Investing involves risk. Investments have fluctuating prices and can result in a loss as well. You can read more about the risks taken when investing here.

What should I invest in today?

I get this question a lot, almost every day, whether it comes from clients, friends and acquaintances, financial agents, or journalists.

Of course, the person in question always seeks to earn as much as possible and with maximum certainty (as little risk as possible). I am literally being asked to help find the winning lottery ticket.

Surprise surprise, I answer the same way every time: "Invest in a broadly diversified portfolio made up of index ETFs. You won't find anything better or more secure if you're willing to commit your money for a sufficiently long period. If you have a short horizon or are just speculating because you read about this superstar deal, I don't know the right answer."

Create an account and start investing today

Of course, my answer is preceded by a series of counter-questions. For how long do you want to invest? What’s your investment goal? What is your target amount and what return do you expect? What kind of downturn can you handle, and what would you do if the investment was in variously large losses?

The Constant Search for the Holy Grail

I know, a dull answer with no story and colossal argumentation. I can sense from the inquirers that I mostly disappoint them. They were looking for confirmation of their reasoning, failing to find it with me. For some, my answer may even sound alibistic, because I am certainly just working to my own advantage.

No, I deduced this answer after years in the financial markets. Even before I founded Finax, I would have given the same answer (after all, I was behind the creation of passive ETF portfolios towards the end of my previous job tenure).

I concluded that long-term passive investing in index ETFs is the best investment, right after entrepreneurship (which, however, carries a much higher risk of failure and overall loss), precisely during my, let's call it "exuberant", career.

17 years in the financial market have shaped my current attitudes. For roughly half of my career to date, I have believed in my ability to beat the market and outperform all the seasoned professionals, similar to many young people today.

Masses of people constantly attempt to achieve long-term excess return (called alpha) over the indices, i.e., to be better than the market. And only a small fraction of a percent succeeds – the typical tip of the iceberg that we look up to, which inspires us but also blinds us and deprives us of rational judgment.

I was not born yesterday, however. Every period in the financial markets has its winners. In times of low interest rates and a strong economy, growth stocks play this role. In times of high inflation, commodities win. In bad times, large value firms outperform the alternatives. The US does well in one period, Europe in another, then they get beaten by Asia.

Source: Henry Neville, Teun Draaisma, Ben Funnell, Campbell Harvey & Otto Van Hemert: The Best Strategies for Inflationary Times (25.5.2021)

Sounds pretty simple, right? Successful investing itself is quite simple at its core. And it is this apparent simplicity that leads many to believe in their ability to beat the market and to the path of actively selecting different assets at different times.

Such a nice notion, however, usually runs up against the harsh reality very quickly. Why? Because none of us can foresee the future, correctly timing investments (buying and selling) to outperform others in a given period is virtually impossible.

At the same time, none of us has such a quantum of quality information, and cannot confidently evaluate the set of the data correctly. The market results from the behavior of millions of participants, each with their own individual unpredictable behavior. How can anyone know which way a share price will go in this setting?

A Wild-Goose Chase

As a result, investors end up chasing the market, jumping from one fund to another with the naive vision of high returns.

If you are convinced that now is an asset’s "time", you have most likely read or heard about it somewhere. When a prospective investment is already being written about in the mainstream media, it means you are not the first to discover it.

Its price is already guaranteed to have risen, which is usually the basis of its "momentary attractiveness". The trend has been running for some time, implying thousands of professional investors have already invested in it before you and pushed the price higher.

You arrive at the pitch when the game is already in progress, jumping on the bandwagon, which is usually too late.

"Buying high and selling low never works."

Alternatively, something negative you didn't count on and wasn't included in your plan happens while you’re invested in your superstar opportunity.

