If you are investing or thinking of investing your financial assets more efficiently, you probably often wonder if now is the right time. This is especially true during periods when the market is starting to recover from downturns and many do not believe that the situation is good enough for stocks, presuming they will decline to new lows. Many people have therefore been putting off investing over the past year.

We are no exception, we also sometimes wonder when would be the best time to put the majority of our savings into the market. However, years of experience in the financial markets have taught us that this is a futile endeavour.

People are mistakenly trying to time their investments. Beginning investors want to find the bottom and the top of the markets, increasing their profit if their prediction is correct. This idea sounds nice and for the sake of appearance very logical. It would be perfect to know to manage your financial assets in this way. But in fact, it is „tilting at windmills”.

„Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” Peter Lynch

Peter Lynch is a legendary manager who ran the most successful Magellan Equity Fund in Fidelity Investments. Lynch was actually one in a million. Under his leadership, the fund earned an average of 29% a year, more than twice the S&P 500 performance.

No One Can Predict Market Trends

A prerequisite for successful investment is to inculcate this basic rule in one´s mind. Otherwise, you will be perpetually unsatisfied with your investments and it will not let you sleep. And, in the end, you will not get such a return as the markets offer you.

Thinking the opposite is a big mistake. There are several reasons for this undeniable fact. First of all, it's our natural traits and emotions. Other factors are the lack of information or man's inability to encompass their vast amounts.

Last but not least, the very nature of the economy and society is the cause. Just as in the human psyche, there are no constant relations in the economy, where one action would always cause a certain response.

Exaggerated self-confidence and fear of loss are emotions that dominate minds of most investors, especially those who are starting out. These are the so-called cognitive brain constraints that are the greatest enemy of a successful investment.

These factors for weaker performance of active investment management are described by numerous studies of behavioral economics and finance that do not look at economics as an exact or rational science but rather as a field which is influenced by subjective human decision-making based on psychological motives.

In practice, it means that 98% of actively managed mutual funds denominated in euros and focused on global equities have not outperformed the S&P Global 1200 World Equity Index over the 10 years ending December 2022.

And these are funds managed by professional managers who spent their entire careers in the financial markets. They have unlimited access to information, powerful analytic tools, and support teams.

Download the Finax app for intelligent investors on your phone.

The best evidence of human inability to predict market developments was the financial crisis in 2008. The vast majority of funds was unable to catch it. The losses of professional managers were generally even larger than the loss of the market itself. Worse yet, most of them have missed the rise of the bull market, and none of them have even anticipated the size it reached over the following decade.

In the US, the average investment fund investing in large US companies reached an annual yield of 8.2% by the end of 2015. The average investor in this type of fund for the same period reached an annual yield of only 4.7%. Where did the missing 3.5% go? Into the effort to manage and time the investments.

It worked similarly in the last bear market. In a Bloomberg survey at the start of 2023, 70% of investors predicted stocks would still find a new low this year. In reality, the S&P 500 index is up 15% in the first 6 months, its second-best first half of the year in 23 years. Today, surveys already show a much more optimistic mood among investors.

Does this mean that the stock market cannot decline again in the second half of the year? Absolutely not, anything can happen. The key lesson is that investors' expectations are chasing a market that is always one step ahead of them. Because of this, they often miss out on returns.

What makes you different from other people? Why should you be the chosen one, who unlike 99% of people, is able to time the investments, when those far more experienced are not able to do so?

