Finax enjoyed a week of glory in September. Almost all the relevant media, TV channels, and radio stations were announcing bombastic news. Finax became the first in Europe to launch a new financial product: the pan-European Personal Pension Product (PEPP), granting Slovaks the opportunity to be the first savers in this European supplementary pension savings scheme.

I have already described PEPP and its main features in my previous blog Introducing the European Pension (PEPP).

Today, I'm going to highlight for whom a PEPP is beneficial. Many of you are already saving or considering saving for retirement and seek to learn which of our two savings schemes you should choose or whether you should consider transferring your current pension savings into a European Pension scheme.

At the same time, Slovakia has a large group that is saving voluntarily in the 3rd pension pillar, which poses another question: should I continue to contribute to the 3rd pillar or redirect my savings to one of the products in Finax?

Since the inception of Finax, our central mission has been to put the client first. That's why we want to clearly communicate if we feel that one product or another could be more advantageous for you.

What Is the Difference between PEPP and Finax Investing for Retirement?

All of us have different needs and find various settings comfortable. To answer this question, we need to know the fundamental differences between the products. I would pick out these to be the key parameters to consider:

If you are only interested in the results and don't want to read through all the details of the three alternatives, navigate straight to the final comparison.

When Will I Get the Money?

Liquidity - the ability to turn investments into cash and withdraw funds – is a frequently overlooked factor. However, it plays a significant role in retirement products. Some of them tie up deposits until retirement.

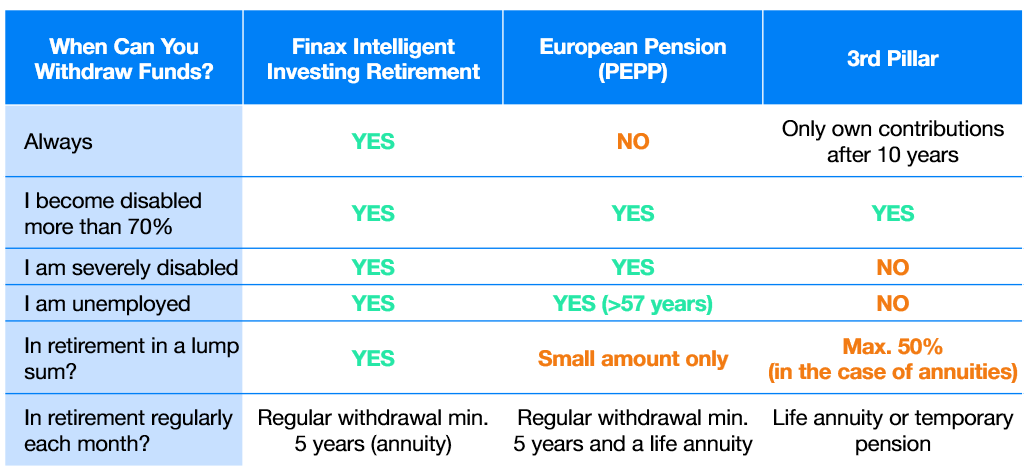

With Finax Investing – Saving for Retirement – you can request a withdrawal at any time and usually receive the money in your account within a week. However, this is not the case for the European Pension and 3rd pillar, where you can only apply for a pension once you become eligible for a retirement pension from the Social Insurance Agency (today at age 62).

However, there are exceptions. The European Pension enables you to apply for early redemption if you become disabled with a reduction in your ability to work of more than 70% after signing the contract or if you are recognized as severely disabled. Similarly, if you have been unemployed for more than a year and are at least 57 years old, you can apply for an early payout. In all cases, funds can be redeemed in a lump sum or gradually if you agree with your provider.

The 3rd pillar also allows you to apply for early redemption of the savings if your ability to work falls by at least 70%. If the participant also contributes their own funds, these can be withdrawn after 10 years, which is what I plan to do next year when my time limit expires to transfer them to Finax.

However, there is another way to look at it. The inability to withdraw early may be more of an advantage for many people. If you want to prevent using your future pension to fund a broken washing machine or car, a PEPP is a better option.

That’s why many employers might prefer retirement savings schemes from which savers cannot withdraw the amount saved early. After all, they are providing pension benefits that are not designated to fund the current consumption of their employees.

