Some questions include website screenshots for easier navigation of the online accounts overview.

9 Most Frequent Questions

- How do I open my first or additional Finax accounts?

- Where should I send my deposits and when will I see them in my Finax account?

- How do I know if my account is active? What does Finax require for account activation? How do I verify my identity and contact details?

- When will my funds be invested? Why is part of my portfolio held in cash?

- How do I change the investment strategy of my account?

- How do I change my investment profile and account name?

- Can I change the amount and frequency of deposits?

- How are my assets protected in Finax?

- What discounts are offered by Finax?

1. How do I open my first or additional Finax accounts?

The process of concluding a portfolio management agreement with Finax is simple and can be done online, who will help you with your investment. The entire process is electronic and paperless.

On the Finax home page www.finax.eu, click on the Let’s start button, which will take you to the registration. The registration, identity and contact details verification, signing of a contract and the opening of your first account will take you only 10 to 15 minutes.

A single person can only conclude one portfolio management agreement with Finax, but up to 99 investment accounts can be opened under this agreement. Each of the accounts may have a different objective and investment strategy risk. Information regarding opening additional accounts can be found at the end of this answer.

The registration process consists of the following steps:

- Investment questionnaire

- Investment plan

- Registration – access creation

- Identity and contact details verification

- Contact verification

- Signing a contract

- Payment instruction

Once all the required conditions have been met, your account will be activated and the funds will be invested on the next investment day in accordance with the agreed investment strategy. Complete contractual documentation will be sent to you by email.

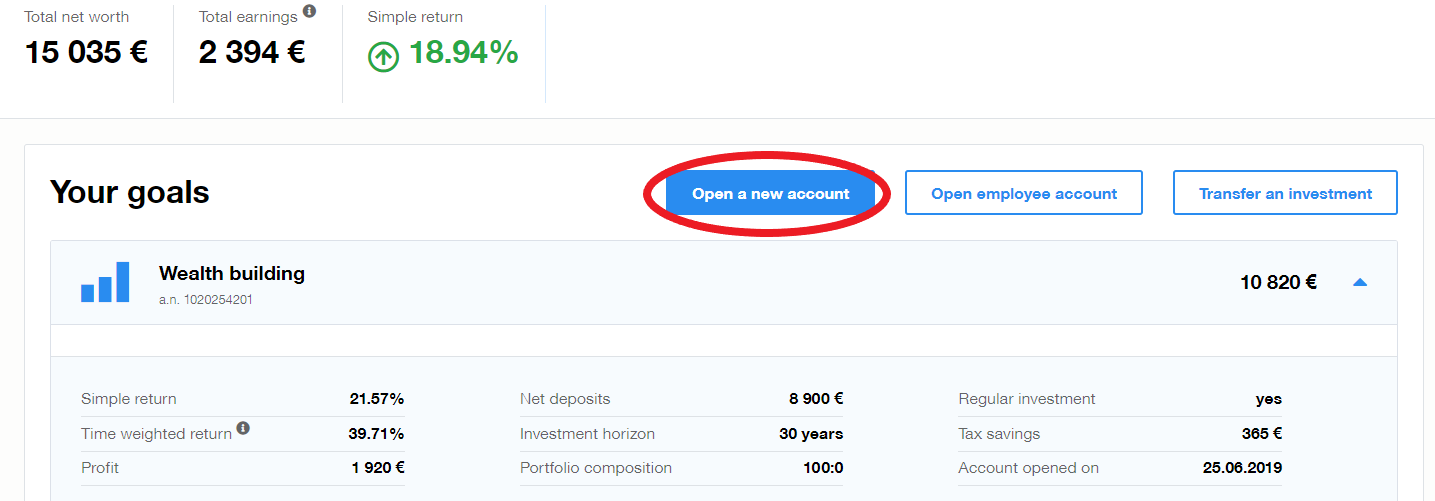

Opening additional investment account

You can open another account even more easily via your online account overview. After logging in, you'll see a blue Open New Account button. If you have a financial agent, you will usually only be able to open a new account with their help.

To open another account, you simply answer the questions in the investment questionnaire and confirm your investment plan and after that a 4-digit SMS code will be sent to you for verification.

