What is currency risk and how does it affect your investments?

The currency risk of an investment represents the impact that the change in the exchange rate of two currencies has on the result of an investment acquired in a foreign currency. If the investor wants to maximize the return and spread the risk, his assets have to leave his home country and the local currency, since they offer only a limited number of investment possibilities. If he wants to grow his assets effectively, he must take on currency risk.

Risk is generally defined as the uncertainty of future developments. When investing, it can be described as the probability of achieving the expected returns. You can read more about the risks you take when investing and the tools that can be used to eliminate the risk here.

As we have already explained many times in the past, risk is a natural part of investing and it is not something you should be afraid of, nor should it be a reason for not appreciating your assets. Risk is a requirement for higher returns. Your assets will not grow without risk. There is no such thing as a free lunch or a risk-free profit.

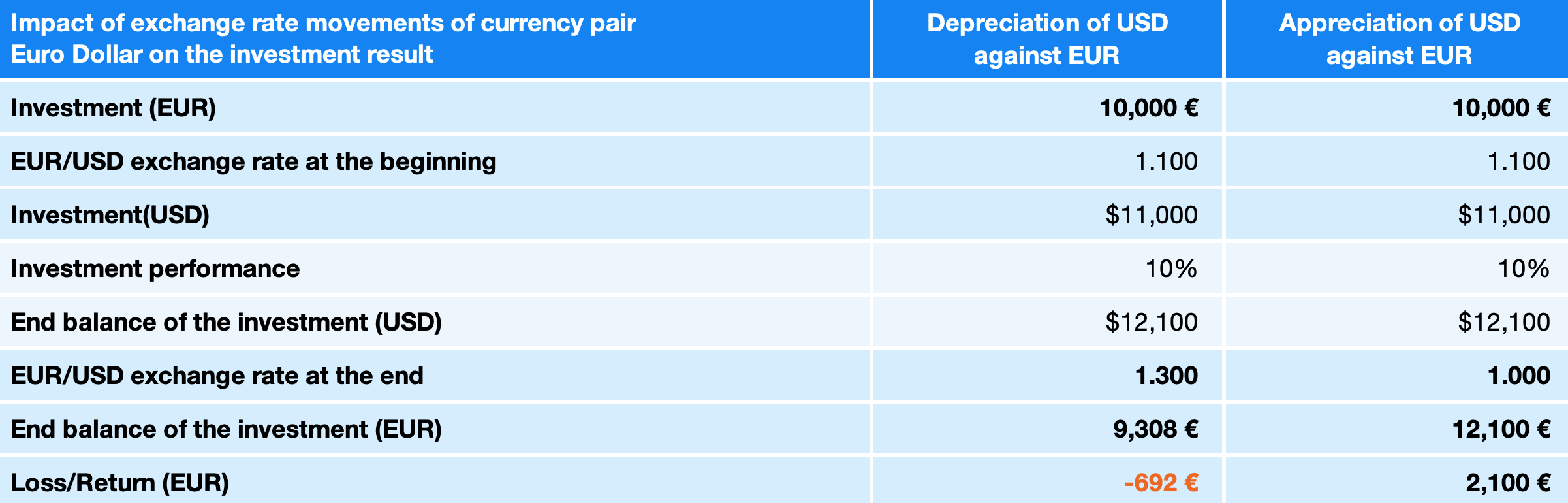

The following table explains, in a simplified way, the impact of currency risk on the investment result. In finance, we do not perceive risk only as a negative aspect of investment. It can cause a loss, but on the other hand the risk can also lead to a higher appreciation.

For example, if you invest 10 000 EUR in the US equity ETF, at the exchange rate of US dollar against the euro being $ 1,1 for 1 euro, you also bear the currency risk. With the previously stated value of the currency pair, you will receive after the conversion $ 11 000, for which you will then buy share of fund.

The dollar value of the ETF will increase by 10% to $ 12 100, but at the same time, the US dollar will depreciate against the euro to $ 1,3 for 1 euro. You sell the investment and convert the dollars earned back into euros. The final value of the investment will only be EUR 9 307,69, despite the positive appreciation of the fund.