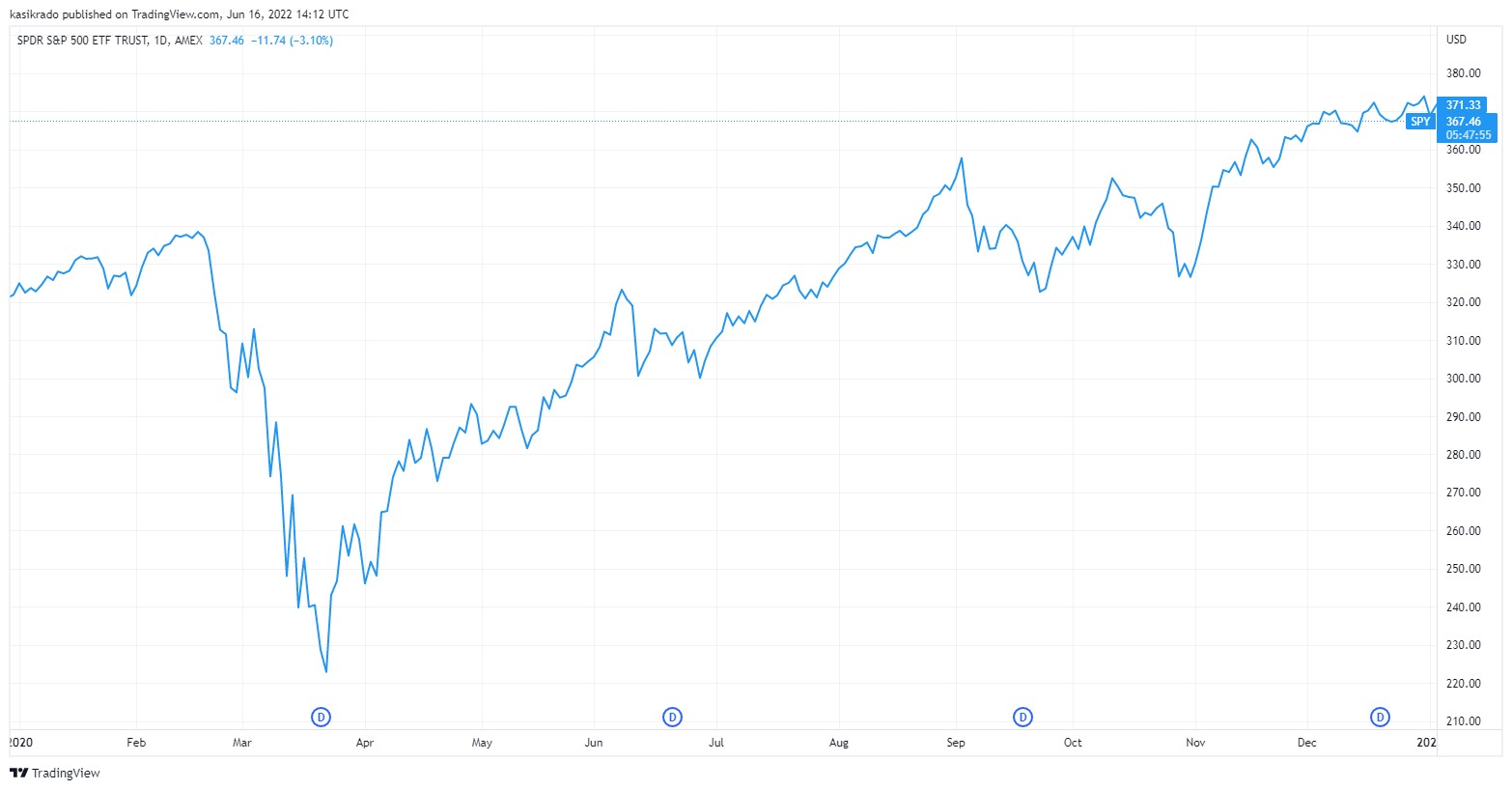

For example, the central bank unexpectedly changes the policy rate, as it did at the end of March 2020, after which the markets miraculously reversed the sharp sell-off to a massive rise, catching many investors by surprise. In anticipation of further declines, they found themselves on the wrong side of the financial market history (uninvested).

If a stock has fallen by 50%, it doesn't mean it can't dip by another 50%. The price of a share says nothing in itself. It is necessary to know what caused the decline. Is it just a result of market sentiment or has the company's end-market changed? Is there something negative going on within the company itself?

"The biggest lie of the financial markets: it will be different this time."

Finally, can you even tell when you will exit your superstar investment? At which moment will its outperformance relative to other assets ceases, and something else becomes more attractive? How will you identify that point? Do you know the answers to these questions, do you have a strategy you will stick to no matter what?

Don't Pull the Cat by the Tail

Let's look more specifically at what I'm referring to. I will briefly take you through my career in the financial markets, focusing on the major market events during that period. A brief review of the past 15 years of investment history will be a good explanation of my views.

I hope it will convince you enough to stop thinking about the constant search for the "right" investments (they exist, but look uninteresting, without a strong story). Your own experience is non-transferable. However, rational people learn from the mistakes of others to avoid repeating them.

Emerging markets

My first contact with the financial markets was in 2005. At that time, emerging world economies and markets were thriving. Commodity prices were rising quite rapidly. Globalization was in full swing. Countries such as China, India, Russia, Brazil, South Africa, or Turkey were the most talked-about markets.

Guess what everyone wanted to invest in back then? Yes, in emerging markets.

The most popular investment vehicle was the acronym BRIC. This was coined by Jim O'Neill, then Goldman Sachs chief economist, as a grouping of countries with high growth potential. BRIC consisted of Brazil, Russia, India, and China (abbreviated by the first letters of the countries' names).

"Between 2005 and 2010, more than 50% of investments flowed to emerging markets."

Just as most retail investors today only want U.S. stocks, they were all invested in Chinese, Russian, and Brazilian titles back then.

In my first investment product, an investment life insurance policy, I myself chose a 50% weighting in a fund focused on emerging markets, with the other half going into developed economy stocks. Yes, those were my beginnings in the financial market.

