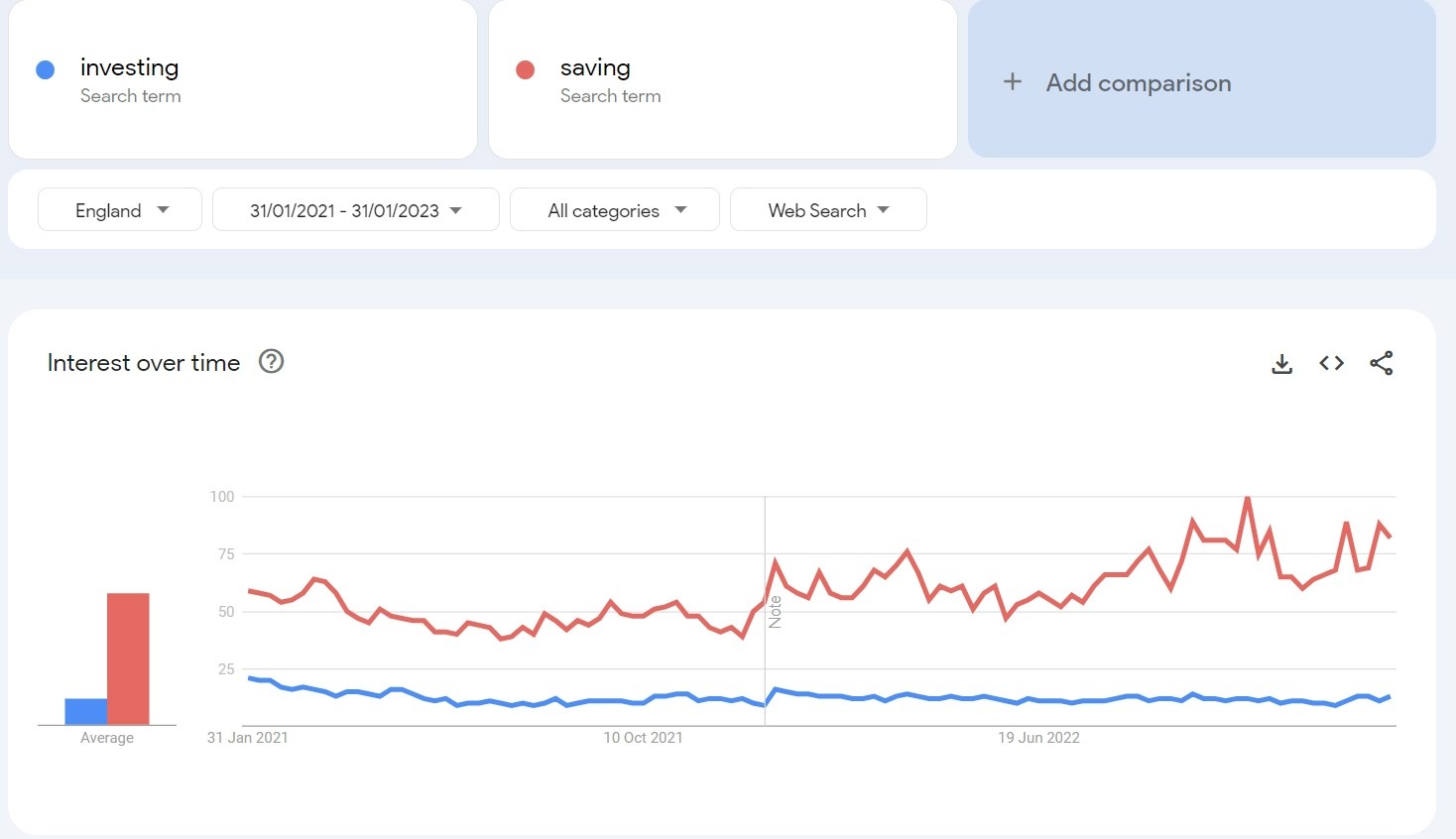

At the end of 2022, the keyword "saving" markedly extended its lead over "investing" in Google search results, preserving elevated levels until today. This is not surprising. The current crisis is affecting, to a greater or lesser extent, each of us. In an era of shrinking budgets, we are increasingly looking to save money. And Google Trends analysis clearly confirms this.

