- The coronavirus will put investments and investors to the test

- Issue of Slovak corporate bonds without market risk

- Credit risk of bonds

- How big is the credit risk of corporate bonds

- Liquidity risk

- Concentration risk

- Yields on direct investment in corporate bonds and on investment in bond ETFs

- Summary, recommendations and comparison of bond and ETF

- Investing in bonds in Finax

The coronavirus will put investments and investors to the test

The unexpected crisis caused by the COVID-19 pandemic and the restrictive measures may, in addition to a social disaster, also reveal unpleasant reality and facts. Ignored risks, hidden in times of economic expansion, suddenly begin to emerge.

"only when the tide goes out do you discover who's been swimming naked" legendary investor Warren Buffett

In times of crisis, the weak links in the economy are being exposed. In times of abundance, economic growth and a surplus of money, shortcomings will naturally disappear. However, the risk represents what happens in case of a scenario that few people expect.

And this exact scenario was caused by the pandemic. It now has the ability to expose the weak and strong.

In the field of investments, among the first instruments used for covering the wounds are the issues of so-called high-yield corporate bonds (high-interest bonds), where also the bonds of Slovak issuers fit into. According to the National Bank of Slovakia, investments in primary issues of corporate bonds in Slovakia exceeded 3 billion euros.

In the Czech Republic, which experienced a similar bond boom earlier than Slovakia, several issuers have already gone bankrupt in recent years. Investors lost money, and threat of the looming crisis, caused by the pandemic, was not even present.

Similar development in the near future cannot be ruled out in Slovakia either. Due to the nature of these bonds, the weaker balance sheets of issuers and their sensitivity to the development of the economic cycle, the risk of default on bonds increased significantly.

Achieve higher returns vyššie výnosy

Start investing tax-smart via low-cost ETFs.

Issue of Slovak corporate bonds without market risk

What is a bond, how does this investment instrument work and why is it considered to be a safer security than shares, is discussed in the article What is investing and what does it stand for.

In Slovakia, the popularity of corporate bond issues has been growing in recent years. However, the National Bank of Slovakia has warned the consumers against them several times.

Concerned are the bonds issued by private companies. Some of these bonds are traded on the Bratislava Stock Exchange, but many issues are not traded.

Even if they are traded, their liquidity is low and the counterparty is almost always represented by the market maker of the given bonds. Therefore, the price of a bond is not determined by the market, but by its creator, i.e. usually the bank distributing the bonds or arranging their issue.

For example, the most traded issues on the Bratislava Stock Exchange are J&T Group bonds, but most trades are also covered by J&T Bank. In these cases, it is inappropriate to describe the secondary market as liquid and functioning.

There is no secondary market for bonds that are not traded on stock exchange. The price of these bonds does not change over time, which cannot be considered as objective pricing determined by investors.

Paradoxically, the investors buying such bonds perceive the fixed price as a positive. They consider the low liquidity of bonds, based only on the issuer's will to repay the liability early, as beneficial. However, this is contrary to one of the basic rules of a successful investment.

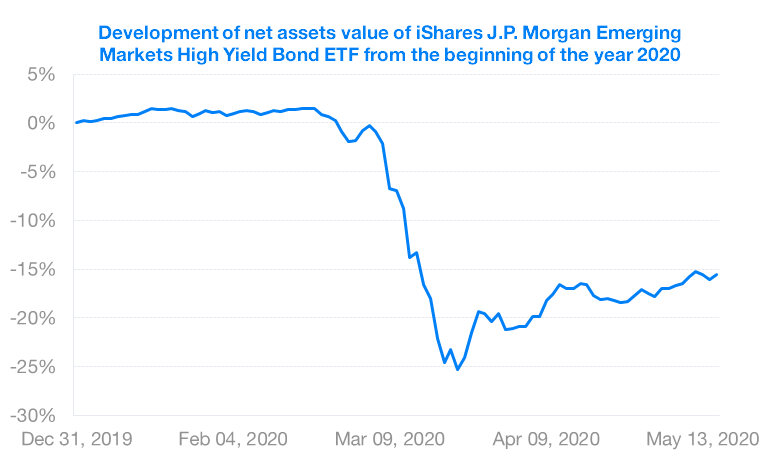

Investments in Slovak corporate bonds will not experience the situation, as illustrated in the following chart. Due to low or even zero liquidity, clients gain a false sense of security that the value of their bonds has not fallen.

