We will continue with traditional transparency of sharing our results even after the third year of Finax existence. We have prepared an overview of basic indicators assessing our last year‘s activities.

While 2019 was the year of establishing our brand on financial markets, 2020 was the year of expansion. Our primary objective was to significantly increase the number of clients and AUM, while successfully expanding to international markets.

You can find the review of our main goals we set for 2020 in the blog Review of 2019 and Finax plans for 2020.

Last year we managed to achieve our goals for all key indicators and we also fulfilled most of our qualitative plans. We are extremely satisfied that we exceeded all our expectations considering that 2020 was a difficult year which will go down in history as the year of pandemic, economic recession, high unemployment rate, and high market volatility.

The results of Intelligent Investing portfolios in 2020 compared with competition will be published in our article 2020 Investment results in the next couple of days.

Tomorrow, we are also going to publish a basic overview of financial market development in the last year.

Create an account and start investing today

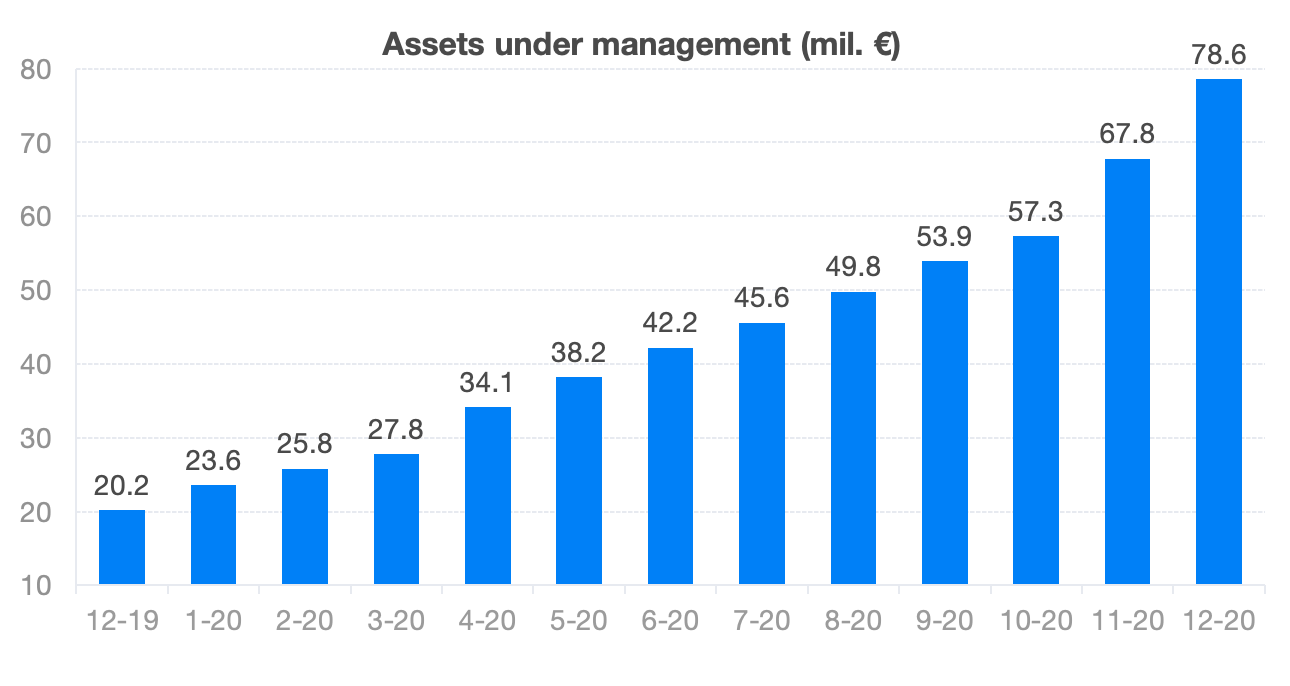

Assets under management

- AUM at the end of 2020 reached 78.6 million EUR, which is a year-over-year increase of 289%.

