2022 was a challenging year for investing. We can say it was the exact opposite of its predecessor. While asset managers reported record highs in 2021, last year brought a fundamental cooling in the investment markets.

Already in the second month of the year, the Russian invasion of Ukraine spooked everyone. Inflation reached levels not seen in the developed world for four decades. Central banks were forced to turn the monetary policy rudder 180 degrees and we saw the steepest interest rate hikes in modern history. Europe faced an energy crisis.

Such a mix has inevitably left the financial markets unsettled. From the very beginning of the year, shares headed downwards. In the course of the year, they fell into a bear market (down more than -20% from the peak), only to end the year with the biggest losses since the 2008 financial crisis. Rising prices and interest rates caused bonds to fall.

The impact was felt by all asset managers, including Finax.

Despite this environment, we were able to grow. We have increased the number of active clients both at home and abroad and the volume of assets under management has grown. However, we fell short of our ambitious targets from the beginning of the year.

In terms of the bottom line, we increased revenues by more than 80%. We still ended 2022 with a book loss, but we managed to reduce it by about half.

In a challenging 2022, we managed to increase our market share, expand the ranks of viewers of our videos and podcasts, and reach out to the younger generation in particular. We see maintaining our average assets per client as a major achievement.

We have worked intensively on numerous innovations and improvements to our services. Several of them represent significant milestones not only for Finax but for the entire Slovak financial market. Many initiatives have also won awards.

Which ones were they, what results have we achieved, what does an intelligent investor look like, what have we achieved in 2022 and what new things have we brought to you?

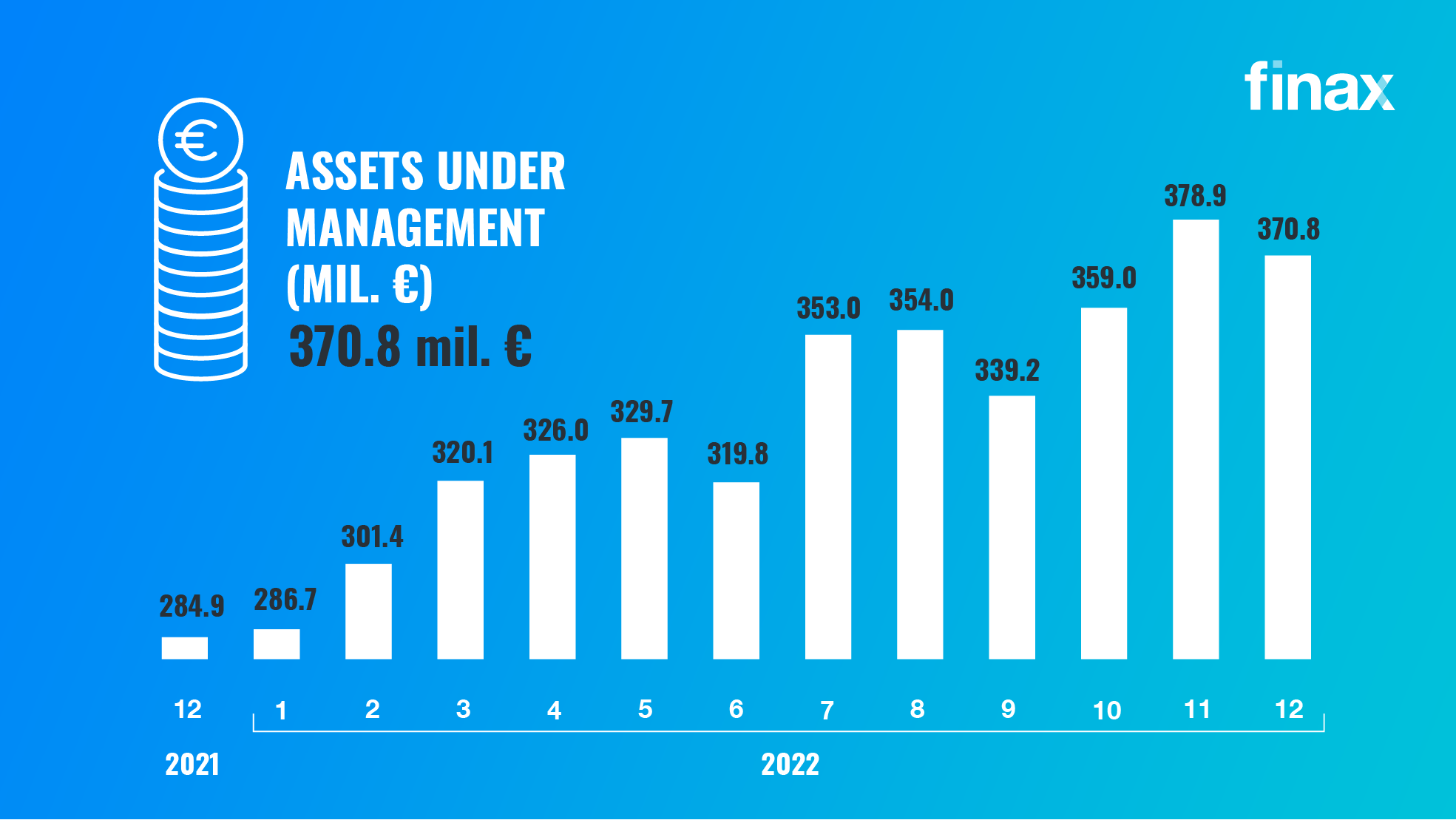

Volume of Assets Under Management

- Assets under management of Finax increased to EUR 370.8 million.

- The year-on-year increase is 30.2%.

- In the context of the development of the financial markets, the economic situation, and the considerable uncertainty, we view the achieved growth as a success, especially considering the development of the investment market in Slovakia (see below).

- Interestingly, in June last year we recorded the first month-on-month decline in the volume of assets under management in more than 4 years of our existence.

