The Finax employee program is an effective savings program for companies that care about their employees.

It is a benefit and motivational tool which the employer can use to save for their employees, for example for retirement or a bonus for meeting their goals. The basis is formed by the Intelligent Investing portfolios, what brings a number of benefits.

More advantages for employees

The standard savings benefit program for employers in Slovakia is the Third Pillar. However, there are no other benefits for employers, except for the contributions being exempt from social security levies.

The Third Pillar is not even attractive for the employees themselves, as it represents an inflexible solution with costs still relatively high, low returns that are subject to tax, and a very weak payout phase.

Finax has decided to change that. Savings plans for employees based on ETF portfolios are significantly more advantageous for employers and their employees in all these areas.

We have already offered a comparison of Finax Intelligent Investing with the Third Pillar before.

Advantage no. 1: Finax offers lower fees than the vast majority of 3rd pillar contribution funds, which means higher returns and assets for both the employer and the employee in the future.

Advantage no. 2: The returns of the ETFs that the Finax portfolios are built on are exempt from tax after 1 year. Third Pillar benefits are subject to tax, which significantly reduces the net return of this solution.

Advantage no. 3: Thanks to passive investing, more effective investment strategy, lower fees, and tax exemptions, Finax portfolios achieve higher appreciation in the long-term.

Advantage no. 4: Finax employee program offers incomparably more favourable savings payout phase during which the assets continue to be appreciated. Thanks to this, the total funds obtained from such savings plan with identical deposits are significantly higher when compared to e.g. 3rd pillar.

Create an account and start investing today

More advantages for employers

The employer will, under his or her name, create accounts for employees. If I have a 100 employees as an employer, Finax will either manage 100 accounts, or only the accounts of the chosen employees. The employer may contribute any amount to any account, one-time or regularly.

Advantage no. 5: The employer shall transfer the money to the employee’s account only when the employer meets the pre-agreed conditions. This can be, for example, staying with the employer for 3 years, achieving a work or sales goal, or another condition set by the employer.

This represents a significant shift in thinking on how the employer can use the benefit system to their advantage. This set up will help you reduce employee turnover, increase their motivation and set up a better long-term employee remuneration bonus system.

In practice, for example, the employer will save 100 euros per month for 3 years for their employee. The total deposits after 3 years will, therefore, be 3600 Euros. Due to the developments on the stock markets the deposits will appreciate to the total of 4000 Euros. If the employee works with the employer the required period of time, these funds will be transferred to the employee’s account after deducting the contributions.

Advantage no. 6: Since this form of remuneration is defined as the employee’s income, logically, both the employer and the employee will have to pay contributions and taxes from the commensurate part of the salary. The employer pays contributions and taxes for the employer only upon paying their salary, which significantly improves their cashflow during the first three years of saving period, as the contributions to their account will not be subject to levies during the first three years.

Advantage no. 7: If the employee does not meet the conditions for transferring the money to their account, the financial assets in the account, including appreciation, remain the property of the employer. Due to the fact that the account is property of the employer at all times, contributions from the given payments do not apply until the transfer of assets to the employee’s ownership.

The Ministry of Labour is preparing a new law on personal pension products. Finax, as a securities broker, will be able to manage such pension products.

Preliminary negotiations at the Ministry, which I took part in as the Vice Chairman of the Association of Security Dealers, show that the Ministry wants to introduce the same or similar forms of tax and levy beenfits for this product, as is the case of the current 3rd pillar, making our product probably even more attractive to the employers.

Let your money make money zarábať

Try invest tax smart with low cost ETF funds.

Transparent for employees

Managing employee accounts in the employer’s name brings undeniable benefits for the company. The reason why no one has done this thus far, is low transparency and great limitation on the level of individually set risk. And these are the main areas of innovation in Finax products.

Advantage no. 8: After logging in into online accounts overview in Finax, the client can also see the account managed by their employer. This account does not count towards the client‘s total net worth, however, complete account information is always available.

The list of benefits doesn’t end here, though. Following discussions with the National Bank of Slovakia, we also came up with a way for employees to set and manage risk on their own on the accounts that are officially the employer’s property.