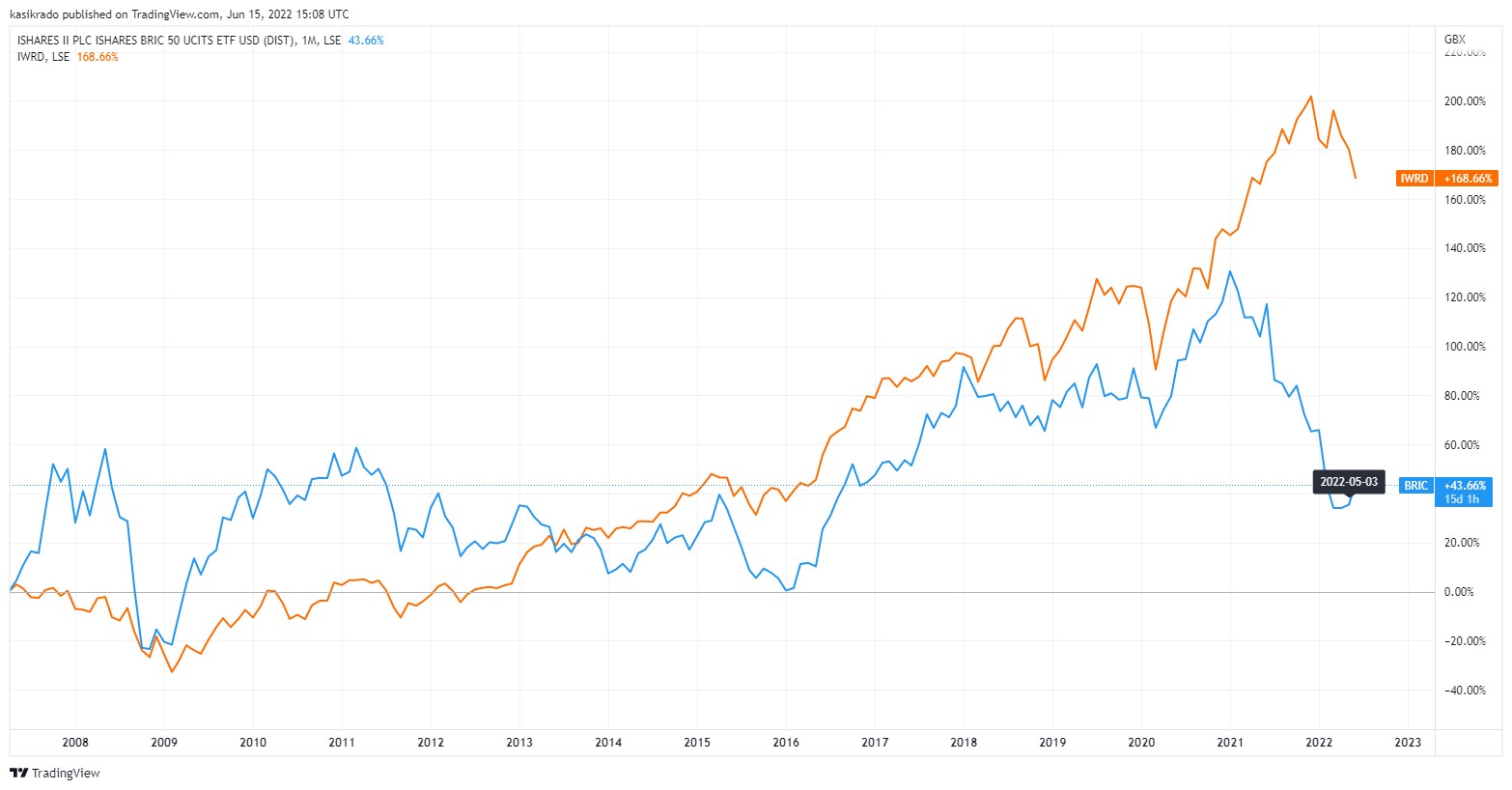

And how much has investing in the BRIC markets earned to date? When was the last time you ever heard or read about the BRICs? The reason why no one offers you an investment in BRIC funds anymore is obvious.

Total return of 47% over 15 years (iShares BRIC 50 ETF, blue curve in chart). 2.6% per year. Just for comparison, a fund replicating the MSCI World index of developed market stocks (orange) has risen by 169% (6.8% annualized) over the same period. In both cases, we're talking about dollar returns of ETFs. The dollar appreciation and dividends paid out would still need to be added to it, making the actual returns higher.

However, if we were to look at the 10 years prior to 2007, the chart would look the opposite. Emerging markets were the best performing asset class, which is why they were the most popular investment in my early career.

The financial crisis

I started my real finance job in September 2007, two months before the stock-market peak. At the time, as an ambitious young financier, I denounced passive investing. I viewed it as an excuse for the incompetence of investment managers.

The financial crisis and the year-and-a-half-long stock market decline of more than 50 percent only reinforced this view. Why should I just watch the value of shares fall when I can also make money on their decline?

However, getting inexperienced Slovaks to invest was literally a miracle at the time. Many people, to their detriment, have avoided investing until today, given what they’d endured during the Great Recession.

"In 2008, you could hardly find a person willing to invest in stocks."

Still, some brave exceptions emerged. And how did we invest then?

We were all convinced that the crisis would not go away quickly. It was a huge reset, an unimaginable collapse of the financial system accompanied by bankruptcies of the banking giants. The financial markets went to the dogs.