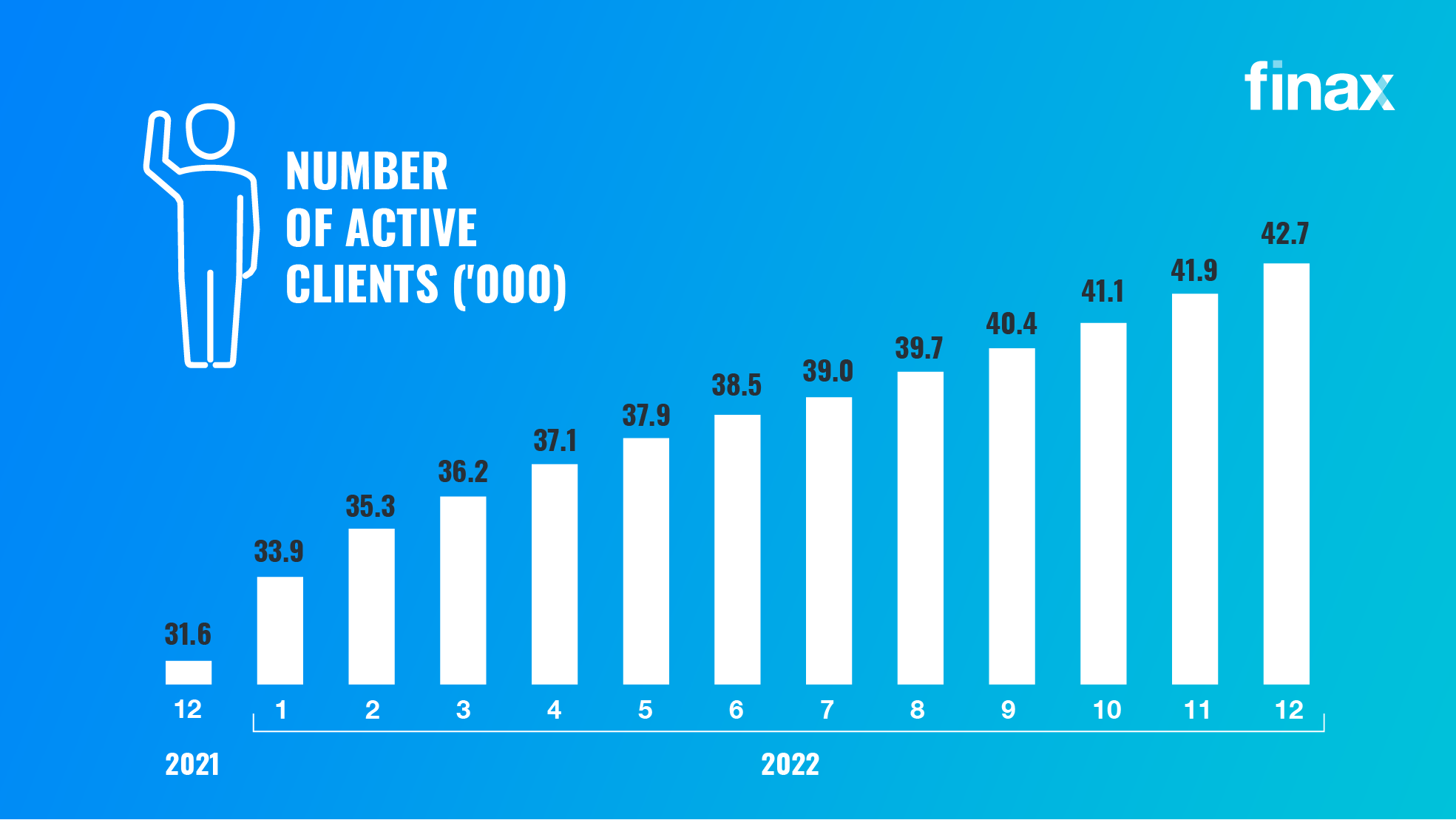

Number of Clients and Average Assets

- Thenumber of active clients rose to 42,734.

- Their ranks have thus expanded by 11,078 clients in 2022.

- This is an increase of 35%.

- An active client holds assets in at least one account at Finax.

- The active client indicator is net, i.e., it also takes into account terminated contracts.

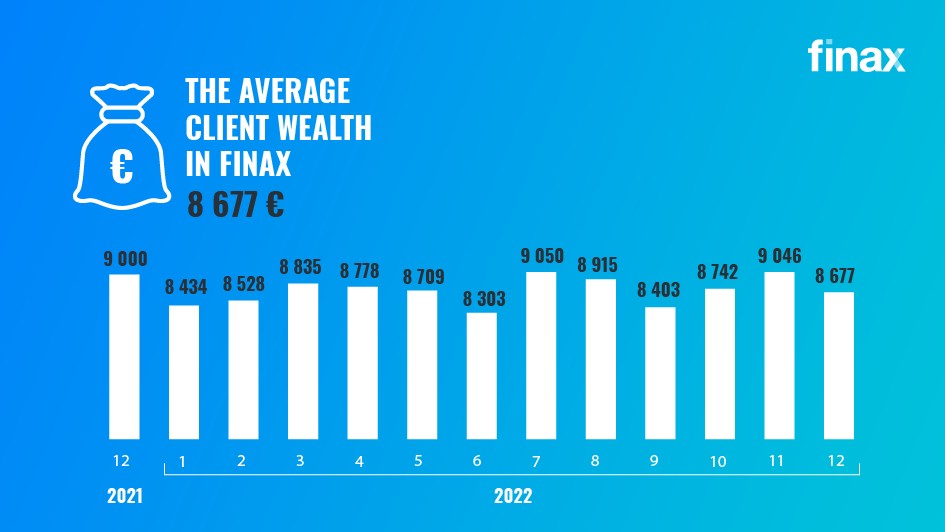

- Finax clients’ average assets ended the year at EUR 8,677.

- They fell by 3.6% year-on-year.

- Nevertheless, this is a very encouraging figure, which remained relatively stable throughout the year despite the addition

- We are pleased to see that despite the more challenging environment, intelligent investors have not stopped building wealth, taking advantage of the downturn in the markets to make new investments.

