The year 2022 has set up a market turnaround on all fronts. After a decade of above-average returns, low interest rates and oblivious inflation, suddenly there was no asset class to hide in. Limited supplies of materials, rising interest rates, and the war in Ukraine all contributed to declines in investment portfolios.

Equity markets descended into a bear market during the year, losing more than 20% since the last peak. Bonds, which experienced their first bear market in 76 years, also posted an unprecedentedly weak performance. Bitcoin wrote down two-thirds of its value, the real estate market literally froze, and commodities also slipped into losses.

Both conservative and aggressive investors have therefore experienced a challenging year. Several are looking at their numbers and damning investing or looking for players who can earn positive returns in the current environment.

Have there been any standout winners in the Slovak market? Have active managers or passive investors been better able to defend themselves? Are long-term investors still in profit? Let's look at the numbers.

If the results convince you that Finax is the best long-term destination for your assets, don't hesitate to take advantage of the investment transfer discount. We'll manage half of the amount you move free of charge for 2 years. Read more about the discount in this article.

Note on the data quoted: All data related to the performance of Finax portfolios represent the actual performance achieved by the sample portfolios. We have described how we calculate actual performance in the article How do we calculate the actual performance of Finax portfolios? Past performance is no guarantee of future returns, and your investment may result in a loss. Find out what risks you are taking when investing.

Tax Disclaimer: In our comparisons, we work on the assumption that the client is a Slovak tax resident. The tax treatment depends on each client's individual circumstances and may vary. Income from the transfer of securities (Art. 8(1)(e) of Act 595/2003 Coll. on income tax) traded on a regulated market are exempt from tax after one year from their acquisition (Section 9(1)(k) of Act 595/2003 Coll.). Income from the sale of ETFs forming the Finax portfolios meets the tax exemption conditions if they are held for at least 1 year and are not included in the taxpayer's business assets. This exemption does not apply to investors who are not Slovak tax residents. Income from redemption (redemption) of units (Art. 7(1)(g) of Act No. 595/2003 Coll.) is subject to tax. The taxation regime for Finax portfolios may change in the future. In our comparisons, we work with the net after-tax income for Slovak tax residents under the currently applicable legislation and do not take into account any rebalancing in the previous year when assessing the tax liability on the Finax portfolios. We use a 19% income tax rate to calculate the net income of mutual funds (to determine the amount of taxation of income from mutual funds).