However, thanks to the tremendous efforts of the US Government and the central bank, the markets found a bottom in early March 2009, something we had not believed in for many years to come.

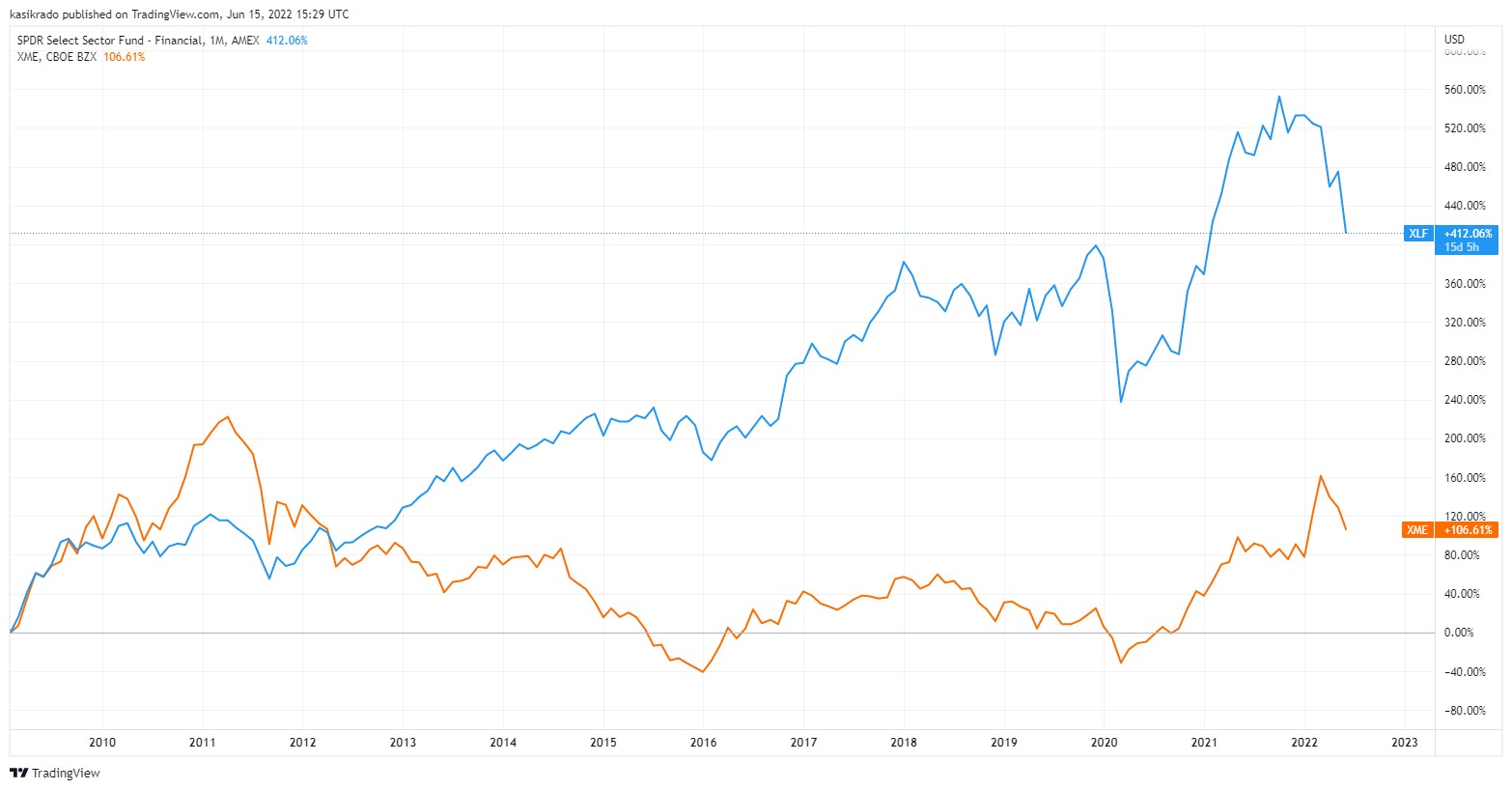

We searched intensively for ideal stock investments (after a few years, I realized that this was completely unnecessary because everything was growing at the time). Our favorites were mainly financial institutions and commodity producers. Both sectors were doing extremely well at the time, but since we were convinced that the world was not out of the woods, we were always quick to exit positions at a profit.

It may sound like a good investment, we earned money, and 10 to 20 percent gains in a short period of time are certainly nice. The problem, however, is that once you sell a position at $10, it's hard to get back in at $12.

If we weren't selling stocks and ETFs, we'd be talking about returns in hundreds of percent today, as the previous chart shows. For some individual titles, returns would reach four-digit percentages.

Although in the case of commodity producers (orange curve), the tide later turned, and two years ago, the investment would still be at a loss after 11 years. More on commodities further down.

In addition, we tried to capture the short-term trends, and their changes, i.e. the ups and downs of the indices, as we were still not convinced the market was bullish (rising). And I was sure one can easily make money even in declining markets. You can imagine how that strategy turned out.

