Are you a person who thinks about their future and doesn't leave their fate to chance? Do you try to manage your finances responsibly to ensure that you are prepared for every unexpected event that life offers?

This product is for you. Finax introduces a new product that should be included in portfolio of every financially responsible person.

We are proud to present a great financial product that covers a major life risk – term life insurance.

What will you find out in this article?

- Basic parameters and advantages of life insurance through Finax

- Why term life insurance through Finax?

- What led us to start offering term life insurance?

- Who is term life insurance intended for?

- How does term life insurance through Finax work?

- Example of combining cheaper insurance with investment product

Basic parameters and advantages of life insurance through Finax

- Insurance covers death by any cause from Komerční pojišt'ovna, a.s.,

- maximum sum insured EUR 50 000, minimum sum insured EUR 5 000 (unit of sum insured EUR 5 000),

- favourable price (the lowest in Slovakia based on survey of insurance prices of competitors),

- minimum exclusions,

- very simple and easy to understand insurance concluded with a few clicks online,

- no health questionnaire,

- high flexibility, no strings attached (you are always getting insured for one year in advance),

- increasing price with age (4 age groups),

- Finax is the insurer and the client is the insured (group insurance - the reason for the low price).

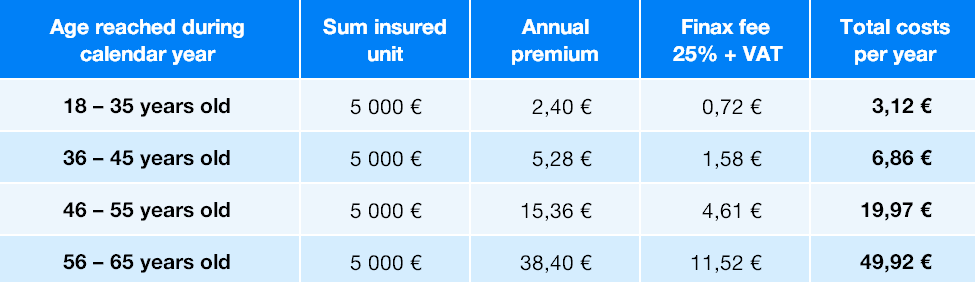

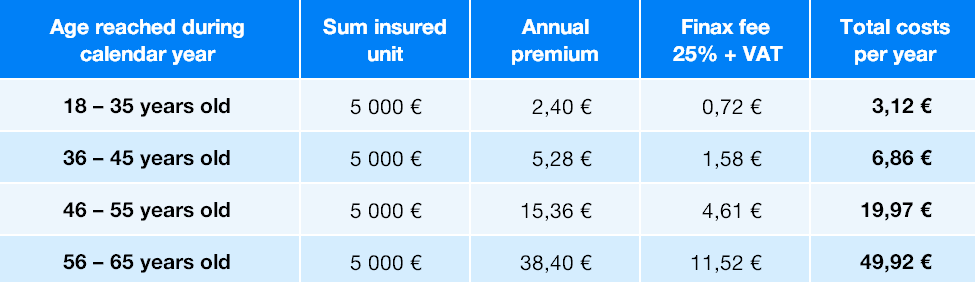

The cost of insurance per year, included is the Finax fee per unit of sum insured, based on the age of the insured:

If you are 30 years old and you want to insurance that covers the risk of death for sum insured of 50 thousand euros, the premium will only be 31,10 euros per year. For a 50-year-old person, the premium would be 199,70 euros (in both examples the fee and VAT are included).

Why term life insurance through Finax?

The main advantages of term life insurance offered by Finax are its price, simplicity and minimum exclusions. For little money, you get excellent coverage of the risk of death, without any questions nor restrictions.

Lower price compared to competitors

To assess the premiums, we have had a look at the competition, namely the 13 most popular insurance companies in Slovakia and their premiums for the coverage of risk of death. Our survey managed to get the premiums for individual term life insurance for 11 of those companies.

Insurance companies usually offer insurance for a certain horizon and the insurance premium is usually the same for the entire duration of the insurance contract. The annual premiums are mainly based on the insurance horizon and the age of the insured, as well as other parameters.

The premiums can vary according to the risk group, which is based on the profession or the health conditions of the insured. Additionally, various discounts are also present and insurers also offer sums insured that change over time. In comparison, we have only focused on a basic service offered by our competitors.