2. Where should I send my deposits and when will I see them in my Finax account?

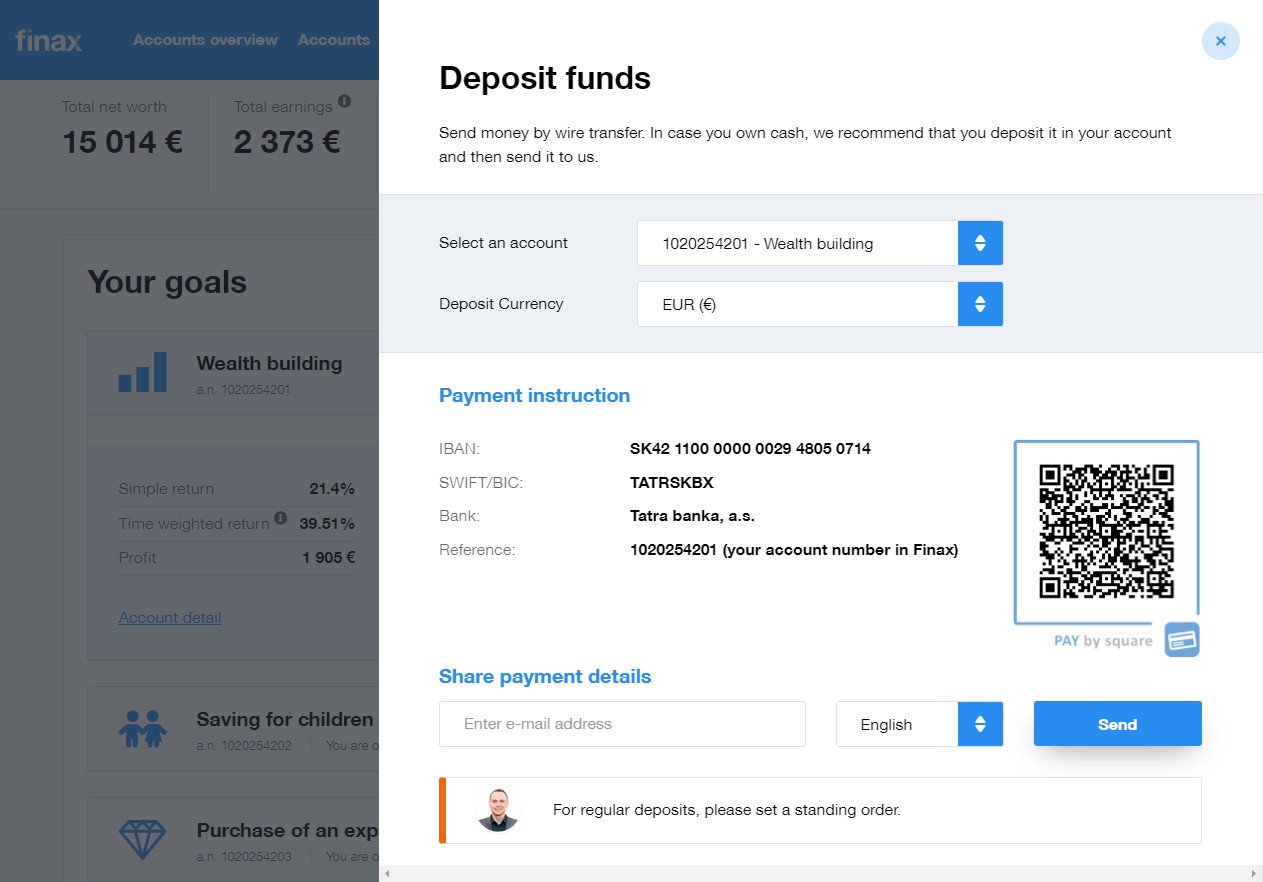

A correct transfer with complete payment instructions is a prerequisite for the deposit to be automatically credited and, upon receipt, immediately displayed in the online account overview.

Your payment instructions can be found in the online account overview by clicking on “Deposit” in the top bar of the main menu. Make sure to firstly select the investment account to which you want to deposit your money.

3. How do I know if my account is active? What does Finax require for account activation? How do I verify my identity and contact details?

For the activation of contract and of the first investment account, the following 5 basic conditions need to be met, so that your funds can be invested:

- Signed contract and finished registration

- Verified identity of the client

- Verified phone number

- Verified e-mail address

- Made deposit to account

If all these conditions are met, the first deposit in the account will be invested on the next investment day in accordance with the selected investment strategy. The investment day takes place once a week, usually every Tuesday, with the exception of public holidays, etc.

The client is informed about the activation of the account via email.

If you, as a client, have yet to fulfill any of the activation conditions, you are periodically informed by email to take the necessary steps needed to complete the activation.