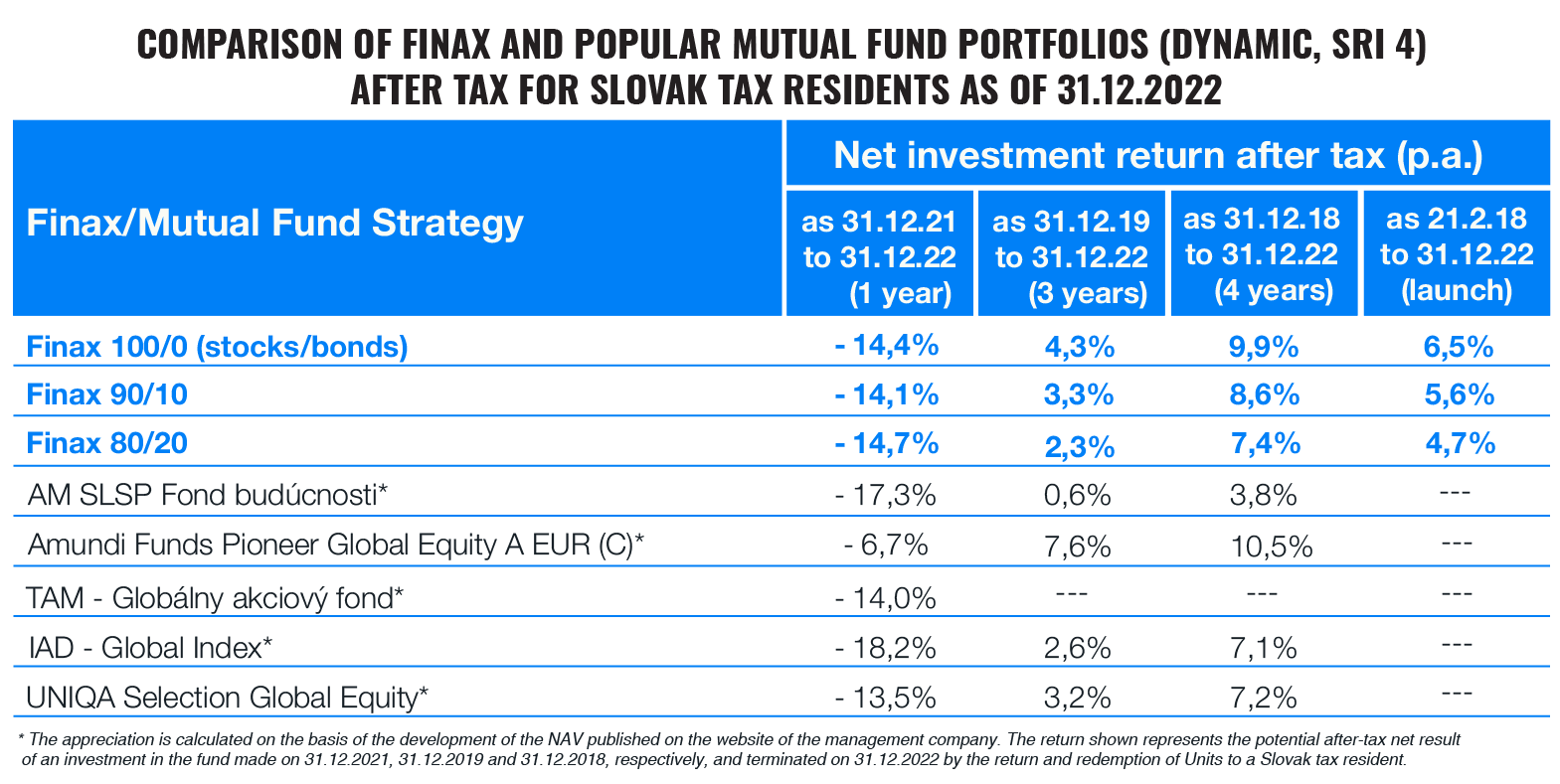

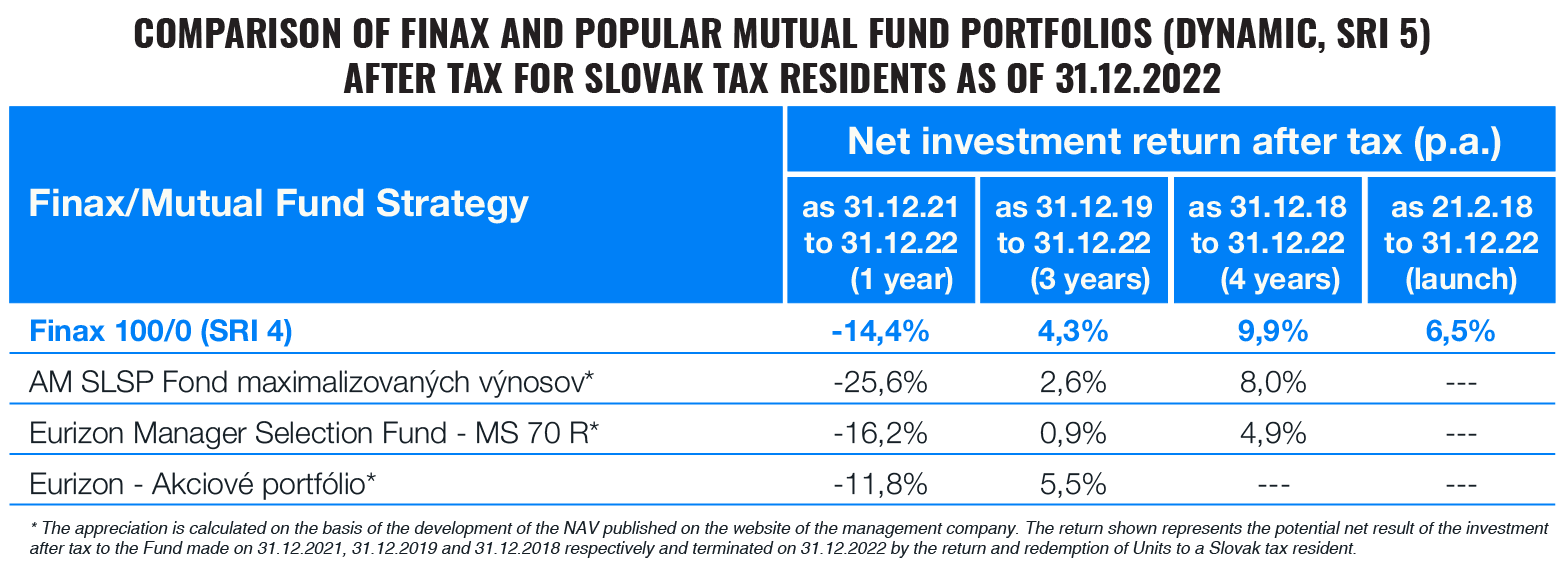

Dynamic Strategies

Dynamic portfolios invest in assets with the highest long-term return (mostly stocks), which also carry the highest risk of portfolio value fluctuations. This year, the equity markets have reminded us what this risk looks like. All dynamic portfolios and benchmarked popular mutual funds ended in the red over the past year.

