The year 2021 has been kind to equity investors. In terms of returns, it belongs among the most successful years. Gains of most developed-country stock indices exceeded 20%.

Finax's portfolios benefited from the developments in equity markets. Mutual funds also utilized the constructive spirit, but net returns lagged behind passive investing in index ETFs.

If your investments came out worse than Finax's results in the following comparison, don't hesitate, transfer your unprofitable investments to Finax, and make money more efficiently at a discount. More information about the discount can be found further below in the article.

Note: All data related to the historical development of Finax portfolios are modeled and were created based on backtesting of the data. We described the method of historical performance modeling in the article: How do we model the historical development of Finax portfolios? Past performance is no guarantee of future returns, and your investment may also result in a loss. Inform yourself about the risks you are taking when investing.

Dynamic Investments

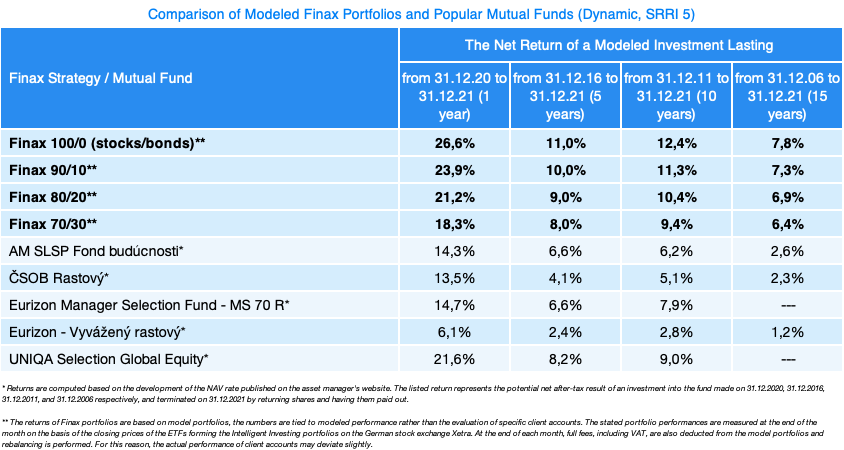

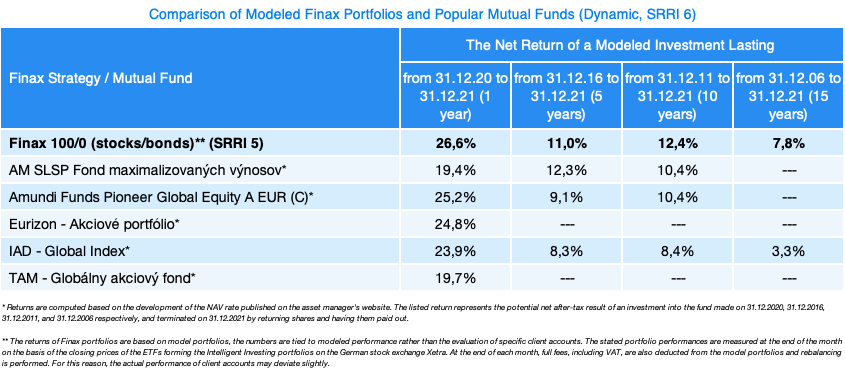

Passive investing through index ETFs invests in the entire global market and offers investors a market appreciation that represents the highest achievable return in the long term, as confirmed by the data in the tables.

Last year, all the benefits of the passive approach displayed their full force - copying the market is more profitable in the long term, it is usually cheaper, spreads the risk more widely, and its returns are tax-free for Slovak residents after one year.

In the field of dynamic investments, Finax portfolios dominated in 2021. Our solutions outperformed all major mutual funds in net after-tax returns, not only in the corresponding risk class but also in comparison to riskier instruments.