European Pension Will Save You Over 40% on Fees

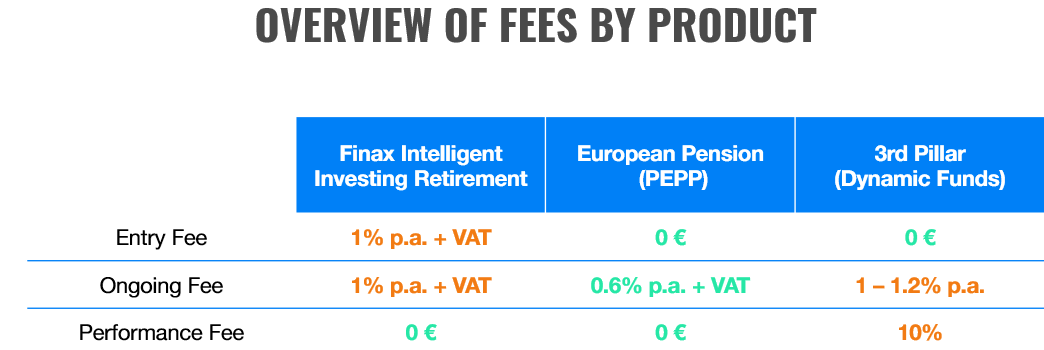

The pan-European pension product regulation sets a maximum total cost of 1% of assets under management per year.

We have gone below the legal limit with European Pension charges. The total cost for the basic PEPP is 0.9% – of which 0.6% is Finax’s revenue, 0.14% VAT (charged together as a fee), and 0.16–0.22% are internal ETF fees already included in their price. It is also the only fee on our European Pension service.

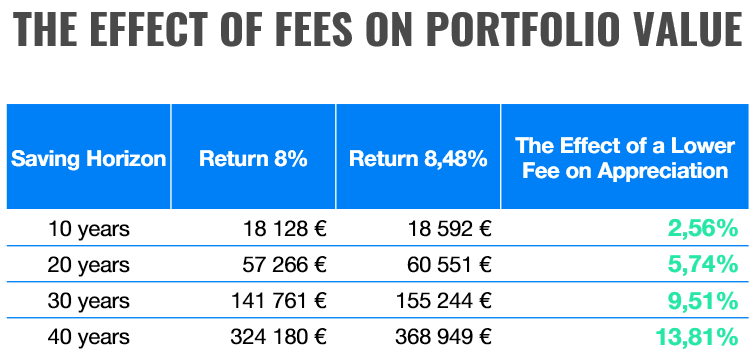

The difference of 0.48% seems small, but it offsets the negative effects of taxation in the long run, which I discuss in the next section. Imagine investing €100 per month for 30 years at an 8% annual return. In the end, you would have saved up €141 761. However, if the return were 8.48%, you would accumulate €155,244.

As you can see in the attached table, the impact of fees on the total return increases over time.

To provide complete information on the cost-effectiveness, let’s discuss the 3rd pillar fees. The Act on Supplementary Pension Saving currently sets the maximum remuneration for the management of contributory funds at 1.2% per annum and the performance fee for asset appreciation in the fund at 10%. Most contributory funds charge maximum fees today.

If I assume that stocks appreciate 10% per annum over the long term, the performance fee for an index strategy after deducting the management fee can average as much as 0.9%. This can add up to a fee of over 2%, almost three times what Finax charges in the European Pension.

Taxation of Returns

For Slovak tax residents, the taxation of returns (benefits) represents perhaps the most significant difference between Finax Investing for retirement in Finax, via the European pension, and the 3rd pillar.

