2020 will definitely go down in history in bold. The reason is well-known – a world-wide pandemic, unprecedented in modern history, COVID-19.

Event of such calibre must have had an impact on the world economy and, therefore, influence capital markets as well. You can learn more about the last year’s market developments in our article “2020 Markets Wrap”.

Let’s have a look at some popular investment solutions and compare them with the results of Intelligent Investing – all against the backdrop of such complicated situation.

Finax has been publishing the results, achieved goals and milestones ever since it was established – and this year is no different. Finax results and interesting statistics about AUM can be found here.

Comparison methods

The readers who have been following Finax for a while now already know that we compare the performance of modeled Intelligent Investing portfolios with identic investments in the form of mutual funds.

This is based on the synthetic risk and reward indicator (SRRI) – risk indicator on the scale of 1 to 7 based on volatility in the last 5 years) and similar fund focus, i.e. investing in global equities and bonds.

Intelligent investing represents investing in the global market. Naturally, we will always find asset classes, sectors and regions, which outperform other assets or indices in the short term.

Warning: All data relating to the historical development of the Finax portfolios is modeled and based on data back modeling. We described how to model historical performance in How do we model the historical development of Finax portfolios?. Past results are not a guarantee of future returns and your investment may result in a loss. Find out more about the risks you are taking when investing.

Create an account and start investing today

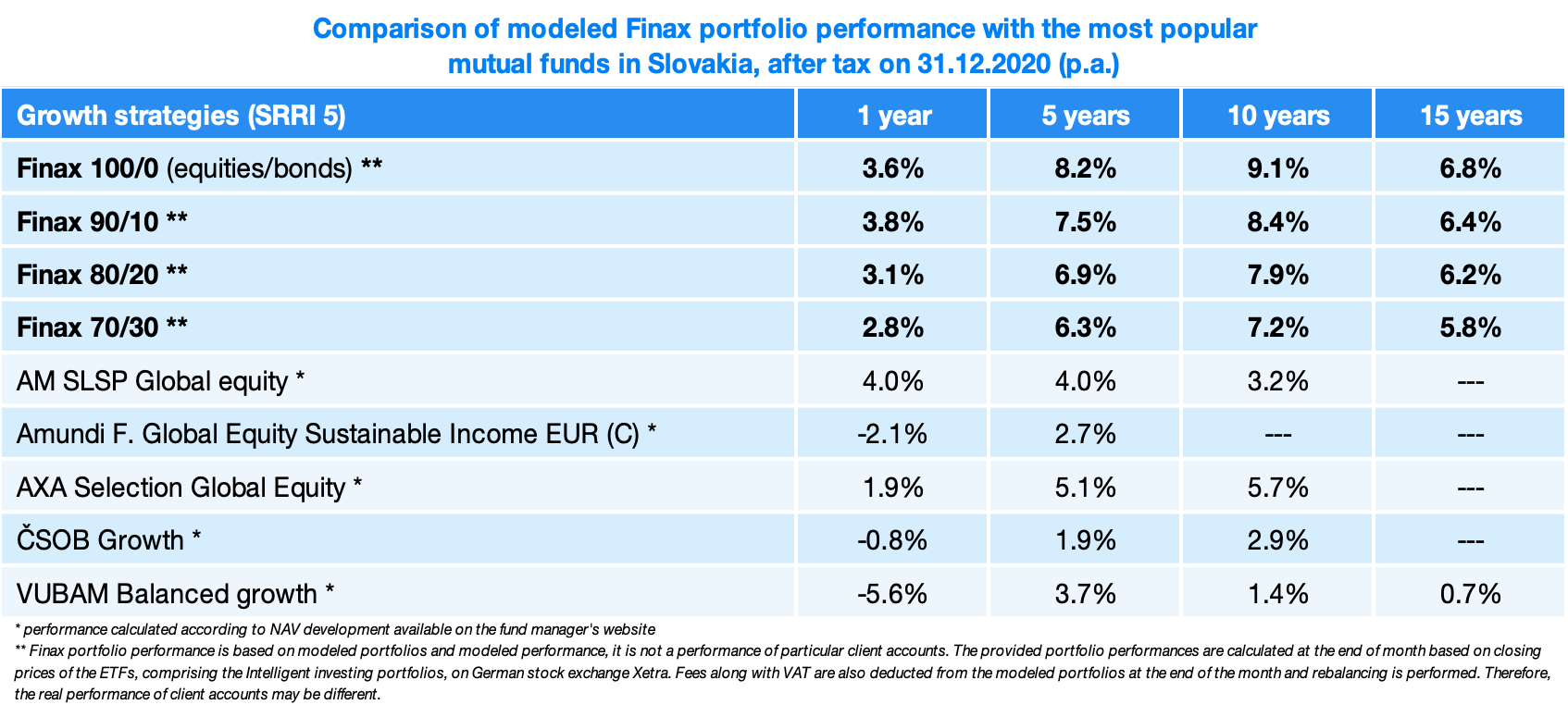

Dynamic investments

Equities did very well in 2020. The returns were not quite as high as the year before, though. Nevertheless, considering the circumstances, no one expected that they would end up in the black at the end of the year.