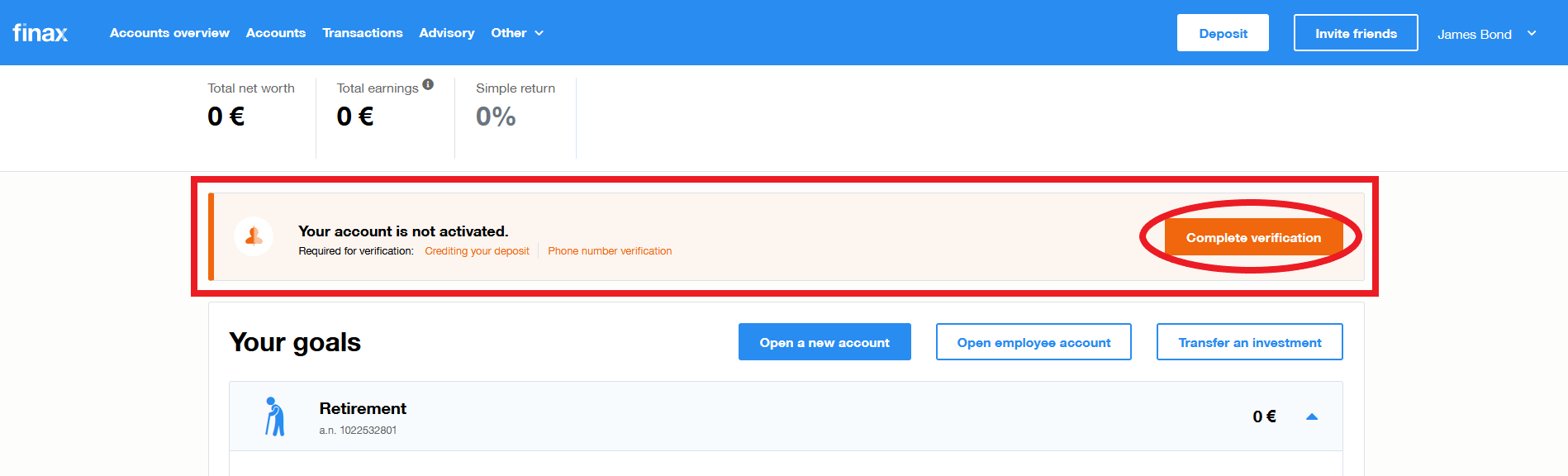

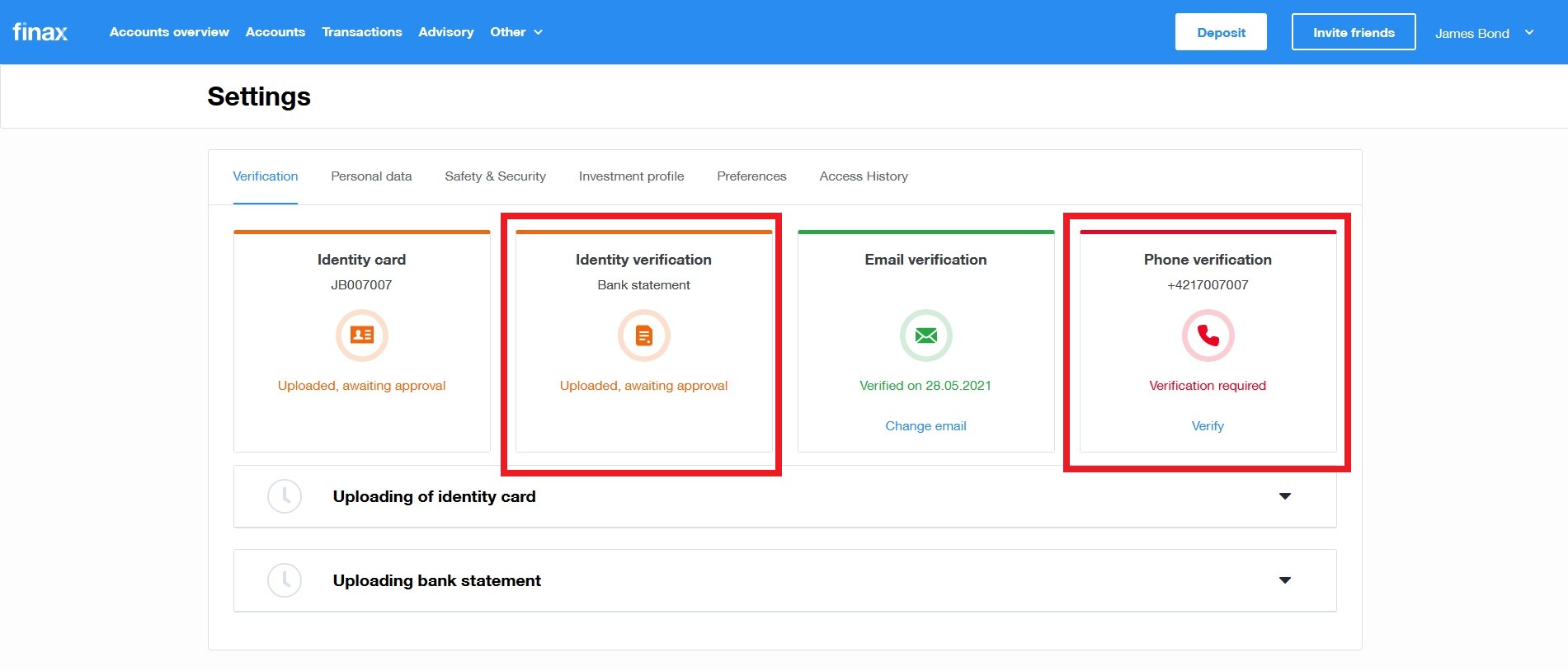

Moreover, after logging into your account, you can clearly see the missing documents. You will see a highlighted bar below the main menu informing you that your account has not been activated.

