I recently read the book Die With Zero by Bill Perkins and I have to say I was blown away by it. As someone who has always been interested in the topics of personal finance, wealth creation, and investing, this book was a great read. In fact, it was the first book that didn't address wealth creation, but how to use it effectively.

The main message of the book is to help readers realize that money is just a tool to maximize our happiness and live life to the fullest. As the title of the book suggests, if we want to enjoy our life to the fullest, there is no point in accumulating wealth until death, because it will be useless to us once we are dead. The most optimal solution, according to the author, is to die with zero in your account.

The author considers spending money on experiences and loved ones as an investment in happiness, and our memories are then dividends that we receive as income in the future. Therefore, we need to invest in experiences that will give us the strongest memories (highest return). At the same time, the earlier we invest in experiences, the longer we will receive dividends from them in the form of memories, and thus the greater the total return on our assets.

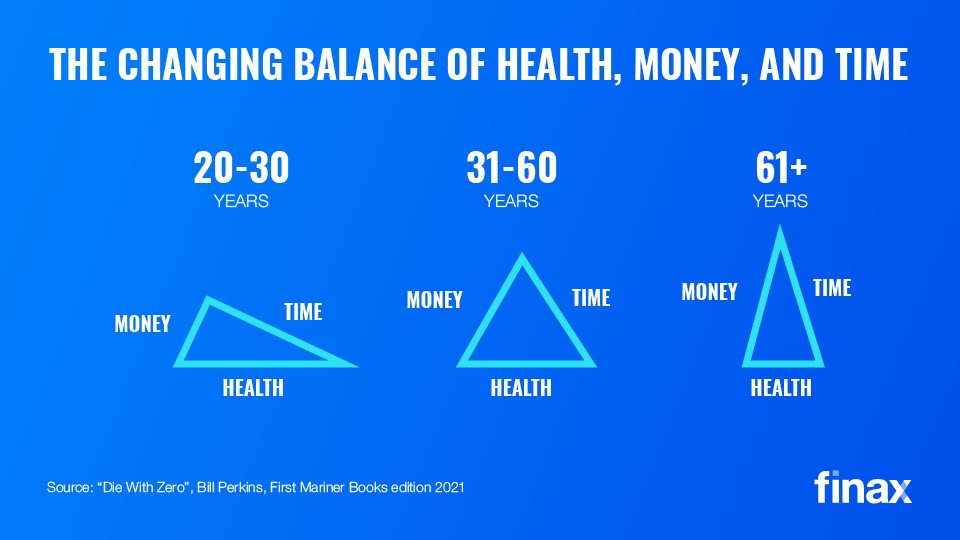

We have three basic resources in life - health, time, and money. Similar to the investment triangle (risk, liquidity, return), it is almost impossible to get a high return with maximum liquidity and minimum risk. It is the same with this trio.

Create an account and start investing today

When I'm young and healthy, I usually don't have enough money to invest in experiences, even though I may be a "time millionaire". Conversely, when I'm old, while I have plenty of money and time, my health is already miserable and I can't indulge in the kind of experiences I'd like. This picture captures it beautifully:

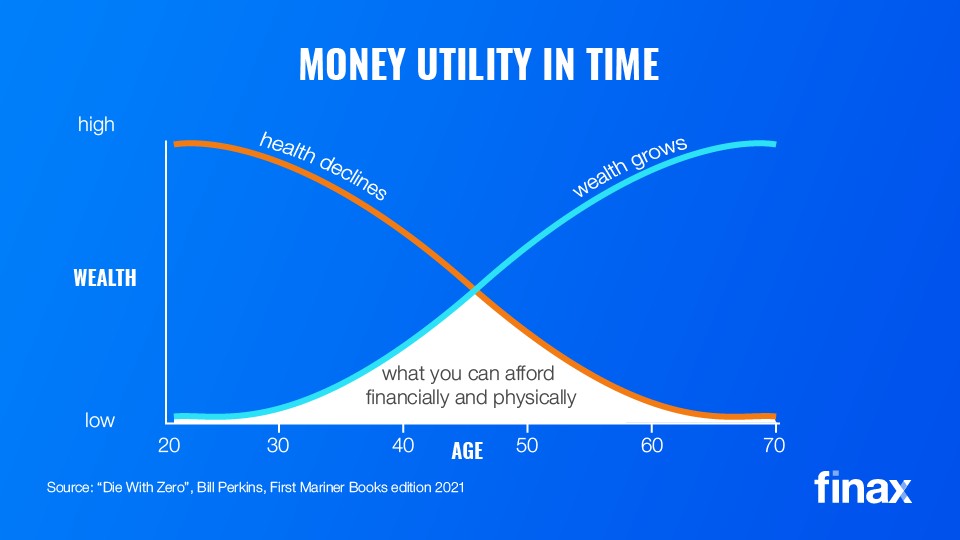

I was also intrigued by a chart in the book that explains the balance of health and experiences and when to maximize them. This chart nicely shows when the biggest opportunities to invest in experiences open up in your life. It's between the ages of forty and sixty.