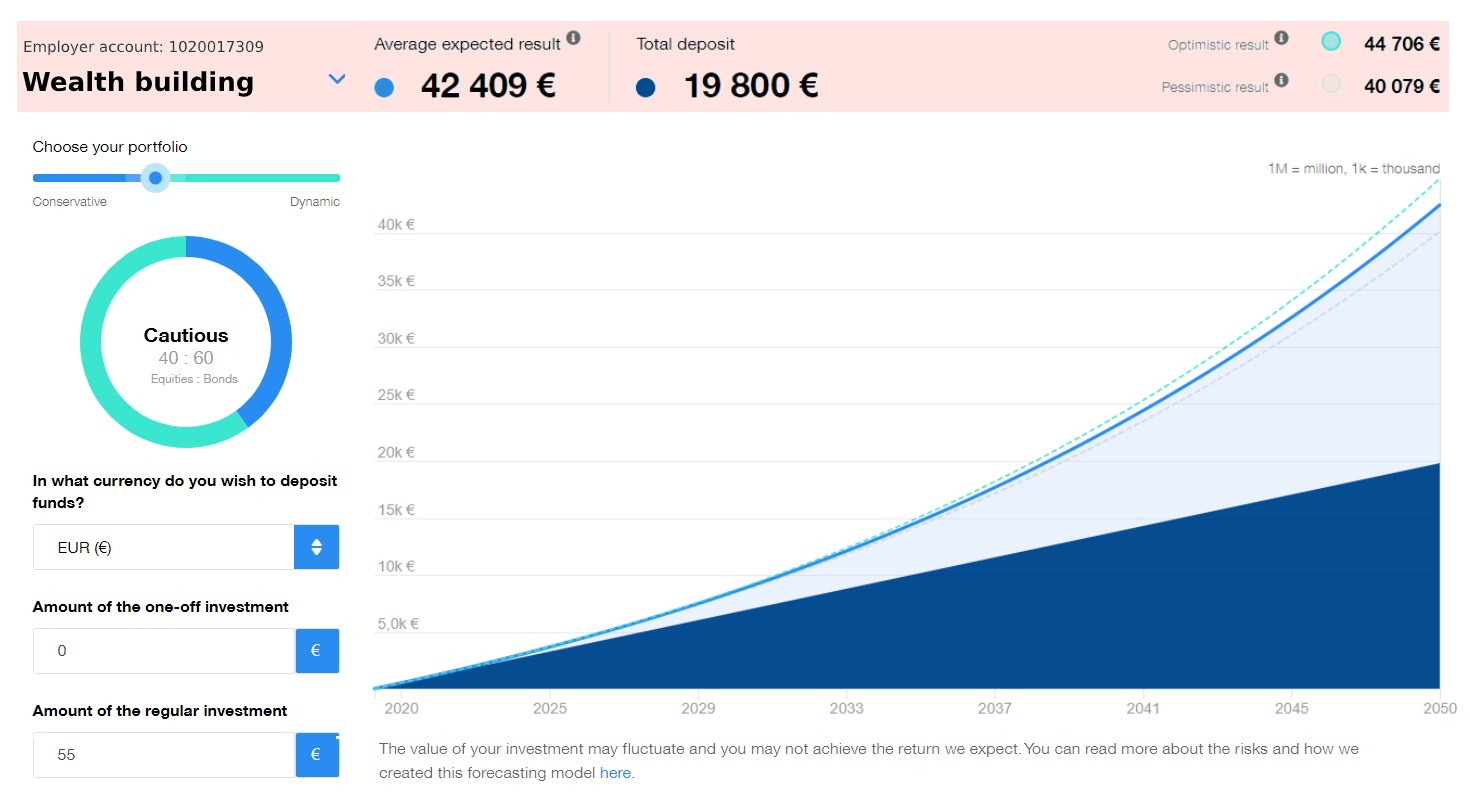

Advantage no. 9: Employee can choose and continuously set their own risk profile of the employee account. They can choose from 11 strategies and customize their strategy online.

