Finax, licensed investment broker from Slovakia, has brought an unrivalled investment product to the Central European market in the form of managed portfolios built on index ETFs and digital solutions.

Currently, the Exchange Traded Funds (ETFs) are perhaps the most cost-effective, risk-spreading and return-investing investment tool. Their portfolios copy the broad market indices, thus embodying the so-called passive investing.

Passive investing removes the human risk from investing and, at the same time, offers broad diversification (risk distribution), thanks to which it achieves, for the vast majority of investors, the best ratio between the achieved return and the risk taken.

Finax is one of the first robo-advisors in the Central Europe and the first in this region to successfully introduce the so-called hybrid model of investment consulting. It represents a combination of personal and online consulting. After the successful introduction in Slovakia, we also launched this model in other countries where Finax operates.

Traditional European robo-advisors usually compete with financial agents. However, that does not apply to Finax. The work of a financial agents can make use the components of a robo-advisor and, in particular, increase the quality of their services.

Many people build trust with a particular person, with whom they have a long-standing relationship, and prefer a face-to-face meeting over the online form. Likewise, financial agents can look into person's finances more comprehensively and offer more in-depth management of financial assets.

In Slovakia, Finax started cooperating with financial agents shortly after the launch of managed portfolios. Today, our services areintermediated by almost three dozen external partners with hundreds of salespeople, including four companies that are among the Slovakia's top ten of independent financial agents licensed for the capital market.

External sales represent one of the main ways of the distribution of Finax's managed portfolios. Therefore, we makeconsiderable efforts regarding development of the agent section on our website and adaptation of the product to the needs of financial agents.

The main advantages and differences that the cooperation of financial agents with Finax offers, compared to traditional investment instruments such as mutual funds, are following:

- Unique investment product:

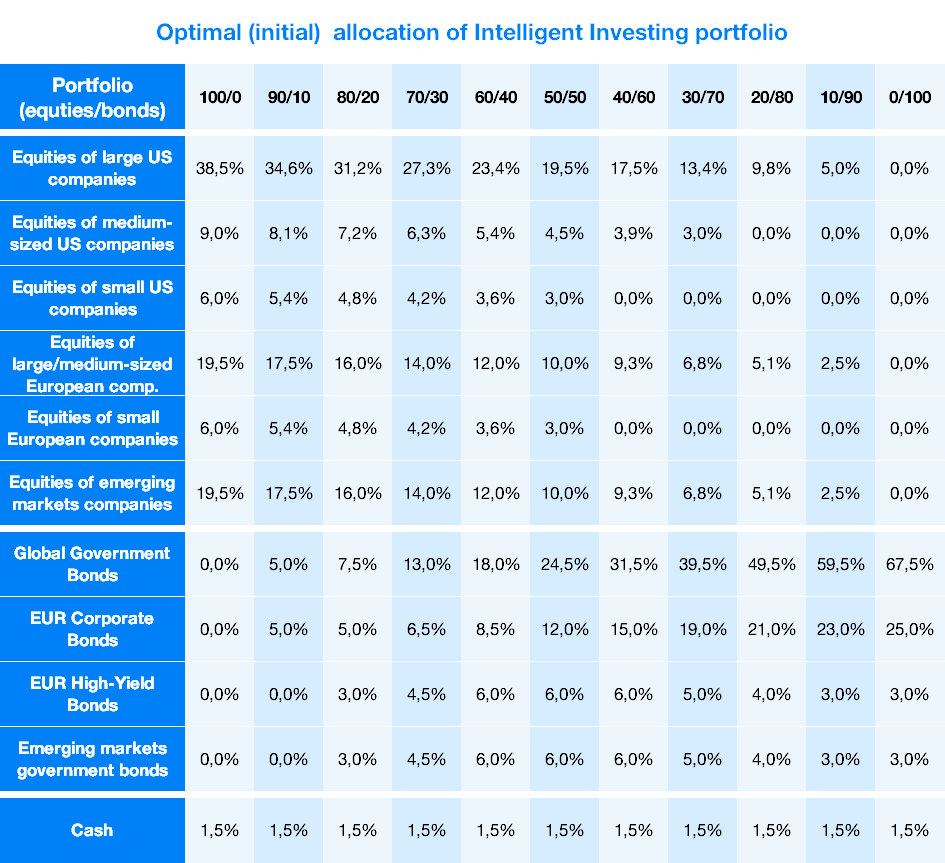

- 11 portfolios under management with different degree of risk built on 10 ETFs;

- higher returns with perfectly spread risk (unrivalled diversification);

- low costs – as a rule, lower fees than in the case of mutual funds;

- investment tailored to each client based on their risk profile.

