Like for most businesses, 2022 was a very challenging year for Finax due to the impact of the war. It was unlike any year we have experienced in our five years of existence.

I am extremely pleased that in 2021, which was one of the best years for the exchanges in decades, we thought about the back door. We have strengthened our capital significantly and built up a financial buffer of more than €500,000 for bad times, from which we were able to draw resources last year. This enabled us to pursue our vision despite the unfavorable situation in the markets.

We did not succeed in achieving all the plans we set out at the beginning of the year, yet in some ways, we achieved much more.

In this respect, I would highlight one victory we achieved last year. We were the first entity in Europe to be licensed to provide a Pan-European Personal Pension Product (PEPP), which we marketed under the name European Pension. This success has taken us from being a regional player to being on the European map of companies that make a difference in the investment world.

However, this leadership was hard-earned and we spent a large part of our design and programming capacity on it. That is why we will be launching some of the projects that were announced last year later this year.

The actual Finax results and comparison with our plans were reviewed by Rado in the blog post Finax results in 2022. In this article, I will therefore focus on the goals and plans for 2023.

Our goals and plans for 2023

The current economic situation and high inflation are not exactly playing into the hands of savings. Higher spending has made it harder for people to put money aside and they don't have as much spare cash as they did in previous years. Nevertheless, we have set ourselves quite ambitious targets:

- EUR 615 million in assets under management, which represents more than 65% year-on-year growth,

- 78,000 active clients, an increase of more than 80%, and our ambition is to get at least 20,000 clients into the European Pension (PEPP).

From a client perspective, which is probably of most interest to you, I would summarise our objectives for now under these six main headings, which I will discuss more below:

- we will expand our insurance product offering,

- good debt will the growth of your savings more efficient,

- the Finax mobile app will be the main tool for client communication,

- through Finbot, clients will be able to keep track of their assets,

- we will extend the European Pension (PEPP) to 7 EU countries.

We will improve our offering in term life insurance coverage

Already on 13 February, we launched new enhanced coverages for risk life insurance in cooperation with our partner, the Czech Komerční pojišťovna. For the majority of our clients (aged up to 55), this is the cheapest term life insurance available on the market.

What has changed in insurance:

- We have increased the death risk coverage to EUR 100,000.

- You can insure the risk of full disability for 100,000 euros and the risk of partial disability for 50,000 euros.

- We have added covers of critical illnesses such as cancer, heart attack, stroke, and many more up to €20,000.

- You can also take out permanent accident insurance for an amount of 20,000 euros with a progression of up to 500%.

- The insurance will be quarterly, very flexible in terms of the sum insured, without a required visit to the doctor, and you can open it in the mobile app in 2 minutes.

As you are used to with us, the younger you are, the cheaper the insurance. The maximum coverage between the ages of 26 and 35, which is the group where insurance is most in demand, will cost €349 per year, less than €1 per day.

The insurance will be the first "app-only" product for us (only available on the Finax app) and the speed of registration will certainly pleasantly surprise you. Unfortunately, we have not been able to resolve the legislative barriers to selling insurance abroad and so this product will only be available to clients living in Slovakia.

Good debt will make growing your savings more efficient

We had already planned to launch this product last year and we were still shrouding it in a bit of a mystery. That's why today I've decided to reveal more about it.

For a long time now, we have been dealing with a group of very dynamic clients who would like to borrow some money at a low-interest rate and invest it. Mathematically, it makes sense - you borrow at say 3% interest and invest in stocks that grow 8-9% (after fees) per year over the long term. By increasing your risk, you can earn a higher return.

Janči Tonka and I have done a lot of research on this way of investing. In particular, about lifecycling, which is an approach to investing that seeks to use credit and derivatives in the early stages of investing to increase returns with reasonable risk. An excellent book on the subject is Lifecycle Investing by Barry Nalebuff and Ian Ayres, for example.

On the other hand, we have a relatively strong group of clients who would like to invest some of their short-term capital safely with a higher fixed return and more flexibility than is offered by fixed-term accounts at the bank.

Today, we have part of the money in the Intelligent Wallet held in cash. We will be communicating a change in investment strategy on the wallet shortly, where cash will be replaced by an investment certificate. With this instrument, we will be able to lend to one group of clients at 3% p.a. and move a 2.5% yield into the wallet. Each group of clients can gain from this.

