Firstly, we have chosen the indexes. The ten core classes of investment assets listed below are sufficient to create an effective portfolio with above average returns and minimum risk.

Selected ETF funds cover most of the world's key regions, as well as economic sectors, investing in more than 10,000 specific securities and corresponding to approximately three quarters of the world market capitalization. (The parenthesis below contains the index that the ETF copies).

- US Large Enterprises (S&P 500)

- US Medium Enterprises (S&P 400)

- US Small Enterprises (Russell 2000)

- European Large and Medium Enterprises (Euro Stoxx 600)

- European Small Enterprises (MSCI Europe Small Cap)

- Emerging Markets Enterprises (MSCI EM)

- Global Government Bonds (Citi World Government Bond Developed Markets)

- European Corporate Bonds (Bloomberg Barclays Euro Corporate Bond)

- European High-yield Bonds (iBoxx EUR Liquid High Yield)

- Emerging Markets Bonds (Bloomberg Barclays Emerging Markets Sovereign)

A wider portfolio would be pointless – it would not outperform the current strategies of Finax´s Intelligent Investing. More funds would only increase the administrative and investment costs. In that case, we would not be able to offer one of the cheapest investment solutions.

We also do not consider it appropriate to concentrate investments in specific sectors or regions, which are currently “trendy”. Our goal was to create a universal solution suitable for every investor, regardless of the amount of investment. An investment product that is good today and it will be equally good and usable also in 10 years.

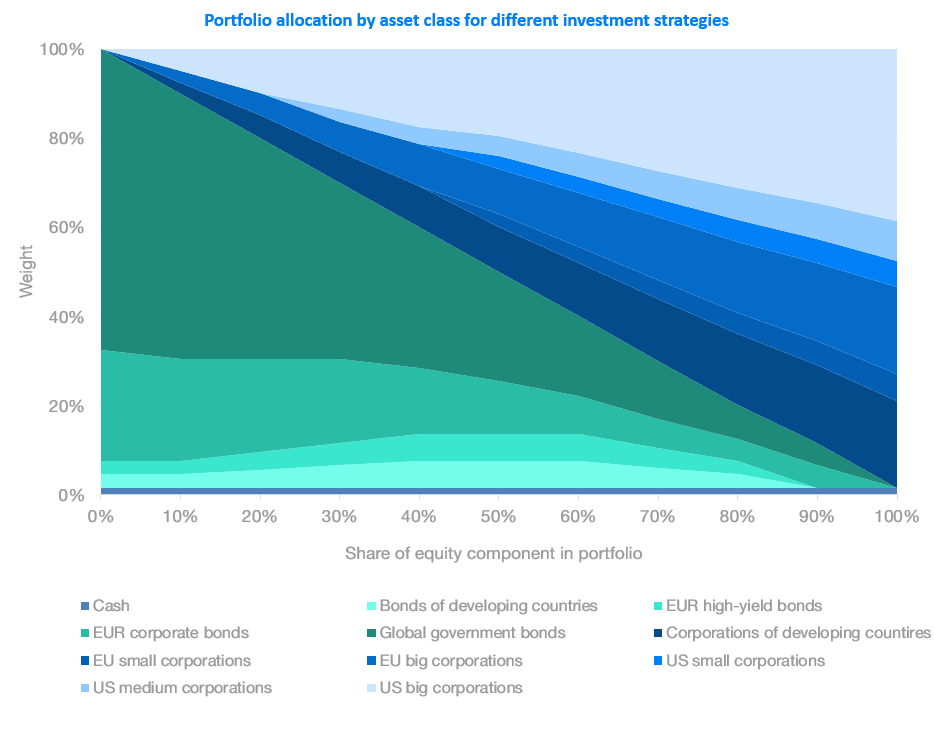

Determination of the proportion of individual asset classes in Finax's portfolios was driven by their share on the global market capitalization. Furthermore, the composition is adjusted to accomplish an attractive yield with an appropriate and as far as possible eliminated risk. The following graph illustrates the share of individual ETFs in our 11 strategies.

Our portfolios contain safer, conservative investments in the form of government bonds, secure investments in the form of the largest multinationals, but also the icing on the cake in the form of shares of young predatory companies, stocks and bonds of emerging countries, or high-yield bonds.

Nonetheless, there are over 5000 ETFs in the world, with tens to hundreds of options available for some indexes such as the S&P 500. So what were the factors based on which we have chosen the individual funds?

The first clear-cut factor was the currency in which the ETF is traded. Since the right investment should be as simple and cheap as possible, we have avoided funds that would require the conversion of client money. Foreign currency purchases of assets would increase administrative difficulties, create room for error, and increase costs.

Another important factor was whether the ETF reinvests the dividend. If the fund pays out the dividend, investors would be liable to tax, which we want to avoid in Finax. The ETFs we buy do not pay out dividends, but they reinvest them in the fund – which results in ETF´s price increase.

A very important factor in selecting specific ETF funds was their ability to copy index performance. The term tracking difference indicates the deviation of the fund's development from the underlying index. Optimal is a positive deviation, when ETF outperforms the index, or a situation when the ETF lags behind the index as little as possible.

The fourth factor was the way in which the ETF fund replicates the index. There are two basic types of replication: physical and synthetic. Physical replication means that the fund is actually investing in individual shares and bonds of the index.

On the contrary, synthetic replication occurs mainly through financial derivatives. The risk of such ETFs is substantially higher. The investor also bears the risk that the issuers of derivatives will fail to repay their liabilities to the fund in the event of bankruptcy. Physical replication is safer and more stable over the long-term.

The fifth criterion was the administrator. We prefer investing through funds of reputable managers who have been on the market for decades and manage substantial amounts of money. In addition to higher security, the size of the fund itself is also a benefit.

Only large funds will survive for a long time and more of their shares are traded daily – they have higher liquidity, i.e. finding a counterparty for a trade is no problem, even under non-standard market conditions. For large funds, the market price corresponds exactly to the net asset value of the fund.

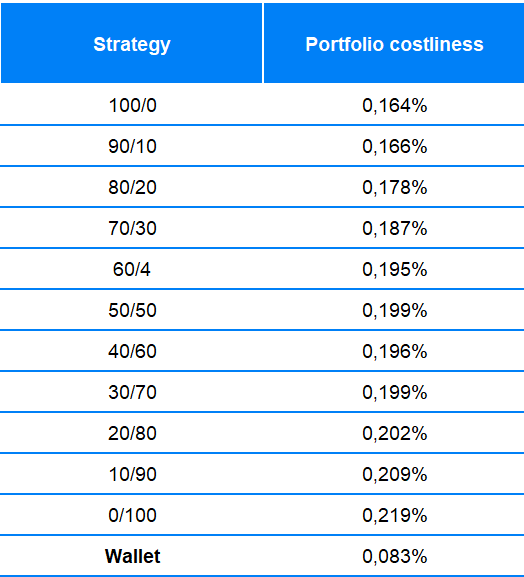

Almost every ETF has its internal fee which the investor pays directly to the administrator. The investor usually does not see it – the fee automatically lowers the ETF's price. Nowadays, these fees are relatively low, but they have also mattered in our selection. However, we did not necessarily choose the cheapest possible funds – the factors affecting security and stability were more important to us than a 0.05% difference in fees.

Of course, the selection of individual funds is not definitive and unchangeable. The ETF pool is growing and changing from month to month.

In any case, we will continue to work to ensure that our clients invest into the best possible funds and we will only make changes in a way that no tax liability arises.

App Store

App Store

Google Play

Google Play

Difficulty

Difficulty