In this blog, using the facts and speaking from experience, I will explain to you that dividend stocks are another widespread myth in our young investment market.

I will describe the reason behind a broad-based passive investment being more appropriate tool for payout portfolio and why dividend stocks are not so great in the asset building phase. I will show you that, even in this case, several common and regularly used phrases are untrue.

Dividend stocks are considered to be stocks of companies that pay out a large part of the taxable economic result (profit) to the owners (shareholders). They are stocks with a higher dividend yield in comparison to the market average.

There are two types of income from stocks. Dividend as distributed profit and the so-called capital gain, which represents the difference between the sale and the purchase price of stock. Dividend yield is the amount of dividend paid out per stock divided by the price of the stock. If a company, whose stocks are valued at 100 euros on the stock exchange, pays out an annual dividend of 3 euros, its dividend yield is 3%.

The dividend yield of traditional dividend stocks ranges on average from 3 to 5 percent per annum. Currently, dividend stocks offer a regular income that exceeds the interest rate of the majority of higher-quality bonds.

Dividend-paying companies are usually large, well-known companies with a well-established reputation. Most of them are among the so-called blue-chips stocks, i.e. companies with large market capitalization (value), strong cash flow, stable stock prices and a significant market share.

Paradoxically, in order to classify dividend stocks as an attractive investment, these factors are not sufficient (often do not even hold true).

Lower return

Dividend companies are mostly companies whose enterprise has matured. They operate in saturated, highly competitive markets, where it is difficult to generate stronger growth.

These companies are usually so well established that there are no other markets for them to penetrate and their innovation potential is low. New investments do not generate the required profits. There is no way of achieving higher growth rate. The costs exceed the generated revenue.

Therefore, companies, with a well-established reputation, that are experiencing significant slowdown in revenue growth will be inclined to pay out a larger part of the generated profit to shareholders. In these cases, cash is a more attractive alternative for shareholders than the uncertain future development.

Typical dividend sectors are telecommunications, large pharmaceutical companies, oil companies, consumer goods manufacturers, network industries (utilities), but also some financial institutions or technology companies.

To get a deeper understanding, I will also provide some specific examples. The best ones are the telecommunications operators in developed economies. Mobile phone coverage in Western countries is already reaching nearly 100 percent. Each of us has a cell phone and there is no need for two of them.

We won’t make more calls, but the mobile data usage will increase. However, competition is fierce. There is no room for price increase and the costs of ensuring data transmission are high. The chances that the turnover of telecom companies will increase are slim.

Nevertheless, profits remain relatively high. For the reasons mentioned above, they prefer to distribute them among shareholders.