- Modern and digital solution representing the 21st century:

- conclusion of a contract electronically (online on the Finax website);

- own agent section with an overview of clients and incomplete contracts;

- personalized profile of the financial agent;

- possibility of a conclusion of distance contract;

- clear proposal of an investment plan for the client (offer letter).

- Improved financial intermediation:

- reducing and simplifying the work of financial agents;

- increase in quality of financial intermediation;

- increase in sales of investment products;

- adaptation of the agent section to the legislative requirements of each country;

- excellent and professional sales support;

- education of financial agents (trainings, newsletter, webinars, articles, etc.).

- Attractive evaluation and business growth:

- standard remuneration (entry fees and subsequently generous commissions);

- faster growth of assets under management due to higher returns;

- considerable flexibility towards the requirements of financial agents;

- growing brand recognition and good reputation.

Individual and personalized access

All your salespeople will obtain a personalized access to better intermediate our products. Each agent receives own login details to access the system, through which the contracts are being concluded. The agent's profile is personalized with own photo, email address and phone number.

During the registration process, your photo and your company logo are being displayed to the client. Thanks to this, even if the client registers using the registration link sent by you or through the proposed investment plan, they know that you are still present.

After logging in to their account, the client sees information about you, as their financial agent, with your name, number, email and photo being displayed. Client always has the feeling that their assets are constantly supervised by their financial agent andthat the agent is always available.