Last year's financial market performance is no reason to denounce investing. Downturns and risk belong to it, representing an inherent cost of long-term returns. On average, a bear market occurs almost every 5 ½ years. Yet every single market downturn in history has been weathered and many times presented a great opportunity to buy a share of the growth of companies at an exceptionally low price.

In a few years, most investors may regret the missed opportunity to invest more during this period. Many are waiting for a downturn to invest larger amounts of savings and are reluctant to invest when that situation arises.

Investing is a long-term and continuous process. Do not make hasty decisions based on a small part of your investment horizon. There is risk associated with investing, but with long term and regular investing, pleasing results will come. After all, the performance tables themselves confirm this.

Over the past year, Finax's dynamic strategies have booked losses in the range of 14% to 15%. Mutual funds have performed similarly, some even worse. Hence, it is not true that active investors can defend against bear markets better than passive ones.

Critics of passive investing often accuse it of accepting losses in downturns and not seeking out parts of the market that make money even in a crisis. Last year proved that such attempts largely don't work, as the market is unpredictable. Declines are, in short, a natural part of investing.

A look at the 4-year horizon confirms our hypothesis that time is the best cure for market downturns. All investment solutions have ended in profit over this longer period. Not even a year of downturns managed to devalue the long-term investors' assets.

Moreover, this horizon shows the dominance of Finax over most of the investment solutions compared. This is true not only in the SRI 4 risk category, to which our dynamic strategies belong, but also in the higher SRI 5 risk class. Low fees, tax exemption after one year of holding ETF funds, and a passive approach that eliminates human error have allowed our clients to make the most out of periods of market growth, even compared to funds that carry more risk.

A bright exception is the Amundi Funds Pioneer Global Equity A EUR (C) fund. It has managed to withstand the current bear market better than any of the available portfolios mentioned, for which it clearly deserves praise. It was the only mutual fund to beat Finax in the last 4 years.

However, it should be remembered that dominance for one year does not necessarily mean anything in the world of investing. Studies show that mutual funds that top the rankings in one year may not even stay in the top half of the best performers in subsequent years.

It proves a valuable lesson about investing. Over the long term, it is extremely difficult to beat the market. However, if you move your investments into a passive, low-fee, tax-free solution, it can save you money. That’s why you should focus on these parameters when choosing an investment solution.