The bar also contains information regarding unfulfilled conditions and a finish activation button. This redirects you to Settings where you have options to fill in the missing information:

- upload ID card/passport and complete the biometric identity verification

- for non-EU clients, for legislative reasons, only a passport can be accepted, which must be accompanied by a residence card issued in an EU country

- verify phone number by requesting an SMS containing a link, with which you can verify your phone number (you only have to click on the link)

- verify the email contact by requesting an email with a link that will be sent to your email address, you only have to click on the link to verify it.

The ID verification may also be subject to a manual check, therefore make sure that the information is correct, and no document is missing. It is also possible that the uploaded documents are being processed, if that is the case, just wait until they are approved.

4. When will my funds be invested? Why is part of my portfolio in cash?

If you have met all the activation conditions mentioned in the previous question, your account has been automatically activated and the funds will be invested. The activation confirmation was also sent to your email address.

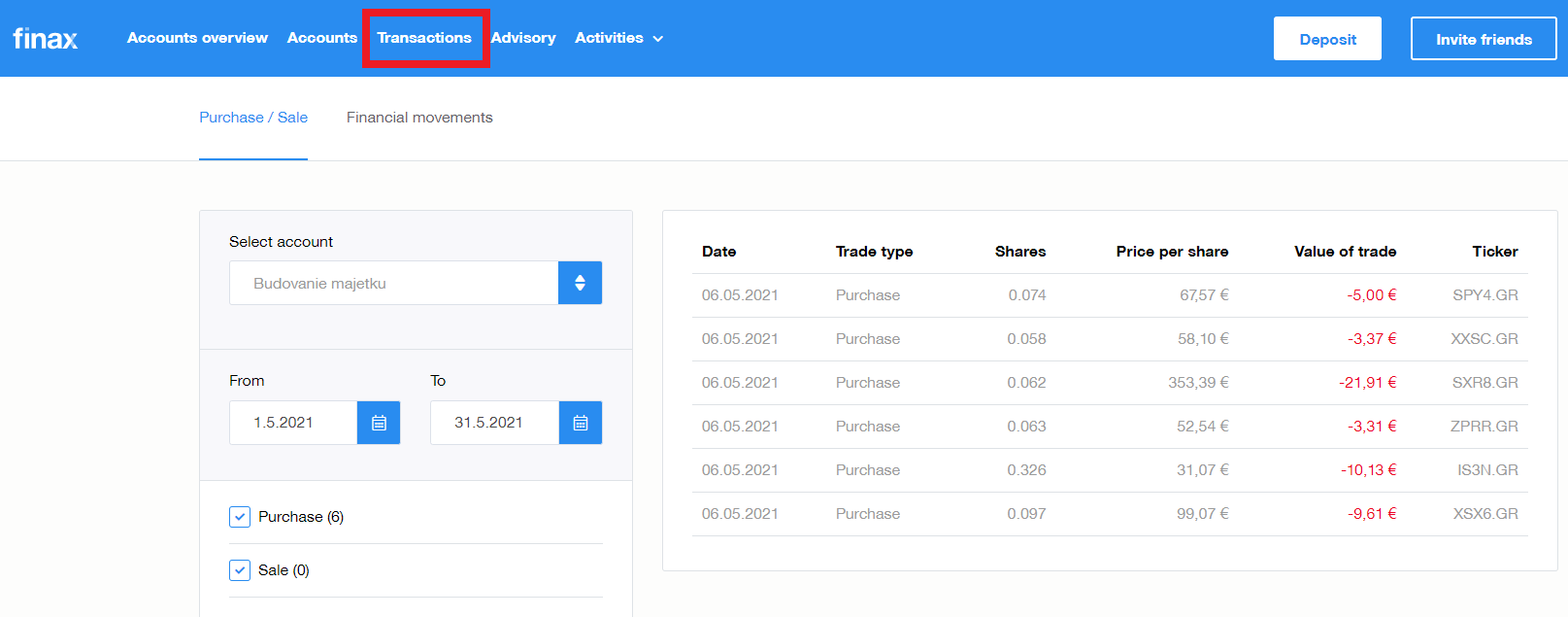

In Finax, purchases are done on a weekly basis. Investment days are usually on Tuesdays. If there is a holiday on a Tuesday or Monday in Slovakia, Germany, or Poland or in case of other specific situations, purchases and sales may be postponed to another day.

Funds credited to accounts, activated no later than the business day preceding the investment day, will be automatically invested.

