Striving for constant progress is a natural trait of human beings. As it’s natural to always look for a better place to live, it should be natural to increase your financial assets. It’s probably also the reason why you have preferred Finax over other forms of wealth appreciation.

Our job is to appreciate your wealth as much as your risk profile allows. You give us a chance and after some time you want to see the results. In order for you to be able to compare our results with other investment solutions you need to know what return you have achieved with a given risk profile.

There are three standard ways of calculating the return. The most widely-used way of calculating the return, and the market standard, is Time Weighted Return (TWR). The other two ways are Money Weighted Return where we distinguish between two types of calculation – simple return and Internal Rate of Return, or IRR.

When you log in to your Finax account you will see two different return indicators. Simple return, which we have been using since the beginning as a basic way of displaying the return, and time-weighted return.

Simple return

Your simple return is the ratio between your profit and your deposits. Profit in this case is expressed as the difference between the sum of the current value of the investment and withdrawals from the investment and all the deposits. To give you an example. You have deposited €10 000 in an account. Today the value of your account is €12 000.

Deposits = €10 000

Profit = account value - deposits

Profit = €12 000 - €10 000 = €2 000

Simple return = profit / deposits

Simple return = €2 000 / €10 000 = 20%

Simple indeed. The fact that you can calculate the simple return on your own often leads you to consider it as the main indicator of the portfolio preformance; however, in case of a long-term, regular investment this indicator might be misleading. It’s the same as asking my son how was school and he replies: „It was OK“. I have the basic piece of information but totally lack the details.

Imagine that both you and your partner invest according to the given example. You really love the 20% return and you decide to invest another 10 000 EUR. What is going to happen? The value of your account will be 22 000 EUR, the total deposits 20 000 EUR, and the profit will remain at 2 000 EUR.

Simple return = (€22,000 - €20,000) / €20,000 = 10%

In contrast, your partner decides to take the profits out and pay for a family vacation. What will be the simple return in this case? The value of the account will be €10,000, the deposits will be €10,000, but taking the withdrawal into account, the return on the investment will still be €2,000.

Simple return = (€10 000 + €2 000 - €10 000) / €10 000 = 20%

Simple return is a good indicator of return when you invest all your funds at the same time, at the beginning. However, it is not a good indicator if you make deposits and withdrawals throughout the investment period – which is the case of probably 90% of Finax clients.

Unfortunately, the simple return is the only one of the three ways of calculating the return that the average person can calculate for himself quite easily. At the same time, it has to be said that investing does not have a great tradition in Central Europe and investors are not commonly familiar with other ways of calculating returns.

That’s also the reason why we decided, at the beginning of Finax, to display the return only as the simple return - which seemed better for new investors.

Time-weighted return

In order for you to grasp how well Finax manages your funds and to be able to compare our appreciation with the performance of other investment solutions (e.g. mutual funds), you need more sofisticated way to calculate return.

As the example of simple return shows, all deposits and withdrawals have a significant impact on the value of simple return. Time-weighted return does not take into account the impact of deposits, withdrawals or fees.

In other words, time-weighted return indicates how much you would earn if you had invested all your funds at the beginning at the same time, instead of investing regularly. We will demonstrate this on Ivan Chrenko’s transparent account, the richest Slovak who is also a client of Finax.

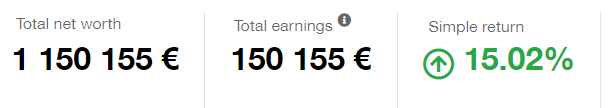

Mr. Chrenko made a deposit of 1 000 000 Euros in Finax and at the time of writing this article his account value was 1 150 155 Euros.

The simple performance is 15.02%. However, when we look at the detail of the account we will see that Mr. Chrenko first made a deposit of 100 000 Euros on May 31, 2019 in order to test Finax out, and only then made an additional deposit of 900 000 on July 27, 2019 – making the total amount of deposits one million. How can we calculate time-weighted return?

1. We need to calculate simple returns for the two time periods:

- May 31, 2019 – July 28, 2019

- July 29, 2019 – January 26, 2021

2. We multiply the partial simple returns (a*b)

For better overview, we demonstrated the first step in the following table:

Date from, Date to, Initial value, Net deposits at the beginning, Final value, Return, Simple return

Mr. Chrenko’s portfolio return in the first period was 2.38% and in the second period 14.74%. If we multiply these two numbers, the result we get is the time-weighted return of his portfolio.

1,0238 * 1,1474 = 1,1747

If we translate this figure into comprehensible form, the time-weighted return in 17.47 %. If Mr. Chrenko had invested everything already in May 2019, his current total asset value would be 1 174 700 Euros, so almost 25 000 Euros more than he has today.

It needs to be said that this calculation was one of the simpler ones because we only had to take into account the two deposits made throughout the whole period. If you invest regularly, each month, then calculating the time-weighted return is practically impossible.

Why don’t we include entry fees?

Finally, it is our duty to mention why we calculate the appreciation on net deposits, i.e. on deposits net of entry fees and, in the case of financial agents, the investment advisory fee (no longer charged by Finax as of the beginning of July 2023), if clients have paid such a fee to the agent.

Entry fees may vary from client to client. For agent-mediated investments, the amount of the investment advisory fee is determined by the agent and therefore has nothing to do with our performance.

It is the market standard in Slovakia that entry fees are not included in the calculation of mutual fund appreciation as it may vary from distributor to distributor. Therefore, if you are to be able to compare the performance of our portfolios with other investment solutions, it is necessary to disregard entry fees.

Key takeaways

If you want to compare your investment in Finax with other investment solutions use the time-weighted return. If you want to know what is your return from the total invested amount, use the simple return.

In majority of cases the time-weighted return will be higher because the funds deposited later on haven’t had the time to appreciate as much as your initial deposit.

That’s the hidden power of long investment period. If you had had the money at the beginning, if you had not waited or divided your investment into smaller parts, you would have earned exactly as much as when we multiply the net deposits by time-weighted return.

The next time you are pondering whether to divide or invest all your funds at the same time, have this in mind.

App Store

App Store

Google Play

Google Play

Difficulty

Difficulty