 € rather than 9 € per hour. In such case, wouldn't it be better for you to change jobs and focus on what would fulfill you even at the cost of seemingly lower wage?

Actually, a lower number on the payroll from another work could mean higher earnings and higher life satisfaction for you.

Money or life?

The authors of the book consider money as a form of life energy. Thus, with each purchase, we trade part of our lives for the item or service purchased.

What part of your life are you willing to trade for a new car or a new phone? Is the latest iPhone really worth 100 or 200 hours of work to you? When you realize how much energy and time you have to spend on each purchase, you may be looking at your expenses from a different perspective. And you will probably become a minimalist.

Simply put, if we could reduce our needs, we wouldn't have to spend so much time at work. Moreover, we could devote the additional time and energy to family, hobbies or volunteering.

Create an account and start investing today

Crossover point

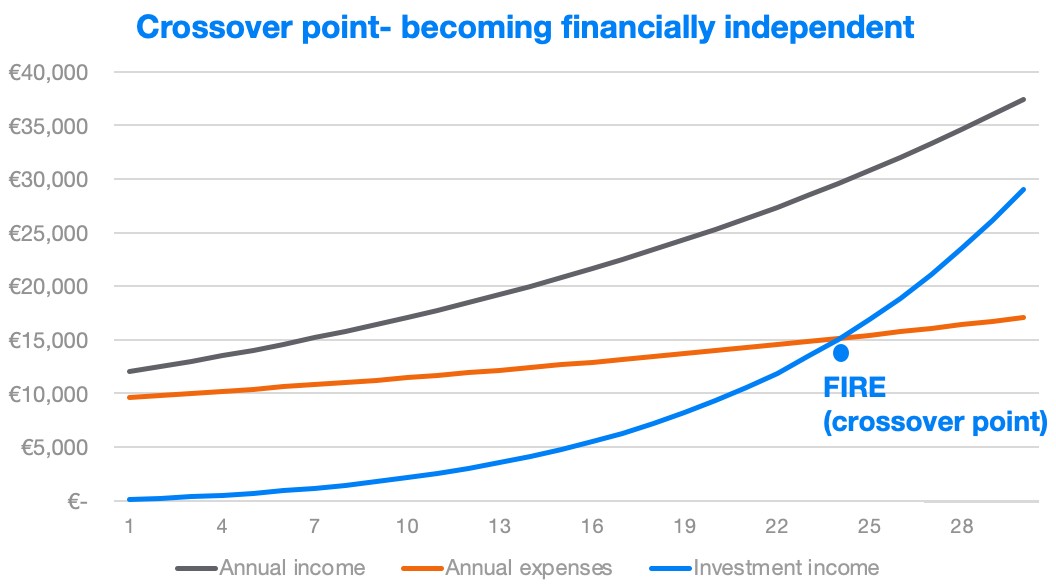

The practical part of the book persuades the reader to accurately track income, expenses and a gradual increase in fixed assets. The goal is to achieve the so-called crossover point, the point at which the return on investment exceeds the expenditures.

Only at this point, will you truly be free and can stop working for money. At the same time, your income will be much more reliable than from any other job.

What might it look like in real life?

Let's say that your net monthly income is 1000 euros per month (i.e. 12 thousand euros per year) and you can regularly save and invest 20% of it.

If you could, during your working life, regularly increase your annual income by 4% and your expenses would only grow at a rate of 2% per year (i.e. approximately at the level of inflation), you would become financially independent by investing regularly after about 24 years (calculating with a fairly realistic 8% annual return).

If you embark on this journey after graduating from university, you would be free (financially independent) before the age of 50. If you could earn or save more, it would be much sooner.

Achieve higher returns vyššie výnosy

Start investing tax-smart via low-cost ETFs.

Save while saving the planet

Your Money or Your Life is not an ordinary book on personal finance. The authors' philosophy is mostly based on their life story and environment, which shaped their view of life and money (hippie culture of the 70's, minimalism, emphasis on ecology, etc.).

I have to admit that some parts were difficult for me to read through. However, what I definitely agree on with the authors is the statement that the most valuable commodity in life is time. We always have to consider how much valuable time we trade for things that we buy.

You can buy book on Amazon.

App Store

App Store

Google Play

Google Play

Difficulty

Difficulty