Sales support tools

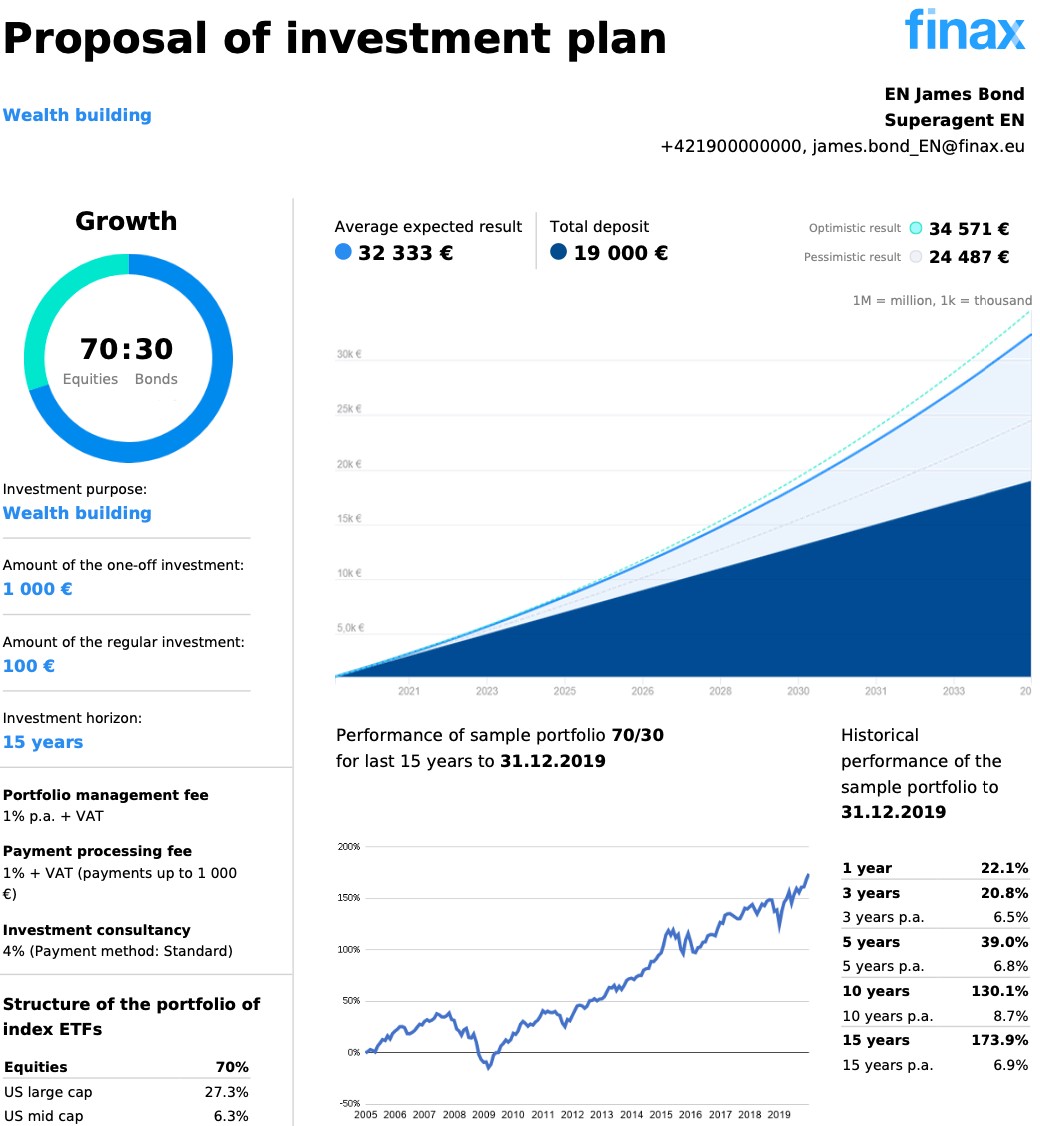

Clear proposal of an investment plan

A useful addition to the agent section is the possibility of sending a proposal of an investment plan (offer letter) to the client. In case the client needs to think over the investment, or you are forced to interrupt your meeting, you can create a pdf version of the proposed investment plan for the client.

In addition to your contact details and logo, the investment plan proposal also contains key information such as the investment strategy, investment parameters, expected and modelled historical development of the portfolio, its composition and key benefits.

During the creation of an investment plan proposal, the client's email address will be tied to the agent for a period of 3 months. During this time, the client concludes the contract exclusively through the financial agent who created the proposal for the client.