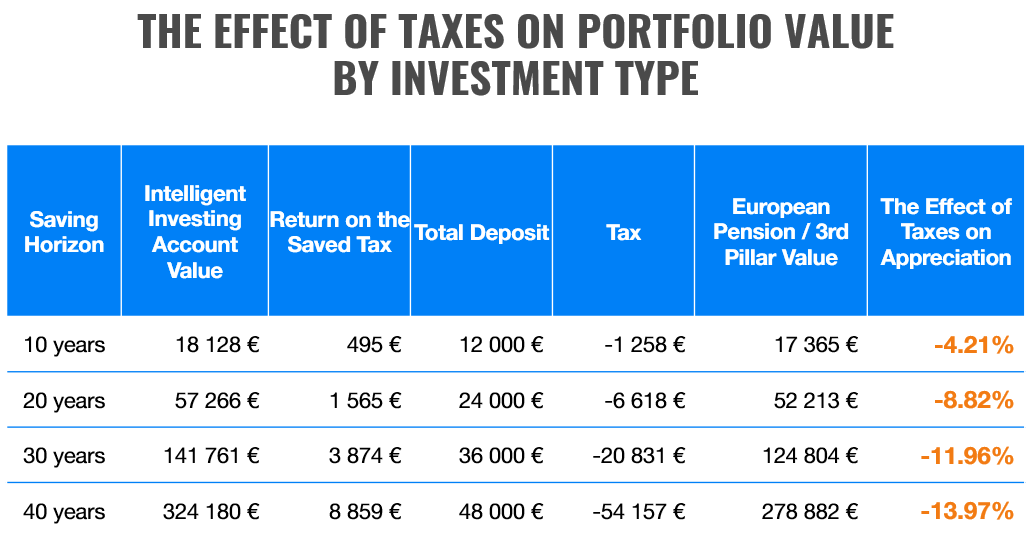

Returns from the European Pension and the 3rd pillar are subject to a 19% withholding tax. If you invest for, say, 30 years, contributing €100 per month, your retirement account will turn total deposits of €36,000 into €141,761, assuming an average annual appreciation of 8%. The appreciation would thus amount to €105,761, which is a considerable amount that would be taxed.

In contrast, returns of Finax Investing are tax-free for Slovak residents after one year of investing, saving you €20,095 in taxes. This makes taxation an important factor in the decision.

If you invest in the 3rd pillar or a European pension, you can deduct €180 from your tax base each year. At the standard tax burden of 19%, this would reduce your income tax by €34.2 each year.

If you were to invest this amount each year, you would accumulate quite a good chunk of money (for example, €3,874 after 30 years), which reduces the impact of the tax disadvantage. I have prepared a comparison table to demonstrate the overall impact of taxation. The European pension and the 3rd pillar are equally disadvantageous from this perspective.

I’d like to mention one more fact here. Employers’ contributions to the 3rd pillar are not subject to social security levies, implying a reduction of 25.2% in employers’ costs. This is not an insignificant amount.

However, as we will later learn in Rado's blog, which will compare the returns of the European Pension and the 3rd pillar, this advantage is eliminated over time due to lower fees and payout phase risk setting.

What Risk Should I Take on My Retirement Account?

The regulation of European pensions has brought a new phenomenon, which has not been dealt with (at least not in Slovakia) in connection to pensions – low risk. While high risk often represents a bogeyman for savers, low risk should receive special interest when setting up long-term retirement savings.

The longer your investment horizon, the lower the risk, making it more suitable to invest dynamically – a higher proportion in stocks. The European PEPP regulation is the first to introduce very strict appreciation requirements. With a high probability, the clients’ returns must be sufficient to at least cover inflation, enabling them to buy "as many bread loaves" in the future as they can with the money today.

To illustrate, let’s look at an example of a conservative saving product in the 3rd pillar. The most conservative funds have only achieved a cumulative appreciation of around 26% over the 17 years of their existence, while cumulative inflation has been around 61% over the same time. Their clients’ savings will buy much fewer goods and services in retirement, and that is a big problem. That's why you need to invest as dynamically as possible for retirement.

