While it might not be the most pleasant thing to worry about, we've all likely wondered what our lif...

We were deceived by the Wolf of Wall Street. What kind of investing has allured young people?

Are you lured to buy stocks and cryptocurrencies through smartphone apps by your peers or influencers? Do they promise a chance to fabulous wealth? Be careful, most such accounts end up in a loss. If you are considering starting to invest but you want to find out about the pitfalls that young investors are currently facing beforehand, this article has been written for you.

Recently, I have been observing a pleasing trend among my peers. Young people have become interested in investing and do not want to leave their money lying idle in bank accounts. That is good news. It's not just my estimate, for example, Finder.com ordered a study on a sample from the United Kingdom and found that more than three quarters of Millennials and Generation Z plan to invest next year.

Source: Finder.com

Source: Finder.com

The main reasons for the appeal included low interest rates in banks, but also the availability of applications for trading, according to the survey. In the chart above you can see summarized reasons for the interest in investing for all generations. However, if we look solely at the Millennials, trading applications were an important reason for 44% of them.

I want to focus precisely on these trading applications in this article, as their pitfalls can be sensed already from ordinary conversations on this topic. One friend’s Dogecoin and Ethereum have just fallen, although it seemed they would grow up to his point. Another one has opened an account on the NAGA platform and gets advice about which stocks to buy this week and which to get rid of from "experienced" streamers.

The world of investing is dynamic and its most skillful members will gain fabulous wealth, you just need to catch the right time and pick correctly, right? After all, we watched the Wolf of Wall Street and saw that trading creates and erases millions in minutes.

The problem is that this is not the case. The world of intelligent investing is surprisingly boring, and rather than paying attention to which cryptocurrency is currently growing, you should arm yourself with patience. But we will discuss that later.

Low fees and the idol of fortune

To begin with, let me look at what has made it easier for young people to access the financial markets. Many use online trading platforms for this purpose. These are applications that everyone can almost instantly download to their mobile phone and start trading, usually with minimal fees. As young people have grown up with smartphones, it's not a problem for them to quickly find their way around the interface.

The specific platforms vary slightly, some of them, such as Robinhood, do not charge fees for individual trades at all and raise revenue from other sources. Others, such as German NAGA, charge fees, but offer their clients the opportunity to copy the trades of well-known investors (speculators) or influencers. This phenomenon, known as social trading, was promoted, for example, by Zuzana Plačková in Slovakia.

Regardless of the specific application, however, investors are united by demographics and motivation. Mostly young investors seek to become their customers. Half of Robinhood's users is under 30 years old and have never invested before. Some want to earn money for their own housing, but many millennials have tried to raise returns to pay off student debts.

GameStop share price development

GameStop share price development

When it comes to motivation, it is very easy to be seduced by the vision of quick earnings. People like Plačková, who allegedly earned 865 euros in 4 days, or even a streamer performing under the pseudonym The Roaring Kitty, who earned 20 million dollars on GameStop stocks, become the role models. Intuition itself suggests that such successes are very difficult to replicate, otherwise we would all live in mansions.

How do users of these platforms trade?

Compared to traditional brokers (i.e. entities that are authorized to buy and sell securities on the stock exchange on behalf of people), we see two differences in the behavior of the average user. The first is a higher frequency of trading, the second is the popularity of riskier, speculative instruments.

Higher frequency means frequent sales and purchases of specific securities. Instead of buying and holding shares for several years, a person tries to guess the weeks when a security will grow, and then get rid of it quickly and exchange it for another. A study from the first quarter of 2020 compared the trading volume between the average user of Robinhood and the traditional American broker Charles Schwab, and found that the former traded 40 times more.

At the same time, riskier tools are popular on these platforms, such as options or cryptocurrencies. The former represent, simply put, a bet on the development of other securities, the latter suffer extreme price fluctuations. But I don't want to mislead you – risky tools are also widely traded on Wall Street, but there it’s performed by mathematical brains and supercomputers.

Source: The New York Times/Alphacution Research Conservatory

Source: The New York Times/Alphacution Research Conservatory

That is why traditional brokers mostly used to ban these instruments for inexperienced investors. However, since it is enough to download an application, risky securities experienced a boom in popularity.

This pattern of behavior happens for two reasons. The first is the philosophy of getting rich quickly. To increase the profit, you try to guess which particular stock will experience an above-average growth and presume it correctly every day.