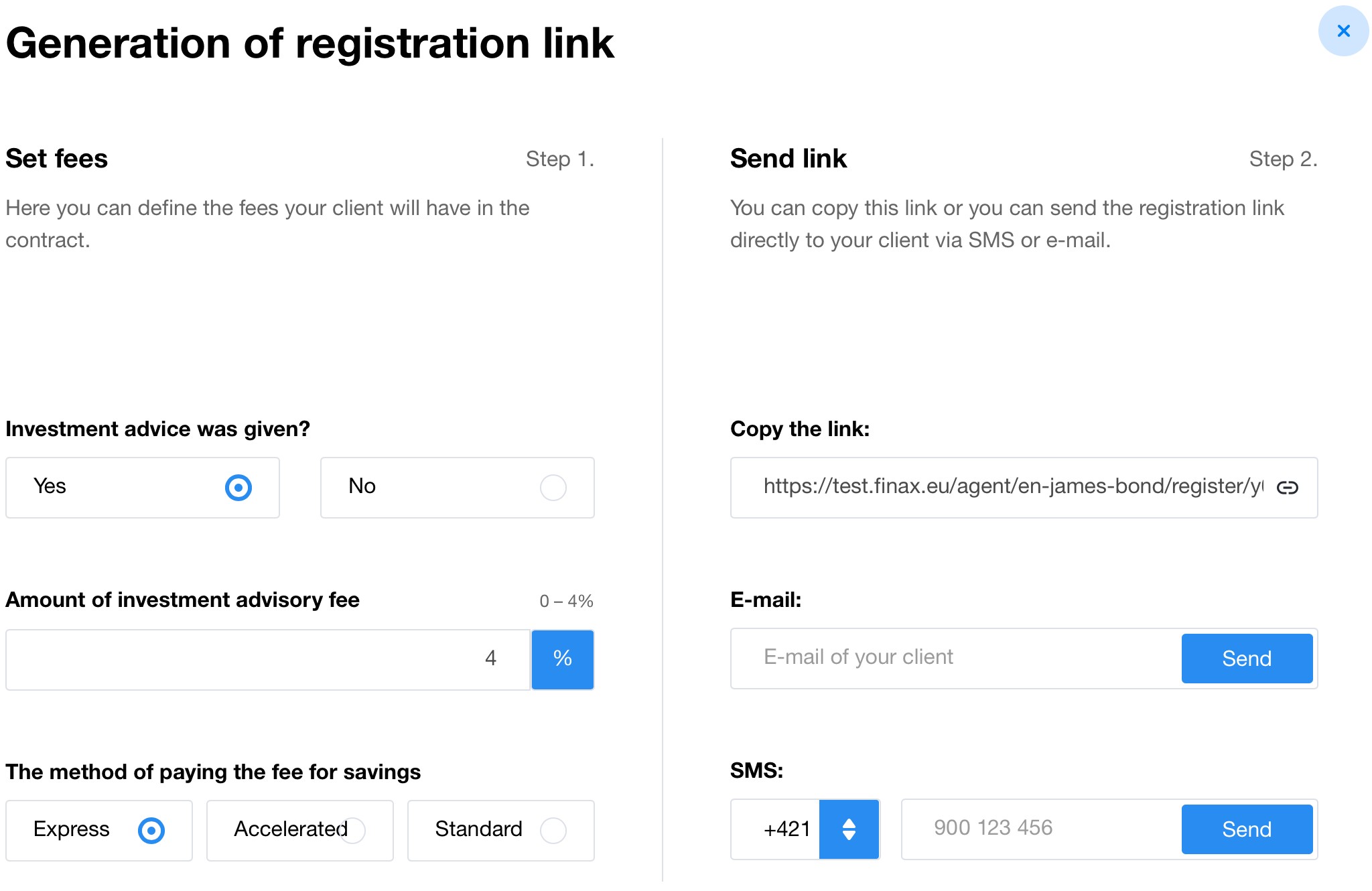

Unique registration link

With Finax, you have the opportunity to generate a registration link for the client, where the investment consulting fee and the method of its repayment will be defined. You can send this link to the client via e-mail or as a text message, since the mobile version of the website also supports registration.

Online, simple, clear and most importantly paperless environment

According to your requirements, we will adjust the information about your company, internal or client’s communication strategy, as well as the content of contractual documents and data, which will become part of the Protocol on the financial service intermediation.