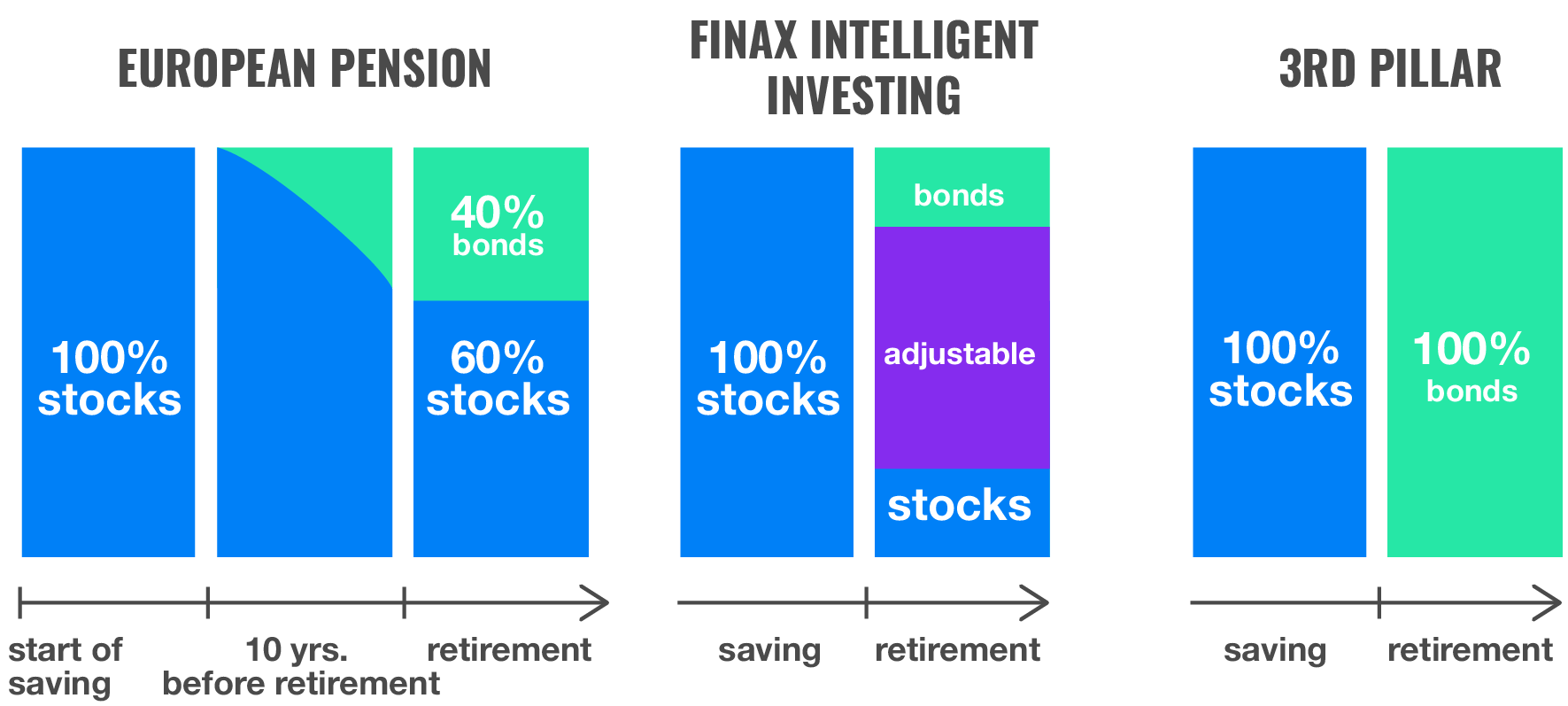

The optimal solution is to invest 100% in stocks during the savings phase and leave at least 60% invested in stocks during the payout phase.

With Finax Investing, your investment horizon should be at least 11 years, you should have investment experience, a good financial situation, and be willing and capable of bearing risk to be able to invest 100% of your savings in stocks. If you do not meet any of these conditions, we must set your investment risk more conservatively. This is our legal obligation.

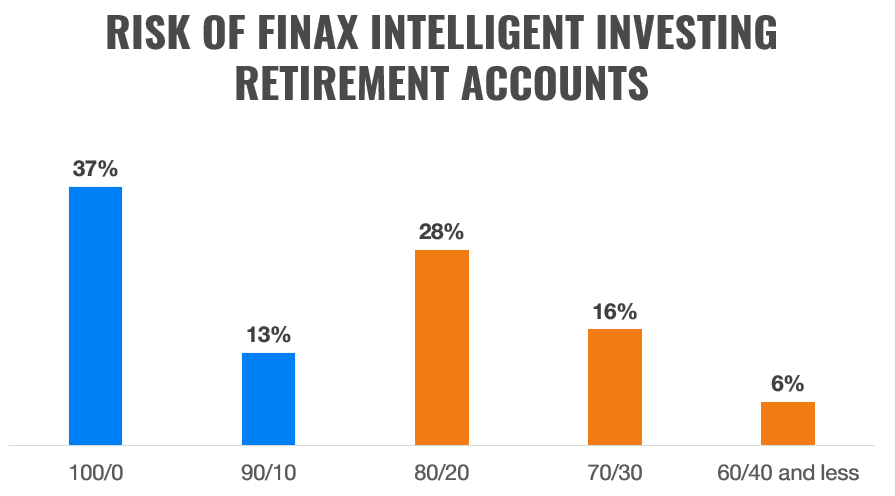

As you can see in the attached chart, half of Finax's clients saving for retirement are investing at 80/20 risk (80% stocks and 20% bonds) or more conservatively.

