In the fourth year of its existence, Finax took a firm position in the financial market field, not only in Slovakia but also in Central Europe. The main objectives for 2021 were growth and expansion, improvement of services and user experience, as well as horizontal and vertical expansion of our offer.

Since our inception, we have strived to make our company as transparent as possible. We believe that showing our cards builds real trust, which had been desperately missing in the world of finance. Communicating financial developments and business activities well beyond legal requirements provides a solid foundation for open and honest entrepreneurship.

That’s why we’re granting you an insight into a comprehensive assessment of our results in the previous year and our plans for 2022. You can compare the achieved indicators with the goals we communicated a year ago, and with the results from 2020.

Last year was very favorable to the financial industry, especially for investment managers. Equity markets made massive gains. Inflation broke records and the financial awareness of Slovaks rose, leading to increased interest in investments.

These facts, coupled with the large savings of Slovak households, resulted in a record year for financial asset managers in terms of net sales (deposits corrected for withdrawals).

Finax did not stay on the sidelines. We have significantly surpassed our primary objective - the volume of assets under management. But we have also met the set targets for the number of clients and other key indicators.

Read how Finax's portfolios performed in 2021 compared to competing mutual funds.

Assets Under Management

- Assets under Finax’s management increased to €284.9 million.

- The year-on-year increase represents a robust 262.5%.

- We surpassed our goal of €200 million under management by 42.4%.

- Client returns at Finax amounted to €32.8 million at the end of the year.

- What is also pleasing about the development of assets under management is their continuous growth with no evident seasonal or market influences. The exemplary behavior of intelligent investors, not succumbing to trends, and avoiding speculation are very encouraging characteristics for the future.

Number of Clients and Average Wealth

- The number of active clients closed the year at 31 656.

- The intelligent investor community grew by 128.6% during the year.

- The target set at 30 thousand active clients was surpassed by 5.5%.

- An active client holds funds in at least one account in Finax.

- The average assets held per client in Finax amounted to €9,000.

- This indicator increased by 58.6% compared to the same period previous year.

- The development of the average wealth of intelligent investors in Finax is a great encouragement for us, especially considering that 56.2% of our clients concluded a contract only last year.

- According to the Allianz Global Wealth Report, the gross financial assets of an average Slovak were less than €16,000 in 2020. We perceive the size of the wealth held by clients in Finax as a sign of strong confidence, recognizing the fact that each client also owns other financial assets (funds in bank accounts, 2nd and 3rd pension pillar, life insurance, and other investments).

New Investments

- Net sales of investments in Finax amounted to €179.8 million last year.

- The year-on-year growth was 236.9%.

- Net sales represent the difference between client deposits and withdrawals.

- As we have already mentioned, 2021 was a record year for investments in Slovakia. Net sales of mutual funds exceeded €1.5 billion.

- Finax outperformed most large asset management companies in the field net deposits. Only the sister companies of the three largest banks, Slovenská sporiteľňa, Tatra banka, and VÚB banka, which serve millions of clients through hundreds of branches with thousands of employees, recorded larger inflows than Finax.

Become a smart investor

- The number of deposits in 2021 reached 320 thousand.

- Compared to the previous year, their number increased by 161.2%.

- The average deposit in 2021 reached €602.

- It increased by 31.8% year-on-year.