We digitize all of the contracts

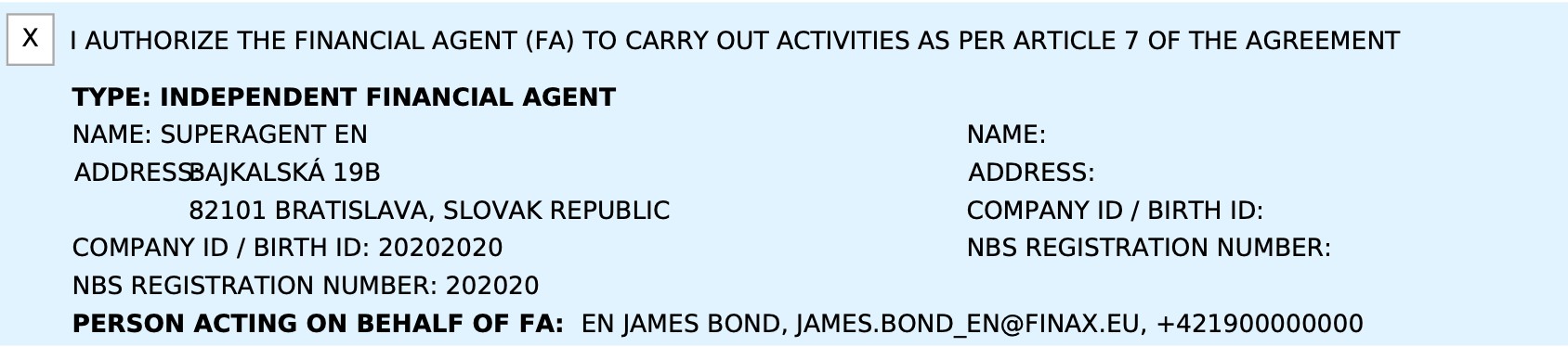

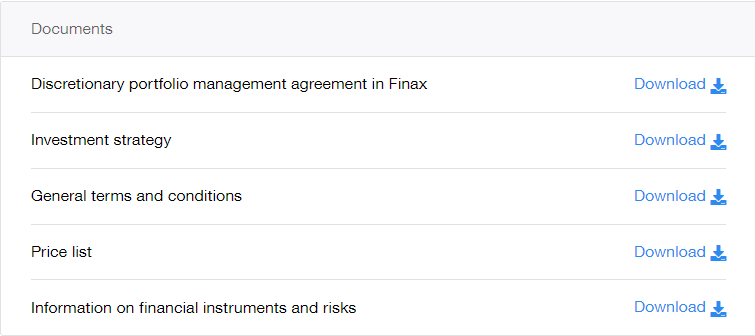

The most important part of our system for financial agents is probably the integration of all the necessary requirements for the intermediation of financial services into online generated contracts. The discretionary portfolio management agreement automatically includes information about the independent financial agent, the subordinate financial agent and the person communicating with the client.

Automated protocol on the financial service intermediation

More importantly, based on client and agent data, our system also generates a Protocol on financial service intermediation. This protocol may fulfill the role of the Record of the meeting of financial intermediaries.

This document contains all of the legal requirements such as client and agent data at all levels, investment questionnaire and its evaluation, fees, all information that you are obliged to provide to the client by law, contract with the client and the consent to the processing of personal data.

You no longer have to go through or write something multiple times. All the contractual documents, including the protocol, will be delivered to the client and to the independent and subordinate financial agent by email after the completion of registration. The process, that is set up in this way, meets the requirements for the provision of investment services in accordance with the law and is localized for each country.

You will always be of assistance to the client

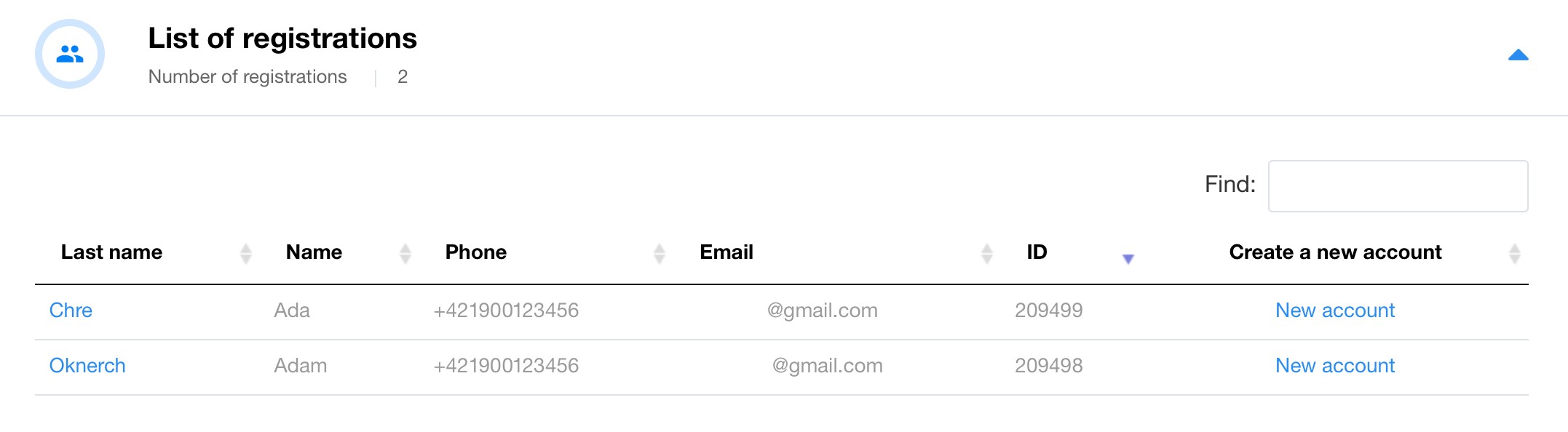

After logging in to the agent module, you can select the Overview of unfinished registrations and the Overview of clients (signed contracts with verified contact details and client identity), where you will find a list of all your clients.

If you want get to an overview of the client’s accounts and settings, you just have to open them. This is the same overview that the client gets to after logging in. You get an accurate picture of the development of your clients' investments. If your client does not understand something, you can easily answer their question.