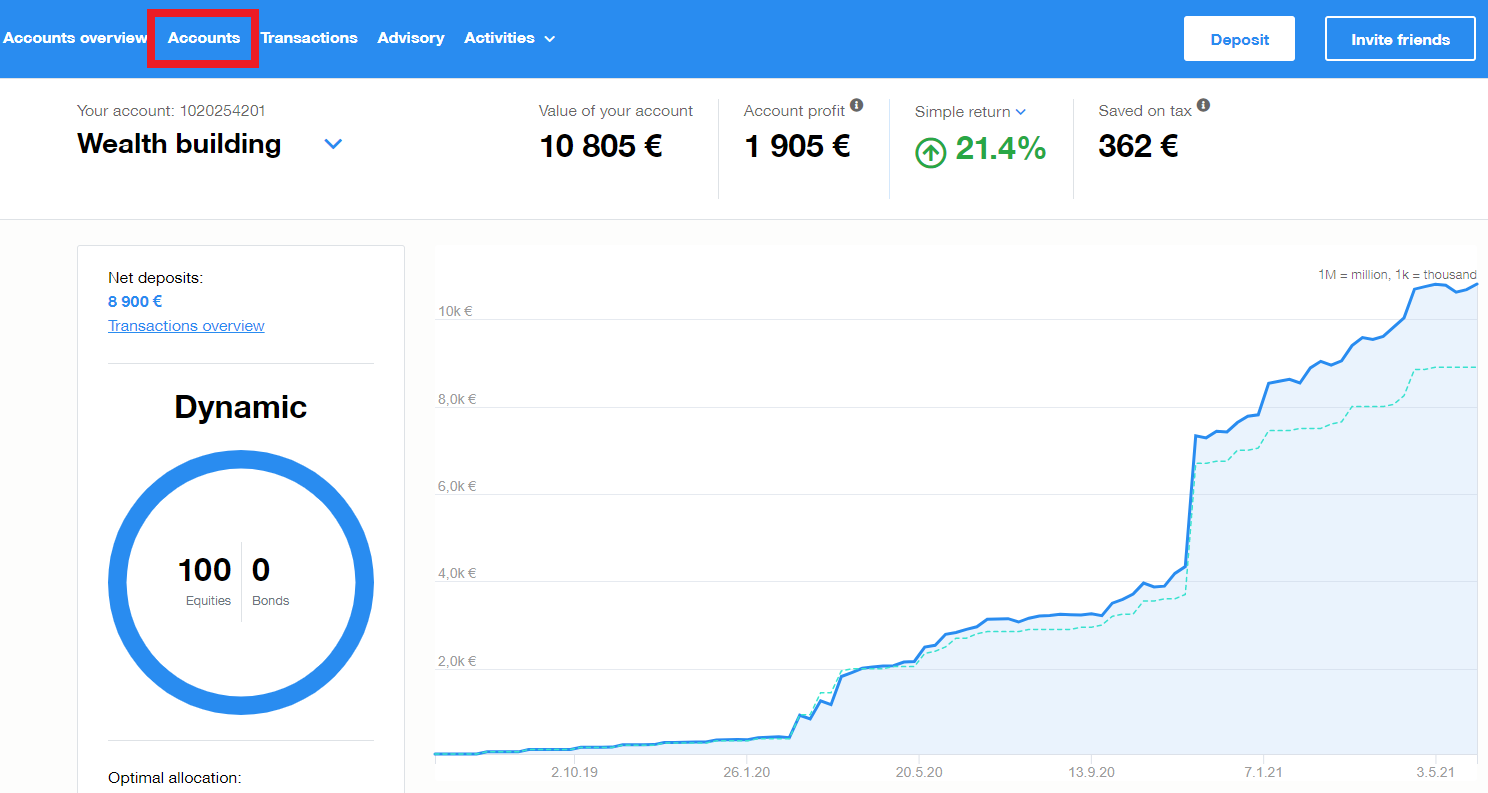

Securities (ETFs) usually appear in the online accounts overview in the Account detail within 2 days of the investment day, i.e., usually on Thursdays.

Due to investment strategies, a small amount of cash, amounting to approximately 1.5% of the account value, remains in the account after the investment day. This cash reserve is used to cover the portfolio management fee, which is charged on a monthly basis.

If we didn't keep the cash in the account, we would have to sell off a fraction of the portfolio each month to cover the fee, which could result in a tax liability for you.

The cash position can range anywhere from 1.5% to -0.3% of the account value. If it falls below -0.3%, roughly 2% of the holdings of all funds are sold off to free up cash again.

In the Transactions overview you will see the executed trades after the so-called trade settlement period, i.e., two days after the purchases are made.

5. How do I change the investment strategy of my account?

If your life situation, risk setting or your investment goals have changed, Finax gives you the opportunity to change your investment accounts strategy. The change is easy and can be made online in the account overview section.

On each investment account, one investment strategy change per calendar year is free of charge. Each additional change during the year is subject to a fee according to the Service Price List.

Your strategy can be changed in the Advisory section. Select the account, where you want to change the strategy, and choose a new strategy simply by moving the circle on the investment risk axis.

