The article will reveal:

- What is the impact of inflation on savings and wealth?

- Is it better to spend rapidly when money is losing value?

- How to protect savings from being devalued by inflation?

- Where to invest savings today so that inflation doesn't eat them up?

- How much money should I invest? All of it?

- How should I invest to prevent inflation from surprising me?

Inflation has a major impact on personal finance and family budgets, primarily on three levels:

- Savings and wealth – the same amounts will buy fewer goods and services in the future.

- Consumption – with rising prices, we can afford less given our income.

- Debt – debtors gain from inflation.

If you want to survive the period of inflation with minimum damage to your savings and with limited impact on your spending, these three facts about the impact of inflation on your budget need to be understood, learned, and always kept in mind.

Today, we will look at the first consequence of inflation, namely its impact on savings. At the same time, we will look at how to protect your assets from inflation as effectively as possible.

Inflation’s Impact on Savings and Wealth

Most of us are aware of the impact of rising prices on the money we hold. If the prices of the goods and services we regularly buy rise, we will inevitably be able to afford fewer of them with the cash we hold.

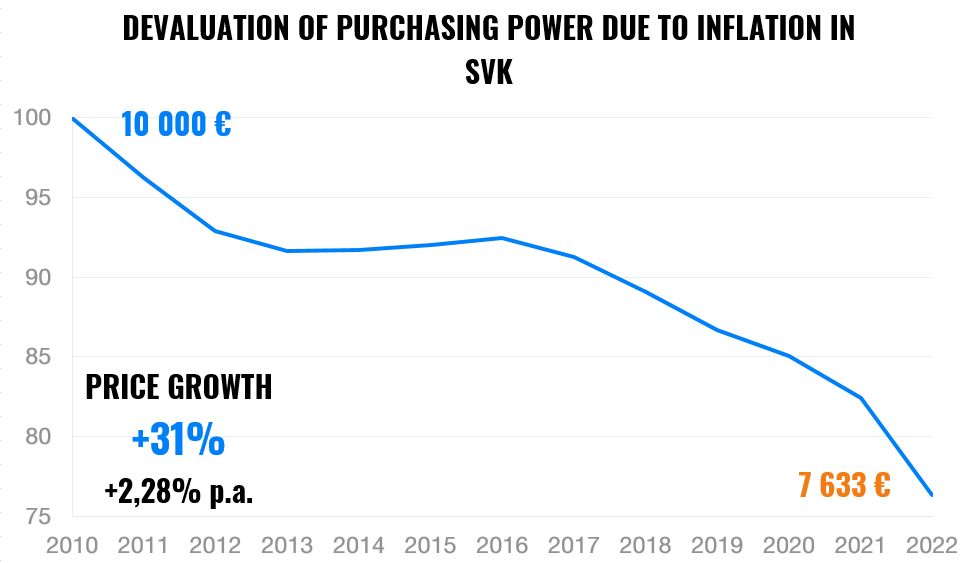

Assuming that price rises will stabilize at 8% in 2022, the prices of the average Slovak consumer basket have risen by 31% since 2011, according to the Statistical Office.

Translated into the value of money, you can buy goods that would have cost you €7,633 at the beginning of 2011 for €10k today. The graph accurately describes the depreciation of the purchasing power of money due to inflation over the past 12 years.

In other words, if you have kept your money in a bank account or cash during this period, you would buy 23.7% fewer goods with it today. In other words, if you failed to appreciate your savings at an average rate of at least 2.28% per year, you lost. The real value of your savings has declined.

Should I Spend Everything, as the Money is Losing Value?

This reasoning is quite rational. It makes sense to realize consumption earlier than planned, e.g., housing renovation, while materials are cheaper. Why wait for higher prices?

Inflation stimulates immediate consumption. People often think and act this way. It is perfectly natural. Although we're big fans of saving, we recommend realizing your plans faster in cases when it makes economic sense.

For example, purchase real estate if you plan to buy your own home within a few years, and your financial situation already allows it. Mortgage interest rates are likely to rise further, and house prices are also likely to be higher in the future than they are today.

But regardless of inflation, sizable expenses await you, whether it's for your retirement, your children's education, a change of housing, starting your own business, or fulfilling your other dreams. And inflation will make these life events more costly. If you spend all your savings, future problems will only get more substantial and expensive.