Source of Acquiring Active Clients

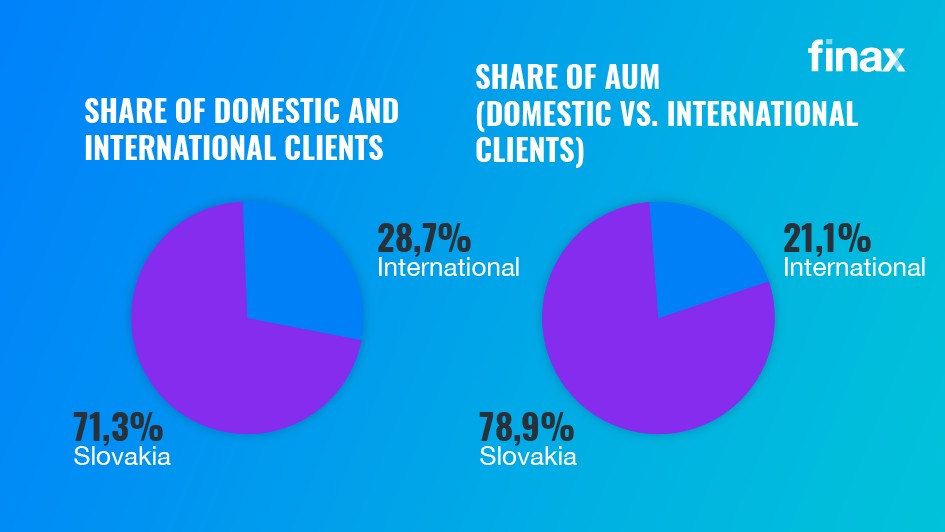

- At the end of 2021, the share of foreign clients was 28.7%.

- It increased by 3.9 percentage points compared to the end of 2020.

- The number of foreign clients increased by 165.6% over the year, while the number of Slovak clients increased by 118.3%.

- The share in assets under management attributable to clients from countries other than Slovakia amounted to 21.1%.

- The share of foreign clients in assets under management increased by 7.5 percentage points.

- Assets under Finax’s management abroad increased by 479.9%, while the increase was on the level of 237.5% in Slovakia.

- In terms of revenue, Slovakia remains Finax's key market, but we are succeeding in foreign expansion and increasing the share of other markets, which is in line with our plans.

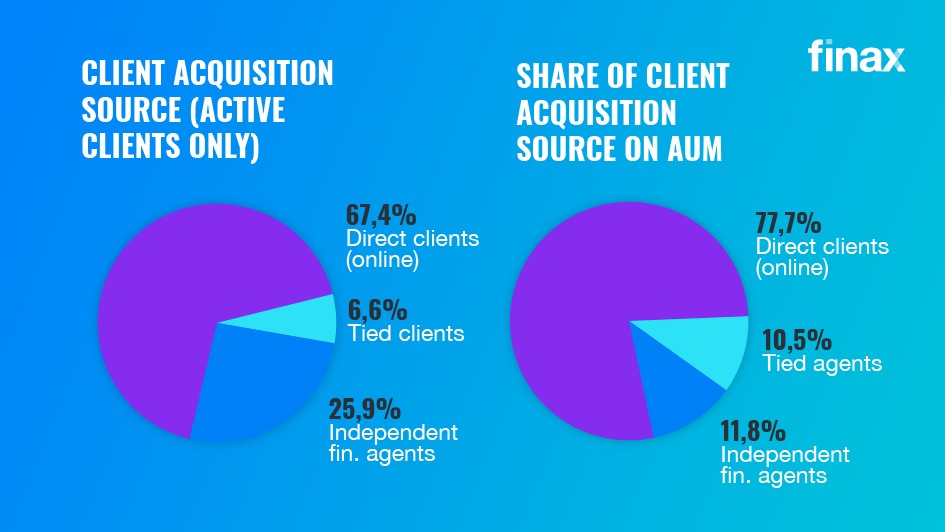

- 32.6% of active clients were intermediated by financial agents.

- The number of active clients from financial agents increased by 88.2% year-on-year.

- The share of client assets intermediated by financial agents in total assets under Finax’s management fell by 4.2 percentage points to 22.3%.

- Still, the assets under management belonging to these clients grew 205% year-on-year.

- We increased the number of external distribution partners to 39 (from 33), of which the number of independent financial agents remained unchanged (21). More than 1,800 subordinated and tied financial agents now have Finax products on offer, an increase of 26%.