The average annual premium of 11 insurance companies offering term life insurance with a sum insured of EUR 50 000 for a 20-year-old person is EUR 266 (sum insured and premium are constant throughout the whole term of the insurance contract).

In case of term life insurance through Finax, a 20-year-old would pay for the term life insurance with sum insured of €50k for the first 15 years €31,20 per year, for the next 10 years €68,60 per year, €199,70 thereafter, and between the age of 56 and 65 €499,20 per year.

Aren’t constant premiums better?

We have deliberately chosen an increasing insurance premium. Assets are the best form of insurance. It is the elderly who have already built up assets, so for them the need to have life insurance is lower.

Conversely, young people have not had the time to build up sufficient assets, so the need to have insurance coverage is more acute in this case. Most young people are active and have commitments (children, mortgages). Insurance premiums at this age are cheaper and do not represent a significant burden on the family budget.

Therefore, we offer a low-cost term life insurance solution that allows for a larger portion of income to be placed in savings and investments, so that the need for insurance will decrease in the future. This combination works out significantly better financially.

High flexibility, no strings attached

The importance of flexibility is often underestimated in insurance. This is the main reason why the average life expectancy of an insurance contract in Slovakia is around 6 to 7 years.

For an insurance with long term horizon, the constant premiums take into account the greater risks at older ages, which is why people overpay for this insurance when they are younger. In the event of termination, the insured had to unnecessarily pay for the future risk. Re-insurance at an older age is consequently more expensive.

Most people in Slovakia are thus overpaying for high premiums. Taking into account the duration of insurance contracts in Slovakia, we consider the premiums increasing with the age of the insured to be significantly more advantageous.

At the same time, with Finax insurance you are not bound to anything. You pay the premiums for the calendar year ahead, during which you are covered for the risk of death. If for any reason you do not want to be insured for the following year, you simply terminate the insurance and do not pay for the following year.

You can then be re-insured at any time at a pre-known price based on your age. Simply put, you can terminate your insurance at any time without affecting its price, which is not the case with standard insurance contracts.

Simplicity

Don't waste your time and money. Conclude an insurance conveniently online. You don't have to meet with anyone, visit a doctor, send in paperwork, or physically sign the contract. You are automatically insured at the beginning of the month following you joining the group insurance through Finax.

How do I conclude an insurance in Finax?

What led us to start offering term life insurance?

One of the requirements for healthy personal finances is treating the potential risks that life has to offer. These include, in particular, events that lead to loss of income, be it health problems, loss of employment or perhaps death.

Finax mission is to make Slovak citizens financially educated and secured people. Security can only be achieved by building sufficient wealth. However, the road to financial independence can be blocked by a situation that we cannot control or completely prevent.

However, we can create safety nets that help us limit the impact of such events. A basic patch for most unforeseen negative life situations is an emergency fund. However, even this cannot cover all of life's risks, such as death.

The best security against unforeseen events provide assets that you may leave to your family. However, building up assets takes time, during which you need to be prepared for potential risks.

Insurance products have a place in clients' portfolios as long as they cover real risks to a relevant extent and at a reasonable price, which is not often the case with insurance contracts in Slovakia.

If you are a breadwinner, a parent, have mortgage, your job exposes you to risks, e.g., you work manually or you travel a lot, and you have not built-up sufficient assets to cover necessary expenses over a longer term horizon, it is wise to cover some of your potential life risks with insurance coverage.

But we don't want you to overpay on your insurance. Our goal is to offer convenient products that make sense in terms of setup and price. I believe we have once again succeeded in doing so.

As your finance partner, we have had the vision of bringing a great insurance solution. For two years, we have been searching for a suitable product and partner that could meet our demanding requirements, namely a well-built, quality insurance product at a competitive price.

At the same time, we have felt the demand from clients who often ask us questions regarding life insurance or our opinion on insurance contracts and their evaluation.

The inspiration for the introduction of insurance was for us once the very popular and very unfortunate investment life insurance combining risk insurance with investing. Unfortunately, this product is very overpriced and I have summarised my personal experience in my blog: 10 years of experience with whole life insurance.

Finax offers you the possibility to fulfil two main goals - building wealth and insuring against the risk of death simultaneously – with the help of two advantageous stand-alone products under one roof. High transparency, no hidden fees, competitive pricing and great parameters that lead to significantly better results, your satisfaction and money saved.