The performance of indices varied depending on the region. While US Stocks and Emerging Markets recorded growth in double digits, European indices ended up in the red. This had also an impact on the total global stock market appreciation. Dynamic Finax portfolios (SRRI 5) finished the year with returns ranging from 2.8% to 3.8%.

Returns were also decreased by the appreciation of Euro against majority of global key currencies (against dollar by 8.9%). Equities in Finax portfolios are not hedged against currency risk. The currency hedging costs would outweigh the advantages of such a portfolio.

However, at times the currency risk manifests itself negatively and at times it can be a positive aspect. Last year, our performances suffered due to the depreciation of dollar; conversely, its appreciation in the previous years had been a great help.

Exposure to other currencies represents another essential form of investment diversification. More details and thorough analysis of currency hedging can be found in the article Currency risk in Finax.

The majority of our competitors were faced with the same challenges. Only one bigger fund with identical risk profile was able to outperform us last year when it comes to net returns. Long-term appreciation, however, remains on the side of passive investing copying the World markets. Finax returns are higher than the competition’s on a horizon of 5 years and longer.

We use modelled portfolio development to communicate Finax portfolio performance. You can read more on why and how we model the development in the article How do we model the historical development of Finax portfolios?

Each Finax client account is specific. Two accounts with the same strategy are different due to different timing of deposits, different resulting fees because of discounts and different timing of rebalancing. These are also the main reasons why the performances of modelled and real portfolios are different.

That’s why we also provide account performance development of a client with a one-time investment in a portfolio of 100% equities. In this case the appreciation was somewhat higher than in case of the modelled portfolio.

The reason behind this is a different portfolio composition at the beginning of the year (investments were made at different times) and rebalancing taking place at different times. In case of client accounts, the timing of the last year‘s rebalancing was ingenious – almost at the same time as markets hit the rock bottom.

You can follow the development of actual accounts on our website by accessing the transparent accounts of Ivan Chrenko and Dominik Hrbatý. The chart below shows Dominik’s account development. Dominik took advantage of the market downturn in March and invested more money.

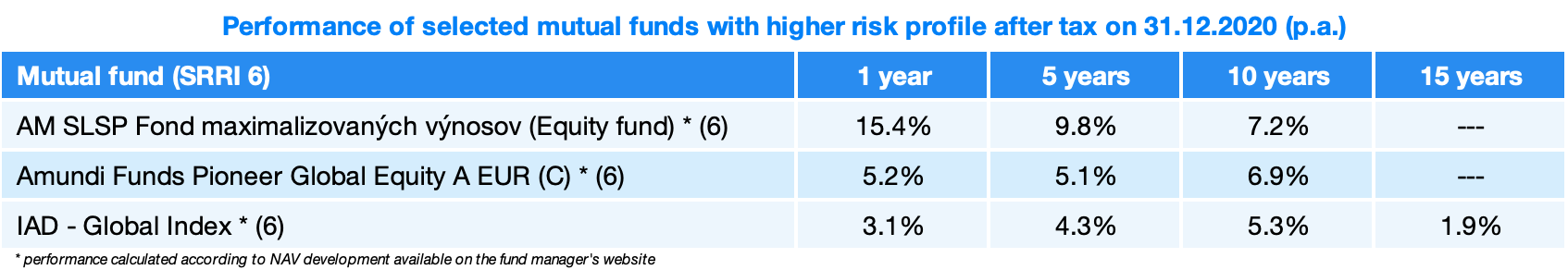

Due to higher market volatility, funds with SRRI of 6 became popular in the portfolios of Slovak mutual fund managers. Some of them were able to take advantage of the market developments – which we hadn’t been accustomed to in Slovakia. They definitely deserve a thumbs-up.

We need to stress, however, that higher appreciation is the result of higher risk – portfolios focused on fewer asset classes with higher volatility.

In spite of higher risks and volatility, long-term returns are still falling behind. In case of active asset management, the investors bear the risk associated with the manager and their investment strategy – on top of the traditional market risks.