The chart depicts the development of the net assets value of the ETF focused on high-yield bonds of developing countries, namely iShares J.P.Morgan Emerging Markets High Yield Bond ETFs.

By being traded on the stock exchange, the ETFs provide sufficient liquidity to investors and therefore their price reflects market expectations and moods. The decline in the market price of bonds takes into account only one thing, and that is the increased risk of default.

Slovak issues of corporate debt securities belong, based on the nature of risk, issuer and yield, to riskier high-yield bonds. The previously mentioned iShares fund is also focused on this asset class.

If Slovak issues were properly traded, with good liquidity, it can be assumed that their price would, due to the pandemic, decline to a similar extent, if not more. The reason for this is the creditworthiness of the issuer and the quality of the issue, as I will explain in the next section Credit risk.

In the case of the ETF, the issuers of the bonds are states and companies valued at several hundred million to several billion euros.

The most frequent issuers in Slovakia are various real estate developer companies or financial groups, but bonds can be found also in other sectors of the economy.

Bond financing is a regular part of the economy. On the one hand, I am extremely pleased to say that, at least in some directions, the Slovak capital market has been set in motion and at least some securities are being issued, but on the other hand, even regarding bonds, we still have a long way to go.

The problem with these bonds lies mainly in the way they are being sold and in the perception of their risk by retail investors. In addition to a stable price, the investors enjoy the relatively decent pay out on a regular basis. However, very few investors are aware of the real risk.

Different risks are associated with bonds in comparison to shares. The risks, that you may encounter when investing, are described in the article What risks do I take when investing?

Credit risk of bonds

Due to the nature of bonds, their biggest risk is the risk of default. This risk is called credit risk.

As is the case with loans, it may happen that the person who borrowed the money will not fulfil the obligation. The issuer issued bonds in order to obtain financing for a certain project. However, if it turns out to be a failure, they used up the borrowed money and the project did not achieve the desired results, they did not earn anything, so the borrower has nothing to pay back with.

Nothing out of the ordinary. This is the natural risk of a loan or credit. Banks are also subjected to it when they lend you money to buy real estate through a mortgage, and so are the investors when buying a bond.

Imagine me knocking on your door today and telling you that I was going to build an apartment building on the other side of town. With the argument that the real estate market is currently booming and it can’t go wrong, I would ask you to lend me for 6% annually 30,000 euros for 5 years.

Most of you would probably close the door. Why? You simply would not believe in the return on your funds. But buying bonds is nothing more than borrowing money with all the risks involved.

To repay the debt, the debtor must earn money, i.e. the invested funds must come back in form of company’s income. Even a project or company needs to earn more money, so they can cover various costs, your interest and the profit of the entrepreneur themself.

But what happens when company's sources of income dry up? Then the default, bankruptcy and liquidation ensue. This can happen for multiple reason, not just because of the coronavirus, which could be the nail in the coffin for similarly funded projects.

In the event of a bond issuer's bankruptcy, your losses will be permanent. Once a company has no cash and no assets, it will not pay back your investment. You can take it to court and try to enforce obligations. You accepted the risk and it came true.

Ltd. is a limited liability company because it is liable for its liabilities only up to the amount of the share capital and once it has nothing to pay out of or sell, it will not give you any more.

The credit risk of non-traded issues of small companies tends to be high. The issuer is often a newly established Ltd. without assets and with a minimum share capital of 5 thousand euros. Such company can issue bonds in the extent of hundreds of thousands to millions of euros.

Financial groups set up a new company for each issue, which is explicitly used as a tool for obtaining financing, the so-called SPV (special purpose vehicle). It will not acquire any assets, often does not carry out business activities at all. Its only purpose is to issue bonds and lend the obtained funds to another company within the group.