European debt crisis

Shortly after the end of the financial crisis, other problems emerged, this time concerning state and bank debt on the old continent. Between 2010 and 2012, Europe faced the potential collapse of Greece and other countries.

"In 2011, many people expected the common euro currency to disappear."

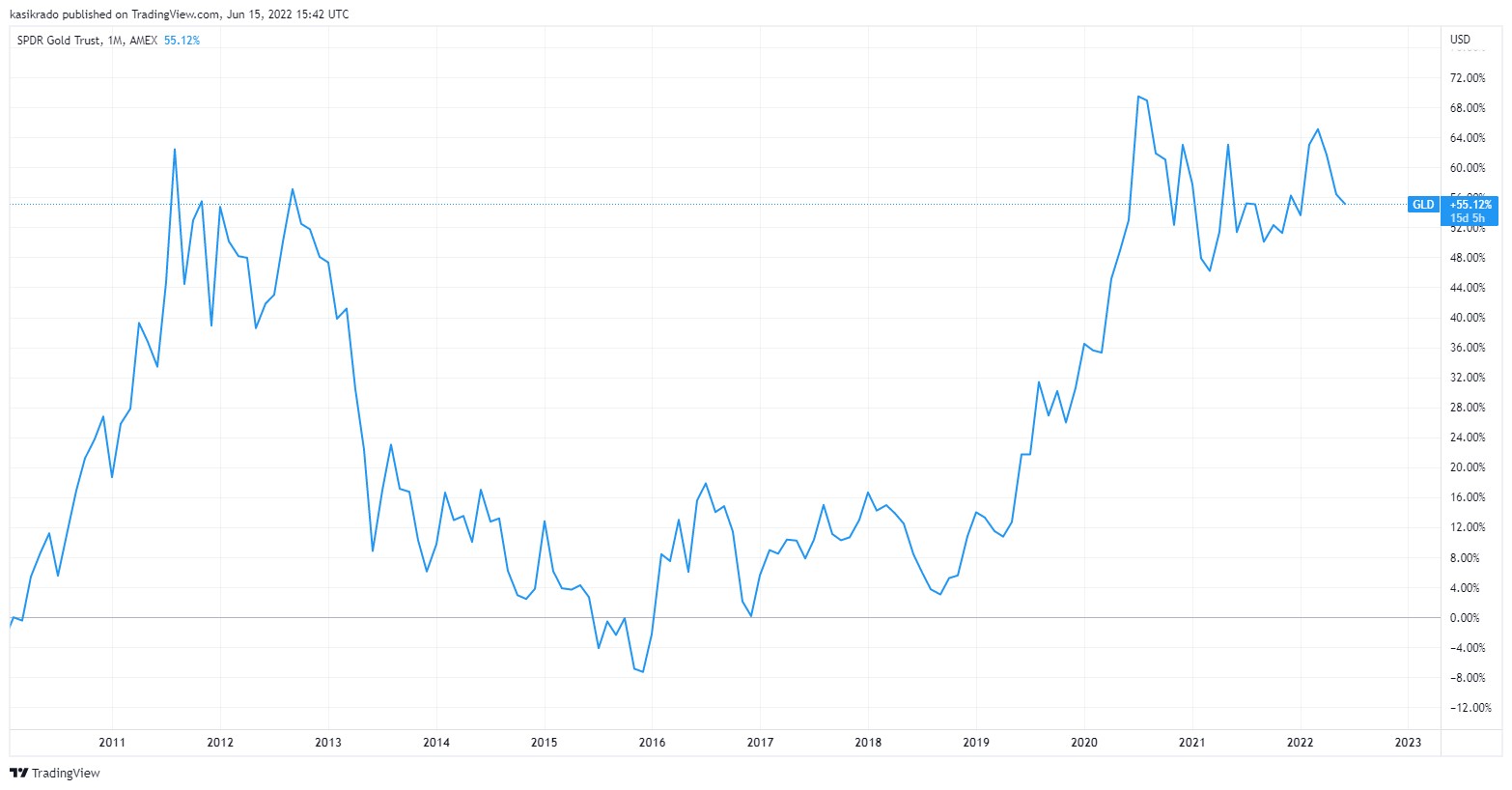

The Eurozone was headed for a breakdown. Everyone moved money to the so-called hard and safe assets such as the Swiss franc, the US dollar, or gold.

We invested intensively in gold even before the outbreak of the debt crisis in Europe, as it was clear above all that the unprecedented stimulus of the central banks must lead to extreme inflation.

And what does well during inflation? Commodities. For a while, this investment was indeed successful, as shown by the following chart of the ETF for gold or the previous chart of the ETF for commodity producers.

The Union, however, saved its countries, did not fall apart, and everything returned to normal. High inflation did not occur, and economies were more troubled by the opposite phenomenon – deflation, i.e., a decline in the general price level. Seemingly safe gold collapsed. In the following years, it lost almost half of its price while the stock indices grew significantly.

Why does gold not represent a good long-term investment?