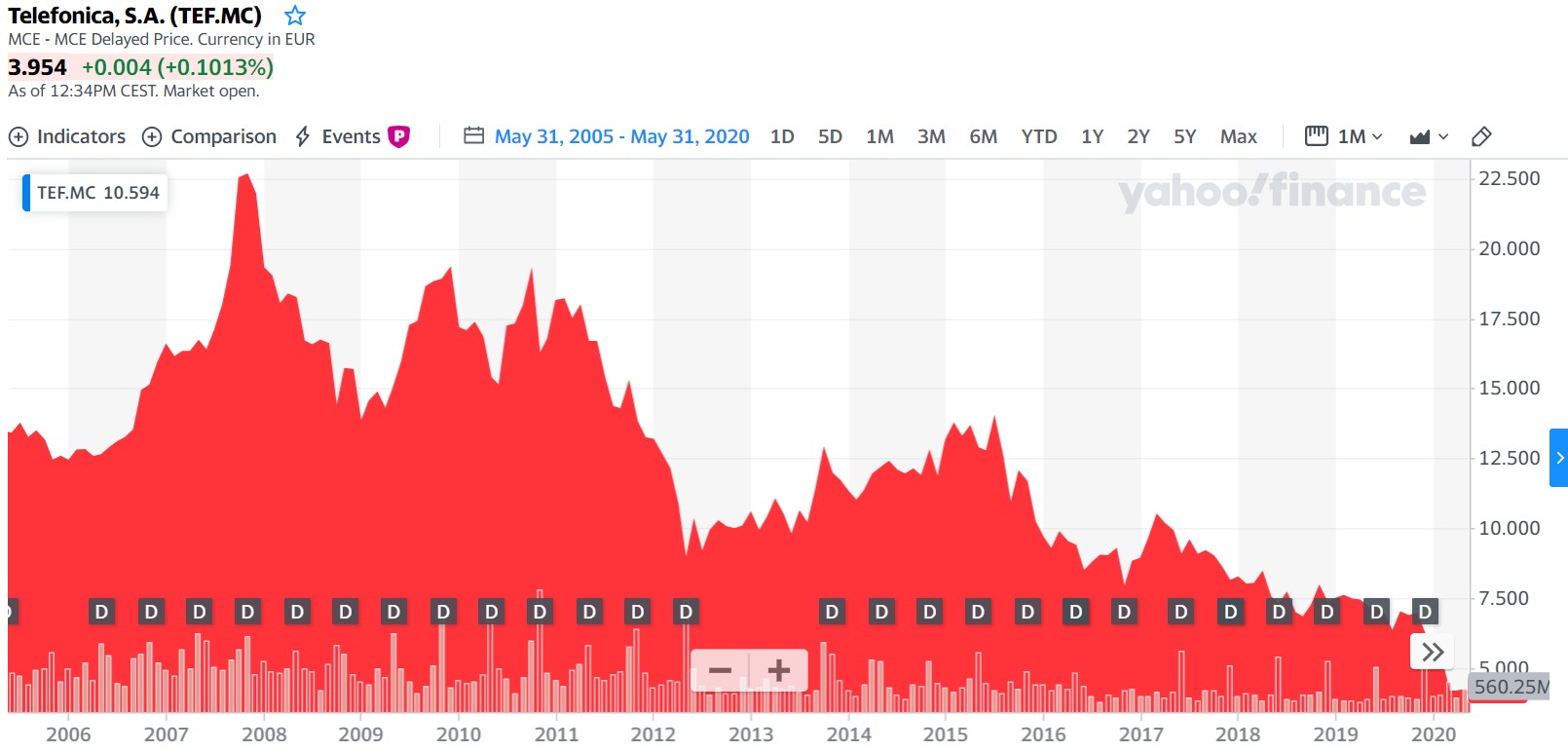

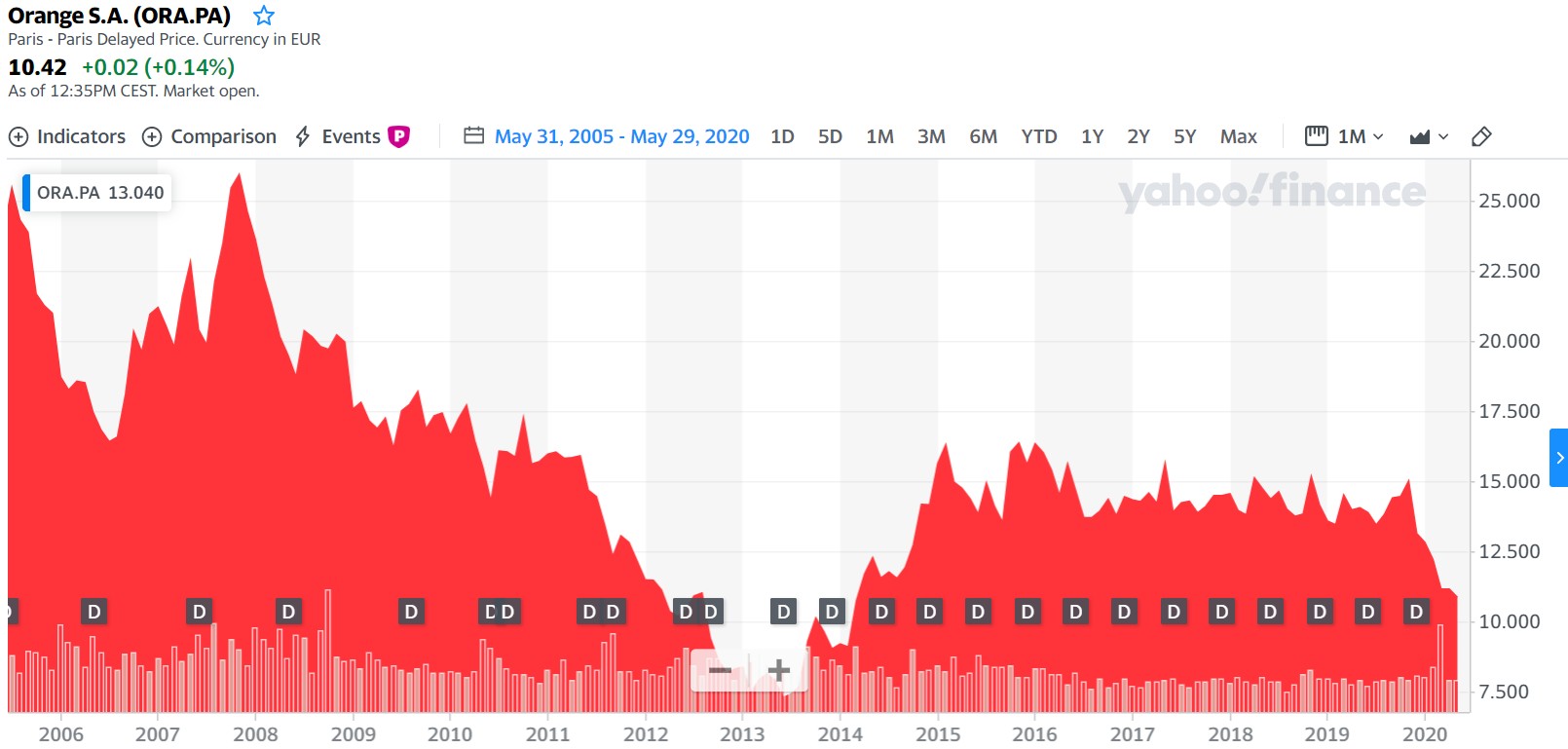

Let's have a look at the stock development of the three operators, in particular Deutsche Telekom, Telefonica and Orange, as they are one of the largest telecommunications companies in Europe.

In all three cases, stock prices are lower than they were 15 years ago. However, the charts do not take into account the dividends paid, which are generous in the case of mobile operators.

Currently, Deutsche Telekom's dividend yield stands at 3.9% p.a. and the stock price has barely changed over the past 15 years. The Spanish operator Telefonica offers a high dividend yield of 8.8% per annum, but the company has lost three quarters of its value over the past 15 years. France's Orange is currently offering a dividend yield of 4.8%, however it has lost three-fifths of its value over the past 15 years.

Similar results can be seen when looking at another dividend sector, oil producers. The following charts depict the stock prices of the two largest oil companies in Western economies (Shell and Exxon), which are (or have been) popular dividend stocks.

The stock prices of both companies are lower than they were 15 years ago. Shell's dividend yield is 3.7%, but the company is valued one third lower than it was 15 years ago. Exxon currently pays 7.4% in dividends, but the stocks have lost approximately a fifth of the value.

Shell lowered its dividend this year. Exxon has not yet responded to the unfavorable development of the oil market, but it can be assumed that it will most likely follow in the European oil giant footsteps. That's the reason why Exxon's dividend yields are so much higher than Shell's.

Just for comparison, Finax's 100% equity strategy has risen by 172% (6.91% p.a.) over the same period, that is over the past 15 years until the end of May 2020. The development of the portfolio is modeled and calculates with a full portfolio management fee of 1.2% p.a.