- We had our goal set at 60 mil. EUR which means we exceeded our expectations by 31%.

- The development of assets does not reflect the market downturn in March. New deposits compensated for the decrease in portfolio values.

- The total earnings of our clients, in a period of less than 3 years, reached 6.2 million EUR at the end of 2020.

- The behavior of Finax clients was rational and admirable in 2020. The volume of withdrawals in March was only a little higher than the average monthly withdrawals for the year. On the contrary, more clients took advantage of the opportunity that the pandemic presented. March will long be a record-breaking month considering deposits and new contracts, which had been totally unexpected at the beginning of the pandemic.

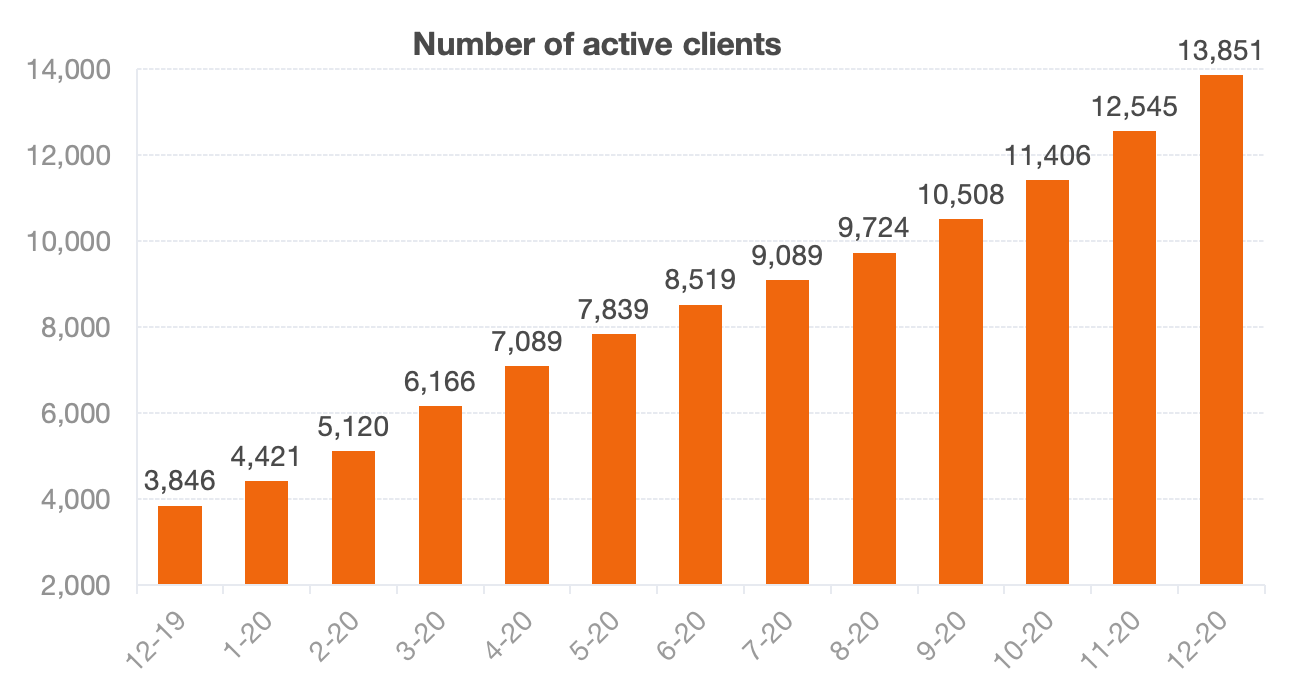

Number of clients and deposits

- Finax had 13 851 active clients at the end of the year. The number of clients increased by 260%.

- Our objective was to manage assets for 11 000 clients. We exceeded the plan by 25.9%.