You recorded a market return of 10%, but you also recorded an exchange rate loss of -15,39%. Your total loss is -6,92% (left column)

If, on the other hand, the dollar appreciates against the euro to $ 1 for 1 euro, in addition to market appreciation, you would also record foreign exchange gain on the investment. In this case, the result would be 12 100 EUR, i.e. a profit of 2 100 EUR or 21% (right column).

Currency risk works exactly the same way for other currencies, i.e. for clients from Poland, the Czech Republic, Hungary and Croatia, where Finax currently operates. However, they also face, in addition to the risk against the dollar and the currencies of developing countries, currency risk in euro investments.

Strategies to eliminate currency risk - currency hedging

Currency risk can be relatively conveniently taken care of and significantly eliminated by various instruments, which are collectively called currency hedging.

In order to hedge the currency risk, the so-called futures contracts - derivatives are used (futures, forwards or swaps). These contracts tell you exactly when and at what exchange rate will you exchange a set amount of money in two currencies in the future.

No hedging is perfect. There are additional costs associated with it. The investor pays fees for the acquisition of the derivative, indirectly pays the interest rate differential of the two currencies and these instruments also require collateral - cash security.

What currency risk do you take with Finax and how did we address it?

When creating Intelligent Investing portfolios, Finax left nothing to chance. We analysed every investment variable and its impact on the potential outcome. We did not omit the currency risk, which we analysed just as extensively.

Based on our research and testing, we decided not to hedge our portfolios, at least for the most part. There were several reasons for this. We will try to explain them further.

Clients investing in euros are exposed to currency risk, as well as clients who deposit funds into investment accounts in local currencies, i.e. in Polish Zlotys, Czech Crowns, Hungarian Forint or Croatian Kuna.

Euro investors bear the currency risk arising from investing in ETFs focused on US equities (dollar), but also on emerging market equities within the iShares Emerging Markets ETF (local currencies) or in some European currencies within the ETF DWS Xtrackers Stoxx Europe 600 (British Pound, Swiss Franc, currencies of the Scandinavian countries, etc.).

Not all equity index ETF funds in Finax's portfolios have a hedged currency risk. Although we purchase the funds on the German stock exchange Xetra in euros, the fund itself and its assets are denominated in the currencies listed above.

The US dollar value of the fund's assets is being constantly converted, at the current spot rate, into the euro value of the ETF on the Xetra stock exchange. Finax clients thus fully bear the exchange rate movements of the currencies in which the equity fund assets are denominated.

On the other hand, intelligent investors are gaining wide currency diversification. The above-mentioned funds invest in assets held in almost 40 different currencies. In the case of a 100% equity strategy, more than three-quarters of the portfolio are exposed to currency risk (53.5% in US equities, 19.5% in emerging market equities and a certain portion in European currencies other than the euro).

On the contrary, bond index ETF funds in Finax portfolios have a fully hedged currency risk against the euro. All bond ETF funds that invest in denominated assets, in a currency other than the euro, contain hedging, i.e. currency fluctuations have no effect on their appreciation.

The bond component of our strategies is intended for conservative investors, who usually have a short investment horizon, only a few years.

Currencies, like equities, show more noticeable movements in short term, in comparison to secured bonds, thereby increasing the volatility of the portfolio (fluctuation of its value), which is unacceptable for conservative investments. This is the main reason why the currency hedging is used for the bond part of our portfolios as opposed to equity investments.

Clients who make deposits in currencies other than the euro bear additional exchange rate risk, resulting from the movement of the value of their local currency against the euro, more precisely through the euro against all other currencies, to which our portfolios are exposed.

Therefore, we provide the same service to clients from countries with their own currency, i.e. 11 managed portfolios built on funds purchased on the German Xetra stock exchange in euros.

We do not make currency hedging into national currencies, i.e. when investing in Polish Zlotys, Czech Crowns, Hungarian Forints or Croatian Kuna, it is necessary to consider this aspect of the investment and the risk, which often plays in favour of these clients, as we will show below.