SPVs in the business register can look like this:

Have you ever wondered why they favour a model set up like this? Why do these companies borrow funds from you? Why don't they approach bigger investors when their project is so amazing, or why doesn’t the bank lend them money? With zero market interest rates, it would surely be cheaper than for 5 to 9% p.a.?

Your money is often used as their assets in the bank, so that more money can be obtained at a lower price and more favourably, but it may differ from case to case.

Also, keep in mind that the bank will not provide a loan that would have, in the event of bankruptcy, a lower priority of claim than your bond. In the event of the issuer's bankruptcy, the trustee in bankruptcy will firstly pay the claims of the state, employees, then the banks and only then the investors.

Credit risk is reduced by securing debt. In such cases, the indebtedness of the bond issuer is covered by specific assets to which the creditors are entitled to in the event of the debtor's insolvency, or they can be monetised to meet obligations. Unfortunately, most Slovak bond issues are not secured.

To be fair, I have to note that bonds often bear the liability of the parent of the group of companies, from which the debt is being issued. This liability significantly reduces credit risk.

The reputation of the group itself can also help to lower the credit risk. Most issuers will always try to do their utmost to meet their public obligations. No one will risk permanent damage to the trade name.

On the other hand, the volume of bonds in the economy is constantly increasing and many old issues are being repaid by issuing new issues. This way, the companies are able to delay the repaying of their liabilities. However, they won’t be able to that endlessly.

Let your money make money zarábať

Try invest tax smart with low cost ETF funds.

How big is the credit risk of Slovak corporate bonds?

The vast majority of corporate bonds in Slovakia can be included among the so-called junk or high-yield bonds. These are the bonds with a higher interest rate and with a low or even no rating at all. As far as I know, none of these Slovak issues have a rating from one of the world's most recognized credit rating agencies.

In Slovakia, there are also no transparent statistics regarding the discipline of issuers and default on its bonds, as is the case, for example, in the Czech Republic.

Credit rating agencies determine the ability to pay back debt with a rating that has 18 tiers, from AAA (the most creditworthy) to CCC (the least). The lower the tier, the greater the risk of default. The last 8 tiers are considered speculative bonds and are referred to as high-yield bonds.

To visualize the extent of bankruptcies we can use the foreign data. Credit rating agencies would certainly place most Slovak corporate bonds in the lower creditworthiness tiers, thus giving them a low rating.

