In the current state, where small one-bedroom apartments in Bratislava are sold with a price tag of around 100 thousand euros, only a few can afford decent housing without needing a mortgage. But long-term living as a tenant does not make sense.

Despite the relatively steep price increase in recent years, real estates are still affordable thanks to the rising wages and low interest rates. You can still get a mortgage today with a rate below 1% for a short-term fixation and around 1.5% for a 10-year fixation. It still holds true that Slovaks borrow for real estate at one of the lowest rates in the European Union.

Currently, it pays off (using common sense) to use cheap bank financing. This also applies to people, who do not need a mortgage or can afford to repay it early. But whether you really need a mortgage or not, you will still have to meet the following conditions.

1, Debts to income ratio (DSTI, Debt Service to Income)

From 1.1.2020, loan repayments can reach a maximum value representing 60% of the applicant's net income (after deducting the subsistence minimum). The aim of the latest NBS’s measure is to ensure that debtors have something to live on after paying out their loan repayments (quite logical, isn't it?).

The bank will also perform a stress test - the DSTI calculation will be based on the mortgage repayment with an interest rate increased by 2% compared to the interest rate assigned to you. Although rising interest rates in Europe are not in sight, banks are also protecting themselves against this risk.

The DSTI indicator has the greatest impact on low-income households and large families, as the subsistence minimum is calculated for the whole household, which significantly reduces the amount of disposable income (from 1.7.2020 the subsistence minimum is 214.83 euros for the first adult, 149.87 euros for the second adult and 98.08 euros for a dependent child).

In 2019, up to 80% of the loan applicant's net income could be used for loan repayments. However, there is an exception for young borrowers under the age of 35. Banks can provide up to 5% of new loans to borrowers with a DSTI of 70%.

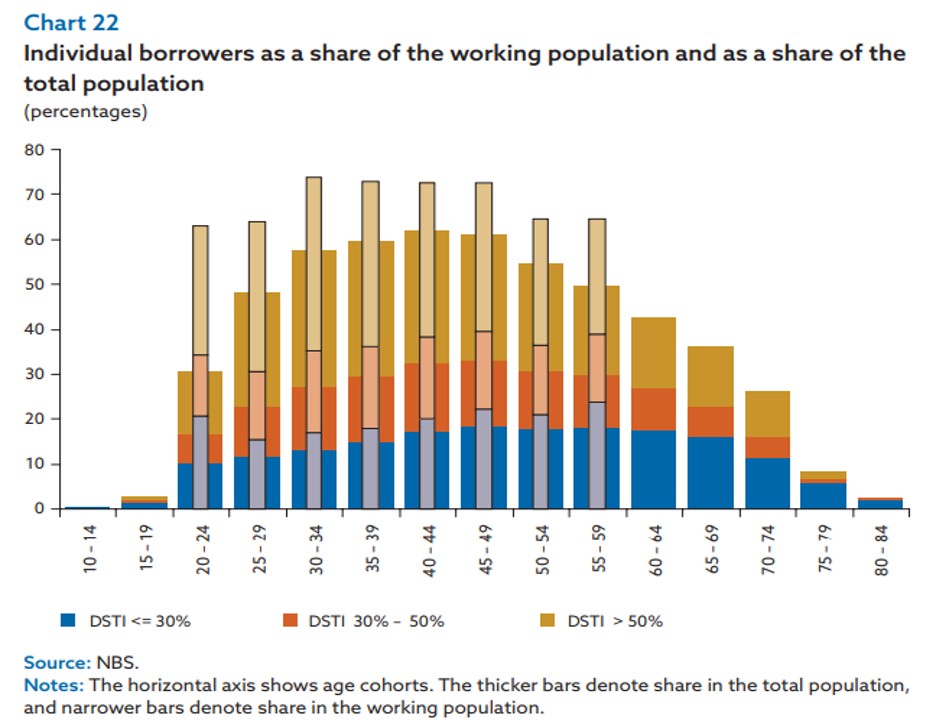

According to the annual Financial Stability Report from November 2019, more than 70% of Slovaks in employment have a loan. For many of them, debt repayments account for more than 50% of income. And these people pose a threat to the stability of the banking sector. A stricter reassessment of the total indebtedness of new loan applicants is therefore a logical step.