Other parameters of the investment plan, such as the amount of deposits or the target amount, can also be changed this way.

You can request the change by clicking on the "It looks good, I want to change plan" button at the bottom of the page. Confirm the change request with the 4-digit numeric code that will be sent to you by means of SMS. I most cases, changes are approved within 24 hours during weekdays. You will be notified in a confirmation email whether the requested change has been approved or denied.

The change is made on the next investment day (usually Tuesday). Please note that new deposit will not be invested when the strategy is changed. It will only be invested on the next investment day (one week later) after the strategy change is made.

Please note that a change of strategy may result in a tax liability, so consider any such change carefully. Don't speculate and don't try to time your investments, with the right strategy you don't have to worry about market risk.

If dynamic portfolios with a higher proportion of equities are red on the strategy axis, it means that your risk profile and the parameters of your intended investment do not allow you to take on higher risk, as it is not appropriate for you. In such case, you can update the Investment Profile in Account Settings (see next question).

6. How do I change my investment profile and account name?

Your investment profile and the investment questionnaire with your answers for each account can be found in the online accounts overview in the section Settings. They are located in the submenu, which shows up after clicking on your name in the top-right corner of the page. There you will need to click on the Investment profile section.

You then have the option to select the account you want to make changes to. Here you can rename your accounts or revise the answers to the investment questionnaire, which will have an impact on the allowed investment strategy. Changes to your investment profile are free of charge and without any restriction.

Answer the investment questionnaire questions truthfully. Only then will the investment strategy be truly suitable for you in terms of risk, and you will feel comfortable following it.

If you change your experience level with investment instruments, the system may also require you to indicate the specific experience you have acquired (for example, here you could choose: mutual fund investing, the second pillar, corporate bonds, unit-linked life insurance, etc.).

If you have made changes to your answers, please request validation of your new investment profile by clicking the Request Change button at the bottom of the page. Confirm the change request with the 4-digit numeric code that will be sent to you by SMS. During business days, changes are approved within 24 hours. You will also be notified about this by email.

To change the account name, you do not need to request the change by clicking the button at the bottom of the page. Just click the Change Account Name button at the top of the page, type in the name you want and click the Save Name button.

7. Can I change the amount and frequency of deposits?

The amount and frequency of your investments in Finax can be changed at any time. There is no need to take any action or give Finax any notice. Simply change the amount on your standing payment order or make an extra deposit.

Always remember to include the correct variable symbol in your payment in order to match your deposit with your Finax investment account instantly.

When you are opening an account, the regular investments and their amount are not binding. They are only used to calculate the expected value of the investment at the end of your investment horizon, to set your investment plan and to monitor the likelihood of achieving your investment goals.

Finax manages your assets. You are the ultimate owner of the securities and the money with all the resulting rights, including their disposal. That means you can deposit and withdraw at any time and any amount (minimum € 20).

You have the option to modify the investment plan with an extra deposit or change regular investments. You will thus know the outcome you can expect from your investment and the probability with which you are heading towards your investment goals. Our algorithms will advise you on how to adjust the plan to achieve your goals.

You can adjust the parameters of the investment plan in the Advisory section. Changes are arbitrary and free of charge, except for changes in the investment strategy, which can be made free of charge only once per calendar year on each of your investment accounts.

8. How are my assets protected at Finax?

Finax is a regulated investment broker governed by the Securities Act and conducts its activities on the basis of a license and authorization from the National Bank of Slovakia. The activities, obligations, and rights of investment brokers are specified by law.

The investment broker keeps records of clients' assets and provides investment services. In the case of Finax, these services include mainly portfolio management, management and administration of securities, and, to a certain degree, receipt and transmission of client orders.

An essential component of the protection of client assets by investment broker is the separation of client assets from broker assets. The client remains the ultimate owner of the assets (both securities and cash) at all times, retaining the rights arising therefrom. The law states that assets shall stay permanently available to the client.

Client assets may only be managed in accordance with the agreed investment strategy. Disposal of the assets is entirely at the client's discretion, i.e., client may at any time dispose of a part or the entirety of the investment, withdraw the funds, make deposits at will, and change the composition of the investment within the bounds of offered investment strategies.

In case of Finax dissolution, client assets are not in any way affected. In such a case, the National Bank of Slovakia will appoint a new custodian who will continue to take care of your assets in accordance with your investment strategy.

Should for any reason the assets become unavailable to the client, their replacement is covered by the Investment Guarantee Fund up to a maximum of EUR 50 000 per client. The protection of the Guarantee Fund does not apply to the decline in the value of the investment due to market developments and to the impact of the materialization of the investment risks.

More information on safety and security of your investment in Finax can be found in this article.

9. What discounts are offered by Finax?

In terms of Central European competition, Finax ranks among the most inexpensive, profitable, and carefree investment solutions. However, we still offer several discounts that can further reduce your fees and enhance the appreciation of your assets.