New Investments

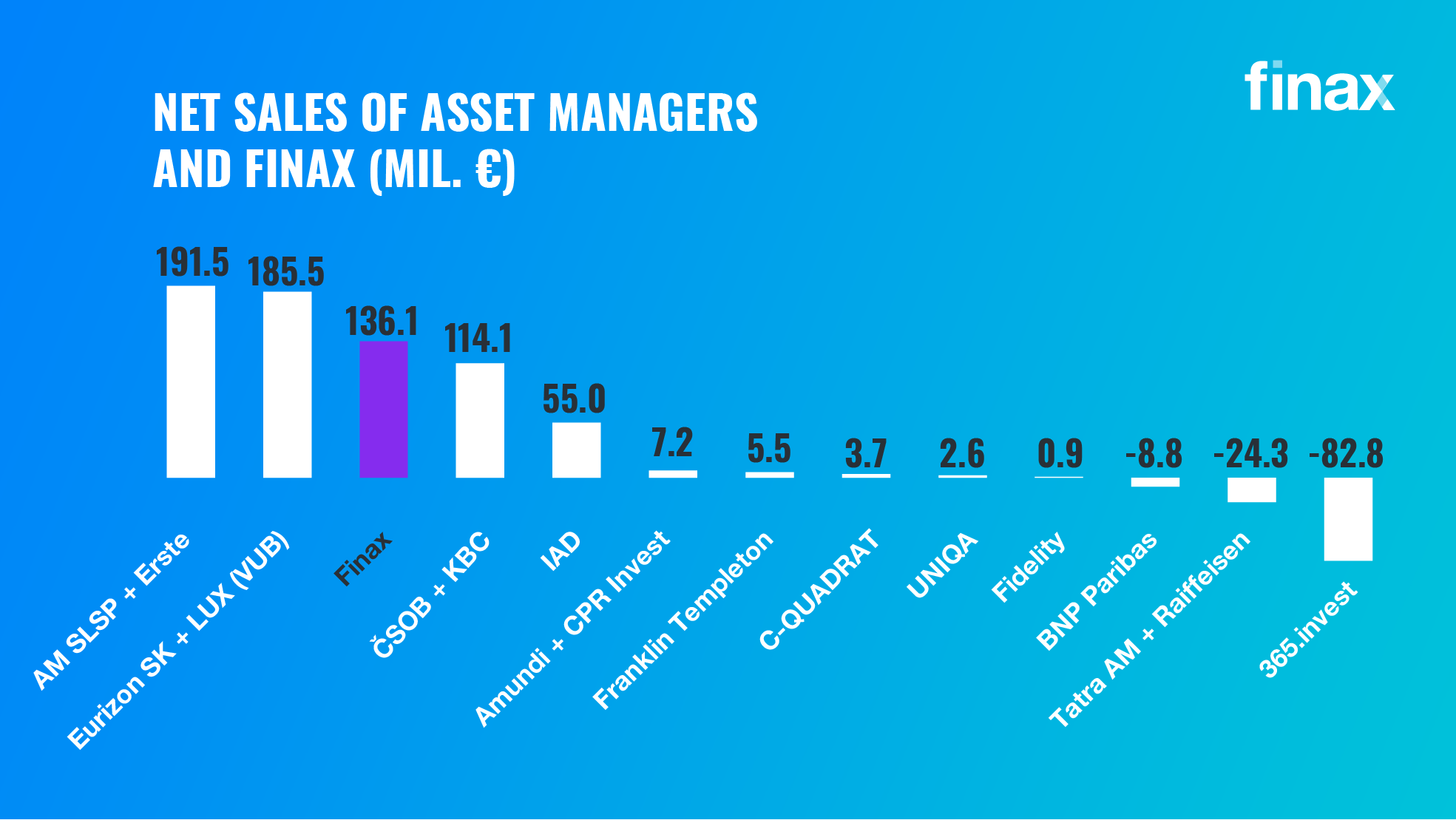

- Net deposits of Finax clients reached EUR 136.1 million last year.

- Compared to 2021, their value was 23.4% lower.

- Net deposits represent the difference between client deposits and withdrawals.

- Despite the year-on-year decline, this is also a great result.

- This is confirmed by a comparison with mutual fund sales in Slovakia, which fell by two-thirds to €496 million after a record year in 2021 (Source: Slovak Association of Asset Management Companies).

- The volume of assets managed by mutual funds in Slovakia fell by EUR 793.1 million year-on-year (Source: Slovak Association of Asset Management Companies).

- While in 2021 Finax sales accounted for around 11.6% of all mutual fund sales, in 2022 it was already more than 27.4%.

- The growth in market share can be clearly seen in the chart comparing Finax's net sales with key asset management companies in Slovakia. Last year, we moved up a notch and were only EUR 55 million short of the leader, while in 2021 the figure was as high as EUR 380 million.

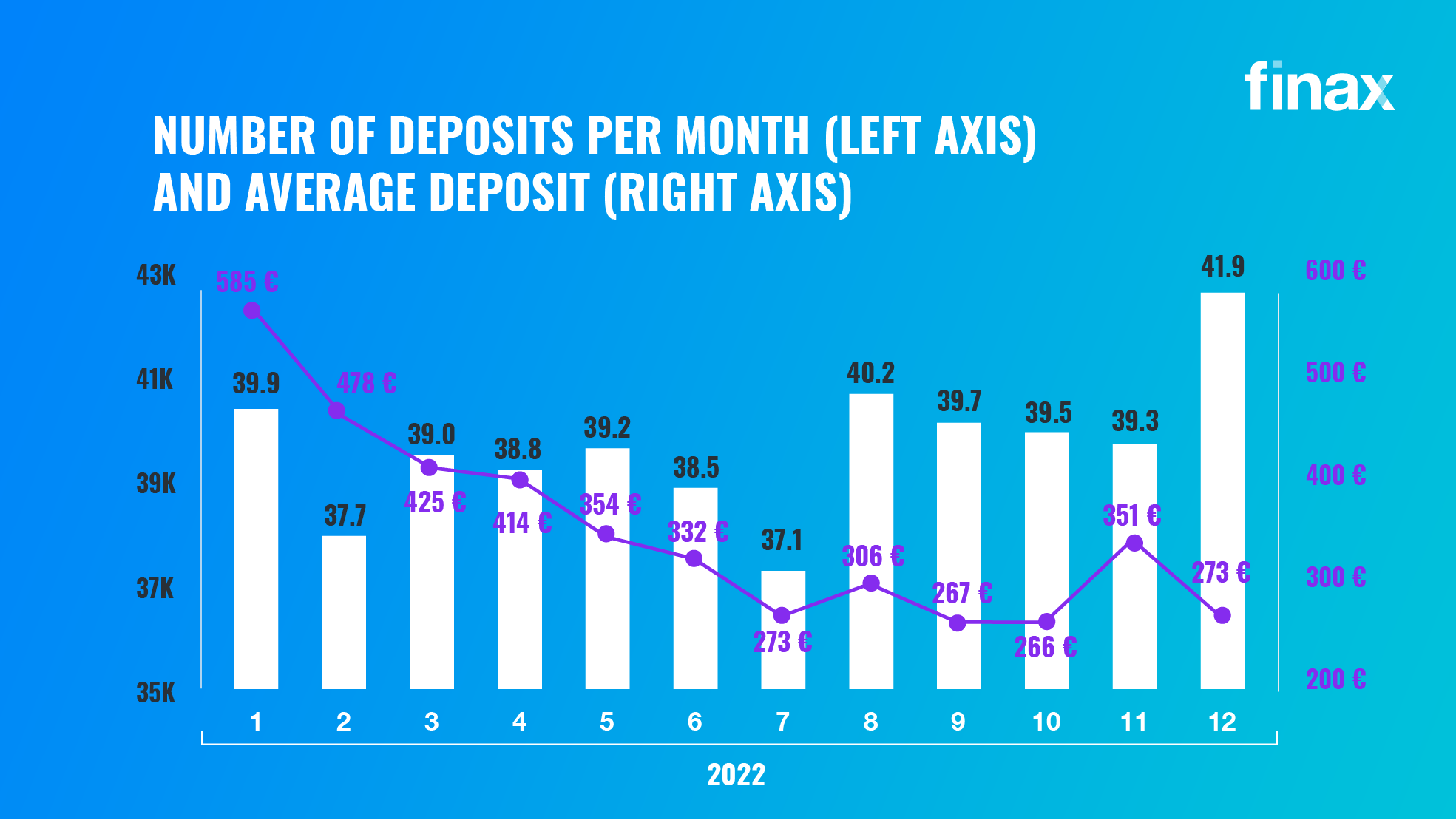

- The number of deposits grew by 47% last year to 470 thousand.