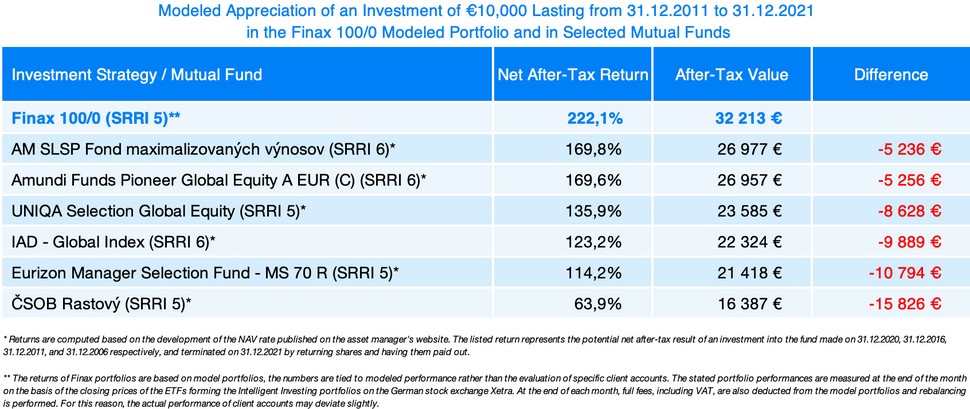

The table shows the balance of a hypothetical investment of 10-thousand euros in a modeled Finax 100/0 portfolio and five major equity mutual funds at the end of 2021, after being invested for 10 years.

Compared to the most efficient mutual funds, investing in a passive portfolio would earn at least 5,200 euros more on net returns over this horizon. Note that the two best-performing mutual funds performed worse despite the higher risk represented by the SRRI indicator.

Start investing with Finax

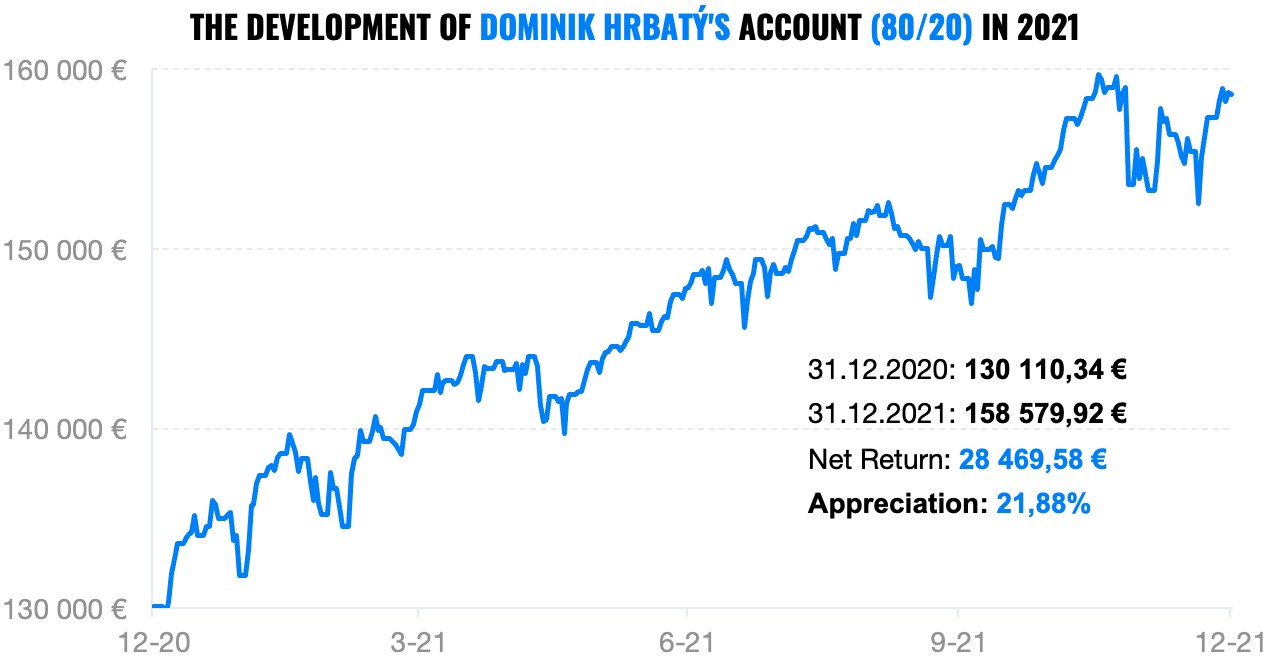

Let's look at how our clients' accounts have performed to verify the proclaimed modeled performance against the actual appreciation achieved. The most famous accounts in Finax are the transparent investments of Dominik Hrbatý and Ivan Chrenko.