Fresh experience

Let's move at a faster pace to the recent past. Of course, even in the years after Europe's debt problems, there was no shortage of interesting events, whether it was the withdrawal of stimulus by the American central bank in 2013, the referendum on Britain's exit from the European Union in 2016, or the US trade war with China a year later.

Negative events appear in the economy with great regularity. There’s nothing we can do about it.

From more recent developments, the covid pandemic outbreak dominates. Today, it may appear as a minor event from an investment perspective due to the rapid stock-market recovery later that year. But we still feel its effects today. It is one of the causes of the current development, and we were all going through March 2020 very intensively.

It was a new experience for everyone. None of us had encountered a complete shutdown of the world economy before. It was bound to result in a huge recession, right? Many investors, retail and professional, anticipated the biggest stock market crash in post-war history.

Although we saw the decline as a buying opportunity, I myself advised to buy gradually by spreading the investments over time. That quickly turned out to be bad advice.

The decline stopped at around -35% and since then, thanks to colossal stimuli, there has been a sharp growth. Many investors wrongly assumed we were only halfway down and missed out on those returns.

A few months ago, most of the market loved American tech companies. Why? Because they brought the biggest profits in previous years, coming out of the pandemic as clear winners.

How have these stocks been performing this year so far? A loss of more than -30%.

And what is trendy today?

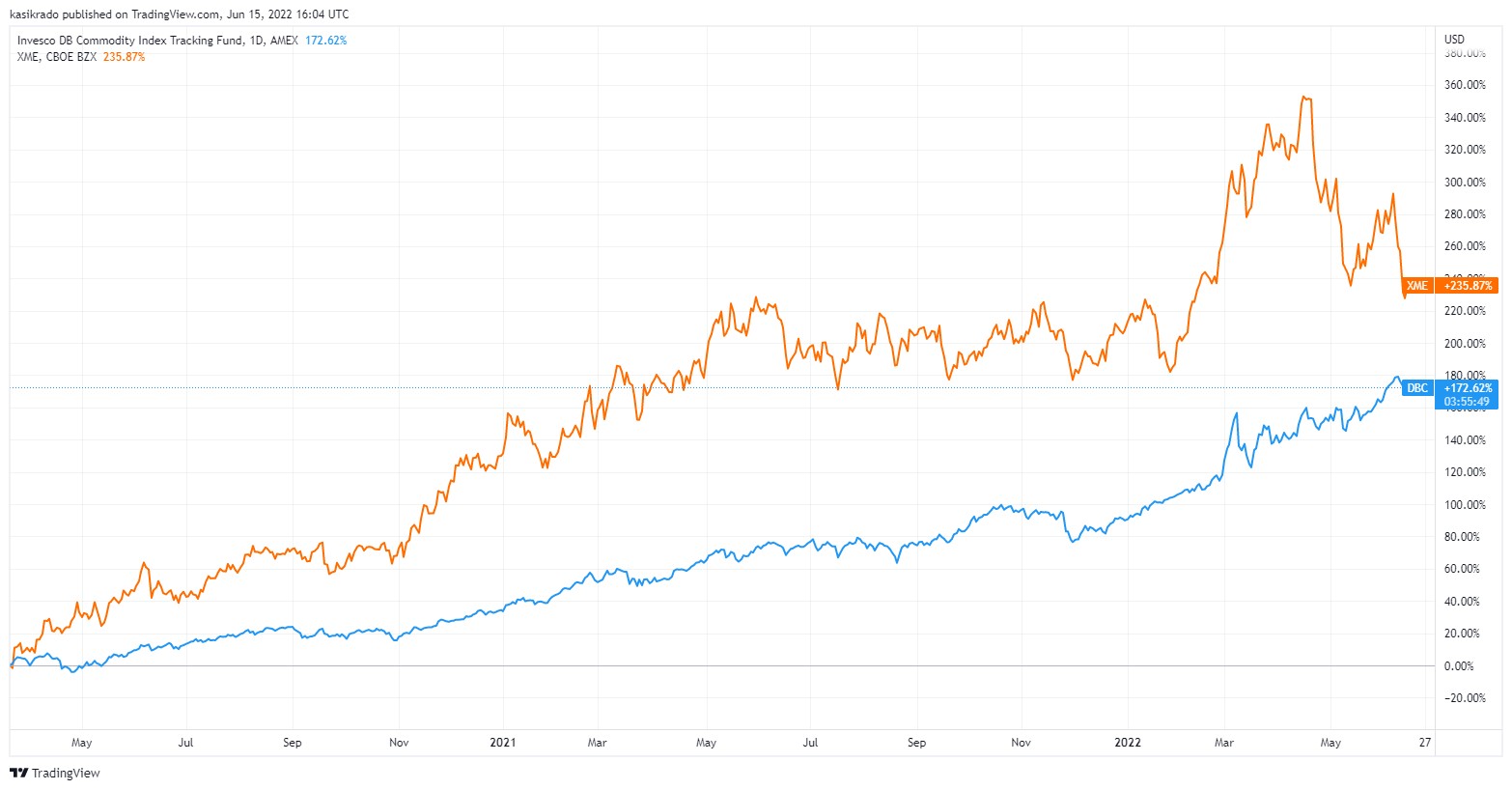

Many investment managers and financial agents talk about commodities and value stocks. Both assets have a strong story behind them that makes them easy to sell. Russia's war in Ukraine and the imposed sanctions fundamentally limit the supply of practically all raw materials. Commodity prices must naturally go up.