- The average deposit fell to €360 (-40%), clearly illustrating inflation-hit wallets and increased uncertainty.

- This remains a well above-average figure given the savings and investment rates of Central Europeans.

- However, the chart points to a misplaced declining willingness to invest larger sums as markets fall.

Source of Client Acquisition

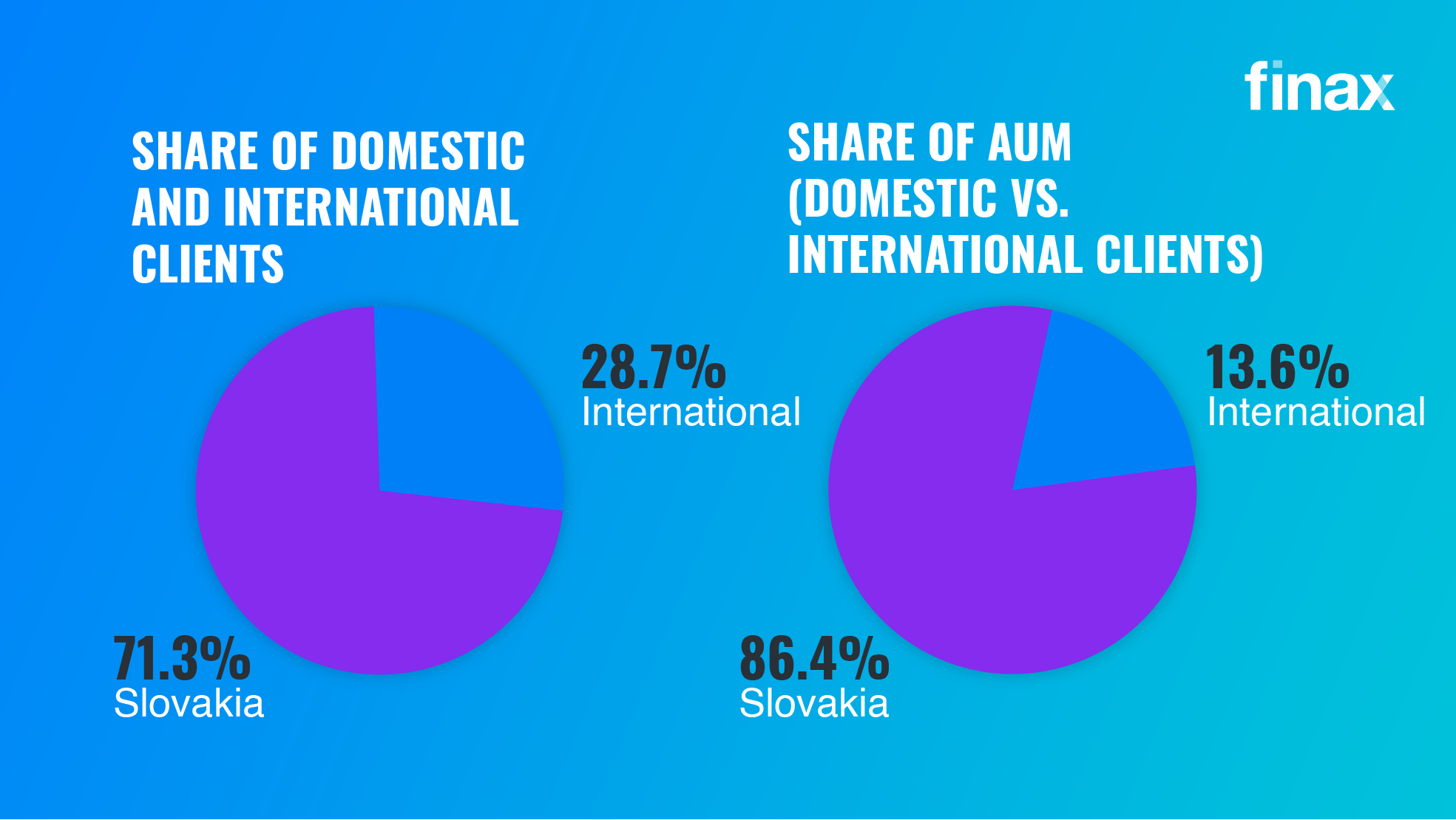

- The proportion of foreign clients ended 2022 at 27.2%.

- Compared to the previous year, their share of total clients fell by 1.5 percentage points.

- The number of foreign clients increased by 27.2% year-on-year, while the number of Slovak clients increased by 36.8%.

- The share of assets of clients from countries other than Slovakia in total assets under management decreased by 1.7 percentage points to 19.4%.

- The volume of assets under management of foreign clients increased by 21%, while the volume of assets under management of Slovak clients increased by 34.6%.

- We see the reasons for the slower growth abroad mainly due to the worse economic situation in key foreign markets of our operations, namely significantly higher inflation (December figures: PL 16.6%, CZ 15.8% and HU 24.5%) and a steeper increase in interest rates (at year-end: PL 6.75%, CZ 7%, and HU 13%).