Note: All data related to the historical development of Finax portfolios have been modelled and were created on the basis of past-modelling of the data. The method of modelling historical performance is described in the article How do we model the historical development of Finax portfolios. Past performance is no guarantee of future returns and your investment may result in a loss. Find out what risks you are taking when investing.

I've calculated the gross cumulative return on investments in these 5 dividend companies over the past 15 years. The overall appreciation of investments includes dividends paid and also takes into account the development of stock prices.

Dividends are taxed in their country of origin and that would further reduce the return. On the other hand, I did not calculate with the reinvesting, which would slightly increase the total return.

I compared the results with a widely diversified modeled 100% equity portfolio from Finax, which invests in approximately 5,500 equities around the world through 6 ETFs.

The return on widely diversified passive investment is, over the past 15 years, 3 times higher than the return of the two most successful dividend stocks among these five. After taking into account the taxes paid on dividends, the difference will be even more significant.

And there are numerous examples. McDonald’s has a hard time selling significantly more burgers than it does today, Coca-Cola is not able to force consumers to buy more cans, households will not use significantly more gas or electricity, and so on.

These companies only manage to maintain such growth thanks to price increases, product adjustments and expansions, or as a result of various targeted marketing campaigns. However, in the short term, they will not achieve revenue growth in the tens of percent per year.

All of the companies are profitable and investing in their stocks will appreciate the assets invested, but the return will still remain below market potential.