It is a pity that this restriction did not come into force earlier. Many Slovaks seem to have forgotten that loans taken in good times will have to be repaid even in bad times. This is being fully reflected in the current COVID-19 crisis. Almost 150,000 Slovaks have already asked their bank to defer payments.

2, Debt to annual income ratio (DTI, Debt to Income)

From 1 July 2019, loan applicants must also meet another condition, which expresses the total credit burden and it may not exceed the net annual income times 8. Exemption may, once again, be granted to applicants under the age of 35 with an income not exceeding 1.3 times the average wage. The DTI for these loans may not exceed the net annual income times 9.

In addition to banks, other credit and leasing providers must also monitor DTIs. It is therefore useful to cancel unused credit cards with a higher credit limit and enabled overdrafts before applying for a loan. Even undrawn commitments reduce your chances of getting a mortgage in the required amount.

Example: If your net monthly income is € 1,000 and you earn € 12,000 a year, your maximum debt cannot exceed € 96,000. But if you are already repaying consumer loan with an outstanding balance of 10 thousand euros, the bank will no longer lend you more than 86 thousand euros.

For spouses or several applicants, revenues are added up. Therefore, independent loan applicants are at a disadvantage, since they might not be able to get loan for their property, especially in the case of real estate prices in large cities.

Achieve higher returns vyššie výnosy

Start investing tax-smart via low-cost ETFs.

3, Debt to property value ratio (LTV, Loan to Value)

LTV indicates the ratio between the loan amount and the value of the appraised property. From July 2019, the mortgage amount to the value of the property may not exceed 80% (Loan to Value - LTV).

Applicants for a mortgage loan should, therefore, use financial resources other than those from the mortgage to purchase real estate. When buying a property valued at 100,000 the bank will lend you a maximum of 80,000 euros. The remaining 20 thousand must come from your own resources (ideally).

In practice, many people use other loans for co-financing - consumer loans and construction loans from building societies or so-called P2P loans. However, these loans typically have a shorter maturity than mortgages (consumer loan can have the maximum maturity of 8 years) and can significantly increase the monthly costs, in addition to a significant repayment of the borrowed amount.

The second (less used) option is the temporary pledging of property, other than the one being purchased, for the benefit of the bank. Thanks to this, you would, even today, be able to acquire 100% financing for the property purchase.

Example: Let's say you plan to buy an apartment for 150 thousand euros and you have not saved for the deposit payment (20% of the purchase price). If your parents agree to the temporary pledging of their apartment with the value of 100 thousand euros, the LTV ratio for your mortgage would be 60% (150,000 mortgage to the total value of the pledged properties 250,000 euros) and the bank would be glad to provide you with a loan after fulfilling other conditions.

Banks favor the prepared

Ideally, you should not start with the process of buying real estate if you have not saved at least 20% of the purchase price. Securing a roof over your head is probably the biggest transaction and also the biggest financial commitment in your life, and you need to be well prepared for this step.

If you want your "own" in 1-2 years, you should rather put the money in a bank account, or set up a separate savings account for this purpose. With zero interest, you won't earn anything, and due to inflation, you will lose some of the purchasing power of your savings. But with such a short horizon, it is better not to take risks.