Investment Transfer Discount

If you use a competing investment product and decide to move your non-performing investment to Finax, we will manage 50% of the transferred funds for 2 years free of charge for you.

To qualify for the discount, simply terminate your existing investment, move the funds to Finax, and within 30 days of the original investment's termination, send us a proof to client@finax.eu.

As a proof, send us a confirmation of termination of the investment (sale, return of units, property purchase agreement), proof of withdrawal of funds, or a transaction information where the crediting of funds from a competitor to your current account can be seen.

More information about this discount can be found here.

Friend Referral Discount

If you are satisfied with our services, please share your experience with your family, friends, or colleagues. Let your friends and acquaintances enjoy an effective appreciation of wealth. We will reward you for it.

For each active invitation (contract concluded with the first deposit), you and your invited acquaintance who opened an account via your referral link will receive a discount of 1,000 euros managed free of charge for 3 years.

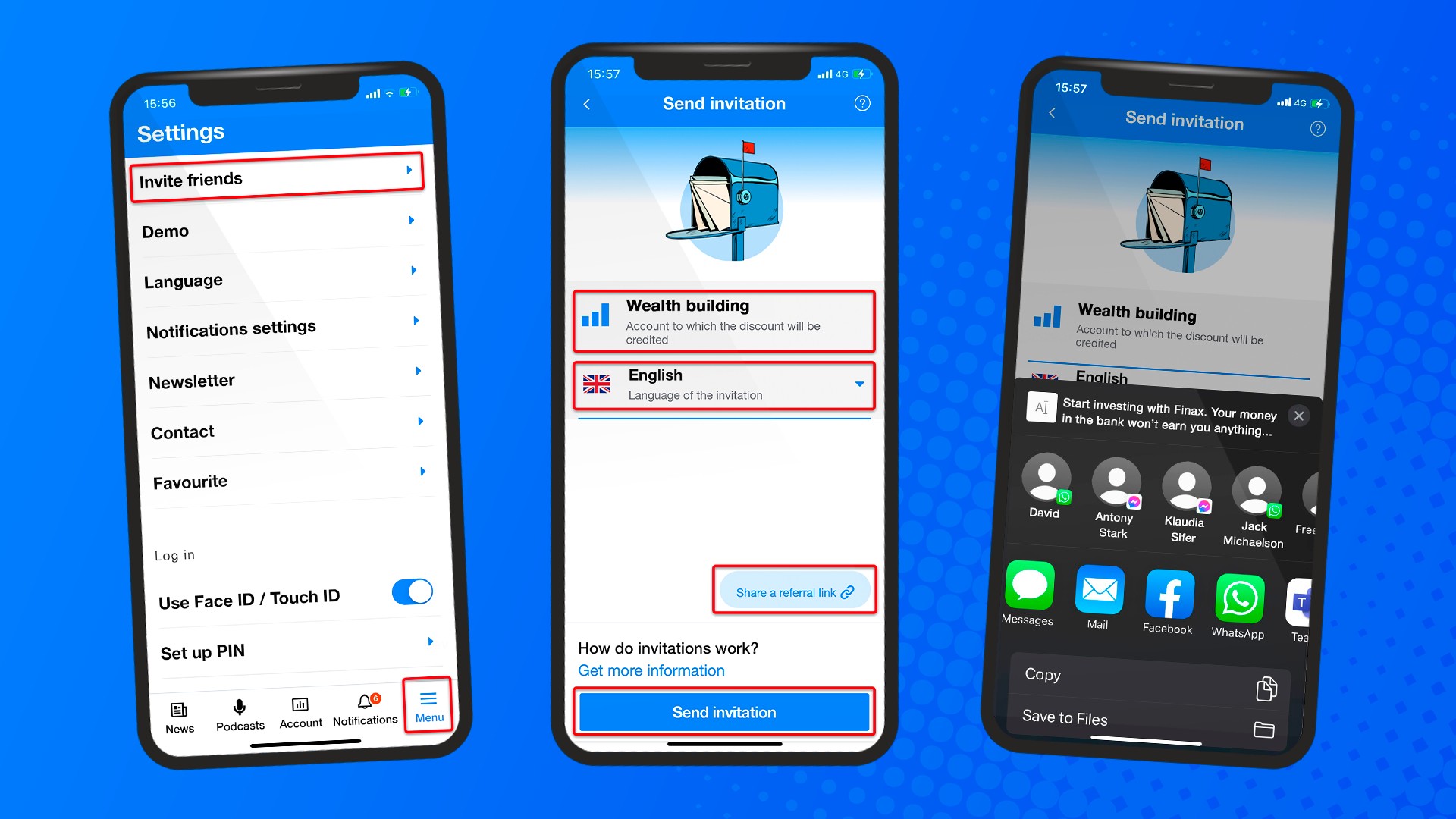

You can invite an acquaintance from the mobile app or from the online account overview on the Finax website.

