More than half a year passed and it is time for the first review. Only six months managed to turn all expectations from the beginning of the year upside down. 2020 will forever be remembered as the year of the black swan.

The black swan, in the context of finances and probability, is an unexpected and unpredictable event with negative consequences on the economy, society and financial markets. COVID-19 represents it perfectly.

The world had to quickly adapt to the new reality. Within a few weeks, our lives have changed and the unthinkable became a reality. Naturally, the change in the society has also led to a change in consumer and work behaviour.

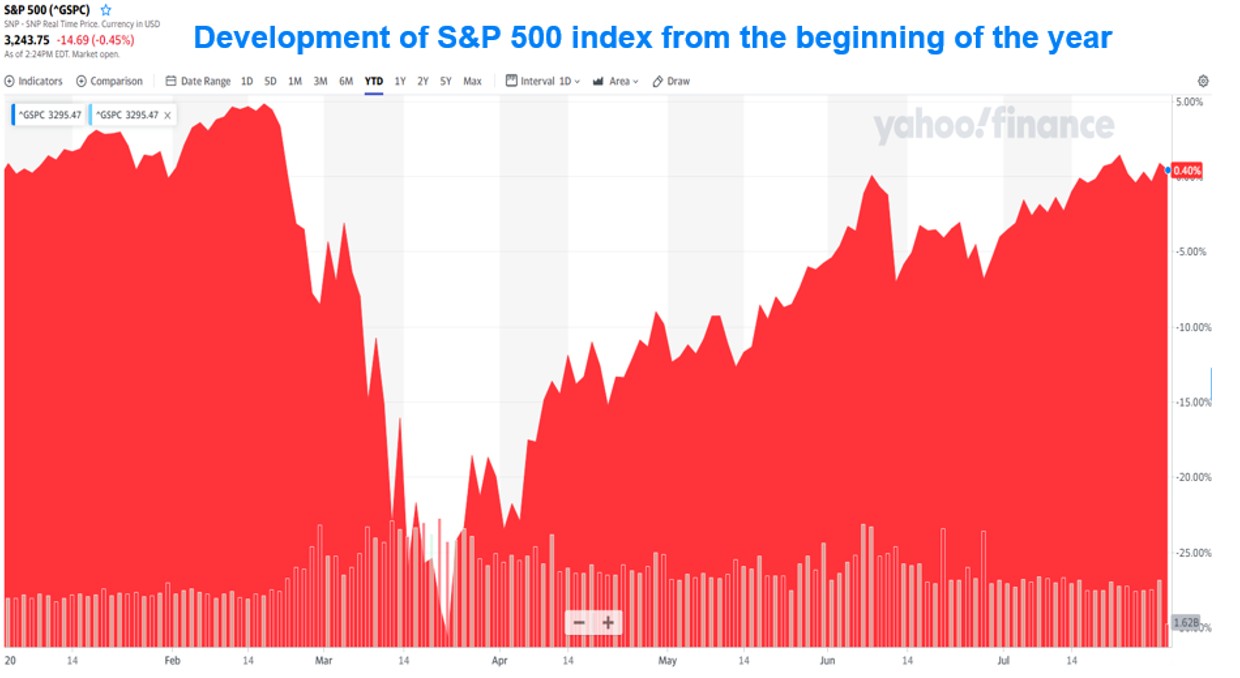

The resulted in the worst global recession in modern history. It has not left the financial markets untouched, as they also rewrote the history books. Stocks recorded the fastest slump in history. In six weeks, they lost on average about 35%.

This created a perfect environment for emotional and exaggerated reactions. Many people and also investors saw the "end of the world" and expected a radical restructuring of the economy and society.

The crisis has been averted for now. It has once again been confirmed that human society is unstoppable and adaptable. We simply got used to the new reality. Countries responded promptly and the majority approached the fundamental challenges responsibly.

The pandemic did not turn the world upside-down as predicted, but only accelerated the current trends. It has strengthened the online space, knowledge economy, working from home and sped up the decline of basic materials sector, traditional heavy industry and other related industries. In few months, it moved the development a few years forward.

The markets quickly bottomed out and they began to go back to normal at a similar pace as at which they collapsed. The stabilization is mainly due to massive incentives from governments and central banks, which can also be called unprecedented. But also, the fact that the "end of the world" is not happening this time either.

At the beginning of the pandemic, separate article was devoted to the development of financial markets. The coronavirus brings an investment opportunity. In this article, I pointed out that, just like any other crisis, this crisis will end sooner or later and at the end of the day it will only present another opportunity.