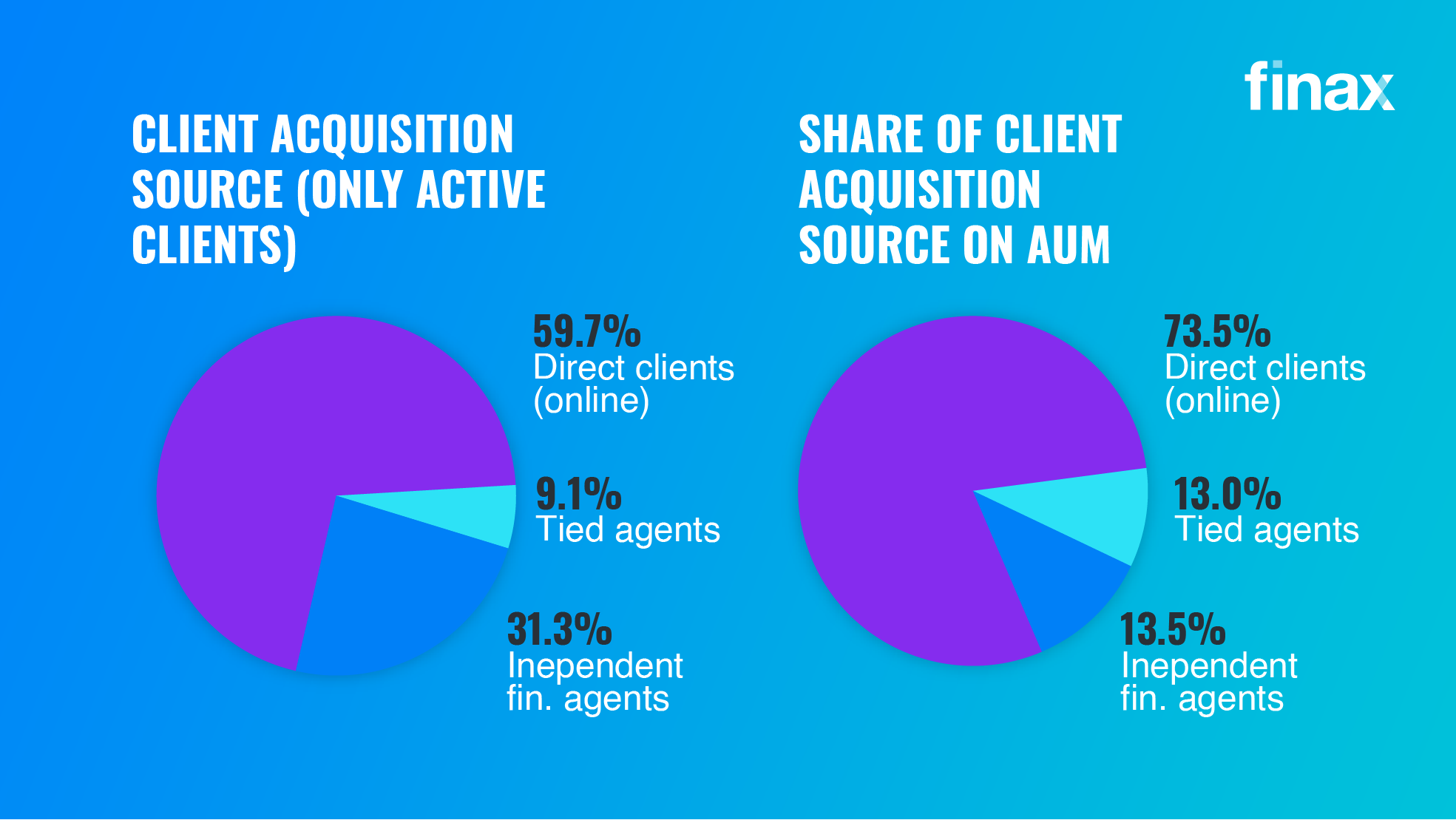

- The share of intermediated clients fell by 3 percentage points to 29.6%.

- The number of active clients from financial agents increased by 22.1% year-on-year.

- The share of financial agent clients' assets in total assets under management of Finax fell by 1.7 percentage points to 20.6%.

- The assets of these clients grew by 21.8% year-on-year.

- At the end of the year, we had 38 external distribution partners, of which 21 were independent financial agents and 17 were tied financial or investment agents.

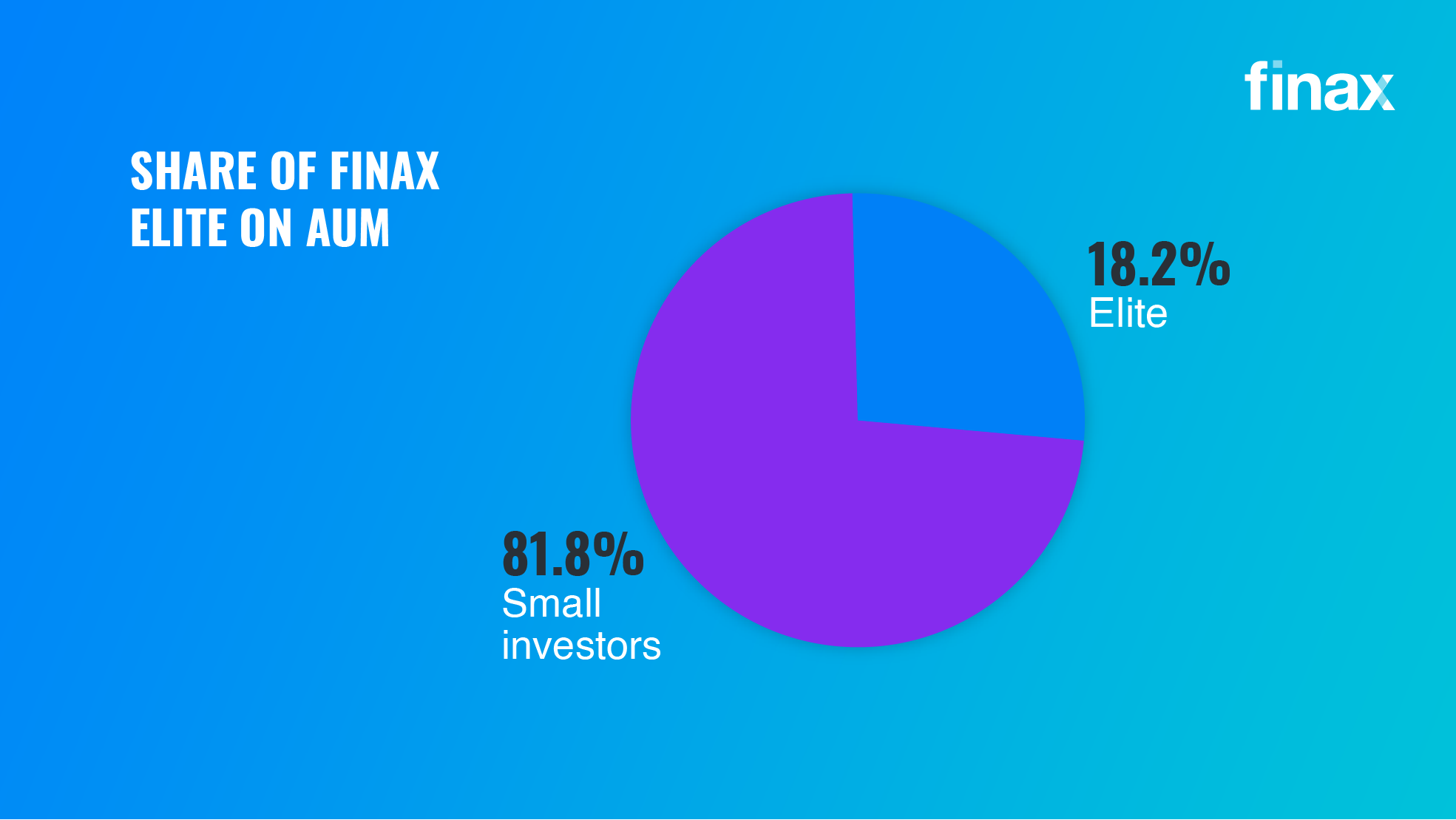

- Elite clients accounted for 26.8% of total assets under management at Finax.