They have been growing for two years though, during which their price tripled (the orange curve is the already mentioned ETF for commodity producers, and the blue one is the largest ETF for the raw materials themselves). Remember the bandwagon from the beginning of the article.

Is now a good time to jump on it? What growth potential do commodities still have? Especially when we extend these graphs, e.g., to a 15-year horizon, we find that commodities are no great deal in the long-run (following commodity ETF chart). If you do not manage to get out of these investments at the right time, you will book losses or, in the best case, you will lose out on the returns that you could have earned elsewhere.

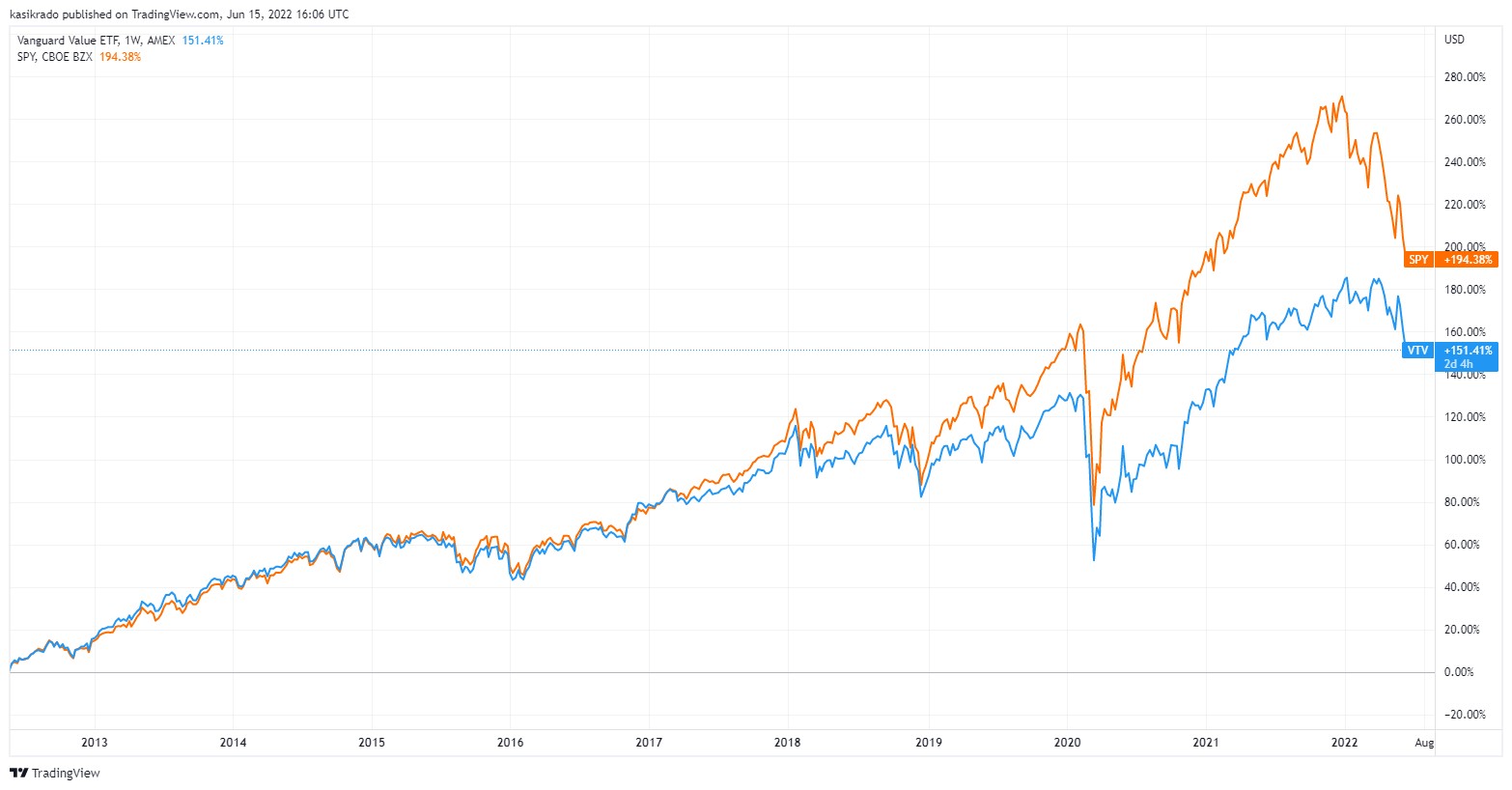

Value stocks are shares in large companies that are no longer able to generate more interesting growth. For this reason, they tend to be cheaper – the ratio of share price to earnings per share is lower. As a rule, however, they have strong cash flows and pay out a large part of it in the form of dividends.

Therefore, the prices of value shares tend to be more stable. These stocks are preferred in times of a recession, which threatens to come at some point in the next few years.

