My parents are both in their seventies. When it comes to money, I'd say - old school. Throughout their lives, they chose the approach to money typical of their generation. Housing savings plans, passbooks, and a bank account.

After experiencing the first and second waves of voucher privatization, they have always avoided investments like the plague. It was only when I founded Finax that a turnaround occurred. Overcoming anxiety, they deposited most of their retirement savings to Finax. These funds were supposed to cover expenses like home repairs and vacations, as their pensions were insufficient to cover them.

I rather had the feeling that mom convinced dad just to support her son in his business (mentally, since their account is free). Mum, dad, many thanks for your trust. I'm very grateful for your support.

The Pandemic Brought the First Panic Wave

They have been investing with Finax almost since its inception in 2018. Less than a year later, the biggest pandemic in 100 years broke out in the world. While in January 2020 their account was still 13.5% in the black, in March two months later it was already losing -15.6%.

The phone was ringing, parents were inquiring. They were worried about their savings, and it was my job to calm them down. It was a success. They didn't panic. They didn't withdraw.

By early May, their account had already swung into profit, and they've been back in the black ever since. In November 2021, their account was exhibiting returns of more than 40%. They earned enough for several vacations or a large-scale home repair.

Today the Markets Are Down Again, but My Parents Are No Longer Calling

War is raging in Ukraine, media articles are shooting out words like inflation, halting gas supplies from Russia, expensive petrol, and God knows what else. The markets have fallen by 15 to 25% since the peak. My father tells me that the value of their portfolio in Finax is down. But you’d hardly notice any anxiety in his voice this time.

I say to myself, wow, what caused such a change? Looking at their account, it's immediately clear. Despite the sizable market drop, their portfolio is 25% in the black. It's clear why dad's taking it so easy.

I keep thinking. All my friends who opened an account with Finax in 2018 and 2019 called me with concerns at the beginning of the pandemic but are not calling me now. Only my friends who opened an account in 2021 and 2022 are dialing my number. I'm experiencing a slight deja vu with them as I did with my parents two years ago.

What Do the Finax Data Say?

I looked at the data to see how profitable our clients are by the year they opened an account. The statistic is not entirely indicative because the clients did not make all deposits in the year when their account was opened. Most clients deposit money monthly, and some may have only recently made a large deposit, letting declines pull their account into a loss.