On the other hand, the European Pension is a product with no risk of early withdrawal due to panic, enabling us to invest even the savings of more conservative clients fully in stocks. Despite the tax on returns, the appreciation of such a portfolio may still provide a higher income than a portfolio whose returns are tax-exempt due to the time test.

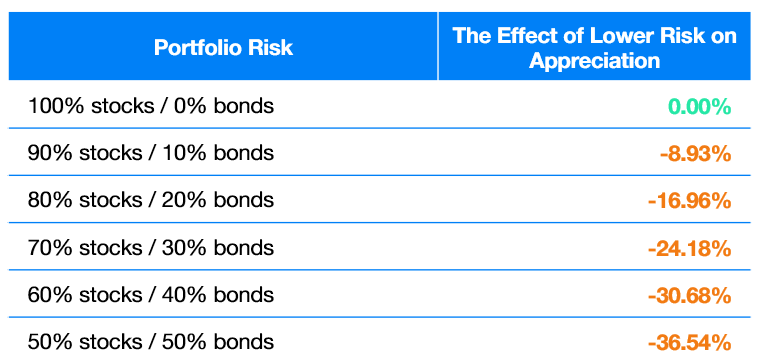

In the table below, I demonstrate the impact of lower risk on the resulting appreciation according to the Finax algorithms:

If you save for retirement for 30 years, contributing €100 per month, and only 70% of your savings are invested in stocks, you lose 24% of return relative to a 100% equity portfolio. That's a substantial number.

The valuation is based on the Finax modeled portfolios. You can read how and why we model portfolio returns here. There is risk associated with investing, and your resulting appreciation may not match the modeled or expected return. Past returns are no guarantee of future returns. Learn what risks you take when investing.

The 3rd pillar is, in my opinion, even worse in terms of risk. For instance, the largest supplementary pension asset management company, NN, now manages just over one billion euros, with only about 42% of all assets under management being in stocks. Even the growth fund currently has only 67.2% of its savings in stocks. In our view, that is an inadequately low weight.

Index funds are thus the ideal instrument, but even these are not offered by all supplementary pension companies (Slovak abbreviation DDS). In the 3rd pillar, there is no automated transfer of a portion of the accumulated savings to more conservative instruments in the period before retirement (except for Tatra banka's supplementary pension company).

Savers who retire in times of a crisis thus run the risk that their savings will either be transferred to conservative payout funds at a very inopportune time or that they will have to wait for the markets to recover before redeeming these funds.

However, I consider the payout phase to be the main problem of the 3rd pillar. Throughout the retirement phase (which is, on average, 19 years in Slovakia), savings are invested in overly conservative bonds that do not bring adequate appreciation. Additionally, the insurance part in annuity payouts swallows up a large part of the pensioner's savings.

Returns Decide

Return is perhaps the most interesting parameter for most people. Rado will discuss it in detail in his blog, but I can already tell you that his calculations make it clear that your 3rd-pillar pension will be significantly lower than the European Pension.