Most people, overwhelmed by negative emotions such as fear will, at the end of the crisis, bang their heads against the door because of their hesitation or because they acted rashly. But the speed at which the markets stabilized and returned to normal surprised us as well.

Controlling emotions is never easy, even for experienced ones. I have to admit that this time, I was unable to follow the basic investment rules that we promote so extensively at Finax. The psyche slightly overcame rationality in my case as well.

Although I increased the volume invested during the downturns, which of course I am extremely pleased with, I did not do so sufficiently. Like many of you, concerns about future developments have created doubts in my mind. I planned to spread the potential investments, as I also recommended in the above-mentioned article.

The COVID-19 crisis thus confirmed one thing in particular. Investments are really not worth postponing, as we have seen many times in the Finax's short history.

Of course, the economy has still not fully recovered, and it is absolutely not my intention to claim victory. The pandemic is gaining momentum every day, the economic recovery still has a long way to go and remains fragile. Markets will remain volatile and they might even approach previous lows.

In any case, it has been confirmed that nothing lasts forever, people can get used to extremes and they are unable deny themselves pleasures for a longer period of time. Growth is natural and desirable for human society. Therefore, the right and healthy approach, not only from a financial point of view, is to be a cautious optimist.

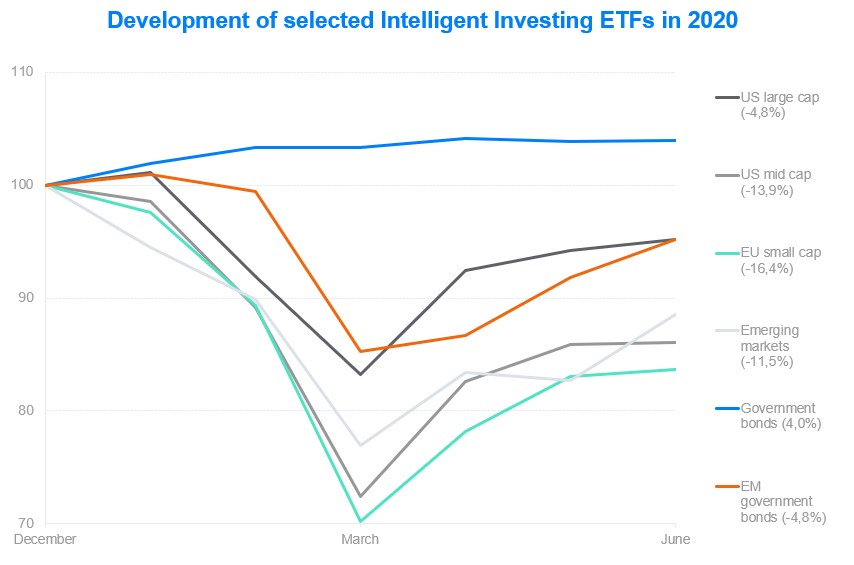

How did the individual asset classes develop in the first half of the year?

It should come as no surprise that in the first half of this year, it was not easy to make money on the financial markets, and only few managed to do so. The vast majority of assets are at a loss compared to the beginning of the year.

As usual, during the times of crisis assets considered to be safe havens, such as government bonds of selected countries or gold, have prospered.

Therefore, the most affected asset classes are those that are most sensitive to economic development. These are mainly stocks of small and medium-sized companies.

Large US stocks have maintained their status of top assets in recent years. The S&P 500 index is dominated by technology giants, who have businesses built mainly on online services. This was the area that did not decline as a result of the corona crisis, but on the contrary benefited from social change.

The only profitable asset class among our ten basic funds on which we build intelligent Investing portfolios have been the aforementioned global government bonds.

Their development during crisis showed that bonds are justified in investment portfolios, despite the negative interest rates and high bond prices. Not only do they reduce portfolio volatility, they can also achieve yield in difficult times, even though many have not been able to imagine where they could grow further. But new horizons can still be found.

The first major rebalancing

The development of financial markets tested the Finax's investment strategies for the first time. The decline of markets caused the rebalancing to be broadly activated for the first time. It was used on almost three thousand accounts of intelligent investors.

And it managed to fulfil expectations and work as expected. It launched almost exactly at the bottom of stock markets. On the best investment day of this year, when many small investors panicked, and where considering their options, rebalancing did the job for them.