Dominik invests with a strategy of 80% stocks and 20% bonds in his first account. The following chart shows the exact development of the value of this account over 2021. Last year, his investment achieved a net return of 21.88%, which is slightly more than the appreciation of the modeled 80/20 portfolio.

Take a look at Dominik Hrbatý's investments. Discover what investing with Finax looks like, browse the online account overview, and track Dominik's investments thanks to his transparent accounts.

Dominik's transparent account

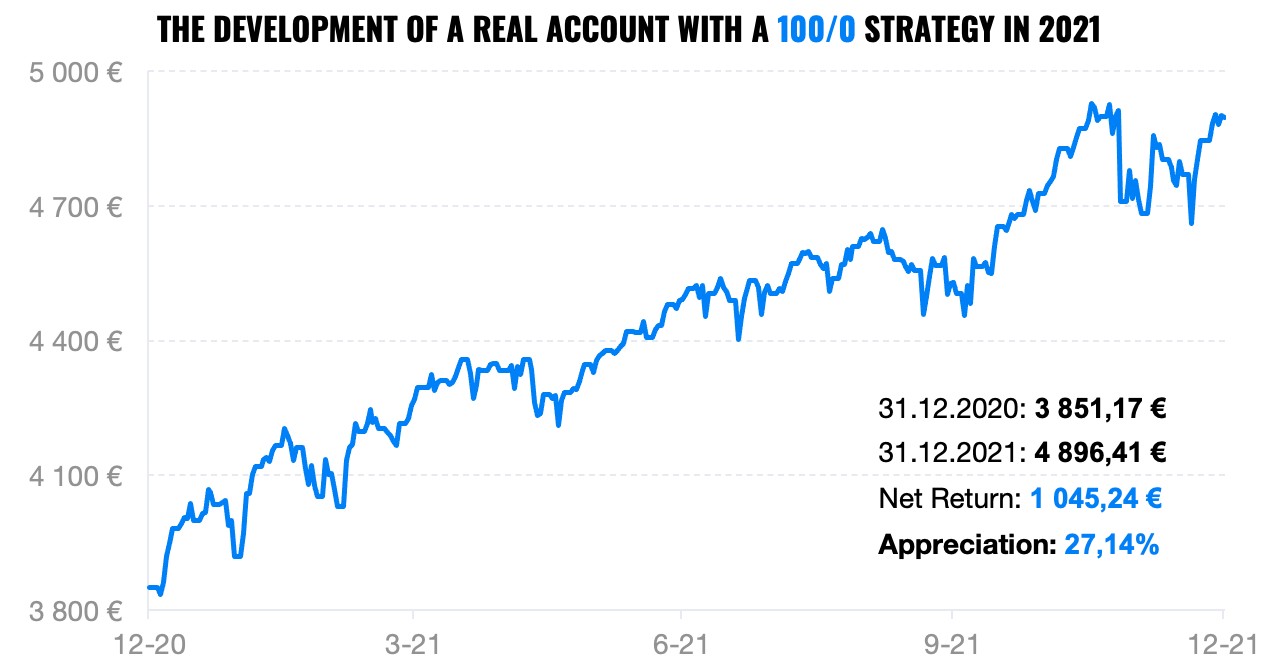

We also reviewed the account of a client with a 100% equity strategy who had not made any deposits, withdrawals, or other investment setup changes during the past year.

This account also achieved a net return of 27.14%, which is higher than the return of the modeled portfolio we use to present our results.

The reasons for the differences in performance of the actual accounts compared to the modeled results are different portfolio compositions at the beginning of the year and different timing of the rebalancing. In your case, the amount managed at a discount or timing of deposits during the year may also create a difference.