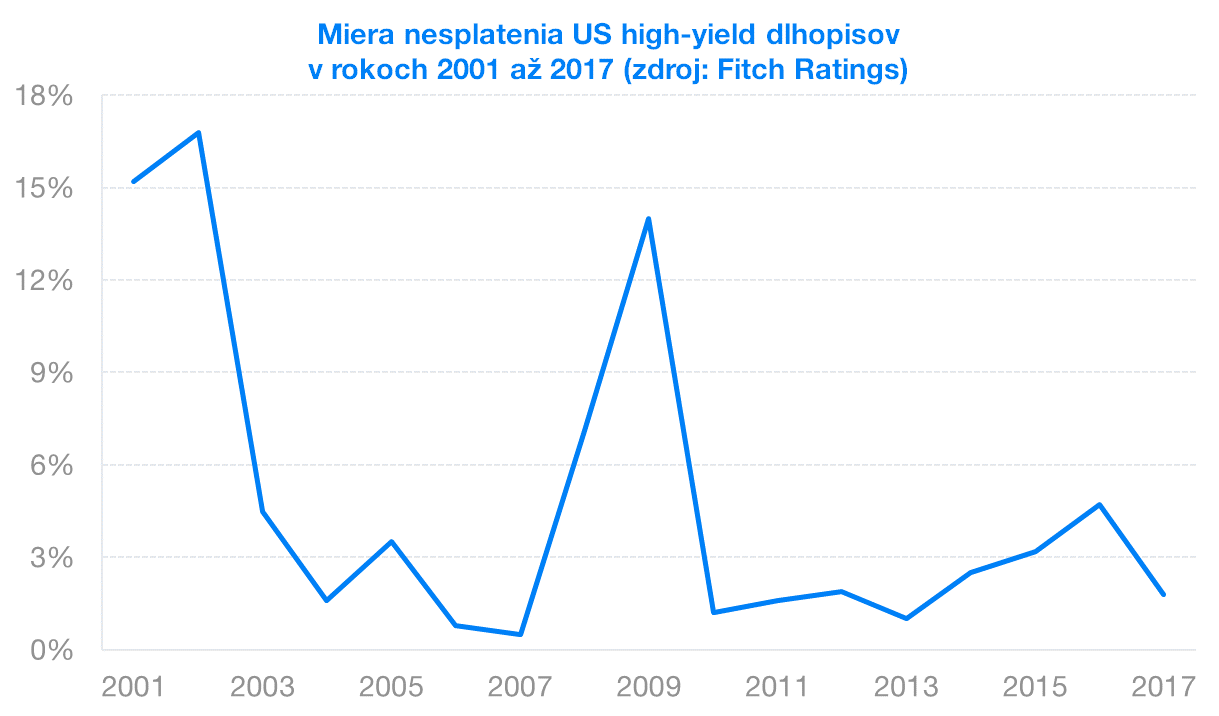

In the US, in times of crisis, the high-yield bond default rate has risen to an average of 15%, as shown in the following chart, according to the credit rating agency Fitch Ratings. The bankruptcy rate in this debt tier is usually below 2%.

15% is not something that should be ignored. It means that in times of crisis, as we are experiencing today, every seventh bond issue is not paid out (goes into default).

In Slovak, the default rate could even be approaching 20%. In other words, every fifth bond can go into default, in the event of economic recession. Most issuers are highly leveraged (the share of foreign sources of funding is very high) and they are mostly smaller companies with highly concentrated sources of income.

The history of bonds is still short in Slovakia, so we have not been able to verify these assumptions yet. During the financial crisis in 2008-2009, the bonds were not so widespread and the volumes issued were lower, but even then, several issuers struggled as they did not repay their liabilities on time.

However, COVID-19 will be the first real test of issuers and it will also provide the first data regarding the behaviour of these bonds during the crisis.

Recommendation no. 1:

When investing in bonds, always research who are you lending money to. Do your homework, who will be your debtor, what do their statements look like, what is their income, solvency, liabilities and their history. Consider carefully how feasible the project, for which you are lending money to the issuer, really is.

Check the ownership structure of the issuer or SPV. Prefer asset-secured bonds and bonds of large companies with a long history, quality management and strong balance sheets (sufficient liquid and quality assets and a smaller share of foreign sources of financing).

Liquidity risk

Slovaks are still mistakenly mostly concerned about market risk. It represents fluctuations in the value of a security due to a change in market price. These bonds are non-traded, so they do not bear this risk. They give the impression of safety and profitability at the same time.

In case of traded assets, losses are usually temporary, especially if you invest in widely diversified funds. If you own thousands of shares or bonds, the bankruptcy of several, or even dozens of issuers, will not fundamentally affect the value of your portfolio.

Markets have always returned to new highs, just give it time. This statement can be visualized using the development of the high-yield euro bond index Markit iBoxx EUR Liquid High Yield, which tracks the high-yield ETF in Finax's portfolios, during the financial crisis of 2007-2009.

The greatest fall of liquid euro high-yield bonds was -37% in 2008, but it took less than two years for the index to return to its peak that it achieved before the crisis. And I'm talking about liquid bonds from this asset class. What losses would have been incurred by lower quality non-traded or low liquid issues?

In addition to credit risk, these bonds carry significant liquidity risk. It is precisely this risk that many perceive as positive, that is to say that these bonds are non-traded, which is, on the contrary, a huge downside.

Imagine that as a result of a pandemic, it comes to light that a company, to which you have lent money through the purchase of its bonds, is failing to implement its plans and its future income is at stake. Three years remain until the maturity of the bonds. What do you do?

Three years of sleepless nights await you, because you have no way of selling your bond. The company is not obliged to buy back the liability from you and the market, where you could monetize the bonds that you hold with a small loss, does not exists.

Suddenly, the advantage turns into disadvantage. This is called liquidity risk, and it is precisely for these reasons that liquidity, i.e. the ability to sell a security, is considered to be a basic parameter of a good investment, often influencing its final result.