It sold positions in matured or less declined bond funds and bought the most discounted assets, i.e. stocks, especially of small and medium-sized companies. The timing of it bore fruit, as shortly after the rebalancing, stock markets found a bottom and headed upwards.

Rebalancing will also be discussed in a separate article in the future and I also plan to make a webinar on this topic.

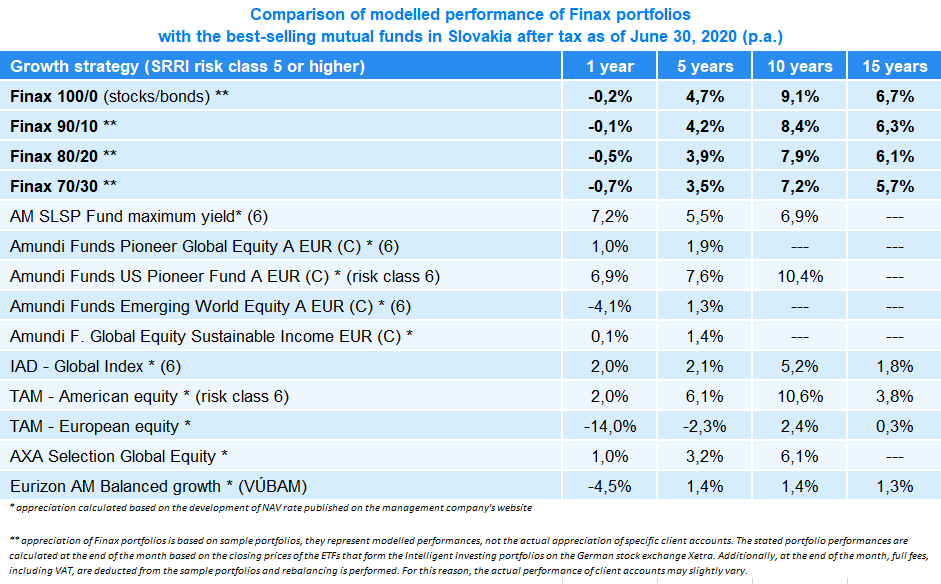

How did equity investments fare? (SRRI class 5 or higher)

Stocks are experiencing an unprecedented volatility this year, which represents a challenge for every investor and investment manager. On the other hand, investments that have been successful in recent years have continued to do so. As I mentioned above, US large cap stocks are doing well.

Many equity funds offered in Slovakia have stopped going against this trend and their portfolios have incorporated these assets, from which they currently benefit.

This is the first comparison in which we are seeing better performance from the competition, despite the capital gains tax. I would like to point out that all these funds achieve a higher appreciation at a higher risk. The number of funds that fell into the 6th risk class according to the SRRI methodology increased due to higher volatility. Finax portfolios still maintain a risk class of 5.

Funds focused on US equities clearly dominate, even over the 10 years’ horizon. The performance of ETFs focused on the stocks of large US companies, which make up the biggest share of the stock component of our portfolios, has, with an annual return of 7.8%, or yield of 14.4% p.a. over the past 10 years, outperformed mutual funds with the same orientation.

Note: All data related to the historical development of Finax portfolios have been modelled and were created on the basis of past-modelling of the data. The method of modelling historical performance is described in the article How we model the historical development of Finax portfolios. Past performance is no guarantee of future returns and your investment may result in a loss. Find out what risks you are taking when investing.

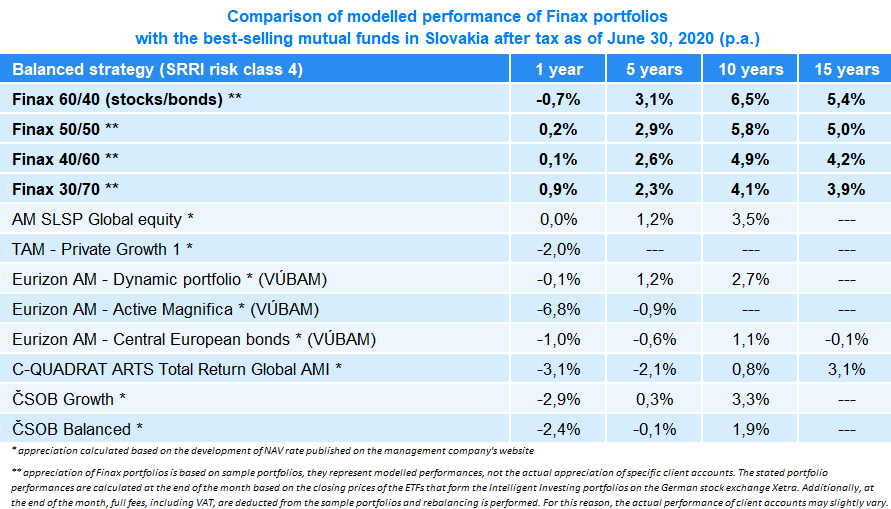

Results of mixed funds (SRRI Class 4)

In case of mixed mutual funds, their managers were not as successful as their stock counterparts. In the list of best-selling and also the biggest mixed mutual funds, we would not find one, whose annual appreciation would be positive.