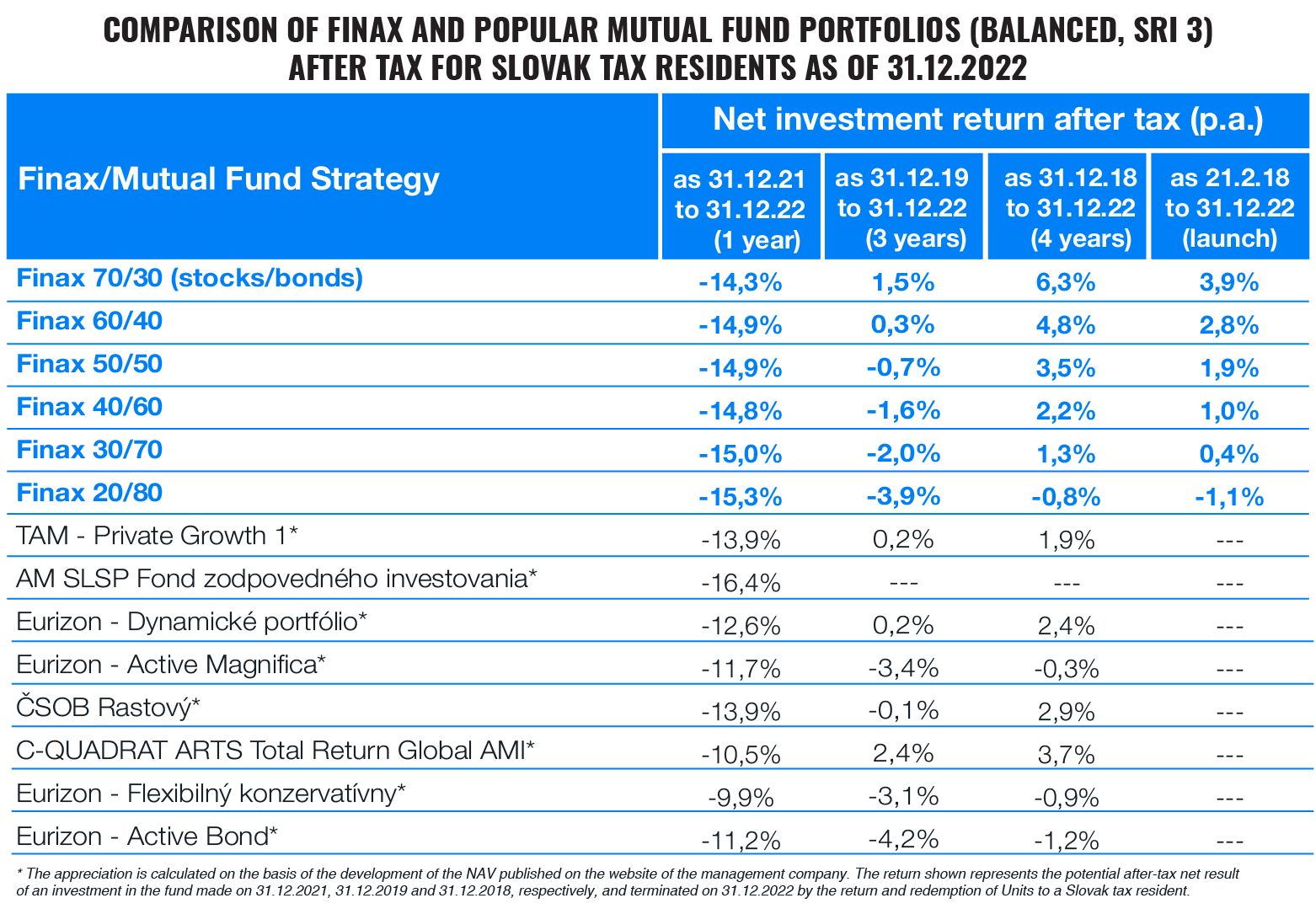

Balanced Strategies

Balanced strategies combine riskier investments in stocks with safer investments in bonds, commodities, or money market instruments. The new SRI indicator has assigned more portfolios into this category compared to the SRRI indicator from the past comparisons.

Finax's balanced strategies complement equities with bonds, which tend to fluctuate less. 2022 was a historical rarity: due to unprecedentedly rapid interest rate hikes by central banks, we witnessed the first bear market in bonds in decades.

Portfolios with a higher weight of bonds have therefore experienced an unusually challenging year. Paradoxically, more conservative solutions have seen greater losses than dynamic strategies.

Over the past year, our portfolios performed slightly worse than our competitors, who also failed to avoid double-digit losses. This was mainly due to the long average duration of the bonds in our portfolios. Duration refers to the time it takes for a bond to pay back the amount an investor bought it for. The longer the duration, the more sensitive bond prices are to rising interest rates.

When investing in bonds, it is also true that the reward for higher risk is a higher long-term return. Bonds with longer durations tend to offer higher yields, but you have to wait until they get paid out.

Today’s bond market also offers an attractive investment opportunity. Thanks to rising interest rates, even relatively safe government bonds are now yielding around 3-4%. If you give your investment enough time, the gradual payout of high interest can nicely appreciate your savings.

This is indicated by the horizon of the past 4 years, where most returns are positive. A number of Finax's balanced strategies have been able to offer more interesting returns than those of our competitors.

The results confirm the philosophy of long-term investing. Even a balanced investment should not be a matter of two years. The reward for patience and risk-taking is the long-term beating of inflation and appreciation of savings.

Conservative Strategies

For the reasons described above, it was our conservative bond portfolios that suffered the most over the past year. The rise in interest rates sent them into losses even on multi-year horizons.

Competing funds are in a similar position, as well and did not avoid high losses. The best-performing defenders lost similarly to our Intelligent Wallet over the past year. Over the longer term, the funds have been more successful in making money.

Again, recall that bonds have always recovered from downturns and benefited from economic growth as well. At current rates of return, it would not be surprising to see the next few years deliver returns above their long-term averages, offering conservative investors a recovery.