- Encouraging aspect is also the increase of the average AUM (assets under management) per client, which increased by 7.8% to the total of 5 673 EUR.

- Increase in the number of clients by more than 10 000 is comparable with the largest European robo-advisors based in Great Britain or Germany.

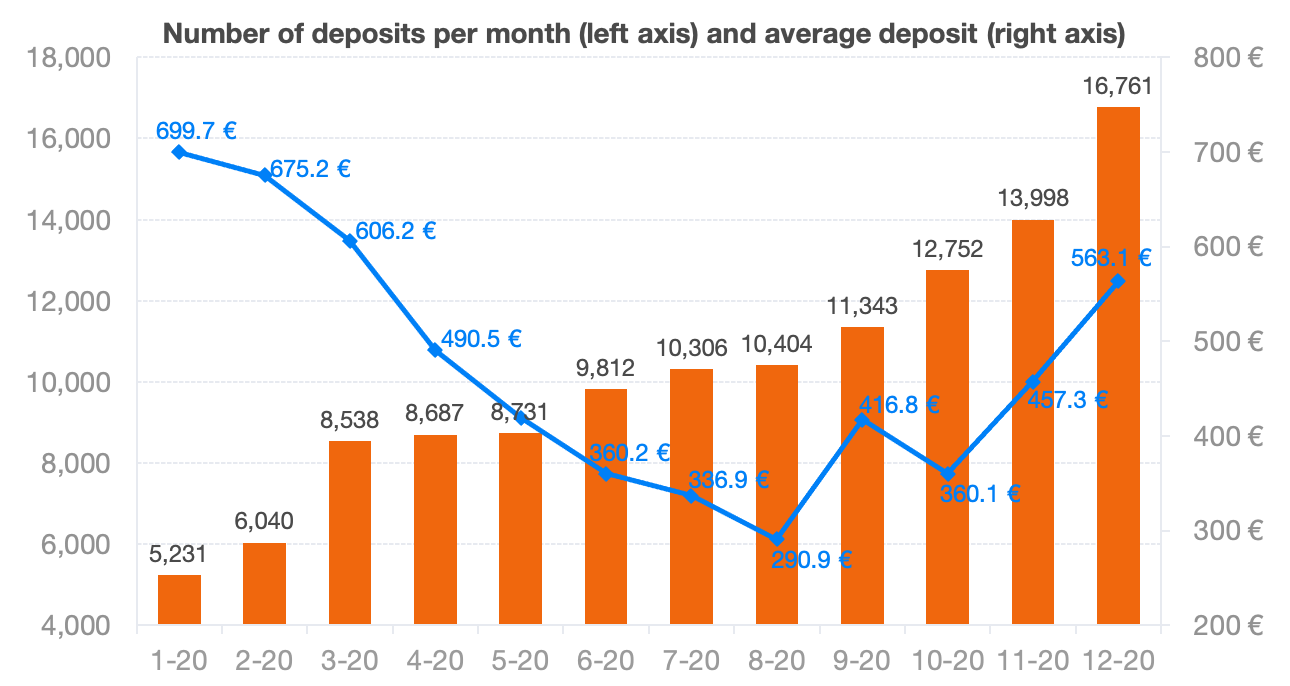

- We received more than 16 700 deposits in December, 2020, which represents year-to-year increase of 282%.

- The average deposit, however, continually decreased during the year up until August – due to the growing number of clients and uncertainty caused by the pandemic. The market rally and increase in the savings of our clients revived the confidence of intelligent investors and that in turn manifested itself in higher deposits.

-

The average year-over-year deposit decreased by 14.8%.