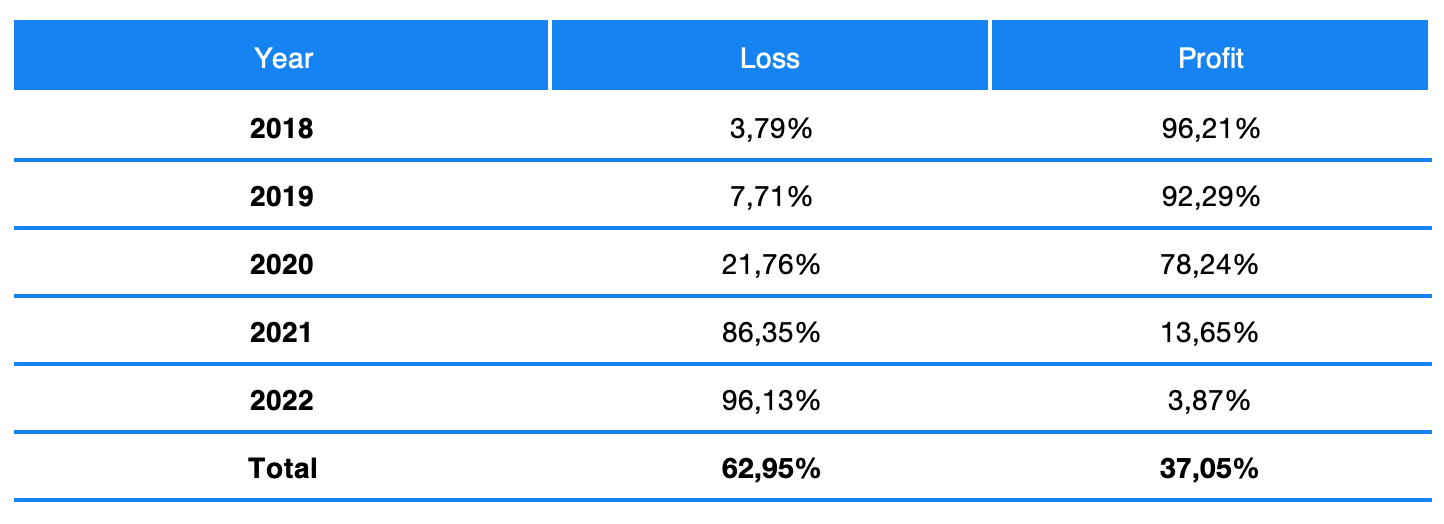

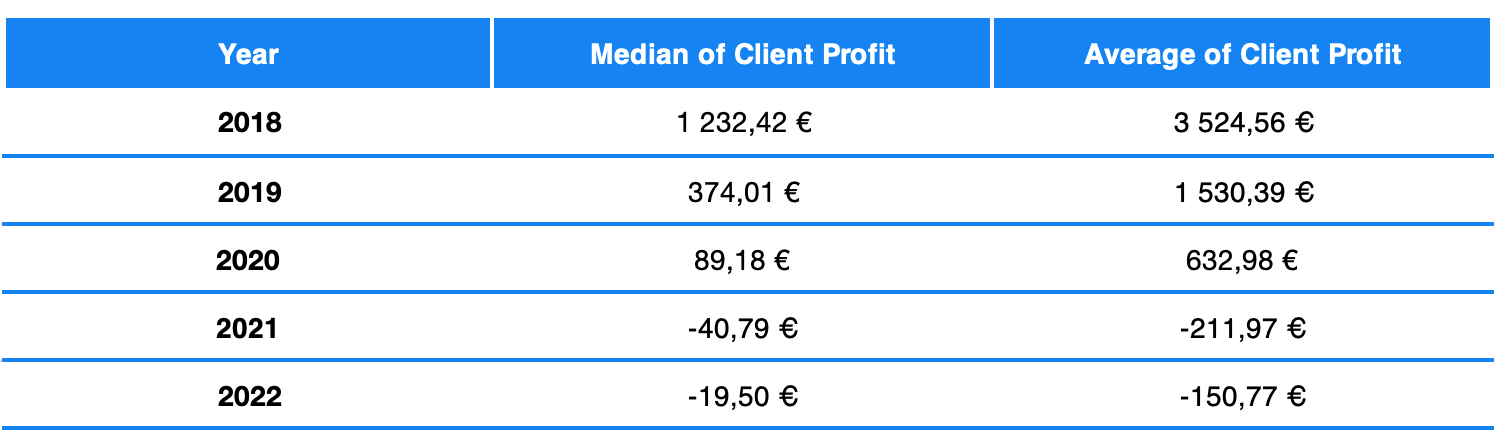

But the data don't lie and confirmed my assumptions (the figures are as of 9th May 2022).

Most clients who started investing with us in 2018 and 2019 are in profit. Most clients who started investing with us in 2020 are also in profit, and only clients investing from 2021 onwards see red numbers in their accounts.

The second table is also compelling, showing how much profit or loss these clients are making depending on what year they started investing.

We have used the average numbers as well as the median (midpoint) which better represents our typical client. It is clear from the data that our clients' gains are significantly higher than their losses.

Stay Patient in Crises, Time Will Erase All Losses

The numbers confirmed my feelings. All those who have been investing with us for longer don’t have to be worried about market downturns that much anymore. Their accounts stay in profit despite declines, and their fears are not as high as those of clients who have only recently set off for their investing journey.

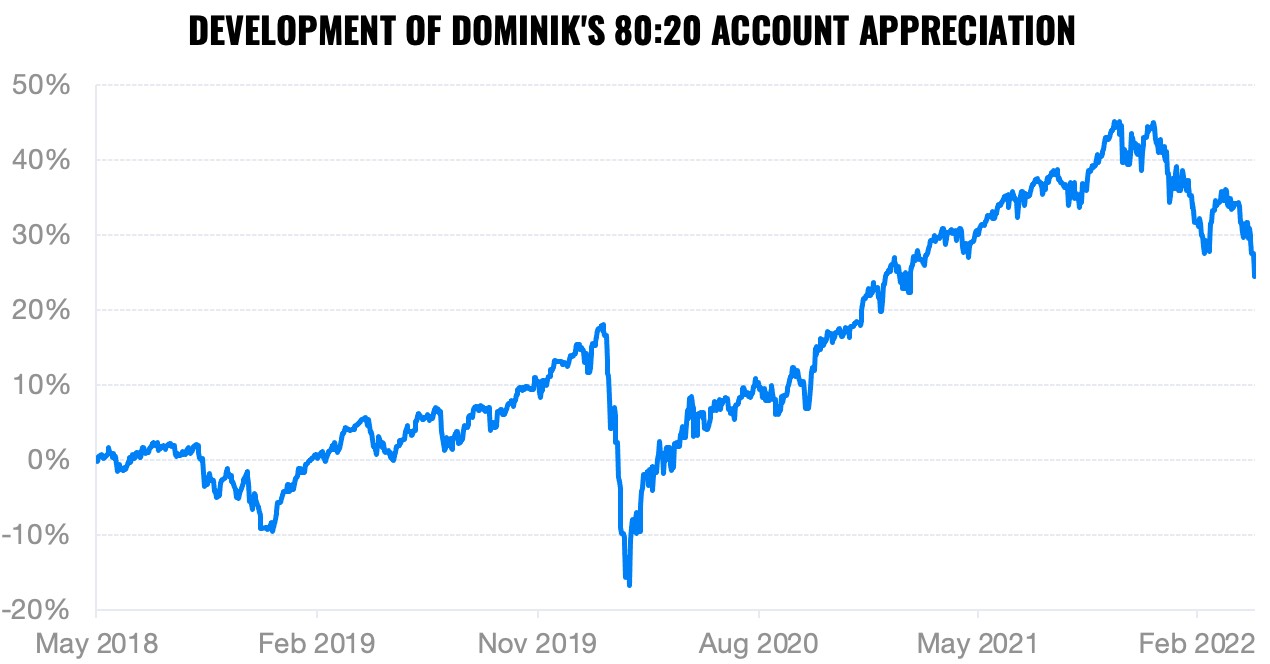

Hence, my message to new clients is this: Investors need to stay calm and patient in crises. If your financial situation allows it, depositing extra money during a downturn, as my brother Dominik does in his transparent account, is an ideal step.

The development of the value of his first account also proves my assertions. Only long-term investing brings desirable results and eliminates risks. The best strategy in times of downturns is to increase investments. If you don't have funds for extra investments, then it's best to do nothing.

Create an account and start investing today

In a few years, you probably won't be that nervous about the next stock market crash. You'll be able to draw from the current experience and likely remain in profit despite a future downturn.

App Store

App Store

Google Play

Google Play

Difficulty

Difficulty