Invest like a pro profesionál

With low fees, no emotions and tax smart.

Why don't we hedge currency risk?

Most investors perceive currency risk incorrectly. They usually see it only as a threat to their portfolio, which only holds true in some cases. Assets in several currencies increase the quality of the investment and help the overall long-term development.

Higher returns & lower risk

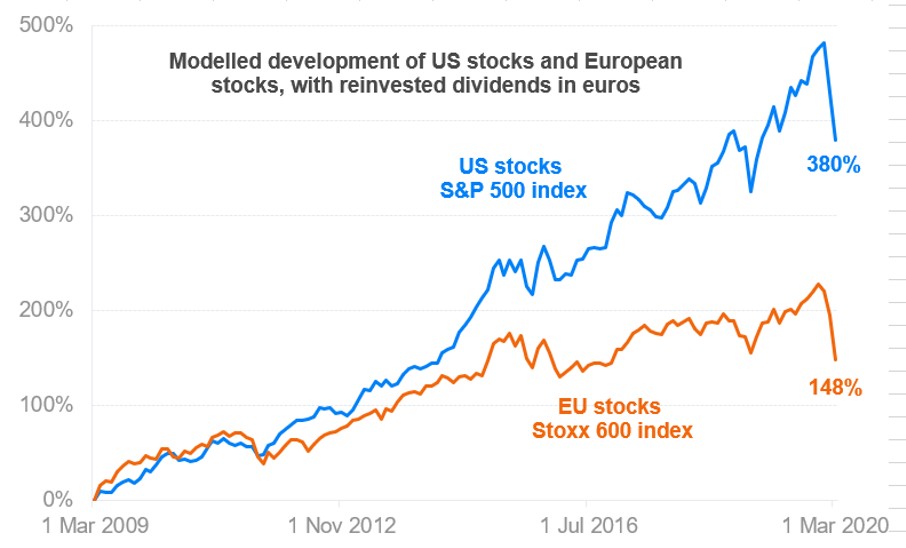

If a European investor wants to maximize the return on his investment, his investment simply has to leave the borders of his country. There is no need to go far to verify the correctness of this statement. Just look at the past 11 years, which have been clearly dominated by US stocks.

If he held the investment only in euros, i.e. remained in Europe, it would not appreciate by much. Shares of large European companies have risen by 148%, including dividends, during this time, while their US counterparts have risen by up to 380%.

This statement also applies to Polish, Czech, Hungarian and Croatian investors. Although these countries have stock exchanges in place, the number of traded securities is limited and their appreciation is low.

The Polish WIG20 index has practically not changed its value in 11 years, excluding dividends paid. The Prague PX index is in a similar situation. A clear exception is the Hungarian BUX index, which increased its value by 165%, excluding dividends paid in this period. However, in this case, it is necessary to take into account the significant depreciation of the forint.

In addition, the disproportionately high risk of local investment must not be forgotten. The investor fully bears the risk of the country, namely economic, political, but also the limited number of positions contained in the national indices. This type of investment does not meet the basic requirements of a good and potentially successful investment.

Wide diversification

The omission of currency hedging is another component of diversification, i.e. risk spreading. The more the investor divides the portfolio among a large number of small partial investments, the less of a risk he bears. The loss on one asset is offset by the appreciation of another.

The same applies to the currency distribution. The individual currencies of different countries develop differently over time. Holding the investment in multiple currencies reduces portfolio volatility and may lead to higher returns in the long run.

For example, the US dollar, the Japanese Yen and the Swiss Franc tend to appreciate in times of risk aversion. So, if the investment portfolio includes instruments denominated in these currencies, in the event of a decline in asset prices, part of the losses is offset by the appreciation of exchange rates, thus resulting in the total loss in the value of the investment being smaller.