In the first phase, which we will probably launched in April, the loan will only be available to Elite clients and only in accounts that already have maximum risk (100% equity investments). If the project is successful, we would like to bring this project to clients with assets of over 10,000 euros at the end of the year.

Mobile application as a key element of our service

The Finax mobile app has undergone many improvements in the past year. The launch of insurance as an "app-only" product indicates how we are thinking about using it in the future. We see mobile as an essential, everyday tool for people. This is also why a significant part of our development capacity goes into its development.

This year, we have set the following goals for the app:

- To complete the development of all the functionalities that are available on the web, so that you can also access them in the app. Today, all we need to finish to achieve this are the functions of changing the questionnaire, changing the investment strategy, opening the pan-European personal pension product, and concluding a contract via a financial agent.

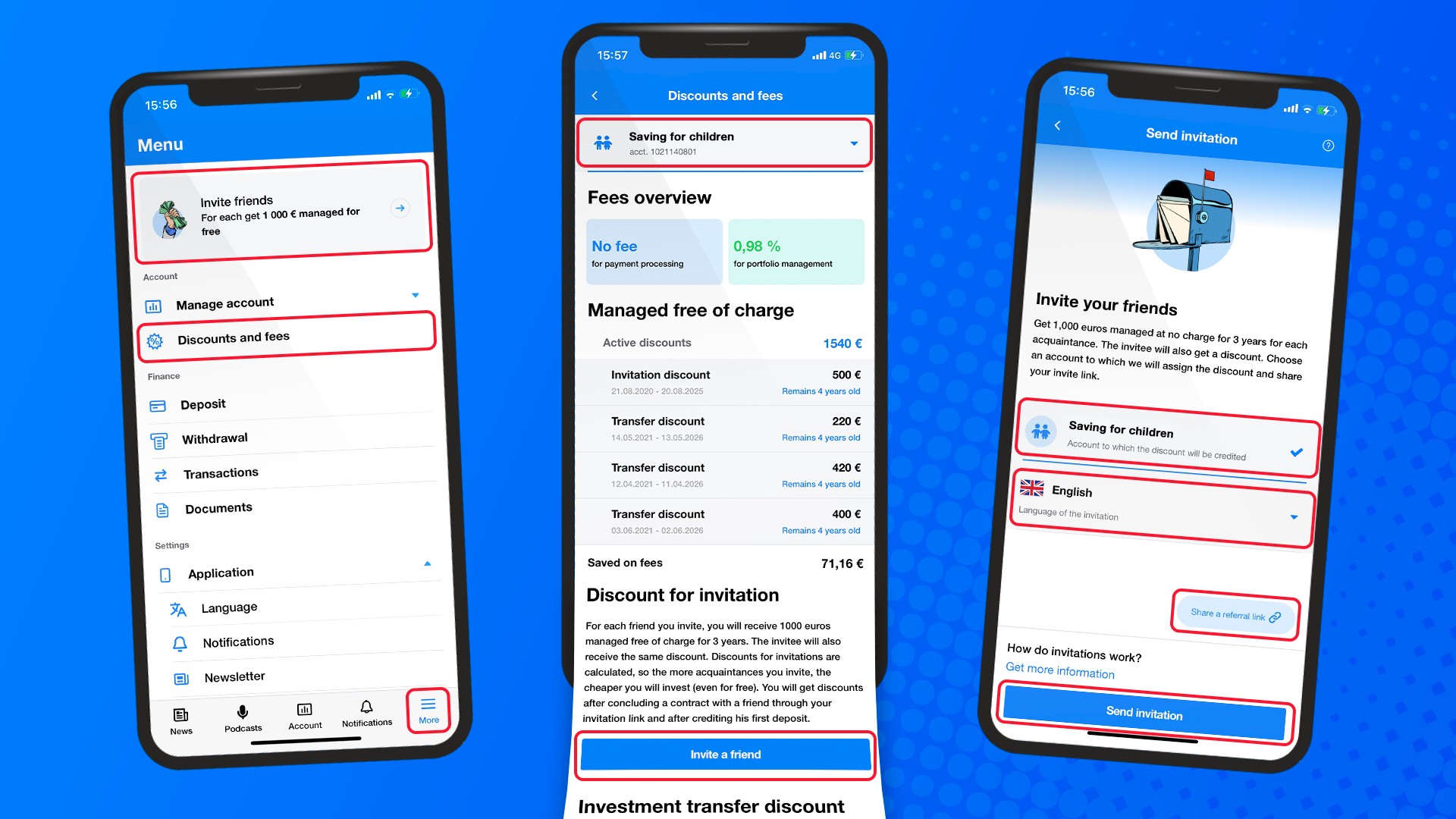

- To make a number of different small UX and UI tweaks that will make the app more intuitive, more modern, and most importantly, more fun for you to use. In this regard, we have already brought an overview of discounts in January, with a redesign of elements planned for March and some other improvements planned for the end of the year.