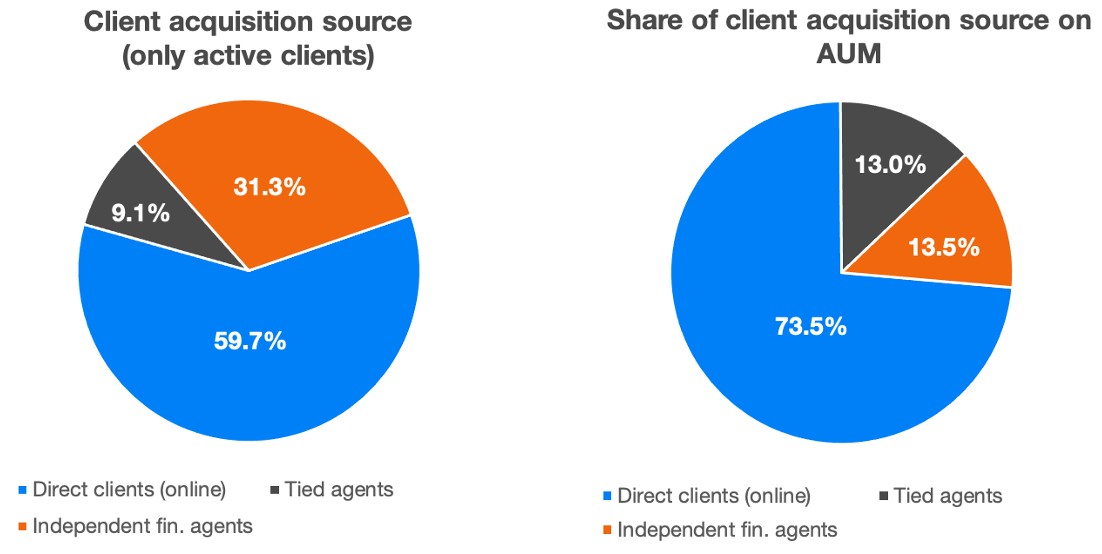

Client acquisition sources

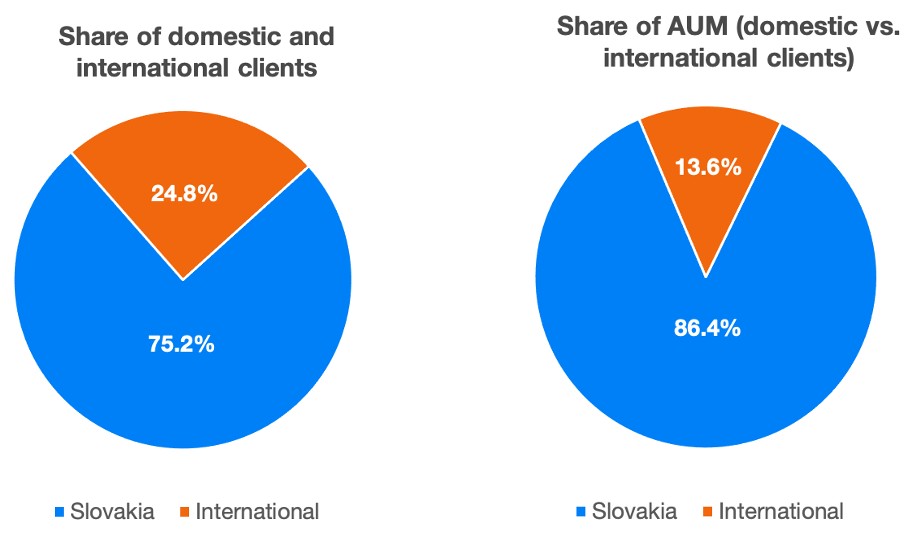

- The share of international contracts reached 35.3% last year.

- Initially, our objective was to reach a 30% share of international registrations (on all monthly registrations) by the end of the year. We managed to achieve it throughout the year and in the last quarter the share of international contracts reached 53.8%.

- 24.8% of clients is international, which is crucial from the geographical diversification of income point of view.

- Share of their assets on the total AUM was 13.6%.

- International markets have just started picking up this year and that’s why the asset average of an international client is lower compared to a Slovak client.