In case of Finax's balanced portfolios, 3 out of 4 were profitable over one year. Likewise, performance over longer horizons comfortably beats the competition.

The results of balanced portfolios with stocks and bonds once again confirm the reason for more cautious investments, their lower volatility, i.e. risks and the ability to bring positive results over short and often turbulent horizons.

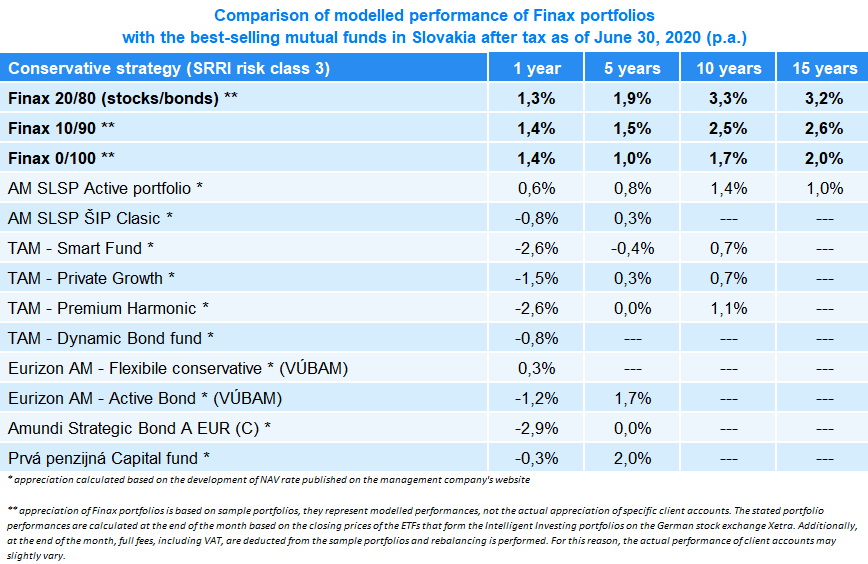

How did conservative investments do? (SRRI class 3)

The rise in bond prices during economically unfavourable periods has had a positive effect on development of Finax's conservative portfolios. The returns on these portfolios are, in comparison to our other products, the highest over the past year.

Paradoxically, conservative competition, focused on profitable bonds, has not been able to use the situation to their advantage and lags far behind the passive solutions offered by Finax.

The performance of funds over the past year is really interesting. Once again, the trend has been changed. There is a general perception that the bond market gives significantly more room for active management to excel. Nevertheless, it is a more specific market, where securities have different maturities, a clear end of their existence, different risks, often lower liquidity, and thus more frequent price arbitrage.

And when it comes to turbulent stocks, where indices are harder to beat in the long run based on all statistics, in some funds, we are witnessing a better performance from active management this year. With longer horizons, the returns are lower compared to index investing.

Looking ahead, the markets will remain difficult and challenging in the near future. I am extremely curious about the development that awaits them and how different approaches will deal with them.

However, passive investing in index funds has an undeniable advantage in this regard. There is no risk of human failure, which frees them from the greatest investment risk, namely the risk of a person, his or her emotions and decisions.

How did mutual funds compare with Finax last year?

If you transfer your existing investments to Intelligent Investing, we will reward you with a fee reduction - we will manage 10% of the transferred investment amount for 5 years free of charge.

In August 2020, a special investment transfer discount applies. We will manage 50% of the transferred amount free of charge for a year.

As of June 30, 2020, all comparisons of popular investment solutions with Finax have been updated:

- Amundi Rytmus (former Pioneer Investments),

- C-Quadrat ARTS Total Return Global AMI fund,

- mixed funds of banks,

- dynamic funds IAD,

- TAM Private Growth funds,

- AXA Tempo,

- Conseq 3D Invest and Active Invest Dynamic fund (former Active Invest Progressive).

App Store

App Store

Google Play

Google Play

Difficulty

Difficulty