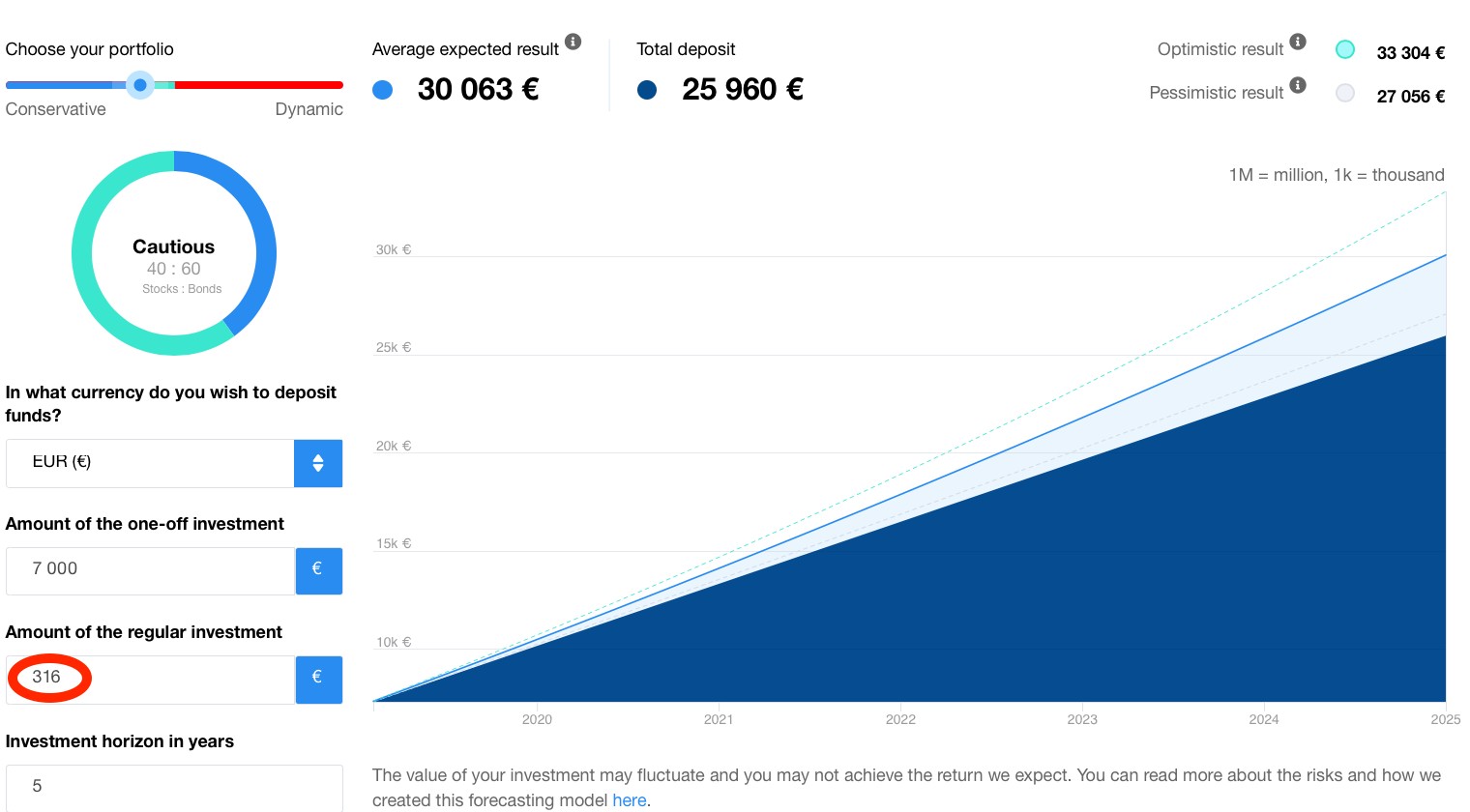

However, if the purchase is planned in 3-5 years, you will do better if you invest the money. Let's say that in 5 years you would like to move in a family house valued at 150 thousand euros and you want to save 20% of the purchase price, i.e. 30 thousand euros. Today, however, you only have 7,000 euros in your account and you are not sure how much you need to save per month. Don't worry, our algorithms will help you set up your financial plan:

After entering the required data, you will find out that in order to achieve your goal (saving the missing 23 thousand euros within 5 years), you need to save 316 euros per month.

If you would like to save the same amount (23 thousand euros) in a bank account, you would need to save 383 euros per month for 5 years. The effect of compound interest can be seen even on a shorter investment horizon. Why not take advantage of it?

Make use of the consultancy services

Recommendation - if you are not sure how to the mortgage application by yourself, you do not want to constantly follow the current offers and conditions of banks or it is a more complicated case (financing the construction of a family house, etc.), make use the services of an experienced financial advisor.

Even though it won't get you better conditions, than the ones you could negotiate on your own, it will definitely save you time and they will guide you through the process. The broker’s commission for the mortgage intermediation is normally paid from the bank's margin, so their services do not cost you a penny.

Schedule a 15-minute phone call for free hovor zdarma

We will help you get started and learn more about Finax.

App Store

App Store

Google Play

Google Play

Difficulty

Difficulty