Passive Investing

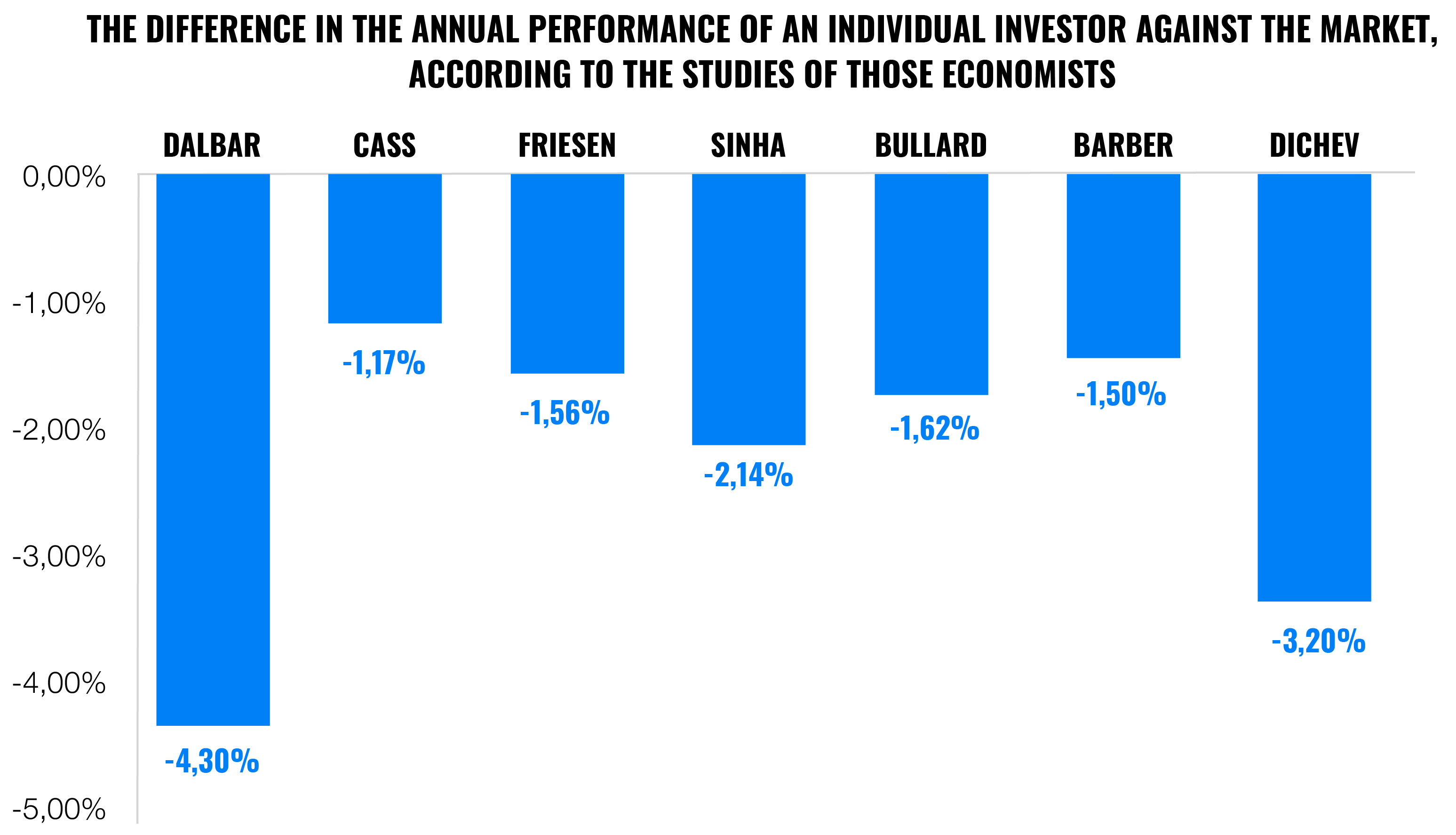

In the US, several economists have developed studies that deal with the relationship between investor´s behavior and the achieved results. All have confirmed that more active investors achieve a lower return than the market in the long run. In addition to wrong decisions, the higher costs of active investment management also play a role.

Moreover, this relation also applies to investors who visit their account more frequently to regularly check the status of their investments. At each visit, the incentive to intervene into the investment emerges.

This distinction in the results between the market and the active investor was identified by the well-known financial writer and illustrator Carl Richards as a behavior gap, which subsequently became widely adopted in finance and can be explained as a loss caused by behavior.

The mentioned researches quantified the investor´s loss due to frequent and unnecessary decisions ranging from -1.17% to -4.3% per annum relative to the achieved market returns.

We, in Finax, drew inspiration from these studies when creating the Intelligent Investing, deciding to come up with passive investing. Indeed, elimination of human decision-making and investment automation leads to a reduction in risk and costs, which together with the long-term perspective, are key factors for a successful investment.

Similarly, these studies clearly confirm that the attempts to time the markets lead to worse results over the long term and are, therefore, futile.

Horizon, Proper Allocation, and the Robo-Advisor Algorithm

„The time in the market, not timing the market, matters for a successful investment.”

The most important and influential factors determining the success of the investment are the investment period, a correct allocation (investment composition) reflecting this period, diversification (risk spreading) and regular rebalancing.

Instead of trying to time your purchase, pay attention to these investment parameters. At Finax, we know their importance, and that's why we place the main emphasis on these factors when choosing an investment.