What's wrong with this investment then? Nothing, it's just useless. Because, again, it’s impossible for a small investor to recognize the right time to return to a broader portfolio, so as not to lose out on return potential. The graph below illustrates this by comparing a value stock ETF (blue) and the broader US stock index S&P 500 (orange) over the past 10 years.

Are dividend stocks a rewarding investment?

Don't Look for a Needle in a Haystack

Conclusively, what is the bottom line and what has my career taught me?

There is no need to chase returns and look for the ideal investment at a specific time. It is literally a bad approach, an unnecessarily risky speculation. It is very difficult to enter a certain trend in time, and even more difficult to exit it at the right moment. In most instances, you won't be able to get a greater return than the broad market itself.

"It doesn't pay to bet on one card."

You can never predict the winner with certainty, you cannot predict the actions of central banks, the development of the economy, and especially the reactions of millions of investors to these events.

The key to success in the financial markets is to always remain invested. Had I followed this simple rule from the beginning of my career, I would have 10 times the value of my financial wealth today (in addition to the aforementioned experiences, I also managed to tank my account to zero several times by trading derivatives). You don't have to repeat these expensive mistakes.

"Only invested money earns returns."

Be aware that when passively investing in the entire market, you hold reasonably large positions in everything mentioned above.

Broad indices contain commodities via their producers, include value investments (e.g. the shares of Warren Buffett's company Berkshire Hathaway represent the 7th largest position in the S&P 500 index), alongside growth shares or real estate investments.

Moreover, these investments are rebalanced. Thus, if the value of value shares increases, their share in the index will increase at the expense of, for instance, tech stocks. Hence, you invest more in them without having to speculate about it.

If, for example, a better period awaits emerging market shares, you’ll be there with passive investing. You are always guaranteed to invest in winners. Of course, you also invest in losers, but it is still difficult to achieve higher returns in any other than this average method, although it doesn’t sound attractive at all.

Nobody wants to be average – an average driver, an average employee, an average father... However, we should strive for this average in the financial markets. Investing is not a sprint and hare coursing, but rather a marathon. If you choose a long-term strategy that makes rational sense, you will outperform all other speculators.

Achieving average returns over a long period of time leads to above-average returns.

Are you investing for many years and want to adapt your investments to short-term trends? Even with a very low probability of their correct timing, i.e., entering at the right time and exiting soon enough?

You can't predict what will turn out to be the best investment over the upcoming 10 years and what will do well in 15 years. Nobody knows. Therefore, diversify – spread out your investments.

Don't worry about investments. Invest regularly in the entire market, and you can rest assured that you’ll have made a good profit at the end of the horizon, more than most speculators who keep searching for the holy grail.

So far, nothing has been better devised for long-term high returns and beating inflation than a well-diversified stock portfolio, as the following table shows (it displays real returns).

Source: Deutsche Bank

The Victory of Reason over Emotions

Times have become much more complicated. The media and social networks are once again filled with negative news and catastrophic scenarios. Inflation is taking more and more money out of our family budgets. Higher prices leave us with lower cash balances.

You’re losing sleep over the numbers in your investment accounts. (Trust me, it’s only about experience. After everything described that I went through, I sleep peacefully, not being bothered with the drop in returns at all, as I know that sooner or later, they will recover. I keep investing new money, making profitable purchases whose value will multiply many times over considering my long investment horizon.)

"We perceive negative emotions three times more sensitively than positive ones."

In these challenging situations, fear wins. Emotions are stronger than reason, especially the unpleasant ones. Naturally, in these situations, we are prone to act impulsively, irrationally, and seek salvation from harm represented by making a loss.

A bad mental state makes us an easy prey, bringing an opportunity for various guaranteed stories that work with negative emotions. Staying rational is difficult in tense situations.

How to keep your head during market downturns when everyone around you is losing it?

Do not fall for the lure of investment product salespeople and asset managers for various special investments if you want to be successful in investing. Don't look for the best investment for a specific time. You will burn yourself unnecessarily, building resent for investing.

It Won’t Be Different This Time

Know that it will be confirmed this time too. A passive approach to investing is the best thing you can do for your future.

Although it may take several years before we see a new stock market peak again. But we will experience it, as well as hundreds of other new peaks. Depositing your savings in stock investments is the only alternative for your savings if you want to appreciate them.

Take a look at Domino's transparent account.

You can also invest on equal terms.

I'm sure that in a few years, in another turbulent period, I'll be reminding myself of 2022 and the mistakes investors made back then, just as I'm writing about it today.

If you want to earn returns, don't delay investing. You won't time the bottom correctly, so don't wait for it unnecessarily. Always take advantage of every drop, no matter when it appears. But don't wait for it, as you can lose solid returns by postponing the choice by too long.

The ingredients of a successful investment are:

- passive investing

- sufficient horizon

- correct allocation corresponding to your risk profile

- no speculations

- no panic

- sufficient diversification

- regular investing

- sufficient emergency fund

- and always spending less than you earn

Keep calm and a strong mind.

App Store

App Store

Google Play

Google Play

Difficulty

Difficulty