That's why even with today's double-digit inflation, it's not wise or advisable to spend all your savings unless you plan to realize your specific goals for the coming years.

The solution is to maintain your savings rate even with rising prices, i.e., save the same amount each month, which is far more challenging with inflation. We'll cover this topic more extensively in future blogs.

At the same time, we need to protect the money we've already saved from devaluation.

How to Protect Savings from Getting Devalued by Inflation?

Again, the answer is relatively simple but harder to implement. Simply appreciate savings and financial assets by returns higher than inflation. That way, the real value of your assets adjusted for higher prices will also rise.

However, this requires some knowledge and experience, but above all your personal conviction and understanding, because the most effective weapon against the devaluation of savings by inflation is investing.

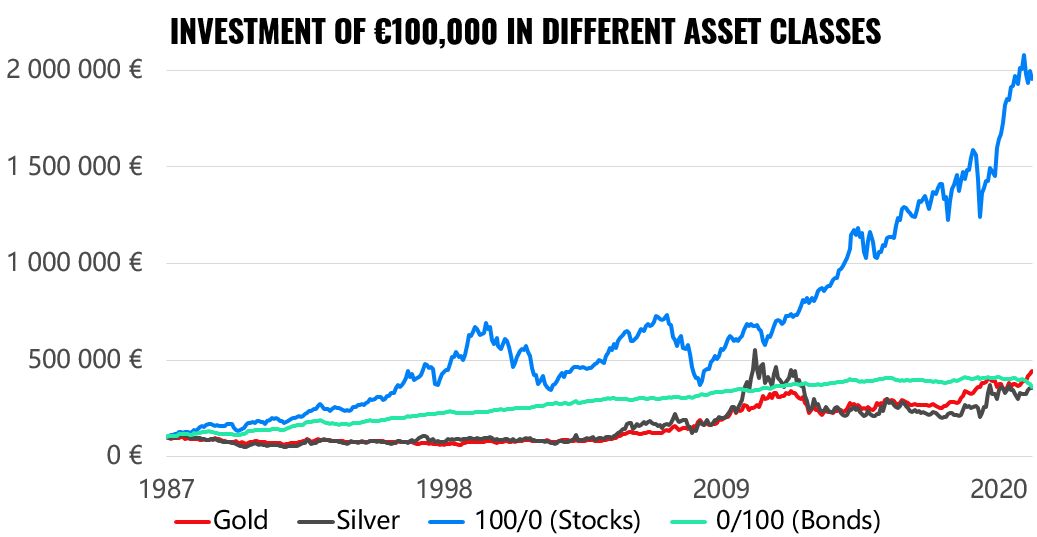

In the long run, stock investments are a clear winner. No other instrument has historically beaten inflation rates by such a wide margin as global equities.

However, investing in equities involves risk. The price of higher returns is the risk reflected in price volatility. Shares do not grow at a constant rate. They are unpredictable and often fall in the short term. Short-term losses are not unusual.

However, over long horizons, they rise in tandem with the growth of the global economy and the profits of the world's companies. Last year alone, US companies managed to generate profits of 2.8 trillion dollars (USD 2 800 000 000 000!). Why not take a slice of that pie when it's so easy?

Rising prices in the economy mean more revenue for these firms for products made and sold and services created. These companies own assets, including real estate, making stock valuations reflect rising prices in the economy well.

Create an account and start investing today

Where Should I Invest My Savings to Prevent Inflation from Eating Them Up?

If you woke up to high inflation today and are hastily looking for salvation for your life savings, we have bad news for you.

Finding an investment that will outperform 11.8% inflation with greater certainty and acceptable risk in the short term (for instance, over the next year) is a utopia. It’s like joining your football teammates during extra time at 0:3.

Will you put your money into commodities at the peak after a two-year 200 percent raise? As the table below shows, over the long term, commodities are inefficient in beating inflation. Will you try extremely risky cryptocurrencies with dubious value and no real use?

Source: Deutsche Bank

To purchase a property, you need a larger sum of money or a mortgage. And they also carry considerable risk with peaking prices, rising interest rates, and the Slovak economic outlook. Let's not forget the associated paperwork and costs, on top of the potentially risky liquidity.