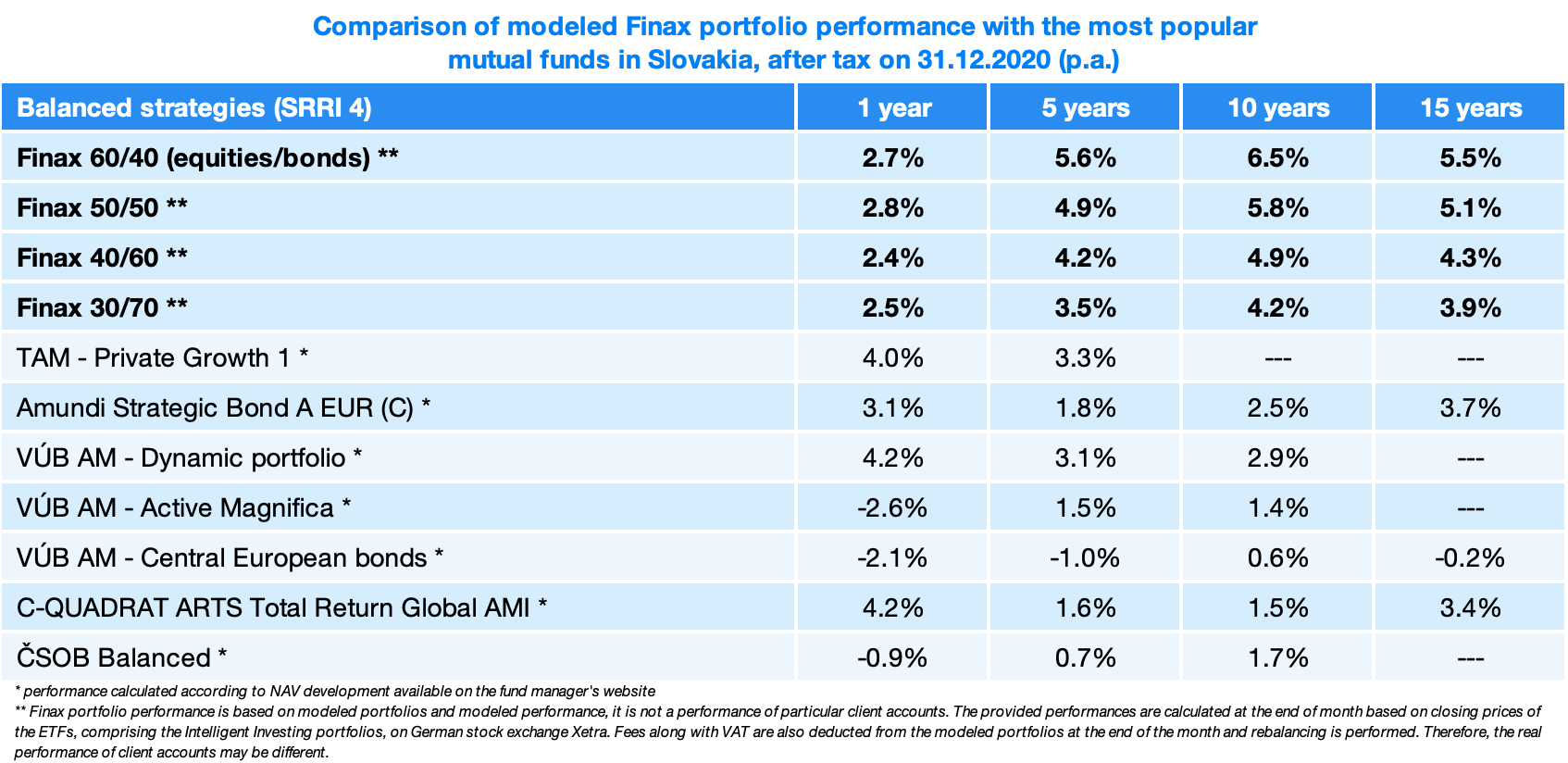

Balanced investments

Investments in the risk category 4 according to SRRI had equally wide range of performance matching the tumultuous market developments. Finax portfolios recorded returns in a narrow range between 2.4% and 2.8%.

Numerous mixed funds managed to achieve higher returns than Intelligent Investing. This risk category, with long investment horizon, also lives up to the predictions of probability – and passive investing of Finax dominates it.