A New Risk Indicator

Earlier this year, new regulation came into force which, among other things, includes new rules for calculating the risk indicator for investment products. In the past, we have used the Synthetic Risk and Reward Indicator (SRRI) in comparisons. From now on, the SRI (Summary Risk Indicator) will be used for risk comparisons.

The SRI can have a value between 1 and 7. A higher number means a higher potential return, but also a higher risk of fluctuations in the value of the portfolio. Compared to the SRRI, it takes several extra factors into account in the calculation. That’s why some strategies have moved into a different category.

Portfolios with the same SRI have a similar risk profile. This allows you to compare which solution offers the most attractive returns given the underlying risk. We have selected funds with a comparable risk to our portfolios based on the SRI.

Mutual funds are required to disclose this indicator in their key information document (KID). Finax is not subject to this legal obligation, but we wanted to go the extra step to make it easier for clients to compare products that match their risk appetite.

The table below shows the SRI indicators we computed for each portfolio. We have used a sample of actual daily returns achieved from 21.02.2018 (the date of first investment in our portfolios) to 31.12.2022.

Please note that we did not have long enough data on daily returns of the Intelligent Wallet. The method applied to the remaining portfolios requires at least two years of actual daily returns. The Wallet was launched on 27.07.2021, which is why it does not cover such a long period.

In order to maintain consistency in the method of calculation, we have decided to leave the Wallet without a category. In comparison, you will find it for conservative portfolios that have an SRI of 2. The Wallet does not need to belong to this category.

Comparison Methodology and Selected Mutual Funds

In the tables above, we have provided a comparison of the net performance after fees and potential taxation (for Slovak tax residents holding the investment for a period of at least 1 year) of hypothetical investments in the Finax portfolios and the most popular mutual funds in Slovakia exited as of 31.12.2022.

In the case of Finax portfolios, we also present the performance since launch, i.e. from 21.2.2018 in the case of Intelligent Investing and from 27.7.2021 in the case of the Intelligent Wallet. You can read the methodology for calculating the actual performance of our portfolios here.

We define popular mutual funds as the largest mutual funds or funds with the largest net sales in the past year in each risk category. At the same time, we try to include all key asset management companies whose services are used by Slovaks.

We have selected 21 funds for the comparison. Unitholders' assets in these funds amounted to almost 3.7 billion euros as of 31 December 2022.

Below you will find the compared funds with the indicated ongoing fee (source documents: KIDs) and the size of assets under management of the fund in Slovakia (source: Slovak Association of Asset Management Companies as of 31.12.2022). The above fee includes all ongoing costs of the fund, including transaction costs.

Finax charges a portfolio management fee of only 1% p.a. + VAT and a payment processing fee of 1% + VAT for payments up to EUR 1,000 (price list of services). The latter fee was not included in our calculations. We plan to abolish this fee in the coming months. In addition, you can reduce your fees by using the investment transfer discount or the recently increased discount for inviting a friend.

Asset Management Slovenskej sporiteľne:

- Fond maximalizovaných výnosov, 2.01%, EUR 549.2 million,

- Fond budúcnosti, 2.02%, EUR 118.4 million,

- Aktívne portfólio, 1.66%, EUR 380.1 million,

- Fond zodpovedného investovania, 1.4%, €151.1 million.

Amundi Funds:

- Pioneer Global Equity A EUR (C), 2.22% + performance fee, €125.5m.

C-QUADRAT:

- ARTS Total Return Global AMI, 2% + performance fee, €67.9m.

ČSOB Asset Management:

- Rastový, 2.29%, €74.1m.

Eurizon Asset Management Slovakia:

- Akciové portfólio, 1.56%, €298.3m,

- Flexibilný konzervatívny, 1.43% + performance fee, €83.8m,

- Dynamické portfólio, 1.74%, EUR 422.8 million,

- Active Magnifica, 1.61%, €134.3 million,

- Active Bond, 1.41% + performance fee, EUR 102.0 million.

Eurizon Capital:

- Manager Selection Fund - MS 70 R, 2.24%, €118.1m.

IAD Investments:

- Global Index, 3.86%, EUR 119.0 million.

Tatra Asset Management:

- Globálny akciový fond, 1.29%, EUR 84.8 million,

- Private Growth 1, 1.87%, EUR 171.0 million,

- SmartFund, 1.62%, EUR 165.6 million,

- Private Growth, 1.73%, EUR 145.4 million,

- Balanced Fund, 1.51%, EUR 171.8 million.

UNIQA Investment Company:

- Selection Global Equity, 1.82%, €63.4 million.

App Store

App Store

Google Play

Google Play

Difficulty

Difficulty