Unfortunately, there is no magic wand to instantly beat inflation. You can't beat rising prices in the short term with certainty.

In the medium term at least, however, inflation can be comfortably beaten. You must reach for the equity investments whose long-term returns outperform the economy's price growth the most. You can reduce their risk by adding bonds.

That doesn't mean you're guaranteed to make a return above inflation every year. But if you hold on for a couple of years, the compounded returns will comfortably beat the rise in the prices of goods and services over that period.

If you think about inflation in advance, you’ll win. The prepared ones don’t get surprised.

To invest successfully, you just need to grant your investment enough time, have a clear financial goal (e.g., retirement), sufficient patience, and emotional resilience. Beating inflation is a long-term and continuous process.

The chart compares the development of the modeled 100% Finax stock portfolio compared to the depreciation of money in Slovakia (cumulative inflation) over the past 16 years. The development accounts for the 10% decline in equity markets so far this year and the 8% inflation assumption for this year.

The horizon of the chart covers several adverse periods in the past, such as the financial crisis in 2008, the European debt crisis in 2011 with the threat of Greek collapse and the breakup of the monetary union (euro), the interest rate hikes in the US between 2016 and 2018, or the coronavirus pandemic in 2020.

As you can see, stocks have done extra work for investors. Our investment returns to date comfortably cover the current high rate of inflation, despite this year's decline in equity markets.

Inflation is no problem for our savings and wealth. We can sleep soundly because our wealth grows at a rate higher than long-term price growth.

Take a look at Domino's transparent account.

You can also invest on equal terms.

How Much Money Should I Invest? All of It?

There is no clear-cut answer to this question, but there are some rules that will help you survive inflation, as well as other difficult life situations. The very basics are to plan and know your possibilities, i.e., your income and expenses. And, of course, not to spend your entire paycheck.

Afterward, the question of investing depends on the horizon of using the money.

The foundation of sound finance is an emergency fund. Keep an amount that covers one to three months of your expenses in your checking and savings account. The remainder of the fund, amounting to three to six months' living expenses, should be invested in a balanced portfolio (composed mostly of bonds, stocks make up less than a half).

Keep savings for near-term goals (those you plan to realize within three years) in savings accounts or conservative investments with a predominance of bonds. Unfortunately, you won't beat inflation with this money. You’ll need them too soon to make it reasonable to accept a higher risk.

Invest the remaining savings without hesitation to bar inflation from wiping them out. Don't let them rot pointlessly in bank accounts or under your pillow. You are currently losing those savings every month.

Funds intended for spending in 4 to 7 years need balanced portfolios mixed of stocks and bonds. Any longer-term goal, like retirement, children's education, etc., can be invested more dynamically, with a heavier weighting in stocks. With these medium- and long-term investments, you can easily beat inflation.

For example, if you have a larger amount of money intended for a property purchase within one year, do not invest it anymore, but rather buy the property as soon as possible. However, if you want to buy it in about 5 years and you are gradually saving up 20% of the property price, then definitely invest these savings.

How Should I Invest to Avoid Future Inflationary Surprises?

The unrivaled investment tool of today is index ETFs. What are these funds and why do they constitute an ideal investment for both beginners and experienced investors?

ETFs, invest in the entire market. They don't pick cherries among stocks and don't look for a needle in a haystack. Instead, they buy the whole pile, the entire market, and all the titles traded in a specific region or according to specific criteria.

They reduce risk by spreading it among hundreds or thousands of stocks or bonds. In this way, you participate fully in the growth of the global economy, benefiting from the profits of the world's companies. This investment approach is also significantly cheaper than other solutions and removes speculation from investing.

Thanks to these parameters, the long-term returns of ETFs are the maximum that most investors can achieve. Index funds have a high return per unit of risk taken. Moreover, in Slovakia, returns are tax-free after one year of holding ETFs.

To make it even better, Finax can help you set up your investment whether you are a novice or an experienced investor. Based on a simple investment questionnaire, we will automatically match the risk of your portfolio to your investment horizon, risk appetite, and experience.

Become an investor today, and protect the wealth created by your work.

Investing has never been easier. Beat inflation in 10 minutes.

What is Intelligent Investing by Finax?

App Store

App Store

Google Play

Google Play

Difficulty

Difficulty