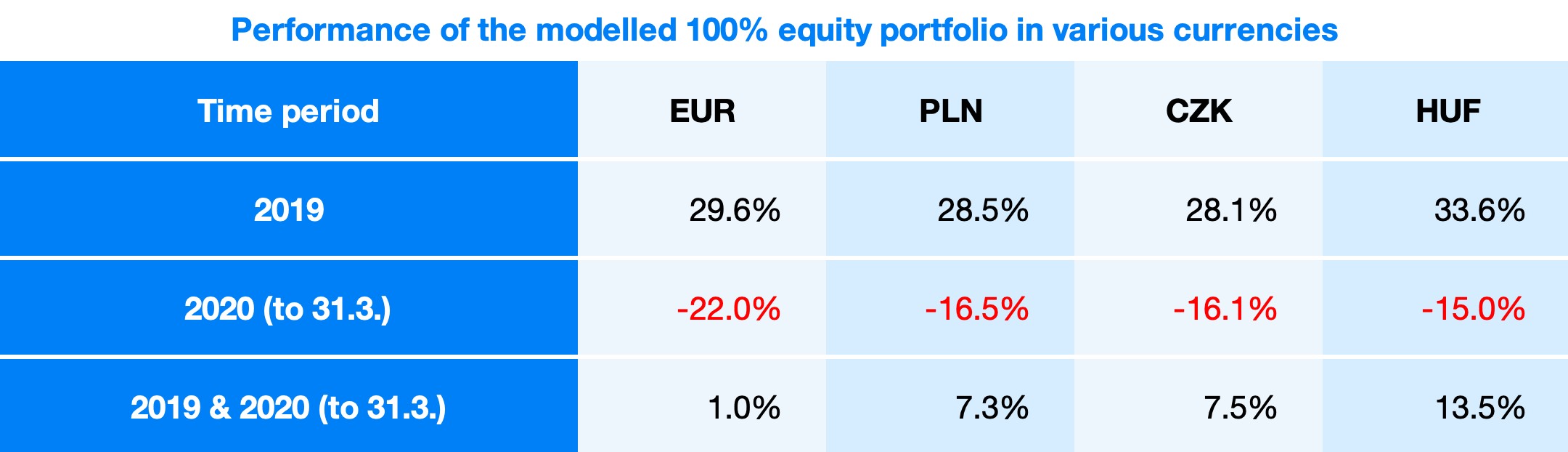

To see this in action, you only have to have a look at the development of Finax's portfolios over the past two months, converted into individual currencies, as shown in the table below.

Central European countries are still considered to be the Europe's emerging markets. In the event of panic in the financial markets, investors always get rid of local assets.

Since the beginning of the year, in three months the Polish Zloty has lost 6.6% against the euro, the Czech Koruna 7.1% and the Hungarian Forint 8.2%. This depreciation of currencies is what represents the exchange rate gain for Polish, Czech and Hungarian Finax investors and a decent compensation for the decline in the value of ETFs.

Of course, it should be noted that just as the today’s depreciation of local currencies plays in favour of foreign investment, so does the appreciation of the zloty, koruna and forint reduce returns in productive times.

Disclaimer: All data related to the historical development of Finax portfolios are modeled and were created based on backtesting of the data. We described the method of historical performance modeling in the article How do we model the historical development of Finax portfolios. Past performance is no guarantee of future returns and your investment may result in a loss as well. Inform yourself about the risks you are taking when investing.

Higher costs

Another important factor that led us to omit currency hedging are the costs associated with it. The investor pays fees for the acquisition of derivatives or the costs are reflected as a mark-up in the higher exchange rate of the currency pair compared to the market (larger spread).

From the investor point of view, the cost of currency hedging is also the need to hold cash in the account as collateral for derivative transactions (cash security). Blocked money is not able to appreciate. Non-working money results in lost profits.

Today, the managers themselves offer ETF funds with currency hedging. Meaning, the fund directly purchases derivatives, which eliminate the currency risk and ensures the performance of the fund in one currency corresponding to the appreciation of the fund's assets in another currency.

These funds tend to have a higher management fee ranging from 0,2 to 0,5 percentage points, and logically equally worse long-term performance.