Balanced and Conservative Investments

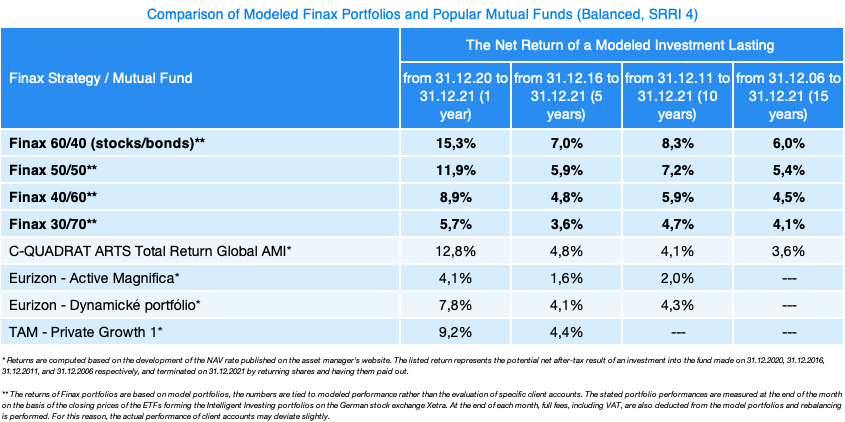

In the balanced risk category (SRRI 4), which includes mutual funds and portfolios with volatility between 5% and 10%, the return dominance of Finax's portfolios is even more pronounced, especially on long horizons. Finax's modeled strategies outperformed all major competing mutual funds on all observed horizons.

The group of investment solutions in this risk class generally includes mixed funds, which combine different asset classes ranging from equity investments to commodities, real estate, and bond instruments. Finax composes mixed strategies from equity and bond ETFs.

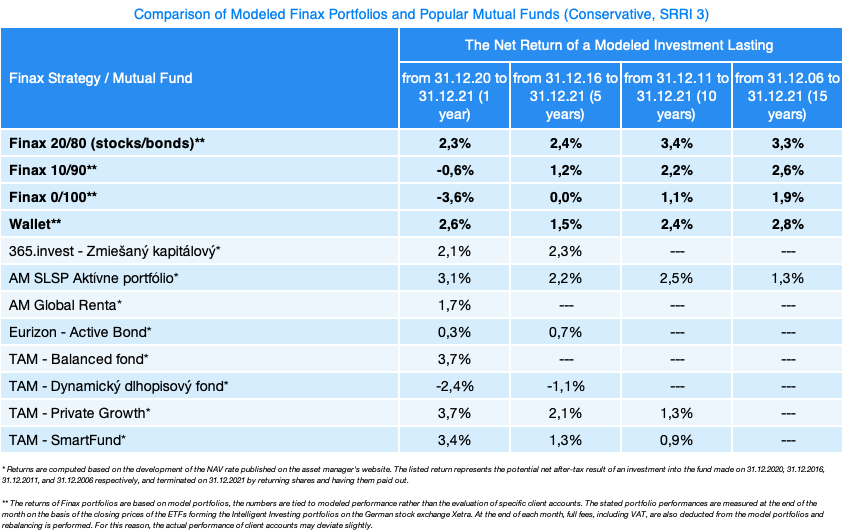

Conservative investments based primarily on bond holdings did not fare well last year. Safe bonds saw a decline of around 3% due to rising yields on fixed interest instruments. Yields reflected high inflation around the world, which we have not witnessed in over a decade, and expectations of a faster stimulus tapering by central banks.

These facts were negatively reflected in the performance of the two most conservative Intelligent Investing portfolios (10/90 and 0/100), which declined last year.

Only the Finax 20/80 portfolio and the Intelligent Wallet, which recorded a gain of 2.6% in its first year of existence, maintained their positive returns.

Most competitive conservative solutions earned higher returns than Finax strategies in the past year. In the field of bonds, active management represents a reasonable competition to the passive approach for several objective reasons, which we wrote about in our mid-year comparison last July.

On longer horizons, however, Finax's portfolios beat the relevant competition in terms of returns even in this category.

Bond markets will continue to be under pressure and face many challenges in the coming year. The normalization of monetary policy in the form of higher interest rates will have an extended negative impact, but in the medium and long term, the attractiveness of bonds and their future yields are higher.