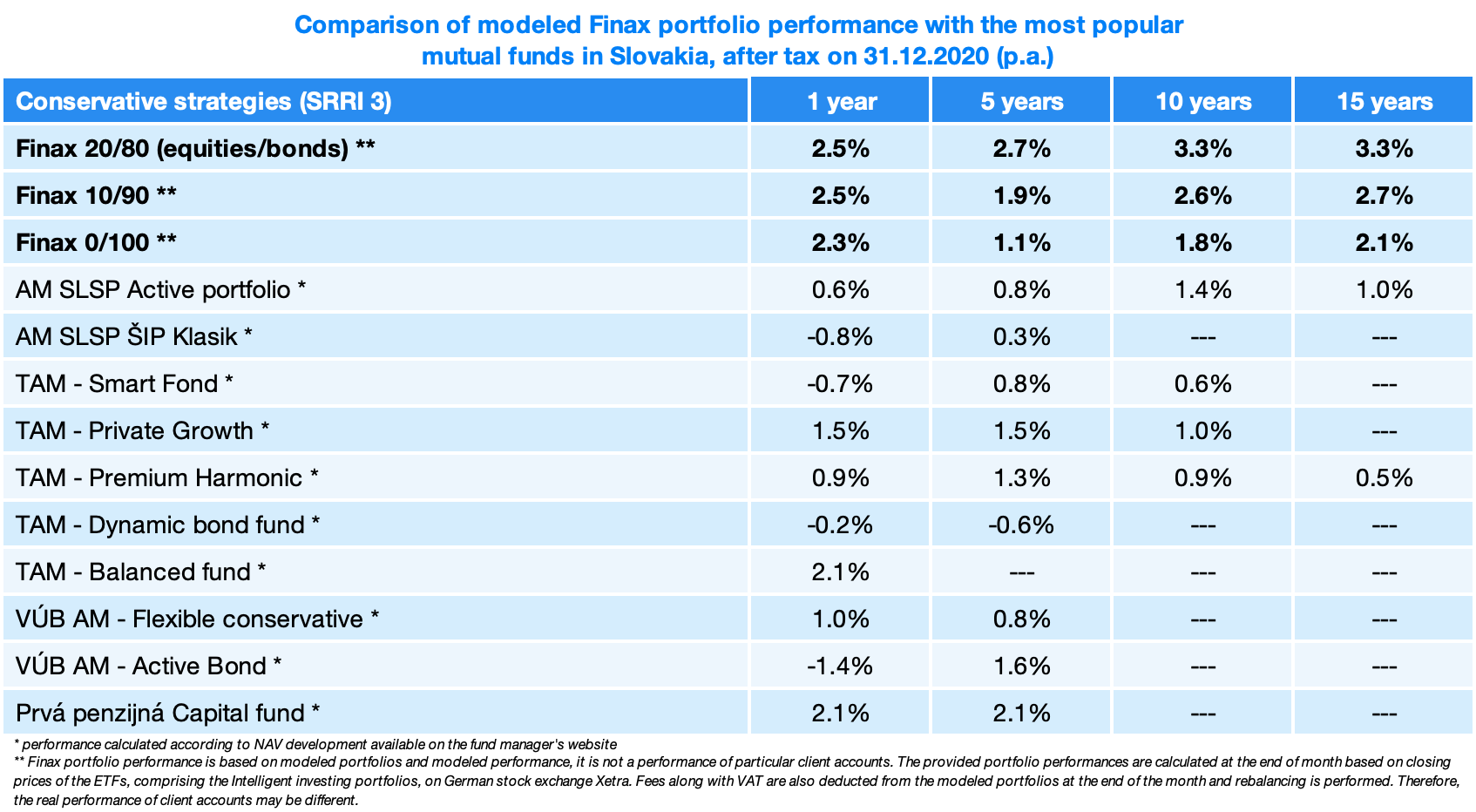

Conservative investments

This is the category which we hadn’t dominated in the previous years – conservative investments with volatility up to 5% (SRRI category 3). Last year, however, Finax conservative portfolios achieved higher returns than the competition.

Many investors condemn passive investing in bond indices with the interest rates currently at 0 or lower. Paradoxically, in Slovakia, this solution outperformed actively managed bond investments with broader offer.

What can be considered quite interesting regarding last year is the exceptionally low difference in returns between the most successful portfolio 90/10 (3.8%) and the most conservative 100%-bond portfolio with the lowest return (2.3%).

Considering porfolio profitability, 2020 can be labeled as “successful” even though not the most successful. We need to understand what the World and the markets went through.

The turbulent year also helped some managers to outperform the indices. It is still more of an exception than a rule.

Achieve higher returns vyššie výnosy

Start investing tax-smart via low-cost ETFs.

Passive investing offers significantly higher level of higher income security when compared to actively managed mutual funds. The long-term returns of Intelligent investing are the evidence of that.

Thus far we haven’t seen better investment strategy for small investors considering the risk-to-return than ETFs. If you want to build and appreciate your financial assets as effectively as possible, there is no better alternative for you than passive investing.

If you transfer your existing investment to the Finax passive portfolios we will give you a discount – 10% of the transferred investment will be managed for free for 5 years.

Furthermore, in January 2021 we have a special New Year’s offer – each deposit of 10 000 Euros and more means you won’t be charged any payment processing fees for the rest of your life on any of your accounts.

App Store

App Store

Google Play

Google Play

Difficulty

Difficulty