Every potential intelligent investor will be asked about the goal of the investment and his/her risk profile at the beginning of his Finax registration. Based on his/her responses, the unique robo-advisor algorithm selects an appropriate portfolio adequate for the investor´s risk profile.

If you're a cautious person who is afraid of a decline in your investment, you'll get a more conservative strategy with a larger bond allocation. The fluctuations of such a portfolio are much smaller than those of a strategy with a larger stock weighting.

The selection of a particular portfolio is further subordinated to the expected duration of the investment. The algorithm is programmed so that you are most likely to achieve positive performance at the investment period you specify. This is based on historical statistics of Finax´s Intelligent Investing Portfolios.

Market Risk - One That Has Always Been Taken Care of by Time

Market risk refers to the uncertainty of achieving a return. Simply put, market risk is precisely the decline in the value of an investment that most of us fear. It is the reason why you put off your investments and needlessly fail to make money.

Market risk decreases as you increase the investment period, as confirmed by the data in the table below. The prolonging investment horizon gradually eliminates the market risk to zero, as you can read in this article.

Note on the data presented: the data related to the evolution of the Finax portfolios for the period 28.2.2018-30.6.2023 represent the real performance of the Finax sample portfolios. The data linked to the evolution of the Finax portfolios for the period 31.12.1987-28.2.2018 are modelled and have been created on the basis of backward modelling of the data. We have described the method of modelling historical performance in the article How do we model the historical development of Finax portfolios. Past performance is no guarantee of future returns and your investment may result in a loss. Know what risks you are taking when you invest.

The longer you let your assets work, the lower the chance of a loss. Similarly, your earnings are growing faster with rising investment horizon thanks to the compound interest.

The average investment period for active accounts in Finax, which our clients have set when opening their accounts, is 17.5 years, which we greatly praise. Fro this point of view, market fluctuations are absolutely negligible, and our clients do not have anything to worry about with such investment periods.

When Is the Ideal Time to Start Investing?

We have revealed the successful investment rules on this page. We have offered tips on how to behave in downward markets in this article. Today, we'll supplement them with recommendations on when and how to start investing, especially for people hesitating and considering to get started.

Be active where it makes sense – in making and saving money. Regarding the investment, you do the best if you ignore your own emotions and opinions on the financial markets direction, as well as the advice of “professionals”.

In the first place, do not speculate about investment instruments. The cornerstone of asset building is passive investing in indexes (ETF funds). Everything else is more complex, risky, expensive, and ultimately less profitable. Unless you already have indexes in your portfolio, do not allocate a fraction of your attention to other instruments.

Let your money make money zarábať

Try invest tax smart with low cost ETF funds.

As long as you have a long enough investment horizon, don't hesitate over the investment and don't try to time it. As we have shown, you will not succeed.

If you do not have a sufficiently long investment period, find the money in your budget that you can leave aside and invest for as long as possible. Only long-term investing offers interesting returns, generates more money, and increases the value of your wealth. If this is an insurmountable barrier for you, your property will never increase in value.

If you have short-term savings that you can't commit for the long term, you can look for fixed-income instruments with lower risk and return. At Finax, for example, we recently featured the new Smart Deposit, which is tied to an interest rate set by the European Central Bank. However, don't forget that you build up the core of your wealth by investing for the long term.

Start as soon as possible. That's the only way to get into investing. Make it a normal part of your life. Only through experience will you understand the laws of investing and the mechanics of the markets.

Have a sufficiently large liquid financial reserve. Do not delay investing. Instead, use market drops to invest extra amounts, decreasing the average purchase cost.

Now think about for how long you have been considering to get started with investing. When did you first come up with the idea of placing some of your money aside and investing into something? You have always found an excuse, haven´t you?

Was it 3 years ago during the Covid pandemic when you were convinced that the markets would go even lower and could not recover sharply? Even though we've had a bear market year in the meantime, you still missed out on returns of 37% (11.07% per year, counting with the actual performance of the 100/0 portfolio).

Was that during the aftermath of the European debt crisis 10 years ago? Today, your deposits would have 2.5 times their original value (249% return, 8.7% per annum, counting with a combination of actual and modelled performance of the 100/0 portfolio).

If you want to make your assets grow, forget about timing your investments. Stop hesitating and start investing.

App Store

App Store

Google Play

Google Play

Difficulty

Difficulty