Build Wealth More Efficiently and Profitably - Transfer of Investment Discount

As last year's results of Finax strategies once again confirmed, passive investing through index ETFs is an ideal way to appreciate savings and build wealth in the long term. There is currently no relevant argument in favor of investing through mutual funds.

The results regularly show that the return to risk ratio is higher in passive investing over the long term. This approach maximizes returns at acceptable risk and thus leads to an earlier fulfillment of investment objectives, which is a fundamental prerequisite for successful investing.

Move your assets to Finax, gain better parameters for your investments, and we will reward you.

If you document the investment transfer, we will manage 50% of the value of the transferred funds free of charge for 2 years. That will make your returns will even higher.

More information to transfer investments to Finax and receive a discount.

If you are not a Finax client, open an account conveniently online in 10 minutes, transfer your less profitable investments under our management, and enjoy the discount and cheaper investing. The investment-transfer offer can be utilized by anyone with no time limit.

Open an account in Finax today

Keeping Wealth in the Right Place Means a Better Pension

More and more Slovaks keep discovering investing. Low pensions, rising salaries, years of zero interest rates, and a massive effort to educate the citizens have resulted in an increased interest of Slovaks in efficient money management. The increase in invested funds was record-breaking last year.

The current situation is still far from ideal, but the trend of taking care of personal finances took the right direction. We are very pleased with this move forward, being proud to represent its part that has contributed to this development. Increasing financial literacy was one of our goals when founding Finax and it is still a basic pillar of the company's mission.

However, the way you invest also matters. Merely starting to invest is not enough to reach your financial goals and realize your dreams. As we have demonstrated, there are big differences in the investment products themselves, their quality, costs, risk, and performance.

All investment types carry risk. Risk is the price of higher returns that beat inflation and offer attractive appreciation over long horizons. The right investment strategy leads to an adequate, maximized return extracted from the risk taken by the investor.

If you can maximize the return per unit of risk, the results are diametrically distinct. The difference in returns of the compared dynamic investment solutions is up to a third on longer horizons.

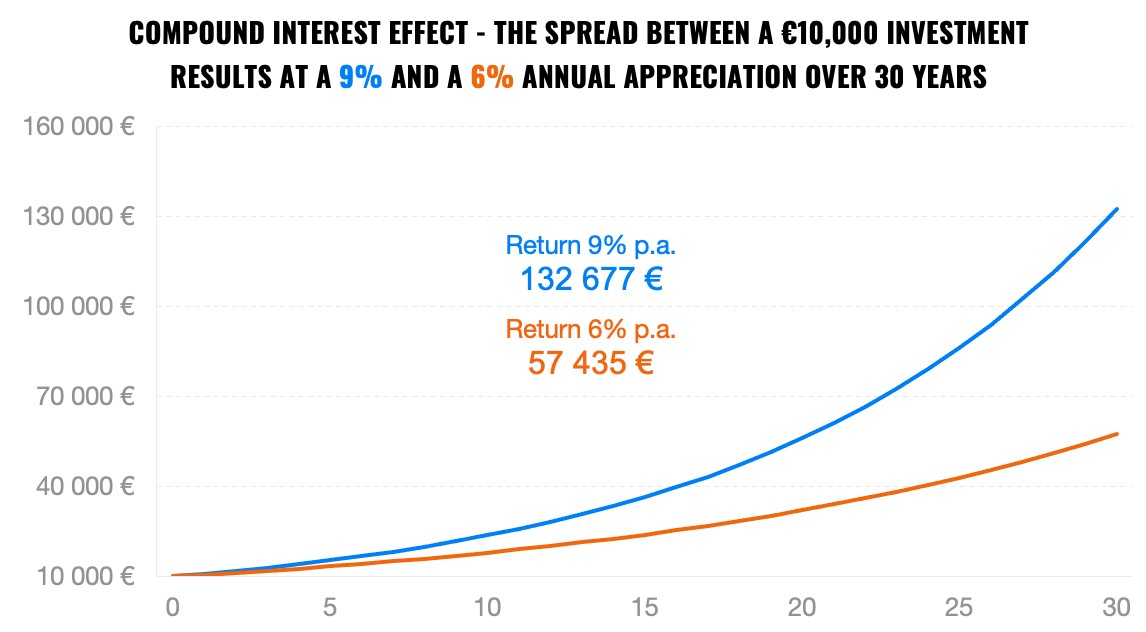

If we assume that, over the long term, equity markets can offer average annual returns of 9%, underperforming by one-third implies a 57% worse result after 30 years.