Who is term life insurance intended for?

Young people

As is clear from how the product is setup and the previous paragraphs, we primarily target the younger part of the Slovak demographics. However, the price comparison shows that it is beneficial even for older people.

It is precisely among younger clients that we perceive a greater need for insurance coverage. The risks are not high, but as the saying goes better safe than sorry.

It is the young people who have not yet built-up their assets, which would be used as a security for the rest of their lives. Most of the time, they have bigger liabilities such as a home mortgage. At the same time, they might even be responsible for minor children.

But they also have one huge advantage, which we in insurance take advantage of. Their health is more robust and they are not at risk of illness to the same extent. This is fully reflected in the price of the insurance.

Risk groups and employees

The insurance is very attractive for people in higher risk insurance groups, i.e., manual workers who are naturally exposed to higher risks as a result of their profession.

Unless you are a stuntman or a professional athlete, Finax death insurance does not differentiate between risk groups based on the profession and the same premiums apply to everyone.

Many employers pay for expensive life insurance policies as a work benefit for their employees. With our product, an accurate and predictable insurance for groups of your employees with very flexible insured sums can be made. Contact us and we will create an individual quote for your employees.

How does term life insurance through Finax work?

Insurance risk

This insurance provides coverage against the risk of death from any cause (it covers both accidents and illnesses). In the event of the death of insured, the sum insured will be paid out to their survivors, whom can be determined in advance in the insurance contract.

The insurance cover contains only minimum number of exclusions, e.g., diagnosed illnesses prior to entering the policy, professional sport, suicide. For a complete list of the ten exclusions, please refer to the insurance terms and conditions.

Who can get insured?

It is a group insurance for our active clients. Our active clients aged between 18 and 64 years old with permanent residence in Slovakia can get insured. Thanks to the group insurance, the risk is spread, which significantly reduces the price compared to the competition. Clients who have activated at least one account with Finax will automatically see a new "Insurance" section in the menu.

Unfortunately, the provision of the insurance itself is not possible. If only one of the partners has an account in Finax, the other partner has the option to register separately as a client (minimum one-time deposit of EUR 10) and subsequently get insured.

What is the permissible sum insured?

The minimum sum insured is EUR 5 000 and the maximum sum insured is EUR 50 000. To make insurance as simple as possible, you can always insure in multiples of EUR 5 000.

The reason for the maximum sum insured of EUR 50 000 is the requirement of the insurer for a health questionnaire or medical examination for sum insured above this limit. In the future, and after discussions with the insurer, the increase in the maximum sum insured might be possible.

How much will the insurance cost me?

The sum insured is always a multiple of the sum insured unit of EUR 5,000, up to a maximum of EUR 50 000. Then, according to the sum insured and the age reached in the calendar year in which the insurance is concluded, the price of the insurance, including the Finax fee and VAT, is determined.

For the first year, you will pay the insurance on a pro rata basis. For example, if you take out insurance on 15 June 2021, the insurance will start on the first day of the following month, i.e., 1 July 2021, and you will pay only half of the yearly amount.

Can changes in the insurance cover be made?

You can terminate your insurance at all times. There is no termination fee associated with it. The insurance is terminated at the end of the calendar year. You can also change the sum insured and the change will take place from 1 January of the following calendar year. The changes in beneficiaries are immediate.

Example of combining cheaper insurance with investing

In order to showcase the profitability of term life insurance offer by Finax, we have prepared an example of a 20-year-old client, who decided to insure against the risk of death for sum insured of EUR 50 000 through Finax. This is then compared with the average price of insurance on the market.

We wanted to see how the client's assets would appreciate if the difference in the cost of the insurance through Finax was invested. Find out more in the following blog: Why is life insurance through Finax so advantageous?

We can disclose that as the client grows older, their assets will also grow, which will allow them to gradually reduce the sum insured, since the total insurance coverage and the value of the assets will always exceed the required EUR 50 000.

The sum assured will even drop to zero over time and the client will be left with assets on retirement well in excess of EUR 50 000. With the competitors’ premiums you will be left with nothing.

In the example, you will understand exactly what our motives are and recommendation on how to approach financial security more advantageously. Even if a client does not make an insurance claim until their retirement, they will be left with decent assets for the same money spent.

Thank you for insuring yourself intelligently.

App Store

App Store

Google Play

Google Play

Difficulty

Difficulty