The second reason, however, is that the platforms directly push their users into frequent trading, which gets me to the next part of the article.

Investing as a computer game

At the beginning you may be wondering why would the platforms do this when it sounds so dangerous. Motivation varies between different applications. You may have heard the phrase that their clients are not really customers, but the product. This is partially true; some platforms earn most of their revenues from the sales of so-called Payment for order flow (PFOF).

Source: Regulatory filings and industry experts

Source: Regulatory filings and industry experts

When you ask the application to buy you a security, it usually doesn't do it right away, but it waits a while and does it later at once with more accumulated orders. During this time, it will sell information about the pending orders to other entities that invest in the stock exchange so that they can buy the security earlier and sell it to ordinary people using the applications at a higher price.

That means the more young clients trade, the more PFOF the platforms can sell. However, some applications charge fees directly for each transaction, which further increases the motivation to push people into frequent trades.

In practice, they achieve this by keeping customers on pins and needles about whether they are just missing out on the best trade of their lives and forcing them to constantly think about whether they should change their strategy. When the value of the portfolio drops by as little as 0.01%, the whole interface lights up in red colors, shouting that the users should get rid of the current stocks and replace them with new ones.

When the client is sitting at work or at lunch, the mobile phone fires notifications about the most profitable stocks in the last 24 hours, so that he/she does not forget to buy them. If they do, confetti shoot on the screen to reward the clients with a dose of dopamine.

A separate method is to offer copying of celebrities like influencers or experienced investors. These people invest large sums or earn salary from the platform that allow them to cover the fees from frequent trades. However, if the average person invests smaller sums in this way, his returns are too small to compensate for the loss resulting from fees, and ends up only losing money while the platform earns.

Why is it dangerous?

The main danger is the almost certain loss of savings invested in the platforms. A study of Brazilian day traders(people who trade every day and whose behavior the high frequency of trading resembles) showed that 97% of them find themselves at a loss after a year of practicing the habit. To explain this, we can help ourselves with the economic efficient market theory.

It says that at all times, all available information is reflected in the value of a security and further price developments will be determined by future events that cannot be predicted. The impossibility of revealing something that the market has missed can be emphasized by the fact that most investors who compete with ordinary people in investing from their seats in investment banks are teams of the best mathematicians in the world assisted by supercomputers.

It is equally dangerous to copy influencers who have no experience with investing and practically also choose random stocks. The NAGA platform, a paradise for social trading, has itself acknowledged that more than 74% of retail investors' accounts suffer financial losses when trading.

The impact on their lives is usually huge, many pour savings for weddings, first homes, or even borrowed money from credit cards into the platforms.