In the Client Overview and the Overview of Registrations, you can conveniently open asset accounts for the client. Under adiscretionary portfolio management agreement, client can have up to 99 accounts and the client can choose the name of the account.

With our system, you have the ability to take care of several financial goals of the client under the same roof, e.g. retirement savings, early mortgage repayment, creation of emergency fund, savings for a car or children.

Unfinished registrations remain stored in your access for a long time. You can return to them at any time in order to complete them.

Finax is cheaper, but it retains the reward that you are used to

Finax charges three fees:

- Portfolio management fee at 1% p.a. + VAT (20%) – a fee calculated from the volume of assets under portfolio management, deducted on a monthly basis. Finax shares this fee with an external sales partner. It is lower in comparison to the most competitors and it plays the most important role in terms of the investment return. At the same time, it represents a great source of passive income for intermediary in the future.

- Investment consulting fee, max. 4% – distribution fee for the correct setting of the client's portfolio. It is paid and calculated as a percentage of the deposits that the client intends to invest. Finax offers 3 ways of repaying this fee, namely express (paid by the client in advance, calculated from the target deposit), accelerated (calculated from the target deposit and paid in the first payments) and standard (ongoing fee collected from each client's deposit).

- Payment processing fee, valid only for deposits below 1 000 €, or equivalent in other currency, at 1% + VAT – fee for crediting the deposit to the investment account. This is a one-time fee charged for each deposit in an investmentaccount that is below 1000 euros. Finax does not share this fee with external partners.

If provided, the investment consulting fee is set for each client individually during the registration phase, according to the agreement with the client. The amount as well as the payment method are fully under the direction of the financial agent. The system will then calculate the total fee.

Finax outside the Slovak market?

In autumn of the last year, we embarked on a journey of foreign expansion. Our strategy was the main reason for this journey and the investment in the amount of EUR 1.5 million obtained from the Growws Sicav fund owned by the richest Slovak, Ivan Chrenko, was the necessary driving force for the successful realization of our goal.

One of the main features of our foreign approach is the provision of localized services. In short, this means that we fully adaptthe Intelligent Investing to the conditions of a specific market, but above all, to the local requirements of clients and agents.

Language (non-)barrier and local content

Our activities are always provided by experts, who speak the language of the country of operation and who, even many times,come from these countries themselves. Because of this, we are able to analyse and perceive the situation of the market as a whole. If you contact our support staff at the local telephone number, you will get a response from a Polish-speaking person [+48 22 104 09 08](tel:+48221040908).

Our website is available in Polish, that includes blogs and webinars, which we also adapt to local market conditions. Financial intermediaries, as well as our clients, consider the content we create as a useful and easy to understand source of information that increases financial literacy.

Local services and legislation

The basis of our operation in all countries is the consideration of local legislation and the use of local services in the investment process.

We are a Slovak investment broker, licensed by the National Bank of Slovakia. All of our clients’ investments, whether domestic or foreign, are subject to the same security rules and measures regarding the investment accounts.

We accept deposits in Polish zlotys, but we only invest in euros. Funds are bought only on the German stock exchange Xetra. We take care of the conversion, making using of the more advantageous terms when compared with exchange rates offered by banks. You can read more about currency risk here.

Finax is passported to most countries of the European Union. That means that based on the notification of selected activities of our entity through the National Bank of Slovakia to the individual national regulators, we can offer our product, in the member countries of the EU, directly or via tied agents.

What to do if you are interested in selling our services?

The unique intermediation module will save you a lot of time when selling financial products, which you can spend on acquiring new customers, taking care of existing ones and developing your organizational structures. You will no longer have to worry about circulating and delivering contracts, and your work will become even more efficient.

At the same time, you will no longer have to resolve the conflict of interest that arises between you and the client. With Finax Intelligent Investing, you can be certain that, in the long run, you are selling the most advantageous investment product with a well-diversified risk. At the same time, you get a reasonable commission for the sale, which quickly increases in the long run thanks to the higher returns.

If you are interested in working with us, feel free to contact our office. After signing the contract, we will create accesses to yourpersonalized agent module and we will also train you on the module. The highest level of support will also be providedthroughout our cooperation.

Help your clients invest intelligently.

App Store

App Store

Google Play

Google Play

Difficulty

Difficulty