Finax offers primarily medium and long-term investments. The investment horizons, that the Finax clients had set up, are in the extent of several decades. During these time periods, the costs of hedging outweigh its benefits.

Of course, this statement cannot be easily generalized. There will certainly be long-term periods during which the dollar will depreciate against the euro and the currency risk will show itself. In most cases, however, the benefits of currency hedging fade away with longer horizon and on the other hand the costs increase.

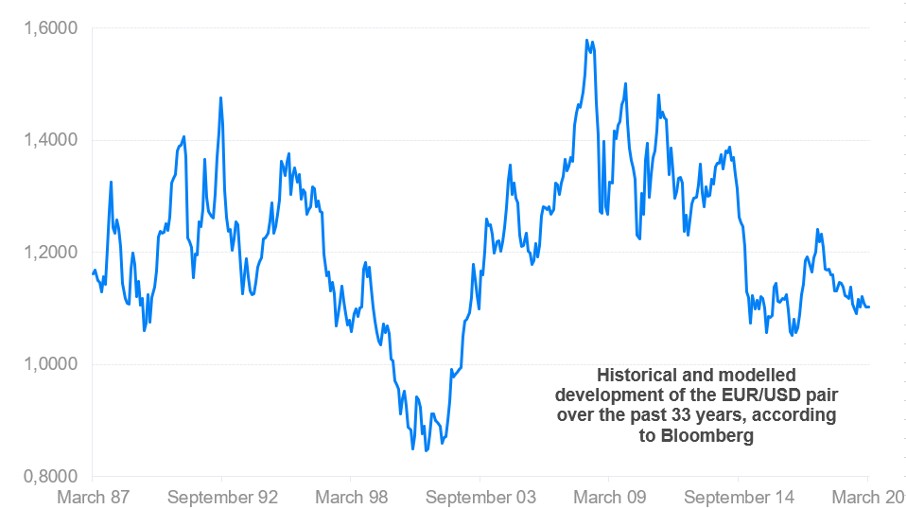

The Bloomberg news agency modelled the Euro Dollar currency pair, beginning with the end of the 1980s, based to the development of individual national currencies on the basis of which the euro was created. Historically, the world's major currency pair value has always ranged from $ 0.8 to $ 1.6 per euro. It is currently around 1.09 EUR / USD (16.4.2020).

Not many people realize today, that we are witnessing a similar development of Central European currencies. There is a myth about them that they tend to appreciate in the long run.

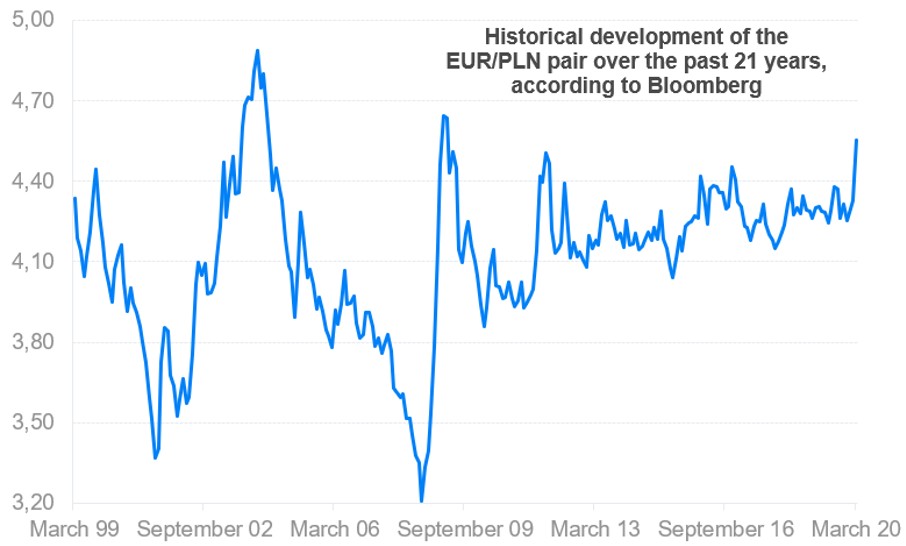

The assumption only applies to the Czech Koruna, which has appreciated against the euro by 41% in 20 years (end of March 2020). As the following chart shows, the Polish Zloty is now even weaker against the euro, roughly on the same level as it was in 2000.