Advantage no. 10: Many employees will consider the fact that after crediting shares to their own account they can freely dispose of their assets, or even withdraw them, as the main advantage over the 3rd pillar. Even though most people do not take advantage of this option, unlike the 3rd pillar, in which case you will see cash only after retiring, savings in Finax are immediately liquid. However, this advantage is unlikely to be compatible with the previously announced personal pension product.

Invest like a pro profesionál

With low fees, no emotions and tax smart.

How to get involved

If you still don’t have an account in Finax, you can set it up in a few minutes on our website www.finax.eu. Click the button I want to start and go through a simple registration process, a part of which is the Portfolio Management Contract, choosing the suitable portfolio, and opening your first account. Anyone can do it in less than 10 or 15 minutes.

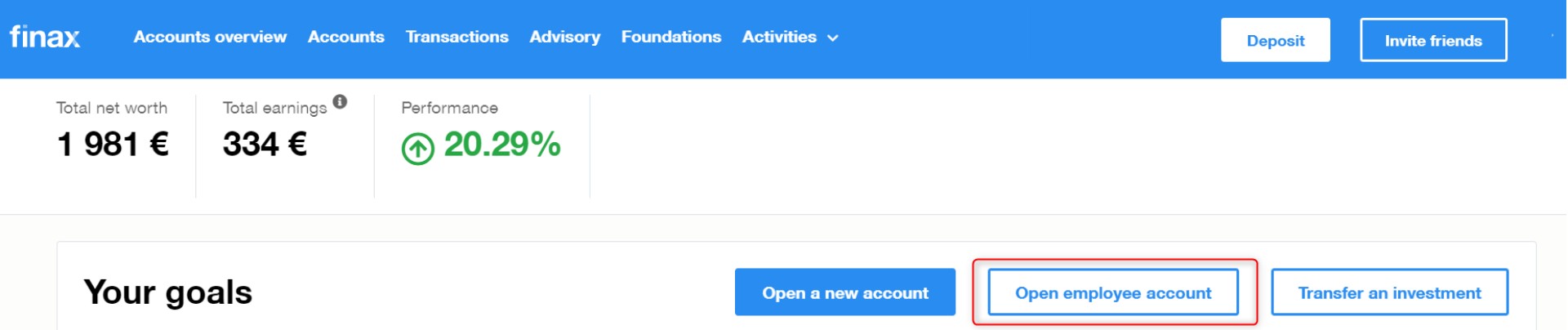

Those involved in the employee program have their own account set up with their employer. You can set it up as well after logging in to your Finax account and clicking the Open employee account button.

Of course under the condition that your employer has implemented the Finax Employee program and offered these benefits to their employees. Subsequently, the employee shall conclude the contract upon entering the program with the employer.