- Elite is a department of private clients of Finax who have at least EUR 100 thousand (household or family) under management of Finax.

- The volume of Elite clients' assets grew by 47.2% year-on-year and its share of total assets under management increased by 2.8 percentage points.

Client profile and investment portfolios

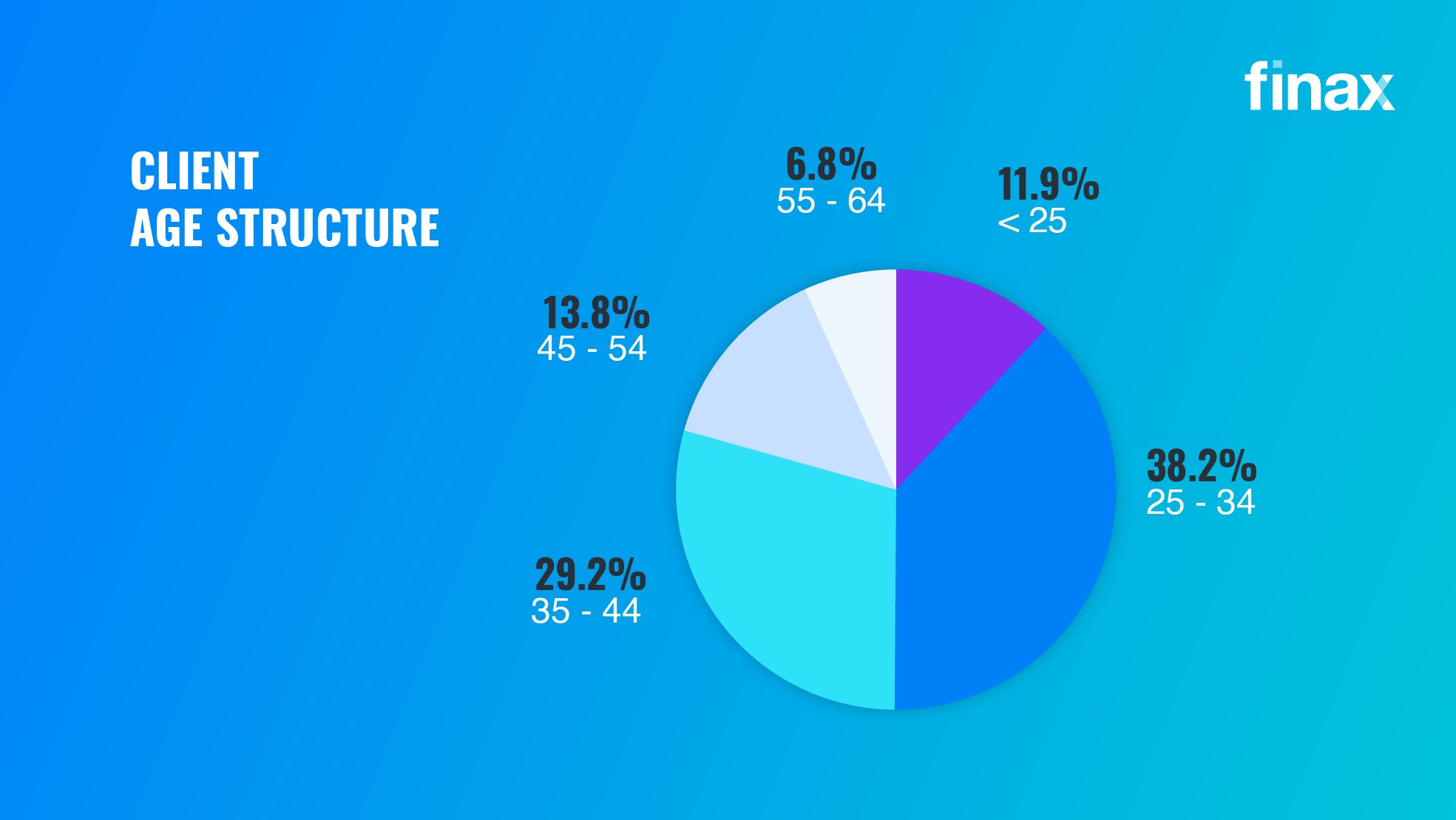

- Finax's clientele has rejuvenated slightly over the past year.

- The share of clients aged 35 and under increased by 2.3 percentage points and exceeded half (50.1%) for the first time in Finax's history.

- The strongest client growth last year was seen in the under-25 category, which grew by 61%.

- In absolute terms, clients aged 26 to 35 saw the largest increase (4226).

- All age categories grew. The year-on-year change ranged from 24% to 61%.

- Despite the fact that the content of our communications and primary online sales naturally appeal more to younger generations, this development was both a pleasant surprise and a delight.

- We are pleased to see a growing number of conscious young people who want to approach their finances responsibly. This statistic gives hope for an improvement in the economic and wealth situation of Central Europeans in the future.