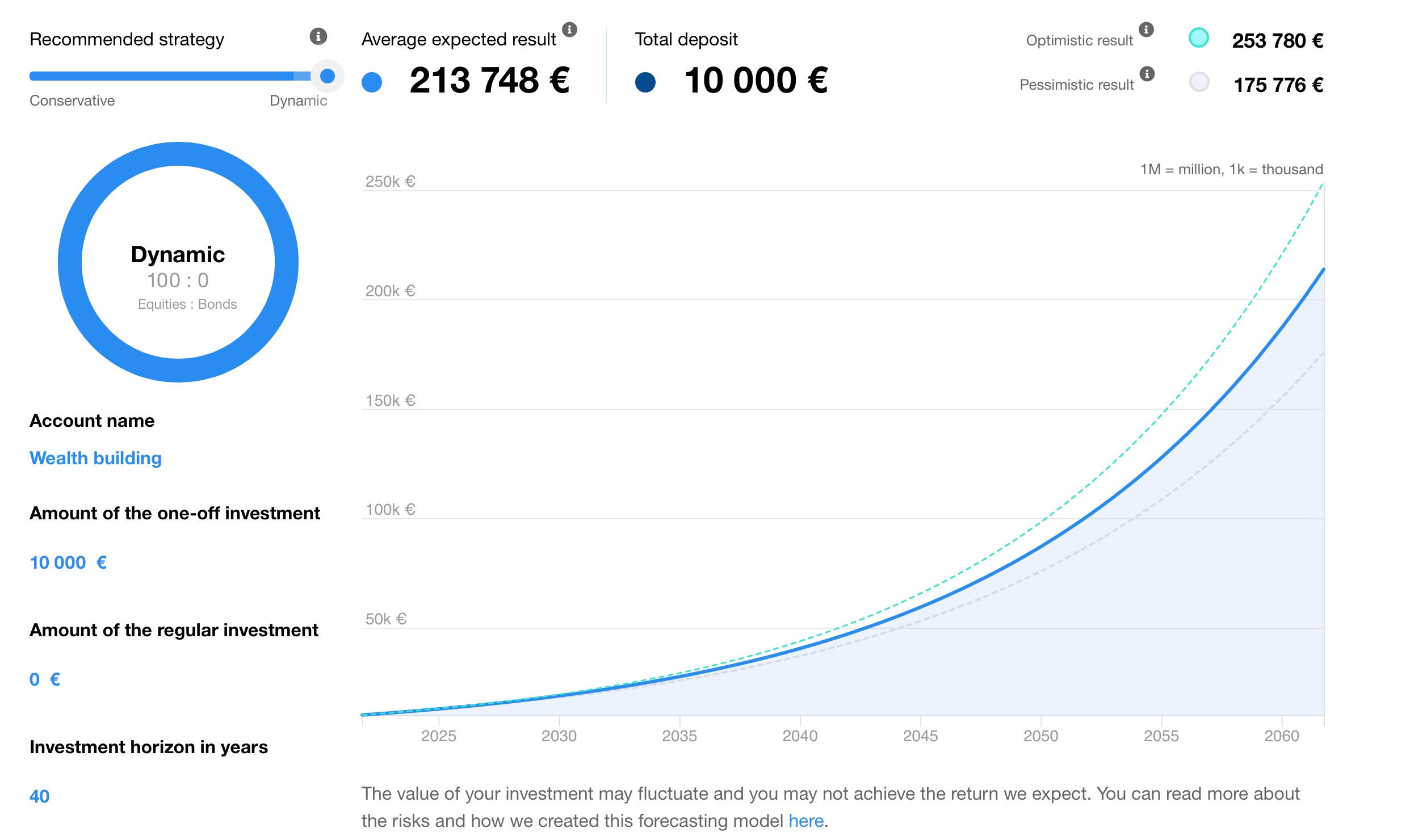

However, this amount is not final. If you lose 10 000 euros at the age of 25, you have also lost all potential future earnings from this money. For example, they could be invested in the stock markets over the long term, which, with an average return of 8% per year for 40 years, would create a decent 217,000 euros with the help of compound interest.

Another damage is the creation of bad investing habits. If a person wants to invest in the long run, for example to save for retirement, he needs to buy a diversified portfolio of securities and ideally leave it alone for decades, even if a crisis comes in the meantime.

Habits such as the illusion of having control over market developments or buying stocks according to current news every week, can spoil this strategy and lead back to a dangerous betting.

What is a better alternative?

Fortunately, there are better alternatives for young people to handle their money safely. It is, however, necessary to get rid of illusions from the very beginning – these strategies will not yield 20 million and they will probably not rank us among the richest people on their own. However, they can almost certainly guarantee that we will be able to afford a decent pension, the purchase of our own housing, or the financing of our children's education.

The way to get rid of the risk of loss is to invest passively in the long-term. The value of the entire market has always grown over the decades, since productivity and the world's wealth have been gradually increasing. Thus, although there were years when the value of all assets fell, they caught up with this loss over the following period. Therefore, it is important not to speculate, keep calm, leave the portfolio alone for years, and reap the return that it will bring later in life.

This argument is also confirmed by the famous bet of investment guru Warren Buffett against hedge funds. In 2008, he bet with them that the index of American companies S&P500 would outperform a carefully picked stock portfolio of hedge fund over the horizon of 10 years. Buffett won the bet.

The most beautiful thing is that this solution is as accessible as the applications mentioned before. Sending 10 euros per month to ETF fund portfolios, that copy the entire market rather than specific stocks, is also possible with a regular student part-time job. However, the vision of having millions a few years after finishing university must be abandoned. The path to wealth requires patience and perseverance, but at the end, a well-deserved reward awaits.

Warning: Investing involves risk. Past returns are not a guarantee of future performance. Tax exemptions apply exclusively to residents of the respective country and may vary depending on specific tax laws. Check out our ongoing and ended promotions.