- External financial agents of Finax brokered 36% of all contracts in 2020. The amount of contracts brokered by agents increased by 126% year-over-year. Their share of Slovak contracts was 54.2%.

- The total share of externally brokered clients is 40.3%, however, their assets are lower compared to other active clients. The share of assets of externally brokered clients is 26.5%.

- The number of external sales partners increased to 33 (from 21), of which 21 are independent financial agents and 12 are tied financial and investment agents. Towards the end of the year, more than 1450 financial agents offered Finax as a part of their portfolio.

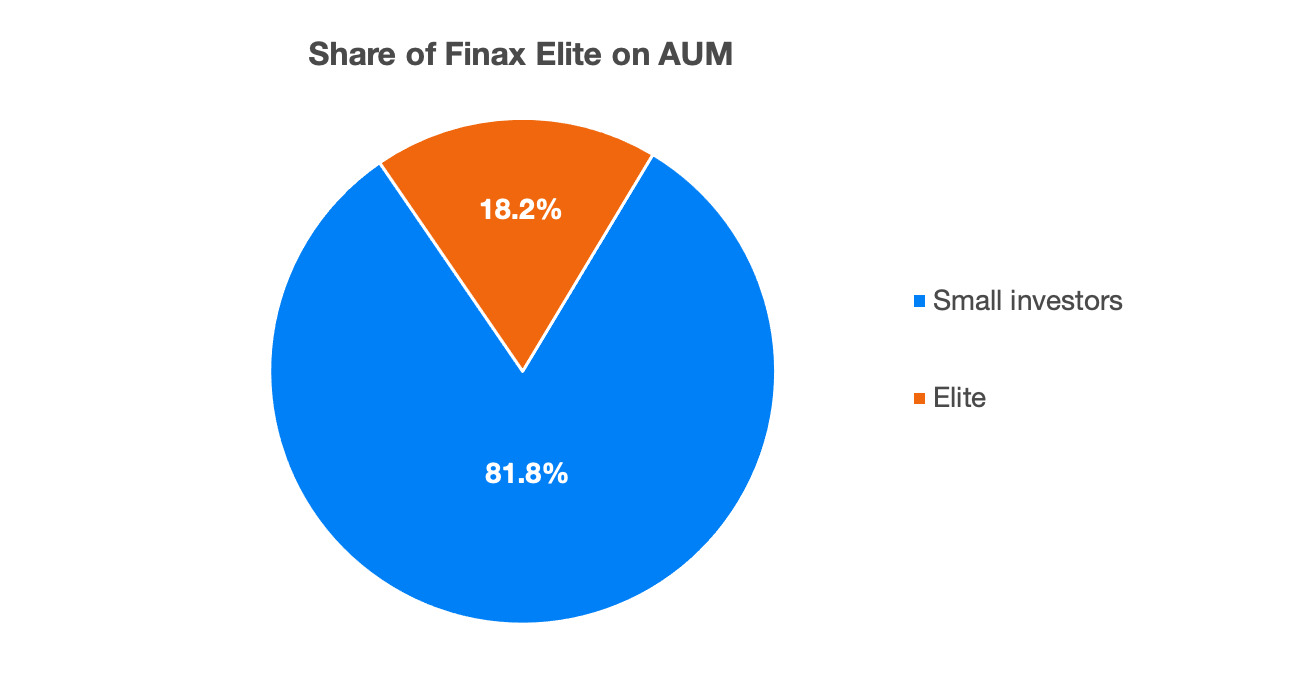

- One of the novelties which we introduced at the beginning of the 4th quarter of the last year was Finax Elite, the private investment center.

- At the end of the year, the share of Elite clients‘ assets on the assets managed by Finax was 18.2%.