But I'll also come back to the idea of "dying with zero in your bank account". Yes, it is almost unrealistic in practice, because you never know what illness you may develop towards the end of your life and how much money you will need to fight it. However, a full life lived a year shorter may be better than experiencing nothing in one's lifetime and plowing that money into prolonging one's health at 85.

Many of you may say to yourselves that you don't mind at all if your account doesn't show zero when you die. After all, the children will inherit it. However, the average life expectancy in Europe today is around 80 years. It often happens that one of the partners dies later, and therefore the children inherit the property relatively late. When the children are, say, 55-65 years old, they are no longer able to enjoy their inheritance as much as if they had received the money at a younger age, due to poorer health.

I am one of the luckier people in that respect. I got my entire inheritance from my parents about 15 years ago when I was 27 (don't misinterpret, both my parents are still alive). My brother bought my parents a house and my parents gave me both apartments they had. I improved those and later sold them. Thanks to them I got a nice foundation to build a family house in Bratislava.

This inheritance had an incredibly positive effect on my life and I am extremely grateful to my parents for it. I live a much happier life without financial stresses and was able to invest a lot of money at a young age in experiences from which I now draw very high dividends in the form of memories.

And to tell you the truth, I don't know if I would be the successful owner of Finax today without that early inheritance. The money I invested in starting Finax would probably have been put into buying a better home rather than into a business with an uncertain outcome. So the early inheritance had a huge impact on my life.

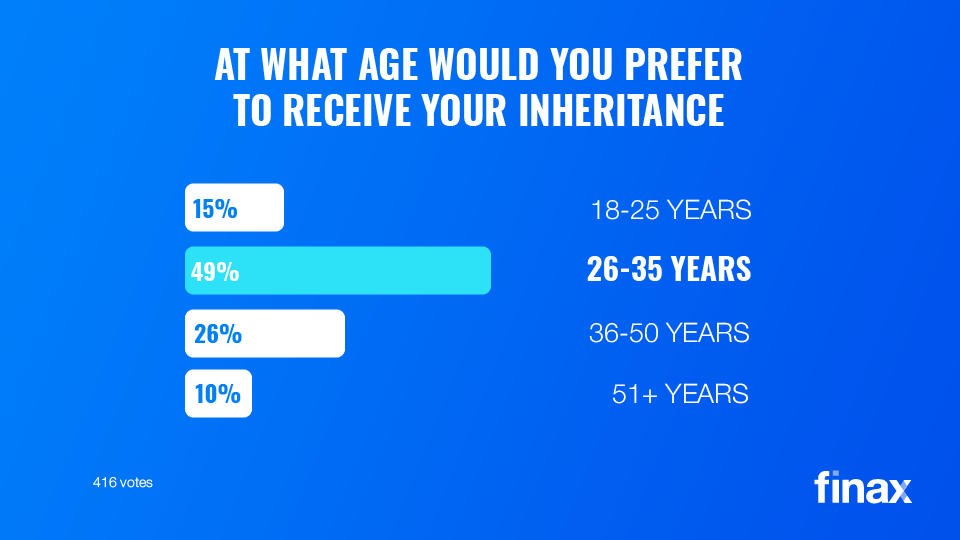

I only operate on one social network - LinkedIn, where I often post mainly my insights on personal finance and the content we create. On my LinkedIn, I recently posted a survey with the rather controversial title "At what age would you most like to inherit a fortune?" with the subtitle: Regardless of how long your parents lived, at what stage in life would you most like to inherit?

In fact, the author used a similar survey in this book and I was pleasantly surprised to find that people in Slovakia perceive the issue very similarly to people in the USA. As many as 416 people voted in the poll, so this idea clearly appealed to many.

The age range of 26-35 is the time when people start families and have the greatest need for money in their lives. At the same time, they are responsible enough at this age to put their inheritance to good use and not squander it in bars and wild rides with friends.

The book is written in an easy-to-understand manner, making it a great read even for those who are new to the topics of personal finance and investing. Bill Perkins does a great job of breaking down the key concepts and principles in a way that is both interesting and informative. He also shares his personal experiences and stories which add great value to the book.

My only criticism of the book is the fact that the author writes it from the position of a wealthy man who has made millions of dollars in his lifetime, and thus somehow finds it easier to write about enjoying life than the average 50-year-old European.

I bought the book through Amazon and it is only available in English. Overall, Die With Zero by Bill Perkins is an excellent book that provides a lot of valuable information on personal finance topics that are looked at from a slightly different perspective - the proper timing of spending money and maximizing utility.

App Store

App Store

Google Play

Google Play

Difficulty

Difficulty