If the issuer told you that in case of an emergency, they will buy back the bond from you before its maturity, try calling them and find out whether they can buy back your bond.

Recommendation no. 2:

The fact that bonds are not traded properly and their price does not change over time is not an advantage. In case you need to terminate and monetize the investment or in case of negative news and problems of the issuer, you cannot get rid of the bond. In such situation, your losses will be greater and permanent.

Prefer traded liquid assets so that unpleasant surprises and painful losses on your build up assets will not await you in the future.

Concentration risk

Another missing key parameter of a successful investment, in the case of purchase of specific corporate bonds, is diversification, i.e. the distribution of risk. Investors usually buy a few issues, often from the same issuer. However, this approach does not involve any spread of risk. The investment is highly concentrated and completely dependent on one entity.

Although non-traded corporate bonds offer an attractive return, they are not free. The golden rule of investing, that yield goes hand in hand with risk, also applies to them. Meaning, by investing in a non-traded bond, you didn't outsmart this rule, you just didn't notice it.

The fact that you earn 6% per year clearly means that you are taking a fairly high risk. The stock market carries significantly higher return potential at comparable risk. The investment takes time, but is distributed among thousands of securities, in the case of index funds, and is not dependent on one local Ltd. with share capital 5 thousand euros and no assets.

Recommendation no. 3:

Distribute your investment. This will reduce the risk. Slovak corporate bonds offer minimal diversification. The bonds in the amount of 3 billion euros are mostly issued by a few large financial groups and several smaller but significantly riskier companies.

Many people mistakenly invest a huge part of their assets in these instruments without spreading the risk between different assets classes, into different sectors, or even without regional diversification. Their investments are completely dependent on the economy of one country, on a few economically sensitive sectors and often only on one entity.

Distribute the bond investments as well. You need a huge amount of capital to effectively diversify your direct investment in bonds, as the minimum investment in bonds is in the tens of thousands of euros, so prefer funds.

Yields on Slovak corporate bonds and on high-yield bond ETFs

The most common argument of investors in Slovak corporate bonds and their sellers is, in addition to a stable price, a high yield. It usually tends to range from 3 to 9% per year before tax. On average, we can talk about an annual bond coupon of 6%.

However, this is a gross return. Income from bond coupons (interest) is taxed in Slovakia. In the case of Slovak issues, is the tax collected by deduction, i.e. immediately upon payment the issuer pays the tax, so the taxpayer's tax obligation is fulfilled.

The coupon payment is collected by the owner of the Slovak bond already tax-adjusted and so they do not have to file a tax return for this income. Thus, the previously stated average interest rate on corporate bonds, achieves the net annual yield of 4.86% after tax. Usually, the investor also pays fees for the acquisition of the bond, its safekeeping or account management, which further reduce the net yield.

The Markit iBoxx EUR Liquid High Yield Euro, which also tracks ETFs in Finax's portfolios, has earned 4.3% p.a. over the past 10 years. This period also covers the decline in its value due to a coronavirus pandemic.

If we have a look at its appreciation before the ongoing crisis, in the decade beginning from 2010 until the end of 2019, it achieved an appreciation of 6.1% p.a.

If you invest in high-yield bonds through the ETF, after one year, the income is exempt from tax, so all this yield is yours.

Specifically, this index contains more than 400 far better-quality debtors, in comparison to Slovak bond issuers. In this portfolio, you will find debt securities of companies such as Netflix, Ford, Intesa Sanpaolo (parent company of VUB Bank), Metro or Teva Pharmaceutical.

With the the euro high-yield ETF index, you are still able to achieve the same return on investment as in a Slovak corporate bond in the long run, but with the risk being 400 times more distributed.

Recommendation no. 4:

The feeling of close relation to the investment, its stability and security are an illusion in the case of corporate bonds. The risk is high, as I have shown in the previous examples.

The biggest myth of investing in an individual corporate bond is its yield, which does not correspond at all to the risk taken. You can achieve a similar and often higher return by investing in a broadly diversified portfolio of high-yield ETFs with significantly lower and more distributed risk.