Client and account profile

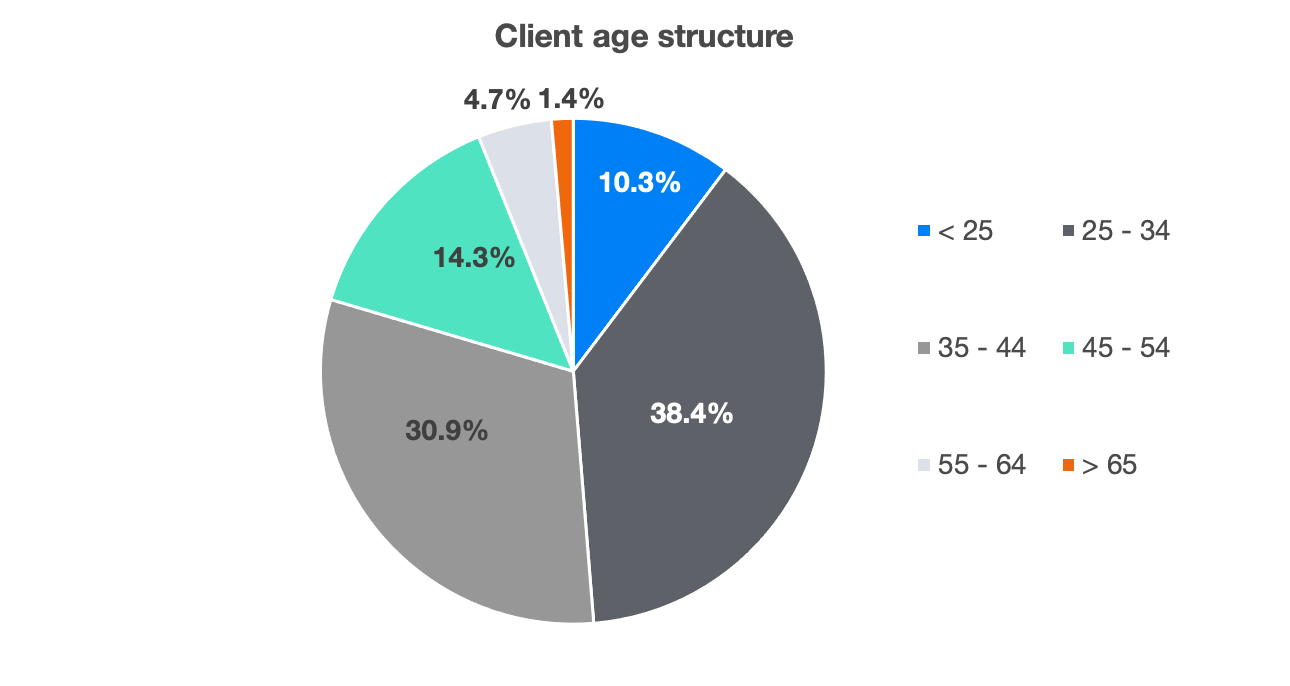

- Finax continues to attract young people, which is the result of our way of communication – the use of online tools and technologies.

- As much as 77.1% of our clients are people under the age of 45. The largest group are clients in between 25 and 34 years of age (38.4%).

- Our clientele got a little bit younger last year. The share of clients under the age of 25 increased by 0.8 percentage point and the share of clients between 25 and 34 years of age increased by 2.7 percentage point.

- We are happy to see such an interest of young people in investing as well as their responsible approach to their personal finance management. We devote a lot of time and effort to education which also falls on a fertile ground according to the statistics. We believe that we are educating the next generation of affluent future retirees.