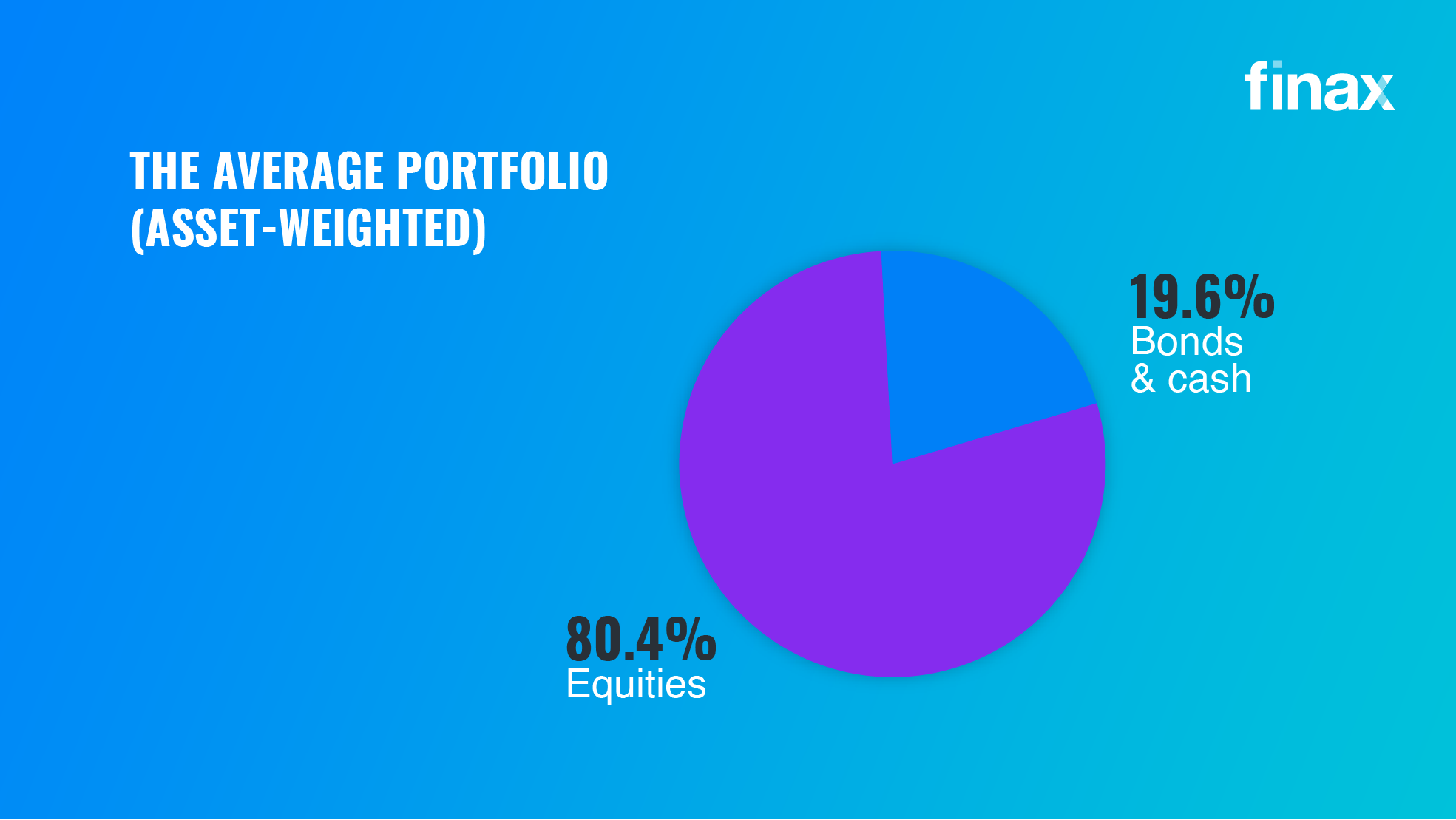

- The average portfolio of Finax clients has slightly increased in favor of equities.

- At the end of 2022, intelligent investors had 78.8% of their assets invested in equity ETFs and 21.2% in bond ETFs.

- The share of equity investments rose 3.2 percentage points year-over-year.

- There was also a change in the ranking of the strategies with the most volume under management. The 100% equity strategy has replaced the 80/20 portfolio (stocks/bonds) at the top of the rankings.

- Finax continues to primarily profile itself as a solution for medium and long-term financial goals. From this perspective, we view the increase in investment risk as acceptable.

- On the other hand, we cannot help feeling that it is largely related to the performance of bonds over the past year, which of course does not make us happy. Investing on the basis of past returns is not correct, it generally leads to taking on disproportionately high risk and worse results.

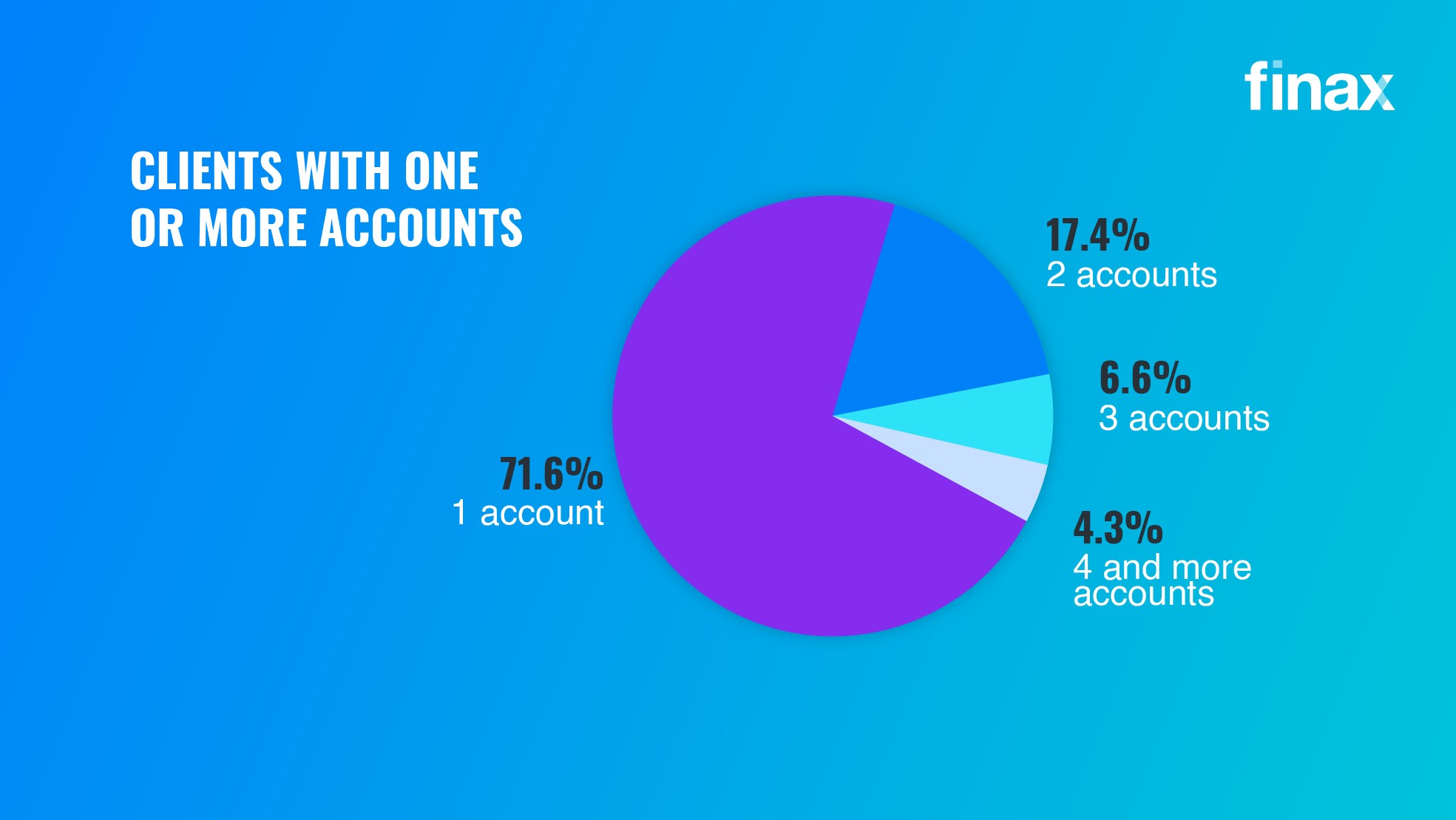

- Finax clients have 60,636 accounts with us.