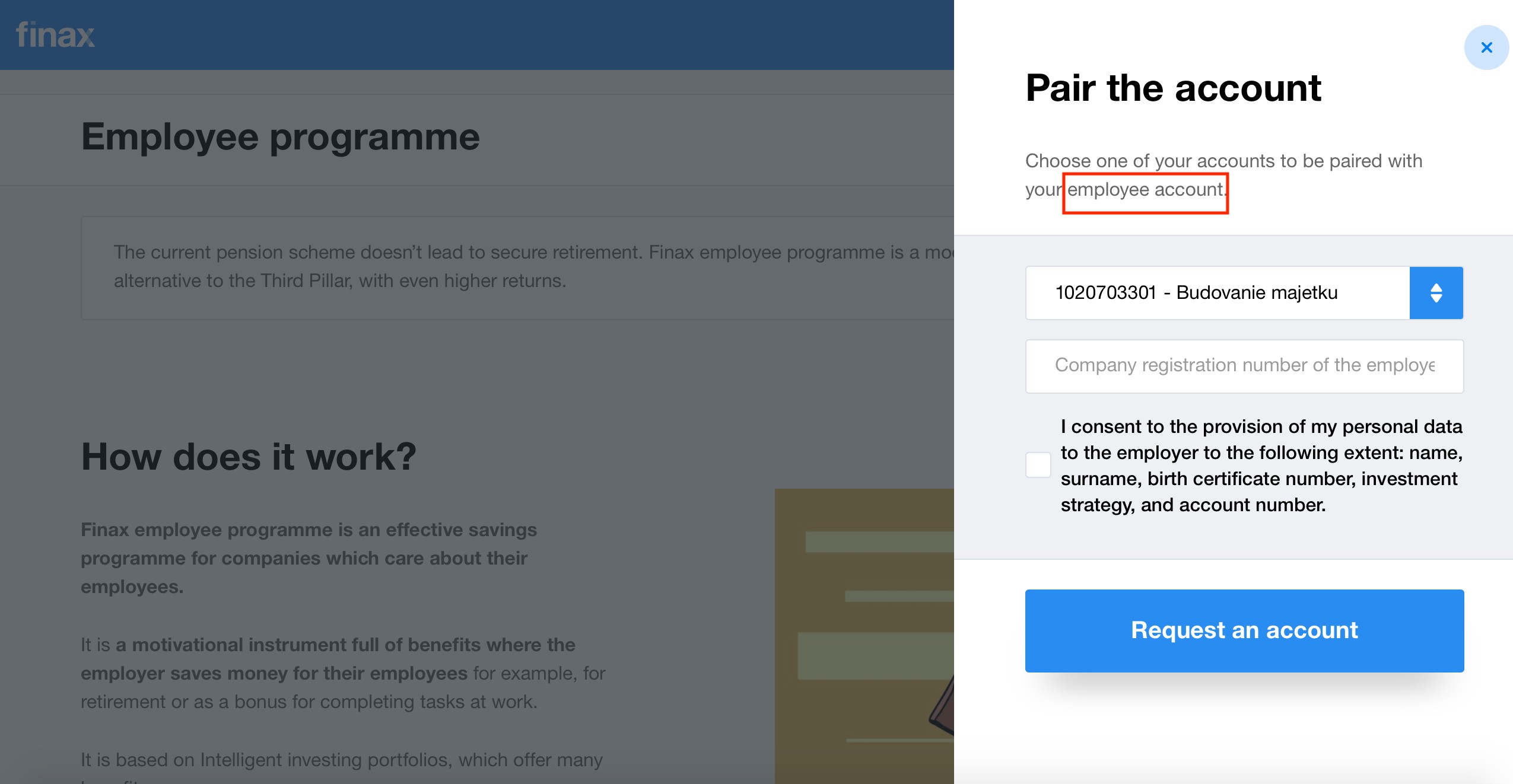

You will then be redirected to a separate webpage describing the basic parameters of our employee program. Click the Request account creation button and choose one of your accounts that you want to have paired with your employee account.

After entering the company registration number and the code from the text message, a request to create and pair the acconut will be sent to your employer. The pairing process is fully automated and you will be notified of the successful result via email.

The newly created employee account will be displayed in the online Accounts overview. You will be able to access account transactions and account details. However, this account is not included in the total assets and is highlighted in red. For better orientation in the platform, employee accounts are always highlighted in red.

After meeting the conditions set by your employer, the securities and financial balance (after taxes and levies) will be transferred to your employee’s paired account.

Of course, you can use your private account without restriction, so you can make any investments or even request a partial or total withdrawal of funds.

Achieve higher returns vyššie výnosy

Start investing tax-smart via low-cost ETFs.

Online management 24/7

You can change the investment strategy of the employee account anytime in Settings (after clicking on your name and surname in the upper right corner of the page) and in the Consulting section.

When you change the investment strategy of your paired account, we will automatically change also the investment strategy of your employee account. You can change your investment strategy (ratio of equities and bonds) once a calendar year, at any moment, for free.

Modern investment earns you more

Do you want a better pension, save for a property purchase or help your children get started in their lives? You can achieve your goals much faster with a contribution from your employer.

Finax employee program is a modern, flexible and, above all, more profitable alternative to the 3rd pillar.

If you want also your employer to be a part of our employee program, contact us at partner@finax.eu or at 02/222 003 58.

App Store

App Store

Google Play

Google Play

Difficulty

Difficulty