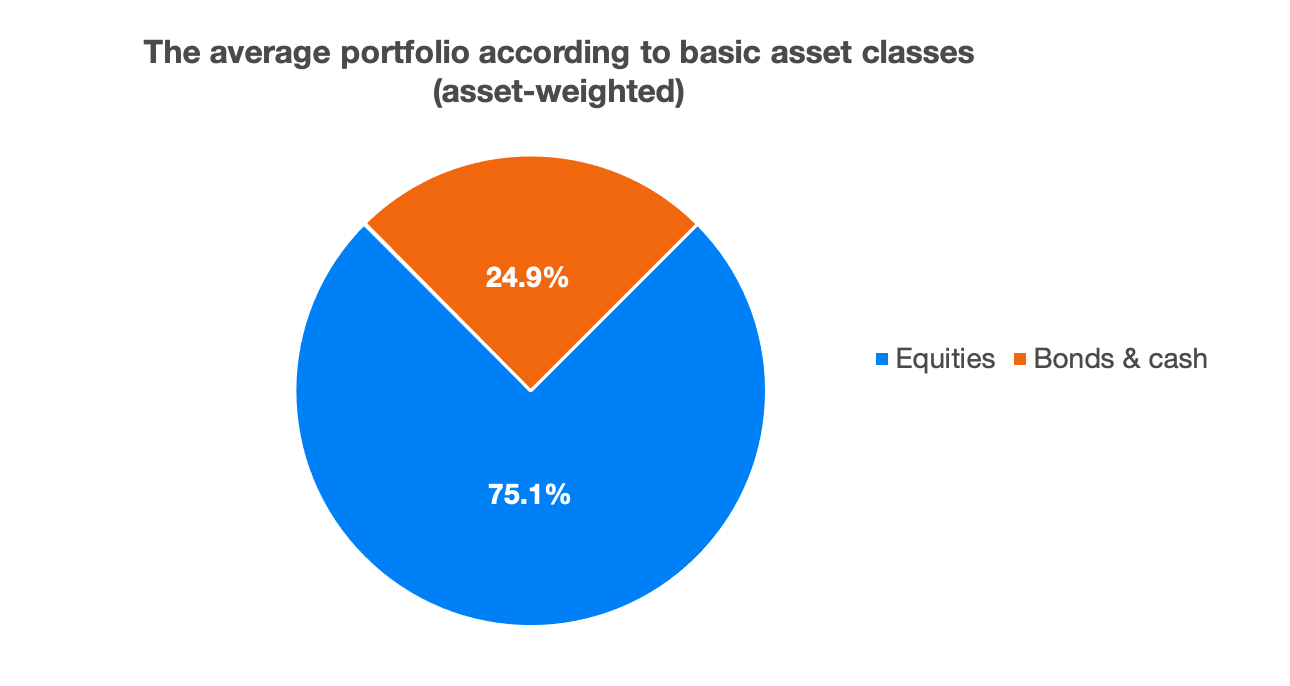

- The average portfolio profile of 2020 was a bit more dynamic.

- The current allocation of assets under management of Finax is 75.1% equities and 24.9% bonds. A year before the share of equities was lower by 5.7 percentage points.

- We consider this trend to be positive as well, as we are primarily focused on mid- and long-term wealth building of intelligent investors.