In the long run, periods of prosperity and times of crisis are intertwined. The apparently growing interest in the topic of saving in the current difficult period has therefore prompted us to ask ourselves: What is more important in the long term: saving or investing?

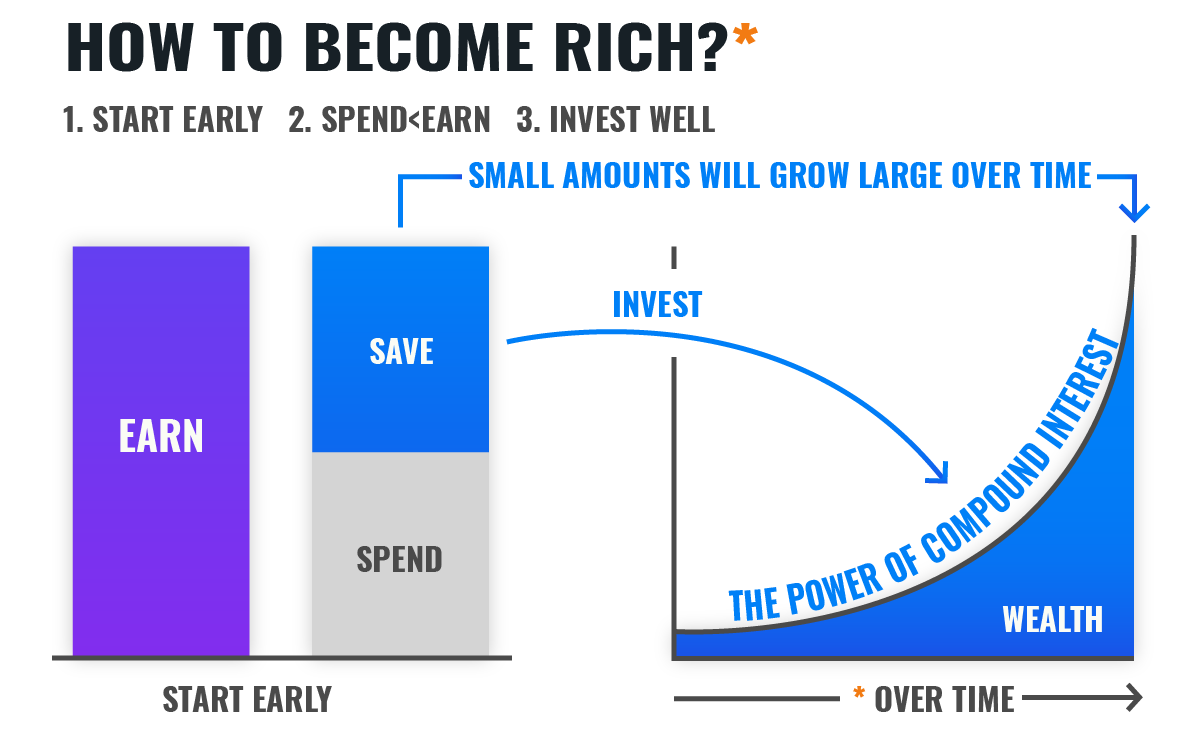

How to Become Rich?

It has been known for a long time that the cornerstone of building wealth is to spend less than you earn and invest the accumulated surplus. Over time, through the power of compound interest, small amounts will grow into large ones, and the earlier you start, the more you will accumulate at the end of the investment horizon.

Such advice has already been given for the rest by George S. Clason, author of the popular financial reading "The Richest Man in Babylon", published... in 1926.

Following these principles is a recipe for success. But which of the factors mentioned has the greatest impact on the final outcome of an investment? The rate of return on investment, or perhaps... the rate of savings?