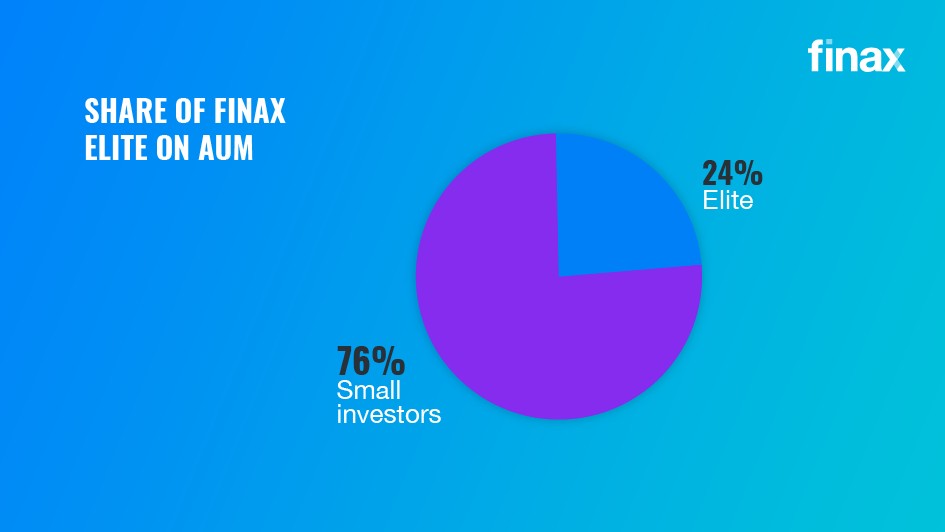

- Finax Elite has been growing decently and has been responsible for a significant portion of the increase in assets under management and average assets per client. Michal Vaculík and his team of wealth managers are doing a great job and clients are extremely satisfied with the services of this department.

- The share of Elite clients in Finax’s total assets under management reached 24%.

- With an increase of 5.8 percentage points, the private banking department has become a significant pillar of Finax's activities.

- Last year we started offering Elite services in Poland as well and the team of wealth managers expanded to 5.

Client and Account Profile

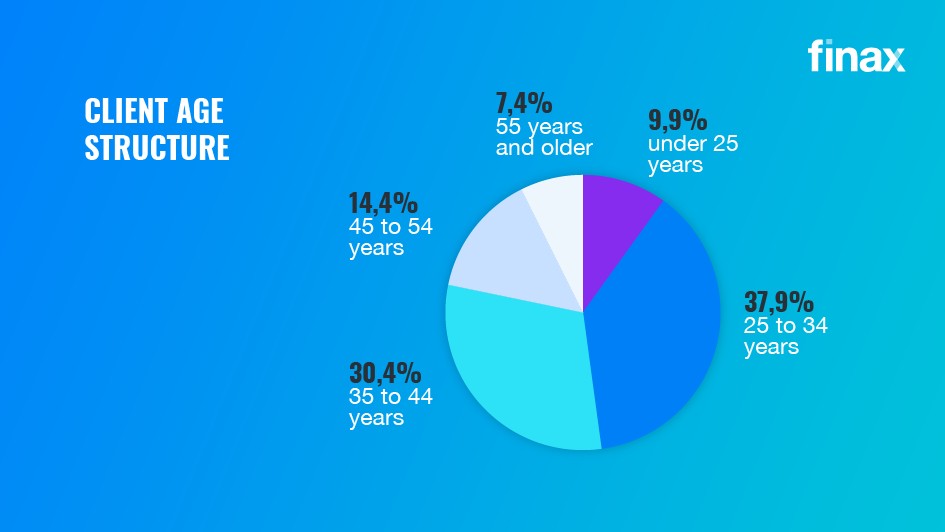

- The age structure of clients has not changed. We continue to appeal mainly to younger generations, which is natural given that our sales are primarily online and communications digital.

- People aged under 45 accounted for 78.2% of clients (a slight decrease of 1.4 percentage points).

- The risk of our clients’ investments has recorded no significant changes either.