- 28.4% of intelligent investors have multiple accounts active with Finax.

- Wealth Building continues to dominate among investment objectives.

Site traffic and content tracking

In 2022, we have prepared for you:

- 61 video podcasts,

- 12 webinars and online workshops,

- 46 new blogs (excluding webinars and updated older articles).

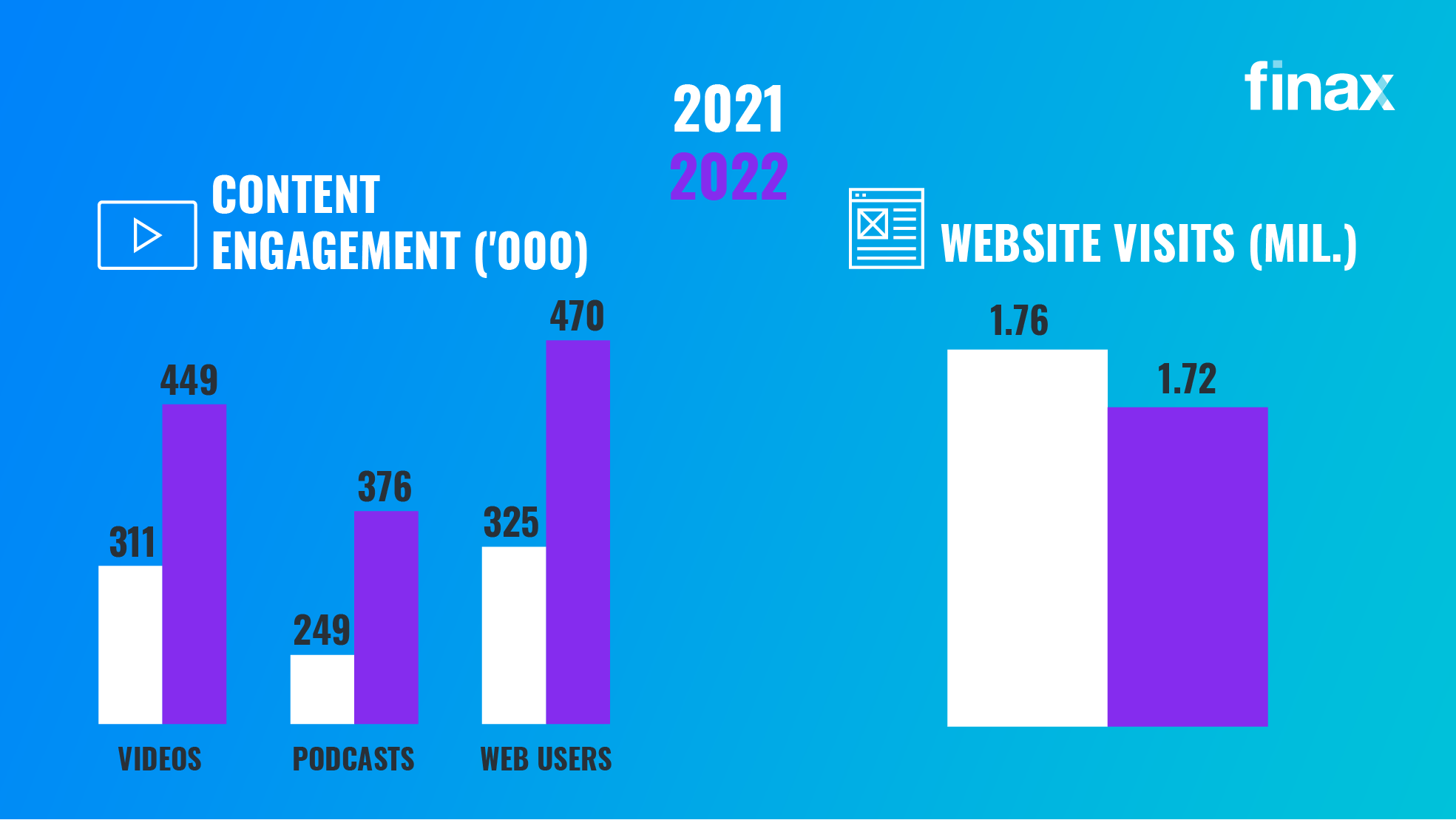

Viewership of our content grew as follows:

- Finax video views across all markets of operation grew 44.1% year-over-year (excluding promotional videos and mobile app views).

- Podcast listens were 51% higher than in 2021 (across streaming platforms excluding the Finax app).

- The number of visitors to the Finax website increased by 44.8% (for all countries and languages).

- However, visits to the site declined slightly, which is primarily related to the much wider use of the mobile app by clients.

News and Milestones in 2022

We did not relax our workload in 2022 either, and in addition to the aforementioned results, we achieved the following successes and made a number of innovations:

- Obtaining the license to provide the Pan-European Personal Pension Product as the first-ever financial institution in Europe.

- Launching the European Pension and gaining the first clients in it.

- Opening of the Polish branch in Warsaw.

- We've updated and simplified biometric identity verification.

- We launched the Finbot personal finance management app.

- Officially launched the financial education project financie.sk, not just for primary and secondary schools.

- We added product pages to the website.

- We successfully passed the IT audit and cyber security tests.

- We have been actively working on other innovations that will see the light of day in the first half of 2023 (insurance, update of Wallet, good debt for margin investing, portfolio revision).

- We have been developing primarily the mobile app, the design and features of which have advanced considerably in the past year, moving closer to a web-based platform.

In the application we added:

- the possibility of entering into a contract,

- opening additional accounts,

- changing personal data and identity verification,

- the ability to withdraw funds,

- sending invitations,

- extension of notifications.

We have won several awards:

- Zlatá minca winner in the Investment ETF Portfolios (Slovakia) category,

- Zlatá minca Award Most Innovative in Investing (Slovakia),

- Winner of the Pasywny Rewolucjonista Award (Poland),

- 11th place in the Companies to Watch category of the Deloitte Fast 50 CE competition (Central Europe).

Also in 2022, we did our best for you and your financial assets. We tried to meet each of your relevant requests, make investing easier and more enjoyable, point out news and important facts in the world of finance, and keep up with legislation and technological innovations.

We sincerely thank you for the trust and goodwill you have shown us even in 2022. Your satisfaction and feedback are our greatest motivation and the fuel that drives us forward. Our primary goal remains to help you with your finances, meet your challenging needs, build your wealth, and make Central Europe a better and more prosperous place to live.

App Store

App Store

Google Play

Google Play

Difficulty

Difficulty