Is Saving More Important Than the Rate of Return?

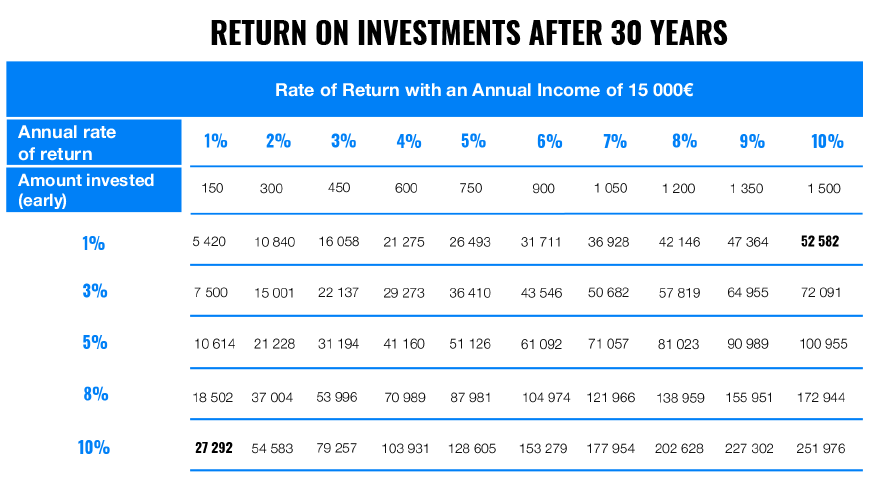

We decided to check it out. Inspired by the table published by Charlie Bilello's Twitter account, we made our own calculations, although the result was already known to us.

We checked how the results of a given investment would be at the end of a 30-year investment horizon, with net earnings of 1 250€ per month throughout the entire savings period. We analyzed the results for different rates of return and different savings rates. What conclusions did we come to?

As it turns out, while the rate of return obviously translates into our final investment outcome, the rate of savings has a bigger impact on the final value of our wealth.

If you invest 1% of your income each year for 30 years, and in each of those years you manage to achieve a real rate of return of 10% - and you must know that this is a really difficult result to achieve, above the long-term market average - at the end of the investment period you will have earned 27 300€.

However, if each year you already manage to put aside 10% of your earnings, but your investment will bring you a real "measly" 1% rate of return per year - then after 30 years your account will contain.... 52 600€. Almost twice as much money!

A Factor You Can Influence

The rate of return on investments, while important, is not under our direct control. It is highly dependent on a whole spectrum of macro- and microeconomic factors. And while we can try to predict which of these will occur during a given period, we cannot do so with 100% certainty or accurately estimate their impact. After all, as we always write, investing involves risk.

On the other hand, the savings rate is a parameter over which we have real influence. Let's not kid ourselves, not all of us are able to put aside a major portion of our salary every month.

However, if we want to increase our savings rate, we have a lot of room for creativity in both cutting expenses and increasing income.

How to Increase Your Savings Rate?

In our opinion, investing should be simple - and that's what passive investing with Finax is. A robo-advisor takes care of multiplying your invested savings, while a diversified portfolio of ETFs mimics the long-term average market return. And you, meanwhile, can focus on managing your budget for even better results.

That's why we regularly try to help you minimize your expenses. From our blog, you will learn how to reduce your food, electricity, gas, water, or fuel bills. We teach you how to save on a daily, weekly, and monthly basis.

For the same reason, we created Finbot, a personal finance management (PFM) app, free to all Finax customers, to help you analyze your finances, plan budgets, and identify areas for improvement.

Gain Control Over Your Money.

Try Finbot completely free of charge

As you can see, while the rate of return shapes the final outcome of our investment, the key role in building wealth is how much of our income we will invest.

So take care of your savings. Leave the investing to us.

App Store

App Store

Google Play

Google Play

Difficulty

Difficulty