In case of the Hungarian Forint, we are witnessing approximately 20-year of continuous depreciation against the euro. Hungarians need to invest their savings abroad, if they want to maintain the purchasing power of their money, when taking into account the rate of inflation in the country and a weak forint.

The historical development of the world's major currency pair, the Euro Dollar, as well as the development of Central European currencies against the euro, shows the insignificance of currency hedging, which usually represents only an unnecessary addition to the investment.

If we had decided to go for currency hedging of the US dollar investment in the last 30 years, the only thing we would have achieved, would be a loss on costs. The difference in the annual cost of 0,3 percentage points between the hedged and the unhedged fund would also be reflected in their performance.

If we calculate with an average annual return on investment of 9% for the cheaper alternative without hedging, the more expensive alternative with currency hedging will earn on average 8,7% per year. The result of the 30-year investment will be a total return of 1227% in the case of a cheaper ETF and 1121% in the case of a more expensive fund.

Administrative complexity, unsuitability of derivatives for retail investors and change in the value of collateral

Lastly, the reasons why we decided not to apply currency hedging are related to investors from countries without a common European currency. Since we are an investment broker and we do not manage any fund, but we manage a separate investment account for each client, we would have to secure hedging for every individual account.

This represents a significant administrative burden and massively complicates portfolio management. The basic principle of Finax is simplicity, because that is the foundation for efficiency and performance. Because of it, we can provide our services on a mass scale and cheaply.

Potential hedging would increase financial and operational risk, as it is not possible to secure derivatives separately in order to hedge accounts worth several hundred or thousands of euros. Every complication of the investment process and portfolio management increases costs and could lead to mistakes that we would like to prevent.

At the same time, majority of regulators in Europe do not consider derivatives to be suitable tools for retail investors. Some even explicitly prohibit the distribution of derivative portfolios through financial intermediaries, with whom we cooperate in several countries.

Derivatives in retail investors' portfolios make it difficult to calculate and pay taxes. Our investment philosophy is exactly the opposite - to simplify, minimize and optimize tax obligations.

Many of our foreign competitors have during today’s volatility finally grasped the negatives associated with currency hedging. The sharp depreciation of local currencies in recent weeks has led to mass losses on derivative contracts, which have in turn required a drastic increase in collateral.

In many accounts, the need for collateral has increased up to 5-fold, resulting in clients being forced to send additional funds, otherwise their regular deposits would not be invested. This is happening at the most ideal time for buying shares, after their slump.

In reality, the clients did not suffer a loss on the currency hedging. What they lost in the value of the derivative, they gained from the growth of assets denominated in foreign currencies (dollar and euro).

Schedule a 15-minute phone call for free hovor zdarma

We will help you get started and learn more about Finax.

Conclusion

As we have shown, we do not consider currency hedging to be a key parameter of a successful investment. It does not determine its outcome to the extent, that the majority of retail investors think it does.

There will always be situations, in which the currency hedging pays off. But if we generalize the approach and look at it statistically, it does not make sense in generalized examples applicable to long-term investments.

Based on our analysis of exchange rate behaviour, their impact on investment results and the possibilities of reducing exchange rate risk, the details of which we have tried to explain to you in this article, we have decided not to apply currency hedging to our investment strategies. The only exception being the bond component of portfolios, where we do not allow any compromises and large fluctuations.

Passive approach, low costs, minimum taxes, quality rebalancing, wide diversification, eliminating the need for human decisions making and minimizing the number of necessary transactions are crucial for the success of the investment. At the same time, we follow the rule, the simpler the investment, the more is it understandable for client and the more he or she can identify with it. Finax meets all of these parameters.

App Store

App Store

Google Play

Google Play

Difficulty

Difficulty