With dividend stocks, you deprive yourself of higher return

Many dividend investors forget about the development of stock prices of companies. They are tunneled vision on the dividend and its amount, but they do not realize or acknowledge capital losses.

By investing in dividend stocks, you are not participating in the real growth of the world economy.

The companies that benefit most from it reinvest their profits in further expansion and innovation, so they do not have cash left to pay out shareholders. However, the investments are able to achieve significant increase in the value of the company (stock prices).

Of the five largest technology companies, in particular Apple, Microsoft, Amazon, Google and Facebook, only two pay out dividends, and not impressive ones. In both cases, we are talking about a dividend yield of around 1% per year (Apple and Microsoft).

None of them are considered to be a common dividend stock. You would not buy shares in these companies by dividend investing.

I suppose most of you know that these are one of the most successful stocks of the past decade. Over the past 5 years, these five companies have achieved an average appreciation of 260% (29% p.a.). Don't deprive yourself of this yield.

The lower appreciation of dividend investing is also shown in the following example. I compared the development of dividend ETFs and ETFs copying the broad-based S&P 500 index (IVV). Both ETFs are iShares traded in the US.

iShares Select Dividend (DVY) invests in 100 companies with consistent records of paying dividends. Simply put, these are selected top 100 dividend companies among the 500 companies in the S&P 500 index.

The following charts depict a 15-year cumulative appreciation, including dividends paid.

By simply investing passively in the US market, you would appreciate your investment almost twice as much as you would with a dividend investing (S&P 500 ETF at +249.2%, while dividend ETFs are at +129.2%). At the same time, the dividend yield of the special ETF is currently 4.46%, while the yield of broad-based ETF of the basic S&P 500 index is 2.24%.

A better proof of the fact that you are unnecessarily depriving yourself of a yield with dividend stocks does not exists.

Achieve higher returns vyššie výnosy

Start investing tax-smart via low-cost ETFs.

You pay taxes on dividends

Another factor of investing in dividend stocks that we have to take into consideration and that will reduce your net income are taxes paid on dividends. Unlike capital gains on stocks or ETFs, income from dividends is taxable.

Dividend tax is collected by deduction at source. If you buy stocks directly or dividend ETFs through brokers, cash payments are already credited to you net, i.e. reduced by the tax liability abroad.

Dividend tax rates vary from country to country, but generally range between 15% and 40%. Since 2017, dividends have been, yet again, an income subject to tax. Divided profit/loss of trading company is subject to 7% tax rate.

If you have paid, in case of holding equities of foreign companies, the dividend tax and the rate did not exceed 7% (the rate in Slovakia), your tax liability in Slovakia is considered to be satisfied.

Slovak Republic has concluded Double Taxation Convention with a number of countries preventing double taxation. These usually serve to decrease the individual national rates, however, only very few Brokers apply these agreements.

You may, however, request a return of the tax paid pursuant to Double Taxation Convention of the Slovak Republic. However, this course of action often leads to a complicated and protracted process with no result.

The easiest way is to avoid paying taxes by taking advantage of tax exemptions in the Slovak Income Tax Act. By investing in accumulating ETFs, which reinvest the paid out dividends within the fund, you achieve the so-called capital gain, i.e. income only from the transfer of securities. These are, in the case of securities traded on stock exchanges, tax-exempt after one year of holding.

With this form of investing, you will earn many times more, as I have already shown you in previous sections of the article. Moreover, your income will not be taxed if you invest for more than one year. You will earn more, while also avoiding administrative obligations such as filing a tax return or tax refund applications.

Please note that the purchase of accumulating ETFs does not necesseraily avoid dividend taxation. Depending on the tax domicile of the given fund and the country where the dividend is paid, the tax is collected in the form of deduction even in case of dividends paid to funds and not to end investors. The dividend tax will, in this case, be paid by the fund from its assets.

On the day dividends are paid out, stock price decreases by the dividend

The price of stock on the market depends, among other factors, on the company's total assets, its profitability and growth potential. The payout of dividends always represents a decrease in the company's assets by the amount transferred to shareholders.

Therefore, on the day the dividend is credited to the stock, its price will decrease by the amount of the dividend paid, which only few less experienced or beginning dividend investors are aware of. For example, the stock price of a company after a dividend payout of 3 euros will fall from 100 to 97 euros.