Overview of the European Pension Essentials

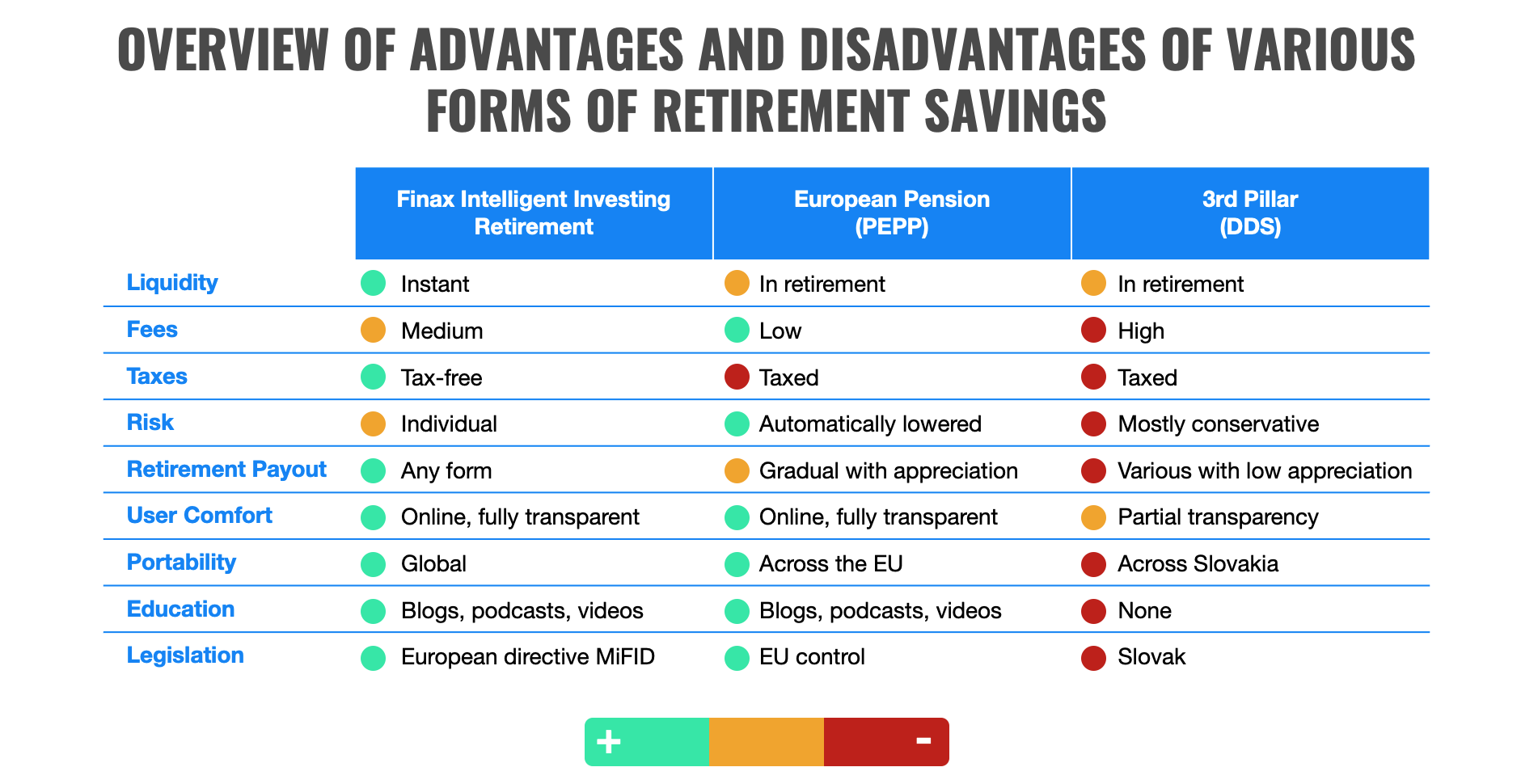

Before displaying the final table of each investment option’s advantages and disadvantages, I would like to summarise the arguments for each of them.

3rd pillar: 3rd pillar money is tied up until retirement, has horrendously high fees, its returns are taxed, the product is neither transparent nor modern, and its average long-term appreciation is a disaster for savers. Apart from one password-protected statement a year, the third-pillar companies do not care about the client. Thus, the benefit offered by employers is not attractive to their employees, apart from the levy benefit and minor tax advantage. Sadly, a well-meant employee benefit doesn’t fully meet its purpose.

European Pension: It is a modern, transparent, and innovative solution for voluntary pension savings with an emphasis on the value of savers' savings. Developed under the umbrella of the European Union, it has guaranteed legislative stability. Better risk adjustment, lower fees, automatic de-risking before retirement, a sensible payout phase during which savings continue to appreciate, and a small reduction in the tax base make it an attractive product despite the taxation of returns and payout only possible in retirement age. You should consider whether it might be more advantageous for you to save for your retirement in it.

Finax Investing for retirement: It is as good an investment solution as the European Pension. As a bonus, you can withdraw the money at any time, and the returns become tax-free after a year. It has slightly higher fees, and you can't deduct the contributions from your tax base. The composition of the portfolio is almost identical to the European Pension, but the product’s nature allows you to set a lower risk, which could deprive you of some of the potential returns in retirement. If you can have at least 90% of your retirement savings in stocks and are financially savvy enough not to withdraw your retirement savings when your car breaks down, this account is the clear choice for you.

I want to set up a European pension

DON'T FORGET: If you like the European Pension and would like to offer it to your employees as part of your benefit structure, please contact us at client@finax.eu, and we will come and present the European Pension benefits to you in person.

If you want your employer to offer a European pension and help us promote it in your work, you can get a free investment management service for the rest of your life. Email us at client@finax.eu to find out what you need to do to get it.

App Store

App Store

Google Play

Google Play

Difficulty

Difficulty