- Gamification will be a nice addition to passive investing, making investing more fun and keeping you involved in Finax activities. There will be various rewards and a nicer visualization of your personal finance milestones, which will also make you more motivated to build wealth, deepen the community of intelligent investors and allow you to participate more in our development.

- Multi-client account tracking. Thanks to this functionality, which we had planned to launch last year, you will be able to view your partner's or your parents' and children's accounts in one app. We have already done some work in this direction. You can already unpair mobile devices that connect to your account via the app after logging in to the site, which is a prerequisite for this functionality.

Personally, I am very much looking forward to these changes and I believe that they will be of great benefit to you as well.

Finbot as a tool for tracking client assets

Last year, we launched Finbot, an app that aims to automate the tracking of your family's expenses and has already found several thousand fans among users. If you happen to have missed what this app is all about, you can find all the details on our website www.finbot.eu. Don't miss our new YouTube channel and podcasts.

This year Finbot will bring some exciting new features:

- Everyone's goal (at least until retirement age) should be to grow their net worth. What you have in bank accounts, invested, in real estate, cars and other assets minus your debts makes up your net worth. To make it easier for you to keep track of your net worth, we will soon be one of the first European platforms of its kind to bring you a tool to track the value of your assets.

- Once we know the structure of your wealth, we plan to better visualize it and help you to optimize it according to your age, income, or other parameters.

- We will start automatic notifications to keep you updated on the status of your personal finances.

We will extend the European Pension (PEPP) to 7 EU countries

Perhaps the biggest piece of work ahead of us is in expanding our services and sales abroad. Selling investments is not like selling socks and it's not enough to just advertise. Long-term savings require a much higher level of customer trust and a professionally crafted product that is also well optimized locally from a tax perspective.

Today, Finax operates in five countries in Central and Eastern Europe and we have plans to expand to two more countries - Slovenia and Romania, where our goal will be to gradually build our brand and market position.

I want to set up a European pension.

We would like to launch the European Pension (PEPP) in all countries, offering savers a modern pension product. Through this, we would like to reach out to employers who operate across the Eastern European region and would like to unify their pension benefits across all countries. What are the key benefits of a European pension?

- If you change your country of residence, you can transfer your pension savings to another country.

- No matter what country you live in, your pension savings still follow the same rules - whether in Germany or Slovakia.

- It's cheap - the maximum annual fee is capped at 1% by European legislation, Finax charges an even lower fee of 0.6% + VAT.

- It has to meet strict criteria for future appreciation with reasonable risk.

- In each country, you can benefit from local tax advantages.

- The rules are set by the European Union and the political risk is therefore significantly lower than for national pension pillars.

The European pension offer for corporate clients includes the increasingly popular financial education for employees, presented in an easy-to-understand way. If you are interested in bringing this useful benefit to your company, be sure to let us know.

Today, Finax is licensed to provide PEPP in Slovakia, the Czech Republic, and Croatia. We have an application filed in Poland and we also want to launch it in Hungary, Romania, and Slovenia later this year.

If you know any Romanians or Slovenians in your area who might be interested in working for us, definitely let them know that we are looking for them.

What improvements would you like to see at Finax?

Our customer, our master. Sometimes you chase after some enhancements and the customer ends up not appreciating them at all. In the past, you have already managed to push some interesting ideas to us, which we have then put into practice. Therefore, I would like to ask you what else we should bring in 2023 (besides higher returns). We would be very grateful for your insights and ideas.

Please fill in the questionnaire.

Already 60 people at Finax are making sure that your life stands on a solid financial footing. On behalf of the entire Finax team, thank you for your trust.

App Store

App Store

Google Play

Google Play

Difficulty

Difficulty