The mobile app allows you to send an invitation with your referral link via your preferred messaging app (SMS, email, Whatsapp, Messenger).

In the app, click on More and then select Discounts & Fees from the menu. In this section, you will find an overview of the fees and discounts for your individual accounts.

You can also invite your friends to Finax here - click on the Invite a friend button. Select the account to which you want to assign the discount once it has been activated, choose the language of the invitation, and send the invitation by the method of your choice. To get the discount, just let the friend register via this link.

You can gift your discount to the acquaintance, who will then receive a benefit of 2000 euros managed free of charge for 3 years.

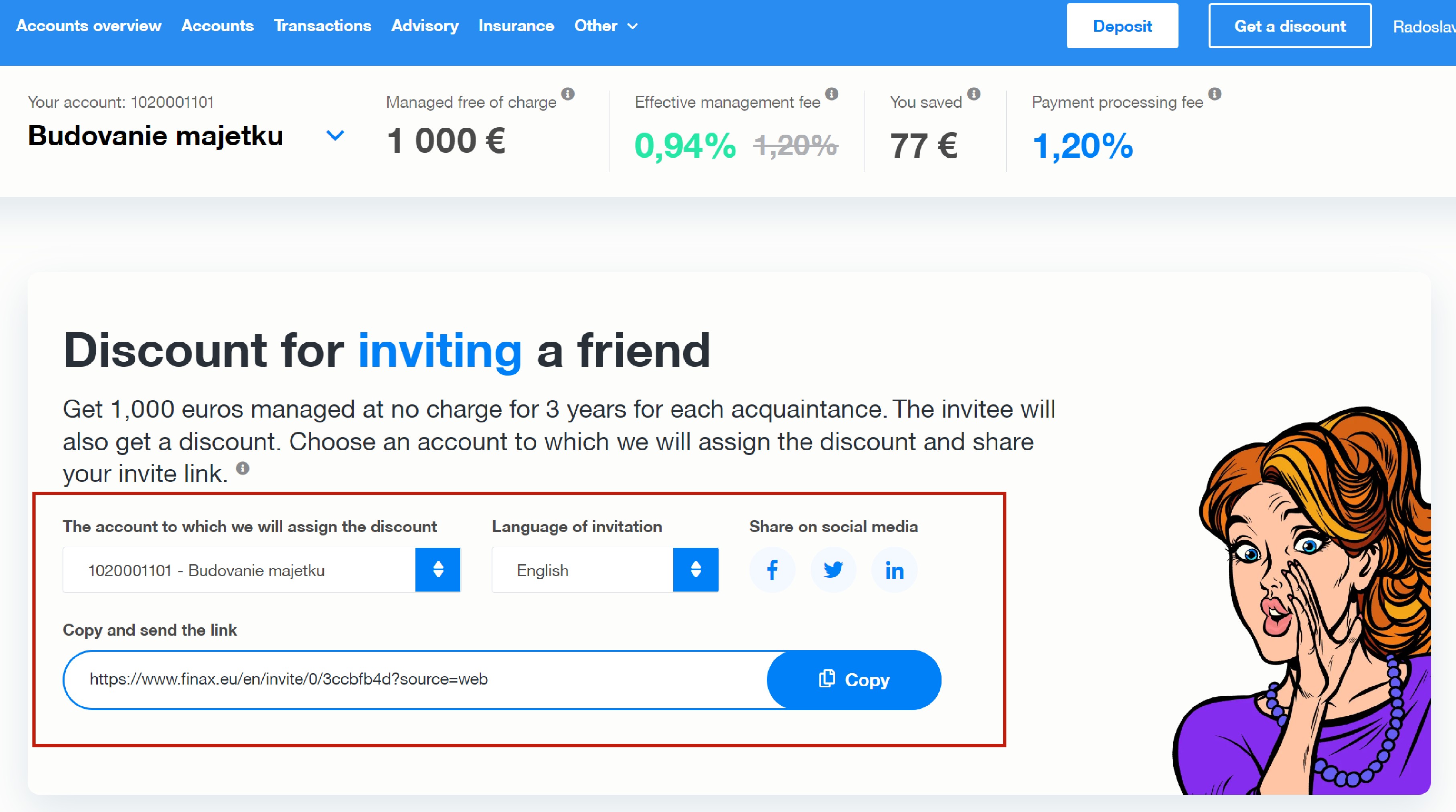

The second option can be found in the online account overview on the website in the Invite friends section.

Here you can copy and send your unique referral link to friends, just like in the mobile app. In the online overview, you can also share the link directly in a social media post. If your friend registers at Finax via this link and activates their contract, both of you will automatically receive the aforementioned discounts.

More information about the discount.

App Store

App Store

Google Play

Google Play

Difficulty

Difficulty