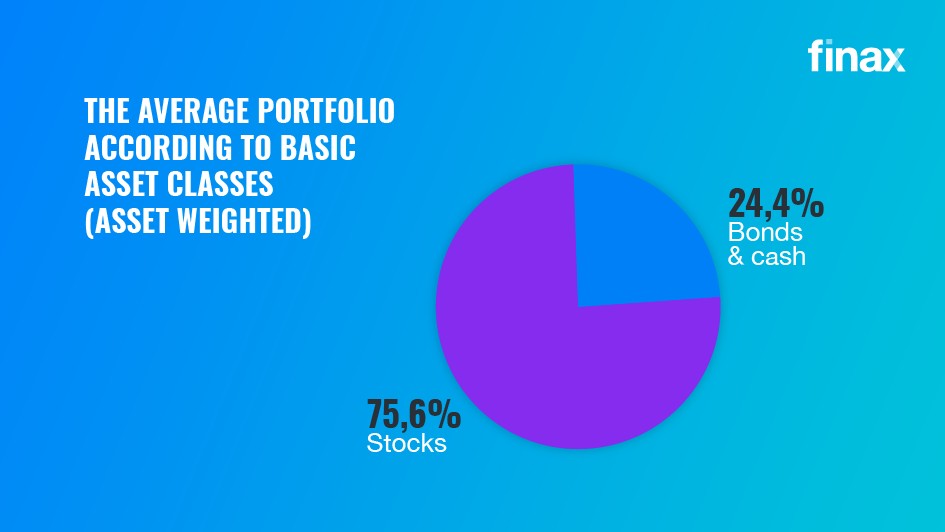

- The average portfolio at the end of 2021 consisted of 75.6% stocks and 24.4% bonds, depending on the strategy selected in the account (not current weights).

- The largest volume of client assets remains invested in the 80/20 strategy, with the most dynamic 100/0 strategy being close behind.

- Clients have more than 46 thousand open accounts at Finax.

- In the distribution of assets among the individual investment goals, Wealth Building dominates with a 56.4% share, followed by Retirement and Saving for Children.

Open an account in Finax today

Website Traffic and Content Following

- Traffic to the Finax website, video views, and podcast listens were up significantly compared to the previous year.

- The following data is cumulative for all countries in which we operate.

- The number of video views on our YouTube channels increased by 558.5%. Users spent 78 thousand hours watching our videos last year. This represents nearly 9 years of viewing.

- The number of podcast listens was 116.2% higher than in 2020.

- The number of website visits increased by 37.5% and overall, compared to 2020, 75.4% more users visited it, browsing 43.4% more sites than the year before.

- We are very pleased with these statistics as well. According to them, we continue to rank among the leaders in financial education.

What we Brought You in 2021

- Intelligent Wallet – a conservatively managed portfolio for short-term investments.

- Life insurance – we began our horizontal diversification by offering attractive death risk insurance with minimal exclusions and no health condition review.

- Mobile app development – we added new features of sending invitations, setting an adjustable horizon in the account progress chart, and new notifications.

- New website – we have begun updating our website, starting with the homepage www.finax.eu.

- Updates to onboarding and online account overview – we made onboarding adjustments related to new products, statutory and regulatory requirements, introduced instant crediting of payments, modified and simplified identity verification, and launched online withdrawals.

- Launching a beta version of the Finbot personal finance management mobile app in Slovakia and Poland, with the aim of introducing it in the other markets in the future.

- The second round of funding from our investor was executed, strengthening our capital position to meet stringent regulatory requirements for equity.

- Reducing the cost of investments through several different promotions.

We are absolutely satisfied with 2021. The results achieved and the innovations brought to the growing community of intelligent investors make it clear that we are not resting on our laurels. We continue to work hard to make our services even more efficient and convenient, aiming to make wealth-building and personal finance management easier on the road to your financial security.

We will soon publish an article with plans and goals for 2022 to let you know what to look forward to.

We sincerely thank all intelligent investors, our employees, business partners, and fans for their trust. Building a financially responsible community, educating, and delivering effective solutions for a better and more secure life is extremely fulfilling for us professionally.

Intelligent investors, we love you. Thank you for your goodwill and regular feedback. You are a key contributor to our results. Without you, our work wouldn't make sense. You are a huge motivation for us.

Thank you.

App Store

App Store

Google Play

Google Play

Difficulty

Difficulty