Numerous times have I encountered the plan to buy stocks before the dividend payout and sell it after. But it just doesn't work that way. The investor will not earn on this speculation, because the stock price will decrease by the dividend amount. Since dividends are taxable and, at the same time, the stock price decreases, the investor usually suffers a loss.

Dividend stocks are neither more stable nor less risky

The last argument, which is often made when justifying dividend stocks, is their higher stability, i.e. lower volatility (fluctuation of stock prices).

As I have already mentioned, dividend stocks are generally companies operating in non-cyclical sectors that are not subjected to economic fluctuations. They are producers of goods and services of daily or regular consumption.

In the event of a recession, the consumption of food, medicine, number of phone calls, etc. does not decrease significantly, which is why the financial result of companies, operating in these sectors, does not fluctuate substantially. This should result in their stock being more stable.

However, that is not entirely true. Many dividend companies struggle to maintain revenue, even in times of economic growth, as their business often responds extensively to economic contraction, which can be the final nail in their coffin.

Many of these companies have reached its peak. Now, their goal is to maintain revenue and market share. In the event of a general decline in demand in the economy, this goal becomes a huge challenge.

Therefore, the statement that dividend stocks are more stable, in times of recession, does not hold true. The previous charts clearly show this fact. All the stocks, mentioned in this article, declined during the pandemic. Many even reached their 15-year lows.

The lower volatility of dividend stocks can be verified on their actual development compared to broad-based indices. For this comparison, the development during this year’s coronavirus crisis of two ETFs from iShares will be used, in particular the Select Dividend (DVY) and the broad-based S&P 500 Index (IVV).

From the beginning of the year until its lowest point in March, the dividend ETF fell by -40.5%. This year performance still remains negative. Since the beginning of the year, the investment has decreased by -21.6%.

In the same time period, the broad-based S&P 500 index ETF suffered a loss of -30.4% at its lowest point, that is 10% lower than the loss of dividend fund. Overall performance this year has reached almost zero. The investment in this ETF has lost just -0.6% in just over six months.

Moreover, dividend stocks investment is always more concentrated, less distributed, and therefore riskier. With this form of investment, you either have to buy profit-sharing stocks directly or a fund focused on such companies. At best, your portfolio consists of several dozens of stocks.

With broad-based indices, you spread the risk more. For example, Finax 100% equity portfolio invests through six ETFs in approximately 5,500 equities around the world. By passively investing in the entire market, you achieve a significantly higher return at a significantly lower risk, which is an ideal investment combination.

Stability and lower risk of dividend stocks are a myth.

Finax payout portfolio

The vast majority of dividend investors naively think that they are investing reasonably, i.e. profitably and relatively safe. In reality, they are not aware of the achieved return and the risk taken, which is not at all favorable compared to other investment alternatives.

Buying dividend stocks makes no sense at all. You are missing out on attractive investments that are carrying the world markets. You achieve lower return on your investment, take more risks and complicate your life with administration.

Dividend investment tends to be more expensive. When reinvesting dividends, you have to pay additional transaction fees. The annual cost of the iShares dividend ETF is 0.39% p.a., while the cost of S&P 500 ETF is only 0.03% per annum.

All of the dividend stocks, that you would like to invest in, are also included in the passive portfolio consisting of ETF funds copying broad-based indices. However, in addition to them, you also own thousands of other companies that prefer to invest the money they earn in their business to increase their profits and shareholder value.

When building assets, your goal should be to acquire the biggest possible stake in global companies, i.e. to develop assets as much as possible, ideally as quickly as possible. At this stage, you do not need to collect cash on which you are not dependent. On the contrary, you need to invest as much of your income as possible. The more money you put in the market, the richer you will be in the future.

If you can achieve higher returns with other tools and a different approach, than it is a no-brainer.

Payout tools or products are especially suitable for so-called annuitants, i.e. people with developed assets, that become a source of their income and cover their living expenses. Dividends can be considered by people, who have reached the stage of capitalizing on their assets.

Even in this case, it is not an ideal investment solution. If you are interested in regular return on investment, i.e. cash payouts, broad-based index portfolios are more beneficial.

That is the reason why we have built our Finax Intelligent regular withdrawal portfolio on our traditional portfolios. In the long run, you simply earn more at lower risk and with wider diversification while also avoiding tax obligations.

For you, this means: higher and longer-lasting income from assets. Additionally, you can invest easily without any administrative burdens such as reinvesting dividends, filing out tax return or applying for a tax refund.

App Store

App Store

Google Play

Google Play

Difficulty

Difficulty