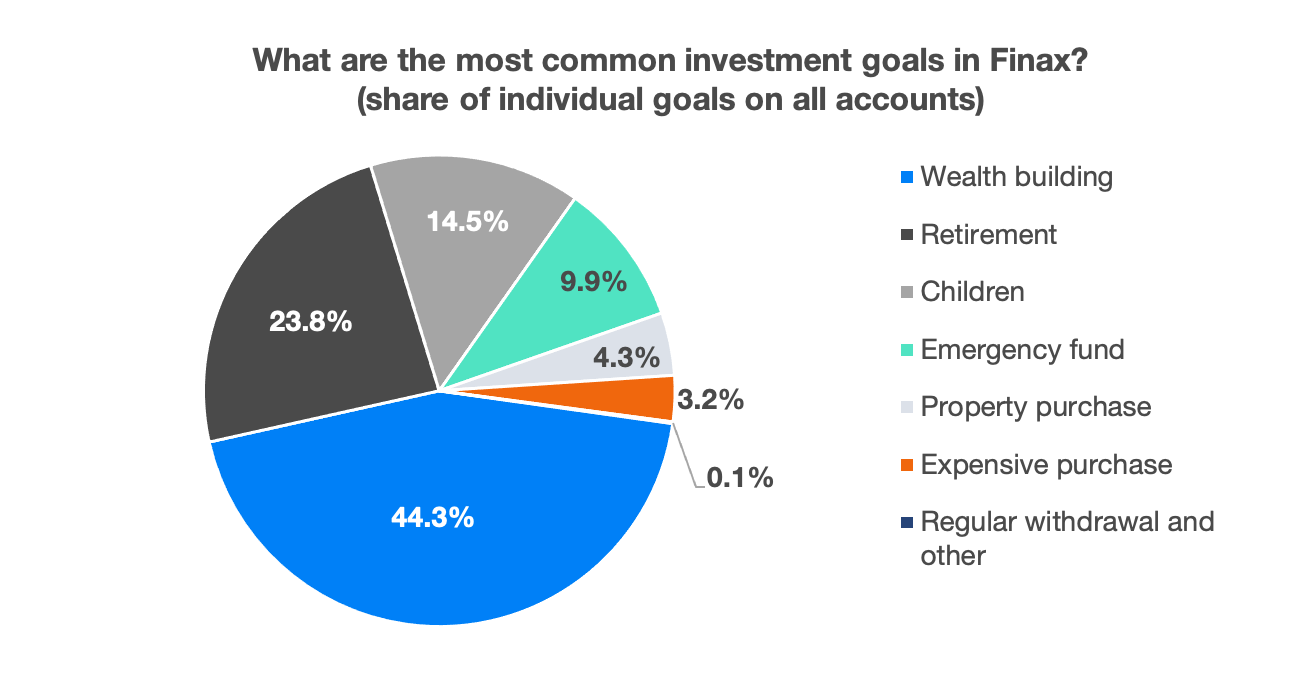

- The share of individual investment goals has not changed significantly.

Website traffic and Finax content stats

- In 2020, our websites recorded 1.28 millionvisits and 5.09 million views by 185 thousand users.

- We started to record more videos and podcast. Videos on our Finax YouTube channel reached 132,7 thousand views and our podcasts were played 131,7 thousand times.

Qualitative results

- Successful inspection by the Office of Personal Data Protection without a single rebuke.

- The launch of Finax mobile app: Finance and investing.

- Creation of new department – Finax Elite for private clients.

- The launch of employee program.

- Entering the Croatian market.

- Higher degree of backoffice process automation.

- Biometric verification for iPhone.

- Launching the affiliate program.

- New Finax podcasts

- New concept of increasing financial literacy awareness (www.financie.sk)

There are only few things we had set out to achieve in 2020 and in the end we failed to deliver on. We planned to enter one more international market but we had to postpone it for now due to capacity reasons. We promised and did not deliver on the digitalization of registration for minors and legal entities and family accounts.

The results of Finax are exceptional even in its third year of existence. We managed to achieve significant growth and exceed all our ambitious expectations. Considering the circumstances, there is nothing to blame on 2020.

Achieve higher returns vyššie výnosy

Start investing tax-smart via low-cost ETFs.

Hard work is the key factor behind our performance. The specific socio-economic situation required a great effort on our part which, however, bore fruit. The fact that we managed almost a quadruple increase in our performance at the time of worldwide pandemic can be considered as a huge success.

First of all, great thanks goes to all of our employees who continue to do a great job and these results wouldn’t have been possible without them. 2020 wasn’t an easy year considering the inevitable change of working habits. All Finax employees aced this transition.

We are grateful for all our clients‘ and fans‘ support and trust throughout the last year.

We will continue to bring attractive solutions in the field of personal finance and investments which will enrich your life even more, help you navigate your family budget and shorten your way to building sufficient wealth.

We are also going to publish an article about our ambitious plans for 2021.

App Store

App Store

Google Play

Google Play

Difficulty

Difficulty