Recommendations and comparison of bonds and high-yield ETFs

I do not want to downplay bonds. Bonds and shares are, in addition to cash, the basic assets classes. The role of the bond in the portfolio is crucial and the bond market is the largest financial market. It is the most important financial instrument in the world. Government bonds of selected countries are considered to be among the safest securities.

However, not every bond is the same. And I have to point this out. Direct investment in a bond requires a more sophisticated approach, investment experience and a lot of research. I would like to know how many investors, in corporate bonds in Slovakia, have studied the issue details, or whether they have actually look through the issuers' statements.

Non-traded corporate bonds are certainly not the right investment for retail investors and should not represent larger part of the investment portfolio than is often the case in Slovakia. The share of corporate bonds in the investor's assets should not exceed 20%. These tools are only the icing on the cake, by no means its main ingredient.

In my opinion, they are financially unattractive investment opportunity. So far, I have never invested in a corporate bond or a bill of exchange from a Slovak issuer. Simple investment mathematics does not support this direction.

The basic investment rule is to maximize the return per unit of risk taken. If I can achieve the same return at a lower risk in another viable alternative, the investment becomes unacceptable to me.

The offered yield on corporate bonds does not correspond at all to the risk taken and the vast majority of the parameters of such an investment are contrary to the basic investment rules. The investment is high risk, with minimal liquidity and zero diversification.

In the case of high-yield bonds, I clearly prefer the index ETFs based on all of the parameters.

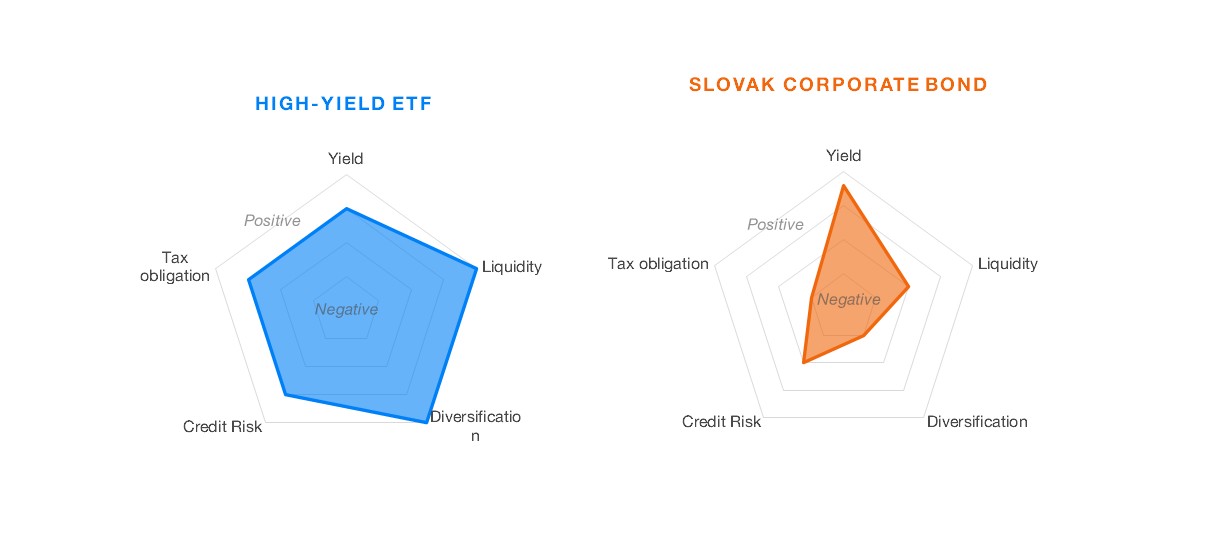

The following chart shows the difference between the five key parameters (yield, credit risk, liquidity, risk diversification and tax obligations) of direct investment in corporate bonds and investment in the index ETF focused on high-yield bonds.

The so-called radar chart clearly shows the advantages and disadvantages of the two investment tools. Each parameter has four quality levels. The more the value of the parameter is on the external level, the more advantageous it is for the investor.

For example, in the case of a corporate bond, you always have to pay tax on the yield, so the level of the parameter is the lowest. However, in the case of an accumulating bond ETF, you will only have to pay the tax if you cancel the investment within a year, thus achieving on the tax parameter the second-best level.