In the case of a one-off investment of 10 thousand euros for 30 years, the difference between the results of portfolios offering a 9% and a 6% annual appreciation is 75 thousand euros. Simply choosing the right investment leads to having 132 thousand euros at the end of the horizon, rather than only 57 thousand.

The difference is huge, with a major impact on the future size of your wealth, the amount of your future income, and thus your standard of living.

That’s why we recommend reviewing your current investments. Find out what costs are involved, what risks you are taking, and whether the returns you are getting are in line with the market developments.

We offer you an easy option to redirect your investment to a better place. At Finax, you can open an account conveniently online in 15 minutes. You'll get the certainty that your savings and wealth will appreciate just as worry-free and efficiently as they did in 2021.

Your money is at stake.

Start investing with Finax

Comparison Methodology and Selected Mutual Funds

In the tables, we provided a comparison of the net after-fee and after-tax (if not exempt from taxation) performance of hypothetical investments in the modeled Finax portfolios and the most popular mutual funds in Slovakia closed on 31.12.2021.

We define popular mutual funds as the largest mutual funds or funds with the largest net sales in the past year in each category according to the type of assets in which they invest (equity, mixed, and bond).

We compare mutual funds to Finax strategies according to the risk-return measure set by the European Securities and Markets Authority's (ESMA) SRRI methodology, which is mandatory for mutual funds, and ranks them into 7 risk categories. More information on the SRRI can be found here.

We have selected 22 funds from different asset management companies for comparison. The value of assets investors hold in these funds exceeded 4.3 billion euros at the end of 2021.

These are the compared funds, each stated with its ongoing fee (source document KIID) and the size of the assets under management of the fund in Slovakia (source Slovak Association of Asset Management Companies).

365.invest:

- Zmiešaný kapitálový, 1,8%, 69,5 mil. euros

Asset Management Slovenskej sporiteľne:

- Fond maximalizovaných výnosov, 1,7%, 558,2 mil. euros,

- Fond budúcnosti, 1,68%, 104,4 mil. euros,

- Aktívne portfólio, 1,64%, 438,9 mil. Euros,

- Global renta, 1,38%, 381,5 mil. euros

Amundi Funds:

- Pioneer Global Equity A EUR (C), 1,9% + performance fee, 141,9 mil. euros

C-QUADRAT:

- ARTS Total Return Global AMI, 2,77% + performance fee, 72,7 mil. euros

ČSOB Asset Management:

- Rastový, 2,02%, 82,3 mil. euros

Eurizon Asset Management Slovakia:

- Akciové portfólio, 1,43%, 183,7 mil. euros,

- Vyvážený rastový, 2,8%, 112,8 mil. euros,

- Dynamické portfólio, 1,67%, 446,4 mil. euros,

- Active Magnifica, 1,48% + performance fee, 188,8 mil. euros,

- Active Bond, 1,39% + performance fee, 153,7 mil. euros

Eurizon Capital:

- Manager Selection Fund – MS 70 R, 2,18%, 108 mil. euros

IAD Investments:

- Global Index, 3,65%, 147,2 mil. euros

Tatra Asset Management:

- Globálny akciový fond, 1,33%, 80,7 mil. euros,

- Private Growth 1, 1,55%, 203,3 mil. euros,

- SmartFund, 1,3% + performance fee, 210,2 mil. euros,

- Private Growth, 1,25%, 186,6 mil. euros,

- BalancedFund, 1,46% + performance fee, 180,8 mil. euros,

- Dynamický dlhopisový fond, 1,25% + performance fee, 179,4 mil. euros

UNIQA Investiční společnost:

- Selection Global Equity, 1,82%, 77,5 mil. euros

App Store

App Store

Google Play

Google Play

Difficulty

Difficulty