The S&P 500 is one of the world's most popular stock market indices. However, to explain what it is, let's first talk about what stock market indices actually are.

What Is a Stock Market Index?

A stock market index is a statistical indicator calculated by stock exchanges or other institutions to track price changes in the financial market. It includes all stocks listed on a given market or only shares of specific companies, selected according to criteria such as sector, industry, or company size.

Checking the quotes of all financial instruments in the area of interest is a task that would probably consume enormous resources of time and energy, and would often be impossible. A stock market index, meanwhile, allows us to observe the trends prevailing in a particular market at a given time.

However, it also has other, more specialized uses. For example, it can serve as an underlying instrument for certain derivatives and investment products, as in the case of ETFs. The index itself is a statistical measure, so it cannot be traded. ETF funds, however, track and "mimic" it, replicating the structure of the chosen index.

How The S&P 500 Works

The S&P 500 is just one of the stock market indexes. It is compiled by the US rating agency Standard & Poor's and consists of 500 American stock companies with the highest market capitalization, or market value (above five billion dollars), which meet additional conditions, such as:

- high share liquidity (annual trading volume is equal to at least 30% of the company's capitalization),

- at least 50% of all issued shares are freely traded on the stock exchange,

- positive financial results for the previous quarter and the previous 12 months.

The value of the S&P 500 index is calculated on a weighted average basis - each company is assigned an appropriate weight based on its market capitalization, so the higher the value of a company, the more influence it has on the value of the index. The index is constantly supervised by the American Index Committee, which once a month evaluates the companies currently included in the index, as well as analyzes any potential changes that could be made. Once a quarter, the index is rebalanced, which means that the structure and composition of the index may change - new eligible companies are included, while those that no longer meet the necessary requirements are excluded.

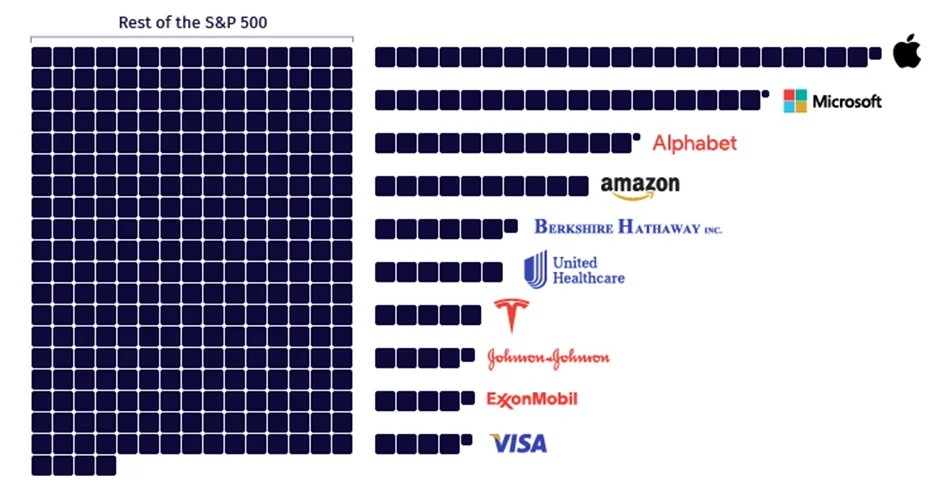

Share of individual companies in the S&P 500 index by market capitalization as of 20.11.2022, source: visualcapitalist.com

Why Do We Hear About the S&P 500 So Often?

If you are just beginning to be interested in the stock market, you may be asking yourself why the S&P 500 index is discussed so frequently. The answer is simple: it is considered to be an indicator of the current economic situation in the United States.

Thanks to the precise rules of selection of companies included in the index, it is considered highly reliable, so it perfectly illustrates the mood and sentiment of investors prevailing in the US stock market. It is generally assumed that a rising trend of the index signifies a bull market and a falling trend signifies a bear market.

OK, but we're still talking only about the United States. What about the rest of the world?

When we talk about financial markets, the role of some countries is sometimes much more important than others. If we look at the world's stock exchanges on a macro scale, we find that the United States (where you can find the world's largest exchanges, the New York Stock Exchange, or NYSE, and the National Association of Securities Dealers Automated Quotations, more commonly known as NASDAQ), are responsible for almost 60% of the financial markets’ total capitalization - that is, the value of shares of listed companies.

The S&P 500 index is made up of global giants whose performance is influenced by global economic trends (such as changes in exchange rates, international trade agreements, or political events). Furthermore, these companies themselves have no small influence on firms and investor sentiment around the world. In addition, they represent a wide range of industries, which provides a broad view of the overall health of the economy. The S&P 500 can therefore also serve as an indicator of global economic conditions.

Of course, this index is not universal and will not work for many applications. It will not tell us enough about the condition of European or emerging markets, nor will it show the changes taking place within individual sectors of the economy. However, it is certainly an extremely valuable source of information in the investment world.

How to Invest in the S&P 500

The S&P 500 - like any index - is a statistical measure, and therefore cannot be traded on its own. However, there is a solution that allows you to easily invest in the companies included in the index.

That solution is ETFs that mimic the structure of indices, such as those included in Finax portfolios. 10 of the 11 Intelligent Investing portfolios contain an ETF that mimics the performance of large U.S. companies, based on the S&P 500 index.

Create an account and start investing today

If, for example, you invest in a portfolio of 100% stocks, Tesla represents 0.63% of your portfolio, Google (Alphabet) 0.64%, Amazon 0.97%, and Microsoft 2.17%. The largest single company's influence on your wealth belongs to Apple, but that's still only 2.57% of your portfolio. Even in case of a total bankruptcy of the iPhone maker (which is hard to even imagine), your loss would not exceed this figure. This is how the magic of diversification works.

Curious about how we choose ETFs for our portfolios? Be sure to take a look at another post on our blog. And if you have any questions about the S&P 500 or would like us to discuss another topic from the world of finance and investment in our next post, let us know at client@finax.eu.

App Store

App Store

Google Play

Google Play

Difficulty

Difficulty