A larger area of the coloured graph stands for a more advantageous solution according to these five parameters.

As I mentioned already, the parameters of the corporate bonds are clearly worse than the parameters of a diversified market solution.

Bonds in Finax portfolios

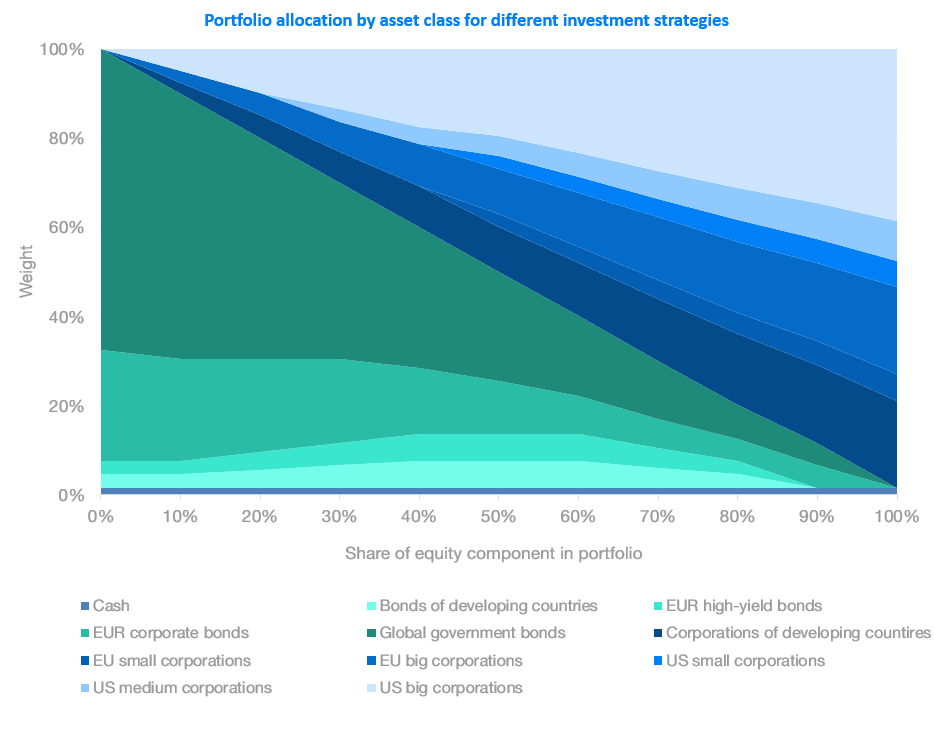

World government bonds make up the largest share in Finax's portfolios. In the case of 100% bond portfolio, the share of government debt is up to 67.5%. The composition of our portfolios and the reasons for choosing the individual assets classes can be found here.

Although their yields are lower, their correlation with other asset classes (identical development) and their volatility (price fluctuation) are also low. Thus, government bonds mainly mitigate risk, reduce volatility and smoothen out the overall development of portfolios with their presence.

In addition to them, you will also find corporate bonds in our portfolios. First things first, they are bonds with a rating within the first 10 tiers, in the so-called investment zone. The creditworthiness of these issuers and the probability of debt repayment is high.

The corporate high-yield bonds are also present in the portfolios, but their share in Finax's portfolios is only up to 6%, precisely for the reasons I have mentioned in this article. High-yield bonds behave more like stocks, they achieve identical returns, but also carry a similar risk.

The four bond ETF in Finax's portfolios invest in approximately 4,000 bonds from 92 countries. Therefore, we managed to spread the credit risk perfectly.

Transfer your investment to us and we'll reward you by managing 50% of the amount of the carried forward investment for 2 years free of charge.

zľavu z transakčného poplatku vo výške 20%

Do not forget that we also reward the transfer of an investment from corporate bonds to Finax with a discount on the transfer of the investment. If you document its termination in bonds, we will manage 50% of the transferred value for 2 years free of charge. More information can be found here.

App Store

App Store

Google Play

Google Play

Difficulty

Difficulty